S&P, IHS to Sell Businesses to FactSet, News Corp to Win Merger Blessing

December 27 2021 - 8:55AM

Dow Jones News

By Colin Kellaher

S&P Global Inc. and IHS Markit Ltd. on Monday said they

agreed to shed a pair of businesses for more than $2.2 billion in

cash in a bid to win regulatory approval of S&P's planned $44

billion acquisition of IHS.

The financial-data companies said FactSet Research Systems Inc.

has agreed to buy S&P's CUSIP Global Services business for more

than $1.9 billion, while News Corp would acquire IHS Markit's Base

Chemicals business for $295 million.

S&P and IHS said they expect the sales would generate

aggregate net proceeds of roughly $1.3 billion.

FactSet, a Norwalk, Conn., provider of financial information and

analytical applications, said it plans to fund the CUSIP

acquisition with cash on hand and committed financing, adding that

it expects a tax benefit of about $200 million as part of the

transaction.

News Corp said Base Chemicals, which provides pricing data,

insights, analysis and forecasting, would become part of the

Professional Information Business of its Dow Jones unit, which also

publishes this newswire. News Corp in August agreed to buy IHS's

Oil Price Information Service and related assets for $1.15

billion.

S&P has also pledged to sell its Leveraged Commentary &

Data business, along with a related family of leveraged loan

indexes, as a condition for regulatory approval of the IHS deal,

which the companies expect to complete in the first quarter of

2022.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

December 27, 2021 08:40 ET (13:40 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

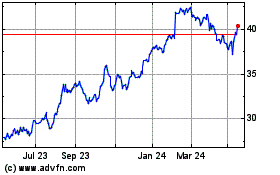

News (ASX:NWS)

Historical Stock Chart

From Dec 2024 to Jan 2025

News (ASX:NWS)

Historical Stock Chart

From Jan 2024 to Jan 2025