Recall Continues Acquisition Expansion and Increases Loan Facility

November 10 2014 - 5:45PM

Business Wire

To Evaluate Potential Alternative Corporate

Structures to Maximise Shareholder Value

Recall Holdings Limited (ASX: REC), a global leader in document

storage, digital document management and data protection, today

updated the market on the continued progress of its acquisition

strategy and announced the increase of its syndicated loan facility

by $250 million to provide further funding flexibility for the

ongoing execution of its strategy. In addition, the company

announced it is exploring strategies to maximise shareholder value

through alternative corporate structures.

Recall’s focus on accretive acquisitions continues, completing

five acquisitions since the beginning of FY15 — three in the U.S.,

one in Australia and one in the U.K. The combined purchase price is

approximately $31 million and, on a post synergy basis, represents

an EBITDA multiple of less than 7.0x. These acquisitions will

generate annualised revenue of approximately $10 million and add

one million carton equivalents. In FY15, these acquisitions are

expected to add approximately $8 million of revenue. The

acquisition pipeline continues to strengthen and is a key component

of the strategy to accelerate sustainable profitable growth.

Recall’s amended syndicated financing agreement increases its

$800 million loan facility by $250 million, to a total of $1.05

billion. In addition, the facility has been amended to a single

5-year term, with a maturity date of October 2019. The key

covenants under the facility remain unchanged with net debt to

EBITDA of less than 3.5x and EBITDA to net finance costs of not

less than 3.5x.

Recall is exploring, with advisers, potential alternative

corporate structures, including a Real Estate Investment Trust

(REIT) in the United States, in order to maximise shareholder

value. Recall will assess the costs and benefits associated with

implementing various structures. Given the uncertainties associated

with obtaining approvals from the applicable authorities, there can

be no assurances that any structures will be implemented. In

keeping with its continuous disclosure requirements, Recall will

update the market when there are material developments.

About Recall

Recall is a global leader in information management solutions,

offering customers complete management of its physical and digital

information assets with one partner. Recall’s innovative solutions

empower organizations to make better business decisions throughout

the information lifecycle, while keeping regulatory compliance and

eliminating unnecessary resources, time and costs. Recall services

more than 80,000 customer accounts in over 300 dedicated operation

centers, spanning five continents in 24 countries. For more

information, please visit recall.com.

Investors and AnalystsRecall Holdings LimitedBill Frith, +61 2

9582 0244Senior Director, Investor RelationsorU.S. media

enquiriesMSLGROUPDavid Sprague or Amanda Fountain, +1

781-684-0770

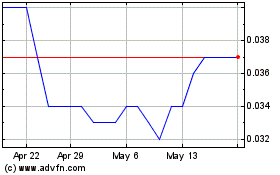

Recharge Metals (ASX:REC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Recharge Metals (ASX:REC)

Historical Stock Chart

From Jul 2023 to Jul 2024