News Corp Announces $1 Billion Stock Repurchase Program; Stockholder Rights Agreement Terminated

September 22 2021 - 9:00AM

Business Wire

News Corp (the “Company”) today announced that its Board of

Directors (the “Board”) has authorized a $1 billion stock

repurchase program. Subject to market conditions and the market

price of the Company’s stock, as well as other factors, the Company

intends to repurchase, from time to time, in the open market or

otherwise, a combination of the Company’s Class A common stock and

Class B common stock. This stock repurchase program, which replaces

the $500 million Class A common stock repurchase program approved

by the Board in May 2013, has no time limit and may be modified,

suspended or discontinued at any time.

“These landmark decisions follow our most profitable year since

the launch of the new News Corp in 2013 and are a tangible sign of

our confidence in the inherent value and enormous potential of our

businesses,” said Robert Thomson, Chief Executive of News Corp.

“With the Board’s active support, we are acutely focused on

long-term value for investors, balancing strategic investments and

capital returns. Our robust cash balance and strong free cash flow

have enabled us to launch a much larger, more aggressive buyback

program that we intend to begin after our quiet period ends.”

The Board’s authorization follows the termination of the

Company’s stockholder rights agreement, which had been in place

since the Company’s inception in 2013, and the execution of a

stockholders agreement by and between the Company and the Murdoch

Family Trust (the “Trust”), which limits the potential accretion of

voting power by the Trust and Murdoch family members through market

purchases or as an indirect result of repurchases by the Company of

shares of Class B common stock. The stockholders agreement provides

that the Trust and the Company will not take actions that would

result in the Trust and Murdoch family members together owning more

than 44% of the outstanding voting power of the Class B common

stock, or would increase the Trust’s voting power by more than

1.75% in any rolling twelve-month period. The Trust would forfeit

votes in connection with an annual or special Company stockholders

meeting to the extent necessary to ensure that the Trust and the

Murdoch family collectively do not exceed 44% of the outstanding

voting power of the shares of Class B common stock at such meeting,

except where a Murdoch family member votes their own shares

differently from the Trust on any matter. The stockholders

agreement will terminate upon the Trust’s distribution of all or

substantially all of its Class B common stock.

The inclusion of Class B common stock in the repurchase program,

termination of the rights agreement and stockholders agreement were

approved by a special committee comprising all of the independent

members of the Board (the “Special Committee”). The Special

Committee was advised by Wachtell, Lipton, Rosen & Katz and

Morris Nichols Arsht & Tunnell LLP as independent counsel and

Evercore as independent financial advisor.

Given trading black-out restrictions, the Company intends to

begin to execute on the repurchase program following the fiscal

2022 first quarter earnings release in early November.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Words such as “may,” “will,” “should,” “likely,”

“anticipates,” “expects,” “intends,” “plans,” “projects,”

“believes,” “estimates,” “outlook” and similar expressions are used

to identify these forward-looking statements. These forward-looking

statements include, but are not limited to, statements regarding

the Company’s intent to repurchase, from time to time, the

Company’s Class A common stock and Class B common stock. These

statements are based on management’s current expectations and

beliefs and are subject to uncertainty and changes in

circumstances. Actual results may vary materially from those

expressed or implied by the statements in this press release due

to, among other factors, changes in the market price of the

Company’s stock, general market conditions, applicable securities

laws and alternative investment opportunities, as well as the

risks, uncertainties and other factors described in the Company’s

filings with the Securities and Exchange Commission. The

“forward-looking statements” included in this press release are

made only as of the date of this release. We do not have and do not

undertake any obligation to publicly update any “forward-looking

statements” to reflect subsequent events or circumstances, and we

expressly disclaim any such obligation, except as required by law

or regulation.

About News Corp

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global,

diversified media and information services company focused on

creating and distributing authoritative and engaging content and

other products and services. The company comprises businesses

across a range of media, including: digital real estate services,

subscription video services in Australia, news and information

services and book publishing. Headquartered in New York, News Corp

operates primarily in the United States, Australia, and the United

Kingdom, and its content and other products and services are

distributed and consumed worldwide. More information is available

at: http://www.newscorp.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210922005599/en/

News Corp Investor Relations Michael Florin 212-416-3363

mflorin@newscorp.com News Corp Corporate Communications Jim Kennedy

212-416-4064 jkennedy@newscorp.com

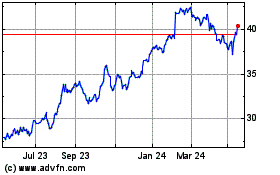

News (ASX:NWS)

Historical Stock Chart

From Dec 2024 to Jan 2025

News (ASX:NWS)

Historical Stock Chart

From Jan 2024 to Jan 2025