Woolworths and Lowe's Exit Home-Improvement Venture

January 18 2016 - 7:57AM

Dow Jones News

By Rebecca Thurlow

SYDNEY--Australian retailer Woolworths Ltd. and U.S. partner

Lowe's Cos. are exiting their unprofitable home-improvement store

venture, which has struggled to take market share from rival

Bunnings.

Woolworths said Monday that it plans to buy Lowe's 33.3% stake

and then either sell or liquidate the business, which includes more

than 50 warehouse-style stores across Australia.

Woolworths and Lowe's have plowed roughly three billion

Australian dollars (US$2 billion) into the Masters Home Improvement

chain since 2011, hoping to capitalize on a booming housing market

that has spurred spending on home projects.

The chain has struggled to compete against Bunnings, owned by

Australian conglomerate Wesfarmers Ltd., missing its target of

breaking even within five years. Masters reported a full-year loss

of A$246 million for fiscal 2015.

"Our recent review of operating performance indicates it will

take many years for Masters to become profitable," Woolworths

Chairman Gordon Cairns said. "We have determined we cannot continue

to sustain ongoing losses from this business."

Lowe's Australian exit comes as it is benefiting from higher

home values in the U.S. and more people moving into new homes. The

company reported a third-quarter profit of $736 million, a 26%

increase from a year earlier.

Lowe's expects to record a noncash impairment charge in the

fourth quarter for exiting the Woolworths venture. The company's

investment to date in the venture was $930 million.

Australia, with its relatively small population of around 23

million, spread out over a huge continent, struggles to sustain a

large number of major players in any industry.

Woolworths, which makes most of its profits from grocery stores,

came to the A$40 billion home-improvement market late, making it

difficult to compete with Bunnings, which opened its first store 20

years ago and now has more than 236 stores.

"We believe the big-box [warehouse] format can only attain

around 15% of the market and Bunnings already has that," said

Commonwealth Bank of Australia analyst Andrew McLennan, adding that

the business opportunity was "smaller than Woolworths

anticipated."

In an industry made up mostly of smaller operators, Masters

aggressively rolled out new stores before making sure customers

wanted to buy what it was offering, Mr. McLennan said. That

included a decision to align its products with Lowe's U.S. hardware

stores--meaning it was selling products and brands unfamiliar to

most Australians.

Wesfarmers on Monday announced plans to expand its hardware

business offshore, in a A$705 million deal to buy U.K.-based

Homebase and build the Bunnings brand there.

Woolworths said it would prefer a trade sale of the Masters

business but hadn't yet received any approaches from interested

parties, leaving the possibility of large write-downs if the

business is liquidated. Still, investors appeared pleased at the

prospect of being freed from the struggling business, sending

Woolworths' shares up 5% in midday trading in Sydney.

Mr. McLennan said Woolworths may sell individual stores to

buyers such as Bunnings or Costco Wholesale Corp.

"But for the A$3 billion that's been sunk into the business

they'll probably get very little out of it," Mr. McLennan said.

Write to Rebecca Thurlow at rebecca.thurlow@wsj.com

(END) Dow Jones Newswires

January 18, 2016 07:42 ET (12:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

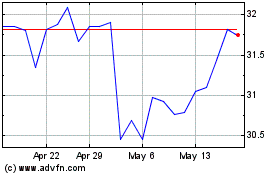

Woolworths (ASX:WOW)

Historical Stock Chart

From Oct 2024 to Nov 2024

Woolworths (ASX:WOW)

Historical Stock Chart

From Nov 2023 to Nov 2024