By Lukas I. Alpert and Patience Haggin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 28, 2020).

Privacy changes in Apple Inc.'s new operating system are sending

ripples through the digital publishing world, with outlets that

rely heavily on advertising bracing for a sizable drop in revenue

from iPhone users.

The upgrade, which is set to roll out this fall, will require

apps to ask users whether or not they want their web activity

tracked. Some publishers worry that most users will opt out,

hobbling their ability to show personalized ads in apps and dealing

them a blow at a time when the industry is trying to recover from

the coronavirus pandemic.

"When every publisher is fighting for every last advertising

cent, this couldn't come at a worse time," said Martin Clarke,

publisher of DMG Media, operator of the Daily Mail and

MailOnline.

Apple's change, which affects collection of Apple's advertising

identifier for users, known as IDFA, also drew criticism from

social-media giant Facebook Inc., which said Wednesday it would

affect the company's multibillion-dollar business of facilitating

ad sales in apps. The new privacy controls will also have an effect

on other ad-technology companies that facilitate ad sales, as well

as makers of apps that sell ads using those intermediaries.

Sheri Bachstein, the global head of consumer business at the

Weather Co., which operates weather.com, estimated that the price

advertisers are willing to pay to advertise within iPhone apps

could decline by as much as 40% as a result of the change. That is

because advertisers generally pay a premium for ads targeted based

on users' interests and behavior on the web.

Apple says it doesn't plan to prohibit tracking, but will simply

require app makers to obtain permission from their users to do

so.

The development comes as tensions between publishers and Apple

have been rising. Last week, a trade group representing thousands

of publishers, including the New York Times, the Washington Post

and The Wall Street Journal, pushed for better terms that would

allow them to keep more money from digital subscriptions sold

through Apple's app store. Dow Jones & Co., publisher of the

Journal and a unit of News Corp, has a commercial agreement to

supply news through Apple services.

In 2017, Apple upgraded its Safari browser to block third-party

cookies -- snippets of code that track users across the web -- by

default, affecting publishers' ability to target advertising.

Earlier this year, Google unveiled plans to implement similar

restrictions in its market-leading Chrome browser by 2022.

DMG's Mr. Clarke said when European regulators implemented

restrictions under a new privacy law, the General Data Protection

Regulation, or GDPR, they left it to publishers to formulate the

language alerting viewers about their privacy rights, but Apple is

forcing everyone to use what he called a "harshly worded

prompt."

The pop-up prompt will state that the app owner "would like

permission to track you across apps and websites owned by other

companies. Your data will be used to deliver personalized ads to

you." In a survey by Tap Research Inc., 85% of respondents said

that if they saw this message in their favorite app, they would

select "Ask App Not to Track."

"This seems aggressively aimed at getting people to opt out,"

Mr. Clarke said. "For Apple to interject itself like this into our

relationship with our readers is outrageous." He said the Mail's

iPhone app draws about 1.2 million viewers a day of its total 16

million average daily users.

"You're almost scaring the consumer into saying, 'Wait a minute.

Am I comfortable with this?'" said Mark Wagman, managing director

at Ascential PLC-owned marketing consulting firm MediaLink.

Alex Austin, chief executive of Branch Metrics Inc., said the

ad-tech company will assume Apple's advertising identifier "is dead

for everything we're doing."

The impact of the coming changes won't be felt uniformly by all

publishers, but could be meaningful for companies that have

"programmatic," or automated ad sales, and have large numbers of

iPhone app users.

"It's by no means life-threatening to us, but for smaller,

independent publishers that are very reliant on programmatic, this

could be really destabilizing," said Peter Spande, publisher and

chief revenue officer of Insider Inc., which publishes Business

Insider.

Jonah Peretti, the CEO of BuzzFeed Inc., said while publishers

may feel some effect in the short term, ultimately the industry

will adjust.

"There are trade-offs for publishers. More direct, contextual

advertising in the long run, but short term it could reduce the

spending of some programmatic advertisers," he said.

Write to Lukas I. Alpert at lukas.alpert@wsj.com and Patience

Haggin at patience.haggin@wsj.com

(END) Dow Jones Newswires

August 28, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

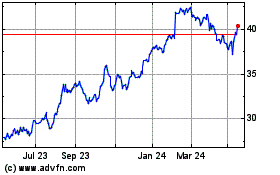

News (ASX:NWS)

Historical Stock Chart

From Oct 2024 to Nov 2024

News (ASX:NWS)

Historical Stock Chart

From Nov 2023 to Nov 2024