Financial Results for the Full Year Ended 30 June

2011

Sims Metal Management (the “Company”) (ASX:SGM) (NYSE:SMS) today

announced revenue of $8.9 billion and a net profit after tax

(NPAT), on a statutory basis, of $192.1 million, representing 93.3

cents per diluted share, for the year ended 30 June 2011. NPAT in

Fiscal 2011, on an underlying basis, was $182 million. See the

Reconciliation of Statutory Results to Underlying Results for Years

Ended 30 June 2011 and 30 June 2010 attached herein for more

information.

Revenue increased 19 percent to $8.9 billion during Fiscal 2011.

EBITDA (earnings before interest, tax, depreciation, and

amortisation) of $431.7 million was an increase of 22 percent on

the prior corresponding period. NPAT of $192.1 million was an

increase of 52 percent on the prior corresponding period. Diluted

earnings per share (EPS) was 93.3 cents per share, an increase of

45 percent on the prior corresponding period. The adverse impact of

foreign exchange translation during Fiscal 2011 reduced sales,

EBITDA, and NPAT each by circa 9 percent relative to the prior

corresponding period.

In Fiscal 2011, the Company’s total scrap intake and shipments

were 14.3 million tonnes and 14.2 million tonnes,

respectively. Scrap intake and shipments increased 7 percent

and 10 percent, respectively, on the prior corresponding

period.

Results at a Glance

(in A$

millions)

STATUTORY:

FY11

FY10

Revenue

$8,853

$7,459

EBITDA2 $432 $353

EBIT $301 $208

NPAT

$192 $127

Diluted EPS (cents) 93.3 64.5

UNDERLYING1: Revenue

$8,853

$7,459

EBITDA2 $416 $382

EBIT $285 $237

NPAT

$182 $147

1 See table attached that reconciles

statutory and underlying results.

2 EBITDA is an unaudited measurement of

non-conforming financial information. See attached table that

reconciles EBITDA to statutory NPAT.

Group Chief Executive Officer Daniel W. Dienst stated, “Given

the uncertain global economic conditions that pervaded during

Fiscal 2011, we are somewhat pleased with our results and, in

particular, with our solid performance in the second half. Second

half net profit after tax increased by 190 percent over the first

half result. Our top line growth in revenues during Fiscal 2011 was

nearly 19 percent and was accomplished through stronger shipments,

which grew 10 percent year on year, and improved pricing. Our

intake improved across all regions and year on year intake

increased by 7 percent with growth most notable in North America.

The combination of improved intake and shipments along with

improved pricing and gross margins allowed us to increase NPAT by

$65 million, or 52 percent over the prior corresponding

period.”

Mr. Dienst continued, “We had set many priorities in Fiscal

2011, including our objectives to increase market share and margins

to drive stronger profit and dividends which were accomplished. We

also invested circa $250 million of free cash flow to execute on

our growth plans for strategic acquisitions and the implementation

of proprietary technology into our core businesses. We have now

extended our new proprietary downstream processing technology to

all of our regions and are pleased with the early results, while

continuing the rollout to additional facilities during the new

fiscal year. During Fiscal 2011, we expanded the footprint of Sims

Recycling Solutions (SRS) further into the U.K. and Continental

Europe with four acquisitions and closed six tuck-in acquisitions

for our traditional metals recycling business in all three

operating regions.”

Mr. Dienst emphasised, “We believe it is notable that such

investments did not come at the sacrifice of our strong

capitalisation. The hallmark of our Company’s financial strength is

evidenced by net debt to total capital of circa 4 percent at 30

June 2011. We also did not compromise our commitment to dividend

policy and maintained a payout ratio of 50 percent.”

Mr. Dienst added, “During Fiscal 2011, our most important

priority again was to improve the safety of our facilities and

operations. In that context, we made significant strides, and note

improved trends during Fiscal 2011 in terms of both lesser

frequency and reduced severity of workplace accidents. This

accomplishment is attributed to our Company wide commitment to

safety at every level in our journey towards an accident free

workplace.”

North America

Sales revenue was up 19 percent on the prior corresponding

period to $6.0 billion and EBIT (earnings before interest and tax)

increased by 51 percent to $121 million. Full year results for

North America were impacted by atypical items that increased EBIT

by $7.0 million, most of which relates to a gain on the sale of

other financial assets. Scrap intake in North America increased by

9 percent on the prior corresponding period to 11.1 million tonnes

and shipments increased by 11 percent to 11.0 million tonnes.

Mr. Dienst continued, “Our North America Metals business had a

strong finish in the second half. North America Metals experienced

meaningful recovery in intake in Fiscal 2011. Shipments were also

strong as we finished the fiscal year with more balanced intake and

shipments, consistent with our goal to be as liquid as the global

trading markets permit. Deep sea ferrous markets demonstrated

stronger demand coincident with the second half of our fiscal year.

We made significant progress in implementing our new downstream

technology in our Eastern Region shredders, which should be

completed over the coming weeks. In addition, we also recently made

significant downstream investments in our Western Region shredders.

We have expectations for strong returns on these investments.”

Mr. Dienst said, “We closed three tuck-in acquisitions in North

America Metals during Fiscal 2011. We expanded our presence in

ferrous trading during Fiscal 2011 through several new important

trading relationships as well as by the establishment or

acquisition of new facilities with export capabilities in Texas and

on the Mississippi River system. We relocated our aerospace

operations to a new state-of-the-art facility.”

Australasia

Sales revenue for the region was up 12 percent on the prior

corresponding period to $1.4 billion and EBIT increased by 31

percent to $80 million. Full year results in Australasia were

impacted by atypical items that reduced EBIT by $2 million. Scrap

intake and shipments at 1.7 million tonnes each represented a 2

percent and 11 percent increase, respectively, year-on-year.

Mr. Dienst said, “Our Australasian business once again

accomplished growth in earnings and strong returns on capital. Our

people, assets and technology create a sustainable competitive

advantage for us in this very important market. We enhanced several

downstream recovery systems including an installation at our St.

Marys shredder, which is generating strong returns. We also closed

an important tuck-in acquisition in Queensland during Fiscal 2011.

Overall, we experienced significant improvement in our ferrous

business within the region. We intend to continue to invest in and

improve on our leadership position in Australasia during the new

fiscal year.”

Europe

Sales revenue was up 25 percent on the prior corresponding

period to $1.5 billion and EBIT increased by 50 percent to $100

million. Full year results in Europe were impacted by $11 million

of atypical income items, most of which related to a commercial

settlement. Scrap intake and shipments in the region increased by 2

percent and 5 percent, respectively. Intake and shipments were each

1.5 million tonnes during Fiscal 2011.

Mr. Dienst said, “Our European business had an outstanding

performance during Fiscal 2011. We noted strong growth in

profitability within our U.K. Metals business and were particularly

pleased by a strong performance from our SRS business in

Continental Europe. We generated improved ferrous and non-ferrous

earnings year-on-year in our traditional metals business and are

nearly finished with the implementation of our new downstream plant

in Long Marston – set to be fully operational shortly. Our SRS

business generated a strong result again from organic growth,

evident in both improved volumes and from new global customer

relationships, as well as enhanced recoveries from investments into

processing technology. Strong results for SRS in Fiscal 2011 are

also attributed to a successful acquisition strategy. During Fiscal

2011, we closed four acquisitions for SRS in Europe and

accomplished two tuck-in acquisitions for the traditional metals

business in the U.K. We currently operate with a footprint for SRS

in 10 countries across Europe and look forward to continued

expansion.”

Markets & Outlook

Mr. Dienst concluded, “Despite the dramas of U.S. politics and

credit downgrade, continued European sovereign debt fears, and

Chinese inflation worries, we continue to find sufficient liquidity

in the deep sea ferrous markets. Non-ferrous trading markets remain

liquid, albeit with extreme price volatility in base metals

markets. Pricing for processed ferrous metals remains relatively

attractive, freight costs remain supportive of our global trading

platforms, and intake currently remains steady. Due to the

uncertainty involving global economic conditions that impact our

business, we are unwilling to provide specific guidance at this

time. We will continue to confidently invest in our business and

people knowing that Sims Metal Management is well positioned and

highly leveraged to a global economic recovery, particularly in

North America.”

Capitalisation

During June 2011, the Company entered into new three-year credit

facilities that do not mature until June 2014. The total lines

provide borrowing capacity of circa $1.4 billion. As of 30 June

2011, the Company had net debt balances of approximately $126

million, representing net debt of 4 percent of total capital.

Dividend

The Company has determined that a final dividend of 35 cents per

share (43 percent franked) will be paid on 21 October 2011 to

shareholders on the Company’s register at the record date of 7

October 2011. The total dividends for all of Fiscal 2011 represent

a payout ratio of 50 percent of net profit after tax.

The Company’s Dividend Reinvestment Plan (DRP) will apply to the

final dividend. All eligible shareholders who are registered as

holding shares in the Company at the record date and who have

provided the Company with the requisite Notice of Election form

prior to that date will be eligible to participate. Shares will be

issued at a 2.5 percent discount to the Company’s weighted average

market price over a period of five trading days commencing on the

trading day after the record date. The dividend is payable in cash

or additional shares (pursuant to the DRP) at the election of

eligible shareholders. Foreign shareholders will be relieved of any

withholding tax as a consequence of the application by the Company

of Foreign Conduit Income Credits.

Reconciliation of Statutory Result to

Underlying Result for the Years Ended 30 June 2011 and 30 June

2010

EBITDA

EBIT

NPAT

(in A$

millions)

FY11

FY10

FY11

FY10

FY11

FY10

Statutory Results $432 $353 $301 $208 $192 $127

Inventory Adjustments to Net Realisable Value - $18 - $18 -

$12

Redundancy Accruals $2 $6 $2 $6 $1 $4

Fixed Asset Impairment & Yard Closure Costs - $15 - $15

- $10

Impairment Identified in Investments in Joint

Ventures and Other Intangibles - $7 - $7 - $5

Transaction and Other Acquisition Costs $3 ($1 ) $3 ($1 ) $2

($1 )

Plant Relocation Costs $4 - $4 - $3 -

Gain on Sale of Other Financial Assets ($11 ) - ($11 ) - ($7

) -

Commercial Settlement ($12 ) - ($12 ) - ($8 ) -

Other Gains Including Formation Gain on the Acquisition

of a Joint Venture ($2 ) ($16 ) ($2 ) ($16 ) ($1 ) ($10 )

Underlying Result $416 $382 $285 $237 $182 $147

Reconciliation of Unaudited

Non-Conforming Financial Information to Statutory Reporting

EBITDA3:

(in A$

millions)

FY11

FY10

NPAT $192 $127

Depreciation and Amortisation $131

$144

Interest expense, net $24 $14

Income taxes $85

$68

EBITDA $432 $353

Net Debt4:

(in A$

millions)

FY11

FY10

Total borrowings $292 $117

Minus cash balances ($166)

($132)

Net debt / (cash) $126 ($15)

Stockholders’

Equity $2,921 $3,279

Net debt as a percentage of Total

Capital 4% NMF5

3 EBITDA is a measure of cash flow

generating capacity that is commonly utilised by the investment

community.

4 Net debt equals total borrowings minus

cash balances at 30 June 2011 and reflects total borrowings as if

borrowings were reduced by cash balances as a pro forma

measurement.

5 NMF indicates not meaningful.

Cautionary Statements Regarding Forward-Looking

Information

This release may contain forward-looking statements, including

statements about Sims Metal Management’s financial condition,

results of operations, earnings outlook and prospects.

Forward-looking statements are typically identified by words such

as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,”

“estimate,” “forecast,” “project” and other similar words and

expressions.

These forward-looking statements involve certain risks and

uncertainties. Our ability to predict results or the actual effects

of our plans and strategies is subject to inherent uncertainty.

Factors that may cause actual results or earnings to differ

materially from these forward-looking statements include those

discussed and identified in filings we make with the Australian

Securities Exchange and the United States Securities and Exchange

Commission (“SEC”), including the risk factors described in the

Company’s Annual Report on Form 20-F, which we filed with the SEC

on 6 December 2010.

Because these forward-looking statements are subject to

assumptions and uncertainties, actual results may differ materially

from those expressed or implied by these forward-looking

statements. You are cautioned not to place undue reliance on these

statements, which speak only as of the date of this release.

All subsequent written and oral forward-looking statements

concerning the matters addressed in this release and attributable

to us or any person acting on our behalf are expressly qualified in

their entirety by the cautionary statements contained or referred

to in this release. Except to the extent required by applicable law

or regulation, we undertake no obligation to update these

forward-looking statements to reflect events or circumstances after

the date of this release.

All references to currencies, unless otherwise stated, reflect

measures in Australian dollars.

About Sims Metal Management

Sims Metal Management is the world’s largest listed metal

recycler with approximately 250 facilities and 6,200 employees

globally. Sims’ core businesses are metal recycling and recycling

solutions. Sims Metal Management generated approximately 85 percent

of its revenue from operations in North America, the United

Kingdom, Continental Europe, New Zealand and Asia in Fiscal 2011.

The Company’s ordinary shares are listed on the Australian

Securities Exchange (ASX: SGM) and its ADRs are listed on the New

York Stock Exchange (NYSE: SMS). Please visit our website

(www.simsmm.com) for more information on the Company and recent

developments.

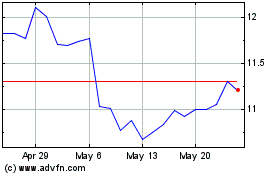

Sims (ASX:SGM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sims (ASX:SGM)

Historical Stock Chart

From Feb 2024 to Feb 2025