Generali Feels Pain of Low Rates, Pressure to Cut Costs--Update

May 12 2016 - 4:29AM

Dow Jones News

By Giovanni Legorano

MILAN-- Assicurazioni Generali SpA said first-quarter net profit

fell by 14% after volatile equity markets and Europe's ultralow

interest rates battered the performance of Italy's largest

insurer.

Generali, presenting its first earnings report under new Chief

Executive Philippe Donnet, said net profit fell to EUR588 million

($671.6 million) in the three months to end March from EUR682

million for the same period a year earlier on a 12% fall in

operating profit to EUR1.16 billion.

In addition to the impact of low interest rates on the

profitability of its life-insurance business, Generali said it

booked less profit on its securities portfolio than in the first

quarter last year which had been a particularly lucrative period

for the group.

Relatively poor market conditions also weighed on the

performance of the insurer's asset-management unit Banca Generali

SpA.

Generali warned that tougher-than-expected financial markets

have ratcheted up the pressure on management to find new ways to

reduce costs to meet targets set out in a four-year growth plan

announced a year ago.

"We are carrying out a thorough analysis to understand where we

can generate additional profitability because market conditions are

more difficult than when we presented the plan last year," said

Chief Financial Officer Alberto Minali.

Generali shares fell more than 2% in early trading, the leading

loser on the Milan exchange.

The insurer is betting on a big commercial push in Europe, Asia

and Latin America to improve cash flow, with gains to be returned

to its shareholders through fatter dividends rather than being

spent on acquisitions.

Generali has said it wants to generate cumulative net free cash

flow of more than EUR7 billion between 2015 and 2018, equivalent to

around EUR1.8 billion a year. Last year the company generated

EUR1.2 billion in cash.

Mr. Minali said Generali isn't changing its financial targets,

noting that at the operating level, the group performed well in

April though it is on alert about any possible impairments in its

securities portfolio considering how volatile markets are.

In the first quarter, Generali's life-insurance business posted

an 8.1% decline in operating income to EUR756 million while the

property and casualty business's operating income was virtually

flat at EUR498 million.

Generali said that against a scenario of low interest rates it

will continue to favor a portfolio of policies less sensitive to

low rates and which absorb less capital at its life business. The

European Central Bank's current policy stance for the eurozone,

where Generali does much of its business, includes subzero interest

rates and large-scale bond purchases.

It confirmed its target of an operating return on equity above

13% and improving dividend for its shareholder, as foreseen by its

strategic plan. Its annualized return on equity for the quarter

stood at 13.3%.

Generali's Economic Solvency Ratio--a measure of capital

solidity for insurers--was 188% at the end of March, after the

company generated 5 percentage points of additional capital during

the quarter.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

May 12, 2016 04:14 ET (08:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

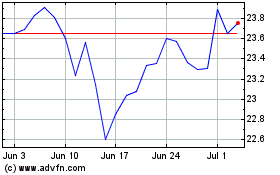

Generali (BIT:G)

Historical Stock Chart

From Jun 2024 to Jul 2024

Generali (BIT:G)

Historical Stock Chart

From Jul 2023 to Jul 2024