Generali Sells BSI to BTG Pactual

July 14 2014 - 4:28AM

Dow Jones News

By Giovanni Legorano

MILAN--Italian insurer Assicurazioni Generali SpA said Monday it

would sell its Swiss private bank BSI to Brazilian bank BTG Pactual

for 1.5 billion Swiss Francs ($1.68 billion).

The insurer said the transaction would allow it to add 9

percentage points to its Solvency I ratio--a measure of financial

soundness for insurers.

"With this transaction we exceed our Solvency 1 target,

restoring the capital base of Generali over a year in advance of

our 2015 plan" Chief Executive Mario Greco said in a statement.

The company had targeted a Solvency I ratio of 160% by 2015.

After struggling for around two years to sell the business,

Generali said in May it had entered exclusive talks with BTG

Pactual about a deal for the unit.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

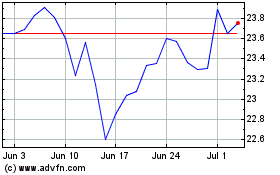

Generali (BIT:G)

Historical Stock Chart

From Jun 2024 to Jul 2024

Generali (BIT:G)

Historical Stock Chart

From Jul 2023 to Jul 2024