N.Y. Fed Adds Wells Fargo as a Primary Dealer

April 18 2016 - 6:10PM

Dow Jones News

Wells Fargo Securities LLC joined the elite club of primary

dealer banks for the U.S. government bond market on Monday.

The news was released by the Federal Reserve Bank of New

York.

Wells Fargo becomes the 23rd primary dealer, which trades

directly with the N.Y. Fed and is obligated to underwrite U.S.

government debt sales.

It was the first time the N.Y. Fed added a new member to the

club since Feb 2014 when TD Securities (USA) LLC was named a

primary dealer.

Analysts say a larger pool of dealers will benefit the Federal

Reserve as it needs counterparties to mop up excess liquidity

pumped into the banking system since the 2008 financial crisis. The

Fed ended its bond buying program in 2014 and raised short-term

interest rates in December for the first time since 2006. Fed

officials have signaled a slow path of normalizing interest rate

policy amid uncertain global growth outlook.

Being a primary dealer carries perks for banks too.

A spokesman at the NY Fed declined to comment.

Though the firms have to meet certain standards, they benefit by

being able to attract more business in the Treasury market. It also

raises the firm's profile, which in turn could boost business in

trading and dealing in the broader credit markets.

As counterparties to the Fed, they meet with Fed policy makers

as well as Treasury officials regularly to discuss funding needs,

auction schedule changes and the interest-rate outlook.

"Primary Dealership will allow us to better serve our existing

customer franchise and is a logical extension of our client-focused

business model," said Walter Dolhare, head of Wells Fargo

Securities' Markets Division.

Still, traders say the allure of being a primary dealer has been

dimmer compared with the era before the crisis.

Tighter banking regulations have pushed big dealer banks to pull

back on fixed income trading. Facing stricter capital requirements

to beef up their balance sheet, they become more hesitant to

connect buyers with sellers in the bond market.

In addition, primary dealers are competing with a wider pool of

investors, especially as hedge funds and high frequency trading

firms have entered into Treasury bond markets.

The structural changes in the bond market have raised concerns

over liquidity.

Regulations and investors are still struggling to pinpoint the

exact reason causing the " flash crash" in Oct. 2014 for the yield

on the benchmark 10-year Treasury note. The yield tumbled and then

quickly reversed in short order and many said thinner liquidity

magnified the violent swings.

Write to Min Zeng at min.zeng@wsj.com

(END) Dow Jones Newswires

April 18, 2016 17:55 ET (21:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

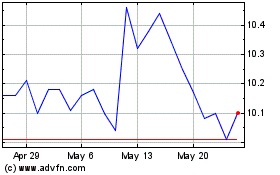

Pacific Current (ASX:PAC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Pacific Current (ASX:PAC)

Historical Stock Chart

From Feb 2024 to Feb 2025