On A Tear: Toncoin Outshines Bitcoin With Price Surge And Social Buzz

May 14 2024 - 5:00AM

NEWSBTC

The native token of the Telegram-connected Open Network, Toncoin

(TON), has outperformed Bitcoin (BTC) despite the recent market

turbulence. Bitcoin fell by 3% over the last week, while TON

increased by nearly 20%. Within the cryptocurrency world, this

unexpected outperformance has set off a wild speculating frenzy.

Will TON’s rapid ascent continue, or is this merely a passing blip?

Related Reading: CEO Drops Bombshell: Trump Campaign Eyes

Crypto-Friendly Policies Social Buzz Fuels The Toncoin Engine One

key factor behind TON’s recent success appears to be a surge in

social media activity. Social volume, a metric that tracks

discussions and mentions on platforms like Twitter and Telegram,

has skyrocketed by over 20% compared to the previous week. This

suggests a growing interest in TON, potentially attracting new

investors and driving up the price. 📉 With #bearish sentiment high,

#crypto markets have continued to slip over the past week. Overall,

the market has dropped -3.6%, and volume is -27% lower than the

previous week. $TON, $KAS, $RUNE, and $AKT have kept traders

hopeful. https://t.co/E6b2DtmAxI pic.twitter.com/VoiCJk1ymh —

Santiment (@santimentfeed) May 13, 2024 Investor Sentiment: A Mixed

Bag For TON However, a closer look reveals a potential wrinkle in

this optimistic outlook. While the overall sentiment surrounding

TON has been positive, it has recently dipped into negative

territory. This could be a sign of growing investor apprehension,

as some may be worried about the sustainability of the current

price rally. Accumulation Signals: Are Investors Betting Big On

Toncoin? On the other hand, some metrics point towards potential

long-term bullishness. The mean dollar invested age, an indicator

of how long tokens have been held, has been gradually increasing.

This suggests that investors are holding onto their TON,

potentially with an eye on future gains. Additionally, the dormant

circulation, representing tokens that haven’t been moved in a

while, has remained low. While a previous spike coincided with a

price peak, the current stability could indicate a more strategic

accumulation by investors. Technical Analysis: Eyes On The Prize

For Toncoin Technical analysts, who study price charts and

historical data to predict future movements, are also cautiously

optimistic about TON. Fibonacci retracement levels, a popular

technical tool, suggest the recent downtrend may be nearing its

end. This could pave the way for TON to climb towards targets near

$10, with potential profit-taking opportunities for investors.

Related Reading: Investment Firm Makes Bitcoin Its Strategic

Reserve – Impact On Price A Marathon, Not A Sprint While the recent

surge in price and social media buzz paints a promising picture for

TON, it’s crucial to remember that the cryptocurrency market

remains highly volatile. The current uptrend for TON could be the

beginning of a long-term ascent, fueled by growing adoption and a

thriving ecosystem within the Telegram network. However, it’s also

possible that this is just a short-lived rally, followed by a

correction. Featured image from Medjan, chart from TradingView

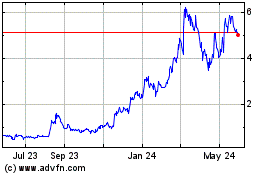

Akash Network (COIN:AKTUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

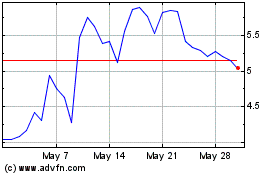

Akash Network (COIN:AKTUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025