Strong revenue growth in line with guidance

Achieved earnings leverage – EBITDA growth

ahead of revenue growth as margins expanded

Iron Mountain transaction proceeding according

to schedule

Recall Holdings Limited (ASX:REC), a global leader in document

storage, digital document management, data protection and secure

destruction services today releases its results for the year ended

30 June 20151.

During FY15, Recall made significant progress on its three

strategic objectives, delivered operating leverage and launched its

digital strategy. The continuing business generated strong constant

currency growth in line with guidance, and all service lines

contributed to revenue growth of 7.5%. EBITDA margins expanded as a

consequence of improvements in operations and EBITDA grew 10.1%.

Underlying profit after tax of US$75.4 million generated underlying

earnings per share of 24 cents, an increase of 23.2% in constant

currency.

The year culminated in the Board’s decision to endorse, in the

absence of a superior offer and subject to an independent expert

concluding the transaction is in the best interests of Recall

shareholders, a proposal from Iron Mountain Inc. to acquire Recall

Holdings by way of a scheme of arrangement. Detailed information

about the transaction will be set out in a Scheme Booklet, which is

expected to be provided to shareholders in October, ahead of a

shareholder vote on the transaction in December.

Highlights

FY15As reported

FY15Constant FX

FY14As reported

ChangeConstant FX

Revenue $827.8 $883.92

$836.1 +7.5%2 Underlying EBITDA $205.5

$220.22 $199.6 +10.1%2

Underlying basic EPS (US cents per share) 24.0

27.6 22.4 +23.2% Final dividend

(AUD cents per share) 10.0

8.0 +25%

- Revenue growth of 7.5%, growth achieved

in all service lines2

- EBITDA growth of 10.1%, EBITDA margin

increased 60bps to 24.9%2

- Strong cashflow with cash conversion

rate of 96%

- 12 acquisitions completed in FY15,

expected to generate annual revenue of US$48 million

- Net carton growth of 7.7%3, resulting

from organic growth of 2.6%, acquisition growth of 5.1% and a

reduction in permouts of 100bps

- Strong contribution from DMS,

significant improvement in SDS following North American SDS

improvement plan

- Storage and retention revenue grew

8.4%, service and activity revenue increased 6.4%2

- Facility Optimisation Program

progressing well, extended to Australia, Brazil, France, Denmark

and UK

- Final dividend of AUD 10.0 cents

determined, 25% higher than the final FY14 dividend

President and CEO Doug Pertz said “Throughout the year, we made

tangible progress on each of our three strategic objectives of

sustainable profitable growth, operational excellence and

innovation for the future, with improvements in operations and

revenue growth across all service lines. Acquisitions, investments

in sales and marketing and improvement in the customer experience

underpinned an increase of 8.4% in our storage and retention

revenue and 6.4% in our service revenue in the continuing business.

Permouts, or carton withdrawals from storage, reduced by 100bps to

3.3%, which is a strong indicator of customer satisfaction.

“We complemented our organic growth with 12 acquisitions during

the year. These acquisitions contributed $23.4 million to revenue

in FY15 and are expected to generate annual revenue of $48 million.

The business is progressing well and assuming the transaction

proceeds as anticipated, I am confident Recall is well-positioned

to make a strong contribution to the combination with Iron

Mountain,” concluded Mr. Pertz.

Regional Results

The Americas achieved revenue growth of 14.0% and EBITDA growth

of 29.7%, driven by the success of the North American business in

the SME market and several highly accretive acquisitions. EBITDA

margin was up 320bps from higher pricing in the DMS business and a

600bps improvement in SDS gross margins. Large contracts won

contributed to activity, including onboarding a major Canadian

government agency that was previously unvended, as well as

beginning to onboard HSBC in the US, Canada and Mexico. In Brazil,

all service lines continued to perform strongly, with organic

growth in the core document storage business approaching double

digits.

In Asia, revenue increased by 26.4%, driven by 11% organic

growth and the full-year impact of the Singapore acquisition.

Underpinning this strong result was accelerating carton growth and

improving customer retention, supported by successful price

increases with a number of larger customers.

In Europe, revenue in the continuing business declined by 1.0%

as the region remained impacted by unfavourable economic

conditions. However, tight cost control drove margin improvement

and a 5.3% increase in EBITDA. Significant business wins were

achieved in the UK, Spain and France, onboarding of the HSBC

contract began and the successful implementation of a digital

services platform provided benefits across the region.

Australia/New Zealand experienced a 1.1% decline in revenue for

the full year. However, revenue increased in H215 by 2.2% compared

with the prior year. Price increases and positive carton growth

supported higher revenue in H215 than H214 and H115. Strong carry

over wins and reduced permouts in H215, together with three

acquisitions completed during the year, generated solid momentum

going into FY16.

Financials

In FY15, Recall’s continuing business2 grew revenue by 7.5% and

EBITDA 10.1%. EBITDA margin expanded 60bps to 24.9%, reflecting

good progress in cost control and gains in racking (+250bps) and

building utilisation (+260bps).

The second facility optimisation program announced in June 2015

will consolidate facilities in Australia, Europe and Brazil. Once

fully implemented in FY18, it is expected to benefit EBITDA by $6.5

million. A related one-off restructuring charge of $16 million,

comprising a $5 million non-cash charge relating to surplus plant

and equipment and an $11 million cash charge from lease termination

and relocation costs, was taken in FY15.

Net cash from operating activities was $127.3 million and cash

conversion was high at 96%. Key funding needs during the year

included acquisitions of $144.3 million, dividends of $43.8 million

and capex of $61.7 million. However, outstanding net debt increased

by only $82 million over the 12 month period to $566 million.

Increased debt was partially offset by the utilisation of cash from

operating activities as well as the appreciation of the US dollar.

Debt ratios remain comfortably within covenants, with closing net

debt to EBITDA less than 2.6x.

Total capital expenditure for the period was $61.7 million, or

7.4% of revenue. This was an improvement over the 8.7% of revenue

in FY14, reflecting a focus on improving ROCI.

The effective tax rate in FY15 was approximately 23%, due to a

one-off material benefit of US$10 million arising from a tax basis

reset resulting from creating a new consolidated Australian tax

group after the demerger. Excluding this benefit, the underlying

effective tax was 34%.

The Board determined a final dividend of AUD 10.0 cents per

share, bringing the full year FY15 dividend to AUD 19.0 cents,

which is a payout ratio of approximately 60% of underlying profit

after tax. The final dividend will be franked to 40%, with 60%

qualifying as conduit foreign income. The final dividend is

expected to be paid on 28 October 2015 to shareholders on the

Recall register on 7 October 2015.

Proposal from Iron Mountain to Acquire Recall

Holdings

On 29 April 2015, Recall announced that it had agreed to key

commercial terms for the acquisition of Recall by Iron Mountain by

way of a recommended and court approved scheme of arrangement. Due

diligence led to improvement in the key terms such that

shareholders will receive 0.1722 Iron Mountain shares and US$0.50

cents for each Recall share they hold. Alternatively, Recall

shareholders may elect cash consideration of A$8.50 per share,

subject to a total cash pool of A$225 million, with preferential

access to the cash offer for the first 5,000 shares of their

holding. Iron Mountain is to establish a secondary listing on the

Australian Securities Exchange (ASX) to allow shareholders to trade

Iron Mountain shares via CHESS Depository Interests (CDIs).

The parties are progressing anti-trust regulatory submissions,

and filings have been made in the key jurisdictions of Australia

and the USA. The records management industry is large, fragmented

and highly competitive, and Recall expects a satisfactory

outcome.

Shareholders will receive additional detailed information on the

transaction and the scheme process in a Scheme Booklet planned for

shareholders in October, ahead of a shareholder vote on the

transaction, which is anticipated to occur in December 2015.

The proposed transaction remains subject to formal shareholder

and regulatory approval. There is no guarantee that the transaction

will complete. Accordingly, Recall remains a competitor with Iron

Mountain, is operating on a business-as-usual approach and

continues to aggressively implement its long-term strategic

plan.

Outlook

In FY16, after excluding SDS Germany sold in December 2014 and

adjusting for $4 million of revenue lost as a consequence of the

CitiStorage fire, Recall expects to deliver revenue growth

approaching double digits, and EBITDA growth at least in line with

revenue growth, on a constant currency basis, together with

continuing strong cash flow generation.

The effective tax rate in FY16 is expected to be approximately

35%.

Recall’s outlook is based on assumptions regarding present and

future business strategies and the environment in which Recall will

operate in the future. Recall’s future results are subject to

market conditions and unforeseen circumstances and risks that may

arise. This earnings release, the investor presentation, Appendix

4E and conference call / webcast details are all available on the

company’s investor relations website at Recall.com.

About

Recall is a global leader in information management solutions,

offering customers complete management of their physical and

digital information. Recall’s innovative solutions empower

organizations to make better business decisions throughout the

information lifecycle, while assuring regulatory compliance and

eliminating unnecessary resources, time and costs. Recall services

more than 80,000 customer accounts in over 300 dedicated

facilities, spanning five continents in 24 countries. For more

information, please visit recall.com.

1 Financials are presented in USD and comparisons to FY14 are

made on a constant currency basis. Financials for FY14 are

presented on a pro forma basis as if the legal structure of Recall

Holdings as at 18 December 2013 (the date of demerger from

Brambles) was in existence for all of FY14.2 Excludes Recall’s

German SDS business divested December 2014.3 Excludes impact of 1M

cartons damaged in CitiStorage fire.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150818006647/en/

Investor relations inquiriesRecall Holdings LimitedBill Frith,

+61 2 9582 0244Senior Director, Investor

RelationsBill.Frith@recall.comorAustralian media

inquiriesGRACoswayFleur Jouault, +61 405 669 632orUS media

inquiriesMSLGROUPDavid Sprague or Amanda Fountain, +1

781-684-0770Recall@mslgroup.com

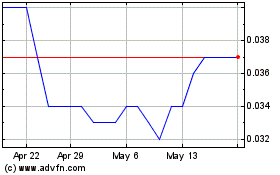

Recharge Metals (ASX:REC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Recharge Metals (ASX:REC)

Historical Stock Chart

From Jan 2024 to Jan 2025