Fiscal 2020 Second Quarter Key

Financial Highlights

- Revenues were $2.48 billion, a 6% decline compared to $2.63

billion in the prior year

- Net income was $103 million compared to $119 million in the

prior year

- Total Segment EBITDA was $355 million compared to $370 million

in the prior year

- Reported diluted EPS were $0.14 compared to $0.16 in the prior

year – Adjusted EPS were $0.18, flat with the prior year

- Completed the sale of Unruly to Tremor International in

January

- Dow Jones results reflected 17% growth in digital-only

subscribers, continued strength in Risk and Compliance

- News UK saw growth in advertising revenues and contributed to

strong Segment EBITDA growth at the News and Information Services

segment

- Profitability contribution from Move, operator of realtor.com®,

increased while the referral model continues to show promising

signs with improvement in close rates and other key metrics

News Corporation (“News Corp” or the “Company”) (Nasdaq: NWS,

NWSA; ASX: NWS, NWSLV) today reported financial results for the

three months ended December 31, 2019.

Commenting on the results, Chief Executive Robert Thomson

said:

“In the second quarter of Fiscal 2020, News Corp saw growth at

several of our news businesses and an increased profit contribution

from Move, operator of realtor.com®. The results were affected by a

sluggish Australian economy, uncharacteristic softness in book

publishing, and foreign exchange fluctuations. We expect

improvement in the second half as real estate markets show signs of

gradual recovery, Dow Jones benefits from new content licensing

arrangements and higher digital subscribers, and HarperCollins

capitalizes on an exciting slate of new releases.

Our News and Information Services segment posted notably higher

profitability driven by a strong increase at News UK as well as

continued growth at Dow Jones, where consumer subscriptions

recently reached a record 3.5 million, including two million

digital-only subscribers at The Wall Street Journal. I would

particularly like to highlight the Risk and Compliance business,

which is flourishing, with over 20 percent revenue growth for the

twelfth consecutive quarter. Client companies are wisely seeking to

minimize risk and maximize compliance.

We are seeing significant progress in our long battle for

equitable treatment from the dominant tech platforms, and our deals

with Apple and Facebook are beginning to yield financial dividends.

The Company took important steps on the path toward simplification

with the sale of Unruly, the ad tech business, while we are engaged

in negotiations for the sale of News America Marketing. We believe

that increasing investor focus on the core growth sectors, whether

Risk and Compliance or Digital Real Estate, will be to the

advantage of our shareholders.”

SECOND QUARTER RESULTS

The Company reported fiscal 2020 second quarter total revenues

of $2.48 billion, 6% lower compared to $2.63 billion in the prior

year period. The decline reflects a $50 million, or 2%, negative

impact from foreign currency fluctuations. The rest of the decline

primarily reflects the difficult prior year comparison at the Book

Publishing segment, lower subscription revenues at Foxtel, lower

print-related advertising revenues at the News and Information

Services segment and continued pressure at REA Group due to

challenges in the Australian housing market. The declines were

partially offset by continued growth in circulation and

subscription revenues at the News and Information Services segment.

Adjusted Revenues (which exclude the foreign currency impact,

acquisitions and divestitures as defined in Note 2) declined

4%.

Net income for the quarter was $103 million, a 13% decline

compared to $119 million in the prior year, primarily reflecting

lower Total Segment EBITDA, as discussed below.

The Company reported second quarter Total Segment EBITDA of $355

million, a 4% decline compared to $370 million in the prior year,

primarily reflecting lower revenues, as discussed above, and a $10

million, or 3%, negative impact from foreign currency fluctuations.

Adjusted Total Segment EBITDA (as defined in Note 2) decreased

3%.

Diluted net income per share attributable to News Corporation

stockholders was $0.14 as compared to $0.16 in the prior year.

Adjusted EPS (as defined in Note 3) were $0.18, flat with the

prior year.

SEGMENT REVIEW

For the three months ended

For the six months ended

December 31,

December 31,

2019

2018

% Change

2019

2018

% Change

(in millions)

Better/

(Worse)

(in millions)

Better/

(Worse)

Revenues:

News and Information Services

$

1,241

$

1,257

(1

)

%

$

2,390

$

2,505

(5

)

%

Subscription Video Services

501

562

(11

)

%

1,015

1,127

(10

)

%

Book Publishing

442

496

(11

)

%

847

914

(7

)

%

Digital Real Estate Services

294

311

(5

)

%

566

604

(6

)

%

Other

1

1

-

1

1

-

Total Revenues

$

2,479

$

2,627

(6

)

%

$

4,819

$

5,151

(6

)

%

Segment EBITDA:

News and Information Services

$

142

$

112

27

%

$

198

$

221

(10

)

%

Subscription Video Services

70

84

(17

)

%

151

197

(23

)

%

Book Publishing

63

88

(28

)

%

112

156

(28

)

%

Digital Real Estate Services

118

121

(2

)

%

200

226

(12

)

%

Other

(38

)

(35

)

(9

)

%

(85

)

(72

)

(18

)

%

Total Segment EBITDA

$

355

$

370

(4

)

%

$

576

$

728

(21

)

%

News and Information Services

Revenues in the quarter decreased $16 million, or 1%, as

compared to the prior year, reflecting a $15 million, or 1%,

negative impact from foreign currency fluctuations. Within the

segment, Dow Jones and News UK revenues grew 4% and 2%,

respectively, while revenues at News Corp Australia and News

America Marketing declined 9% and 4%, respectively.

Circulation and subscription revenues increased 3% compared to

the prior year, which includes a $6 million, or 1%, negative impact

from foreign currency fluctuations. Circulation and subscription

revenues again benefited from a healthy contribution from Dow

Jones’ consumer products, which saw a 5% increase in circulation

revenues, reflecting 17% digital paid subscriber growth and

subscription price increases. Dow Jones’ consumer products reached

3.4 million total subscribers, reflecting an 8% increase compared

to the prior year. The results also reflect an 8% increase in

revenues at Dow Jones’ Professional Information Business, which

benefited from 21% growth in its Risk & Compliance products.

Price increases and digital subscriber growth at other mastheads

also contributed to the results. These increases were largely

offset by lower print volume in Australia and the U.K.

Advertising revenues declined 5% compared to the prior year, of

which $7 million, or 1%, was related to the negative impact from

foreign currency fluctuations. The remainder of the decline was

driven by weakness in the print advertising market, primarily in

Australia, and lower home delivered revenues, which include

free-standing insert products, at News America Marketing. The

declines were mitigated by growth at News UK, led by strong digital

advertising growth at The Sun. Advertising revenues at Dow Jones

declined 5% in the quarter. Digital revenues represented 43% of

total Dow Jones advertising revenues in the quarter.

Segment EBITDA increased $30 million in the quarter, or 27%, as

compared to the prior year, benefiting from a $22 million one-time

benefit from the settlement of certain warranty related claims

pertaining to previously incurred and ongoing repairs and

maintenance costs for News UK’s printing business. The results also

reflect higher contribution from News UK, resulting from cost

savings, and from Dow Jones, as well as lower losses at the New

York Post. The improvement was partially offset by the lower

revenues at News Corp Australia and News America Marketing

referenced above.

Digital revenues represented 36% of News and Information

Services segment revenues in the quarter, compared to 32% in the

prior year. For the quarter, digital revenues for Dow Jones and the

newspaper mastheads represented 39% of their combined revenues, and

at Dow Jones, digital accounted for 57% of its circulation

revenues. Digital subscribers and users across key properties

within the News and Information Services segment are summarized

below:

- The Wall Street Journal average daily digital subscribers in

the three months ended December 31, 2019 were 1,929,000, compared

to 1,709,000 in the prior year (Source: Internal data)

- Closing digital subscribers at News Corp Australia’s mastheads

as of December 31, 2019 were 566,600, compared to 460,300 in the

prior year (Source: Internal data)

- The Times and Sunday Times closing digital subscribers as of

December 31, 2019 were 320,000, compared to 269,000 in the prior

year (Source: Internal data)

- The Sun’s digital offering reached approximately 140 million

global monthly unique users in December 2019 (Source: Google

Analytics; prior year comparable statistic unavailable due to

source change)

Subscription Video Services

Revenues in the quarter decreased $61 million, or 11%, compared

with the prior year, of which $25 million, or 5%, was due to the

negative impact from foreign currency fluctuations. Adjusted

Revenues for the segment decreased 6% compared to the prior year.

The remainder of the revenue decline was driven by the impact from

lower broadcast subscribers and changes in the subscriber package

mix, partially offset by higher revenues from Foxtel’s OTT

products, Kayo, which launched in November 2018, and Foxtel

Now.

As of December 31, 2019, Foxtel’s total closing subscribers were

2.952 million, an increase of 3% compared to the prior year,

primarily due to subscriber growth at Kayo, partially offset by

lower broadcast subscribers. 2.268 million of the total closing

subscribers were broadcast and commercial subscribers, and the

remainder consisted of Foxtel Now and Kayo subscribers. As of

December 31, 2019, there were 372,000 Kayo subscribers, of which

350,000 were paying subscribers, compared to 72,000 subscribers

(42,000 paying) in the prior year. As of February 5th, there were

more than 370,000 paying Kayo subscribers. As of December 31, 2019,

there were 343,000 Foxtel Now subscribers, of which 334,000 were

paying subscribers, compared to 358,000 subscribers (354,000

paying) in the prior year.

Broadcast subscriber churn in the quarter was 16.0% compared to

15.6% in the prior year, due to increased volume of churn from

lower-value customers on expiring contracts in wholesale channels,

partially offset by improvements at the Foxtel retail channel.

Broadcast ARPU for the quarter declined 1% compared to the prior

year to over A$77 (US$53), primarily due to the changes in the

subscriber package mix.

Segment EBITDA in the quarter decreased $14 million, or 17%,

compared with the prior year, primarily due to lower revenues,

partially offset by lower total costs, including programming and

transmission costs. Adjusted Segment EBITDA (as defined in Note 2)

decreased 12%.

Book Publishing

Revenues in the quarter declined $54 million, or 11%, compared

to the prior year, of which foreign currency fluctuations had a

negative impact of $2 million, or 1%. The revenue decline was

primarily due to the difficult comparisons to the prior year, which

had higher sales of Homebody: A Guide to Creating Spaces You Never

Want to Leave by Joanna Gaines, Girl, Wash Your Face by Rachel

Hollis, The Hate U Give by Angie Thomas and The Subtle Art of Not

Giving a F*ck by Mark Manson. The decline was partially offset by

the success of The Pioneer Woman Cooks: The New Frontier by Ree

Drummond and The Beast of Buckingham Palace by David Walliams.

Digital sales increased 5% compared to the prior year, primarily

due to growth in downloadable audiobooks, and represented 19% of

Consumer revenues for the quarter. Segment EBITDA for the quarter

declined $25 million, or 28%, from the prior year, primarily due to

the lower revenues noted above and the different mix of titles.

Digital Real Estate Services

Revenues in the quarter declined $17 million, or 5%, compared to

the prior year, of which foreign currency fluctuations had a

negative impact of $8 million, or 2%. Segment EBITDA in the quarter

declined $3 million, or 2%, compared to the prior year, primarily

due to the $5 million negative impact from foreign currency

fluctuations, as lower revenues at REA Group were more than offset

by lower costs at Move. Adjusted Revenues declined 3% and Adjusted

Segment EBITDA increased 2%.

In the quarter, revenues at REA Group decreased 8% to $173

million from $189 million in the prior year, primarily due to the

negative impact from foreign currency fluctuations, lower revenues

associated with declines in listing volumes and fewer new project

launches, partially offset by higher yield and improved product mix

in the residential business.

Move’s revenues in the quarter decreased 1% to $121 million from

$122 million in the prior year, primarily due to lower revenues

from software and services. The decline was partially offset by 4%

growth in its real estate revenues, which represented 82% of total

Move revenues, reflecting growth in audience and higher lead

volume, as well as higher revenues from Local Expert. Realtor.com®

continued to migrate leads from its ConnectionsSM Plus product to

its performance-based Opcity product, which resulted in a delay in

the timing of revenue recognition. Move continues to see

improvements in all key metrics with the Opcity product, including

close rates. Based on Move’s internal data, average monthly unique

users of realtor.com®’s web and mobile sites for the fiscal second

quarter grew 9% year-over-year to approximately 59 million, with

mobile representing more than half of all unique users.

CASH FLOW

The following table presents a reconciliation of net cash

provided by operating activities to free cash flow available to

News Corporation:

For the six months ended

December 31,

2019

2018

(in millions)

Net cash provided by operating

activities

$

192

$

358

Less: Capital expenditures

(237

)

(264

)

(45

)

94

Less: REA Group free cash flow

(86

)

(105

)

Plus: Cash dividends received from REA

Group

35

37

Free cash flow available to News

Corporation

$

(96

)

$

26

Net cash provided by operating activities of $192 million for

the six months ended December 31, 2019 was $166 million lower than

$358 million in the prior year period, primarily due to lower Total

Segment EBITDA as noted above and lower cash distributions received

from affiliates of $22 million.

Free cash flow available to News Corporation in the six months

ended December 31, 2019 was $(96) million compared to $26 million

in the prior year period. The decline was primarily due to lower

cash provided by operating activities, as mentioned above,

partially offset by lower capital expenditures. Foxtel’s capital

expenditures for the six months ended December 31, 2019 were $129

million, compared to $139 million in the prior year period. Free

cash flow available to News Corporation has typically been higher

in the second half of the fiscal year.

Free cash flow available to News Corporation is a non-GAAP

financial measure defined as net cash provided by operating

activities, less capital expenditures (“free cash flow”), less REA

Group free cash flow, plus cash dividends received from REA

Group.

The Company considers free cash flow available to News

Corporation to provide useful information to management and

investors about the amount of cash that is available to be used to

strengthen the Company’s balance sheet and for strategic

opportunities including, among others, investing in the Company’s

business, strategic acquisitions, dividend payouts and repurchasing

stock. The Company believes excluding REA Group’s free cash flow

and including dividends received from REA Group provides users of

its consolidated financial statements with a measure of the amount

of cash flow that is readily available to the Company, as REA Group

is a separately listed public company in Australia and must declare

a dividend in order for the Company to have access to its share of

REA Group’s cash balance. The Company believes free cash flow

available to News Corporation provides a more conservative view of

the Company’s free cash flow because this presentation includes

only that amount of cash the Company actually receives from REA

Group, which has generally been lower than the Company’s unadjusted

free cash flow. A limitation of free cash flow available to News

Corporation is that it does not represent the total increase or

decrease in the cash balance for the period. Management compensates

for the limitation of free cash flow available to News Corporation

by also relying on the net change in cash and cash equivalents as

presented in the Company’s consolidated statements of cash flows

prepared in accordance with GAAP which incorporates all cash

movements during the period.

OTHER ITEMS

Subsequent Events

In January 2020, the Company sold Unruly to Tremor International

Ltd (“Tremor”) for approximately 7% of Tremor’s outstanding shares.

The transaction is subject to certain cash adjustments, and the

Company agreed not to sell the Tremor shares for a period of 18

months after closing. At closing, the Company and Tremor entered

into a three year commercial arrangement which granted Tremor the

exclusive right to sell outstream video advertising on all of the

Company’s digital properties in exchange for a total minimum

revenue guarantee for News Corp of £30 million.

In February 2020, Foxtel and certain of its subsidiaries entered

into a subordinated shareholder loan facility agreement (the

“Telstra Facility”) with Telstra, an Australian Securities

Exchange-listed telecommunications company which owns a 35%

interest in Foxtel. The Telstra Facility provides Foxtel with up to

A$170 million that can be used to finance cable transmission costs

due to Telstra under a services arrangement between Foxtel and

Telstra. The Telstra Facility bears interest at a variable rate of

Australian BBSY plus an applicable margin of 7.75% and matures in

December 2027. The terms of the Telstra Facility allow for the

capitalization of accrued interest to the principal

outstanding.

Dividends

The Company today declared a semi-annual cash dividend of $0.10

per share for Class A Common Stock and Class B Common Stock. This

dividend is payable on April 15, 2020 to stockholders of record as

of March 11, 2020.

COMPARISON OF NON-GAAP TO U.S. GAAP INFORMATION

Adjusted Revenues, Total Segment EBITDA, Adjusted Total Segment

EBITDA, Adjusted Segment EBITDA, adjusted net income attributable

to News Corporation stockholders, Adjusted EPS and free cash flow

available to News Corporation are non-GAAP financial measures

contained in this earnings release. The Company believes these

measures are important tools for investors and analysts to use in

assessing the Company’s underlying business performance and to

provide for more meaningful comparisons of the Company’s operating

performance between periods. These measures also allow investors

and analysts to view the Company’s business from the same

perspective as Company management. These non-GAAP measures may be

different than similar measures used by other companies and should

be considered in addition to, not as a substitute for, measures of

financial performance calculated in accordance with GAAP.

Reconciliations for the differences between non-GAAP measures used

in this earnings release and comparable financial measures

calculated in accordance with U.S. GAAP are included in Notes 1, 2

and 3 and the reconciliation of net cash provided by operating

activities to free cash flow available to News Corporation is

included above.

Conference call

News Corporation’s earnings conference call can be heard live at

5:30pm EST on February 6, 2020. To listen to the call, please visit

http://investors.newscorp.com.

Cautionary Statement Concerning Forward-Looking

Statements

This document contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements include, but are not

limited to, statements regarding trends and uncertainties affecting

the Company’s business, results of operations and financial

condition, the Company’s strategy and strategic initiatives,

including potential acquisitions, investments and dispositions such

as the strategic review and potential sale of NAM, and the outcome

of contingencies such as litigation and investigations. These

statements are based on management’s views and assumptions

regarding future events and business performance as of the time the

statements are made. Actual results may differ materially from

these expectations due to changes in global economic, business,

competitive market, regulatory and other factors. More detailed

information about these and other factors that could affect future

results is contained in our filings with the Securities and

Exchange Commission. The “forward-looking statements” included in

this document are made only as of the date of this document and we

do not have and do not undertake any obligation to publicly update

any “forward-looking statements” to reflect subsequent events or

circumstances, and we expressly disclaim any such obligation,

except as required by law or regulation.

About News Corporation

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global,

diversified media and information services company focused on

creating and distributing authoritative and engaging content and

other products and services. The company comprises businesses

across a range of media, including: news and information services,

subscription video services in Australia, book publishing and

digital real estate services. Headquartered in New York, News Corp

operates primarily in the United States, Australia, and the United

Kingdom, and its content and other products and services are

distributed and consumed worldwide. More information is available

at: www.newscorp.com.

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited; in millions,

except per share amounts)

For the three months ended

For the six months ended

December 31,

December 31,

2019

2018

2019

2018

Revenues:

Circulation and subscription

$

990

$

1,029

$

1,985

$

2,063

Advertising

677

718

1,285

1,382

Consumer

421

478

808

878

Real estate

242

248

460

475

Other

149

154

281

353

Total Revenues

2,479

2,627

4,819

5,151

Operating expenses

(1,350

)

(1,484

)

(2,687

)

(2,824

)

Selling, general and administrative

(774

)

(773

)

(1,556

)

(1,599

)

Depreciation and amortization

(162

)

(163

)

(324

)

(326

)

Impairment and restructuring charges

(29

)

(19

)

(326

)

(37

)

Equity losses of affiliates

(3

)

(6

)

(5

)

(9

)

Interest expense, net

(8

)

(15

)

(4

)

(31

)

Other, net

2

7

6

27

Income (loss) before income tax

expense

155

174

(77

)

352

Income tax expense

(52

)

(55

)

(31

)

(105

)

Net income (loss)

103

119

(108

)

247

Less: Net income attributable to

noncontrolling interests

(18

)

(24

)

(34

)

(51

)

Net income (loss) attributable to News

Corporation stockholders

$

85

$

95

$

(142

)

$

196

Weighted average shares outstanding:

Basic

588

585

587

584

Diluted

590

587

587

586

Net income (loss) attributable to News

Corporation stockholders per share - basic

$

0.15

$

0.16

$

(0.24

)

$

0.34

Net income (loss) attributable to News

Corporation stockholders per share - diluted

$

0.14

$

0.16

$

(0.24

)

$

0.33

NEWS CORPORATION

CONSOLIDATED BALANCE

SHEETS

(Unaudited; in

millions)

As of December 31, 2019

As of June 30, 2019

ASSETS

Current assets:

Cash and cash equivalents

$

1,272

$

1,643

Receivables, net

1,570

1,544

Inventory, net

358

348

Other current assets

518

515

Total current assets

3,718

4,050

Non-current assets:

Investments

325

335

Property, plant and equipment, net

2,476

2,554

Operating lease right-of-use assets

1,299

-

Intangible assets, net

2,257

2,426

Goodwill

4,976

5,147

Deferred income tax assets

283

269

Other non-current assets

948

930

Total assets

$

16,282

$

15,711

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

375

$

411

Accrued expenses

1,072

1,328

Deferred revenue

411

428

Current borrowings

-

449

Other current liabilities

869

724

Total current liabilities

2,727

3,340

Non-current liabilities:

Borrowings

1,201

1,004

Retirement benefit obligations

258

266

Deferred income tax liabilities

268

295

Operating lease liabilities

1,343

-

Other non-current liabilities

358

495

Commitments and contingencies

Equity:

Class A common stock

4

4

Class B common stock

2

2

Additional paid-in capital

12,183

12,243

Accumulated deficit

(2,114

)

(1,979

)

Accumulated other comprehensive loss

(1,117

)

(1,126

)

Total News Corporation stockholders'

equity

8,958

9,144

Noncontrolling interests

1,169

1,167

Total equity

10,127

10,311

Total liabilities and equity

$

16,282

$

15,711

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS (Unaudited; in millions)

For the six months ended

December 31,

2019

2018

Operating activities:

Net (loss) income

$

(108

)

$

247

Adjustments to reconcile net (loss) income

to cash provided by operating activities:

Depreciation and amortization

324

326

Operating lease expense

86

-

Equity losses of affiliates

5

9

Cash distributions received from

affiliates

5

27

Impairment charges

292

-

Other, net

(6

)

(27

)

Deferred income taxes and taxes

payable

(35

)

40

Change in operating assets and

liabilities, net of acquisitions:

Receivables and other assets

(1,661

)

(140

)

Inventories, net

3

(43

)

Accounts payable and other liabilities

1,287

(81

)

Net cash provided by operating

activities

192

358

Investing activities:

Capital expenditures

(237

)

(264

)

Acquisitions, net of cash acquired

(2

)

(185

)

Investments in equity affiliates and

other

(8

)

(13

)

Proceeds from business dispositions

-

5

Proceeds from property, plant and

equipment and other asset dispositions

10

32

Other, net

3

16

Net cash used in investing activities

(234

)

(409

)

Financing activities:

Borrowings

917

263

Repayment of borrowings

(1,161

)

(470

)

Dividends paid

(81

)

(81

)

Other, net

(3

)

(45

)

Net cash used in financing activities

(328

)

(333

)

Net change in cash and cash

equivalents

(370

)

(384

)

Cash and cash equivalents, beginning of

period

1,643

2,034

Exchange movement on opening cash

balance

(1

)

(32

)

Cash and cash equivalents, end of

period

$

1,272

$

1,618

NOTE 1 – TOTAL SEGMENT EBITDA

Segment EBITDA is defined as revenues less operating expenses

and selling, general and administrative expenses. Segment EBITDA

does not include: depreciation and amortization, impairment and

restructuring charges, equity losses of affiliates, interest

(expense) income, net, other, net and income tax (expense) benefit.

Management believes that Segment EBITDA is an appropriate measure

for evaluating the operating performance of the Company’s business

segments because it is the primary measure used by the Company’s

chief operating decision maker to evaluate the performance of and

allocate resources within the Company’s businesses. Segment EBITDA

provides management, investors and equity analysts with a measure

to analyze the operating performance of each of the Company’s

business segments and its enterprise value against historical data

and competitors’ data, although historical results may not be

indicative of future results (as operating performance is highly

contingent on many factors, including customer tastes and

preferences).

Total Segment EBITDA is a non-GAAP measure and should be

considered in addition to, not as a substitute for, net income

(loss), cash flow and other measures of financial performance

reported in accordance with GAAP. In addition, this measure does

not reflect cash available to fund requirements and excludes items,

such as depreciation and amortization and impairment and

restructuring charges, which are significant components in

assessing the Company’s financial performance. The Company believes

that the presentation of Total Segment EBITDA provides useful

information regarding the Company’s operations and other factors

that affect the Company’s reported results. Specifically, the

Company believes that by excluding certain one-time or non-cash

items such as impairment and restructuring charges and depreciation

and amortization, as well as potential distortions between periods

caused by factors such as financing and capital structures and

changes in tax positions or regimes, the Company provides users of

its consolidated financial statements with insight into both its

core operations as well as the factors that affect reported results

between periods but which the Company believes are not

representative of its core business. As a result, users of the

Company’s consolidated financial statements are better able to

evaluate changes in the core operating results of the Company

across different periods. The following tables reconcile net income

(loss) to Total Segment EBITDA.

For the three months ended

December 31,

2019

2018

Change

% Change

(in millions)

Net income

$

103

$

119

$

(16

)

(13

)

%

Add:

Income tax expense

52

55

(3

)

(5

)

%

Other, net

(2

)

(7

)

5

71

%

Interest expense, net

8

15

(7

)

(47

)

%

Equity losses of affiliates

3

6

(3

)

(50

)

%

Impairment and restructuring charges

29

19

10

53

%

Depreciation and amortization

162

163

(1

)

(1

)

%

Total Segment EBITDA

$

355

$

370

$

(15

)

(4

)

%

For the six months ended December

31,

2019

2018

Change

% Change

(in millions)

Net (loss) income

$

(108

)

$

247

$

(355

)

**

Add:

Income tax expense

31

105

(74

)

(70

)

%

Other, net

(6

)

(27

)

21

78

%

Interest expense, net

4

31

(27

)

(87

)

%

Equity losses of affiliates

5

9

(4

)

(44

)

%

Impairment and restructuring charges

326

37

289

**

Depreciation and amortization

324

326

(2

)

(1

)

%

Total Segment EBITDA

$

576

$

728

$

(152

)

(21

)

%

** - Not meaningful

NOTE 2 – ADJUSTED REVENUES, ADJUSTED TOTAL SEGMENT EBITDA AND

ADJUSTED SEGMENT EBITDA

The Company uses revenues, Total Segment EBITDA and Segment

EBITDA excluding the impact of acquisitions, divestitures, fees and

costs, net of indemnification, related to the claims and

investigations arising out of certain conduct at The News of the

World (the “U.K. Newspaper Matters”) and foreign currency

fluctuations (“Adjusted Revenues,” “Adjusted Total Segment EBITDA”

and “Adjusted Segment EBITDA,” respectively) to evaluate the

performance of the Company’s core business operations exclusive of

certain items that impact the comparability of results from period

to period such as the unpredictability and volatility of currency

fluctuations. The Company calculates the impact of foreign currency

fluctuations for businesses reporting in currencies other than the

U.S. dollar by multiplying the results for each quarter in the

current period by the difference between the average exchange rate

for that quarter and the average exchange rate in effect during the

corresponding quarter of the prior year and totaling the impact for

all quarters in the current period.

The calculation of Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA may not be comparable to

similarly titled measures reported by other companies, since

companies and investors may differ as to what type of events

warrant adjustment. Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA are not measures of performance

under generally accepted accounting principles and should not be

construed as substitutes for amounts determined under GAAP as

measures of performance. However, management uses these measures in

comparing the Company’s historical performance and believes that

they provide meaningful and comparable information to investors to

assist in their analysis of our performance relative to prior

periods and our competitors.

The following tables reconcile reported revenues and reported

Total Segment EBITDA to Adjusted Revenues and Adjusted Total

Segment EBITDA for the three and six months ended December 31, 2019

and 2018.

Revenues

Total Segment EBITDA

For the three months ended

For the three months ended

December 31,

December 31,

2019

2018

Difference

2019

2018

Difference

(in millions)

(in millions)

As reported

$

2,479

$

2,627

$

(148

)

$

355

$

370

$

(15

)

Impact of acquisitions

(5

)

-

(5

)

(2

)

-

(2

)

Impact of divestitures

-

(5

)

5

-

-

-

Impact of foreign currency

fluctuations

50

-

50

10

-

10

Net impact of U.K. Newspaper Matters

-

-

-

(1

)

4

(5

)

As adjusted

$

2,524

$

2,622

$

(98

)

$

362

$

374

$

(12

)

Revenues

Total Segment EBITDA

For the six months ended

For the six months ended

December 31,

December 31,

2019

2018

Difference

2019

2018

Difference

(in millions)

(in millions)

As reported

$

4,819

$

5,151

$

(332

)

$

576

$

728

$

(152

)

Impact of acquisitions

(21

)

-

(21

)

13

-

13

Impact of divestitures

-

(12

)

12

-

(1

)

1

Impact of foreign currency

fluctuations

134

-

134

23

-

23

Net impact of U.K. Newspaper Matters

-

-

-

1

6

(5

)

As adjusted

$

4,932

$

5,139

$

(207

)

$

613

$

733

$

(120

)

Foreign Exchange Rates

Average foreign exchange rates used in the calculation of the

impact of foreign currency fluctuations for each of the three month

periods in the six months ended December 31, 2019 and 2018 are as

follows:

Fiscal Year 2020

Q1

Q2

Australian Dollar / U.S. Dollar

0.69

0.68

British Pound Sterling / U.S. Dollar

1.23

1.29

Fiscal Year 2019

Q1

Q2

Australian Dollar / U.S. Dollar

0.73

0.72

British Pound Sterling / U.S. Dollar

1.30

1.29

Adjusted Revenues and Adjusted Segment EBITDA by segment for the

three and six months ended December 31, 2019 and 2018 are as

follows:

For the three months ended

December 31,

2019

2018

% Change

(in millions)

Better/(Worse)

Adjusted Revenues:

News and Information Services

$

1,251

$

1,252

-

Subscription Video Services

526

562

(6

)

%

Book Publishing

444

496

(10

)

%

Digital Real Estate Services

302

311

(3

)

%

Other

1

1

-

Adjusted Total Revenues

$

2,524

$

2,622

(4

)

%

Adjusted Segment EBITDA:

News and Information Services

$

141

$

112

26

%

Subscription Video Services

74

84

(12

)

%

Book Publishing

63

88

(28

)

%

Digital Real Estate Services

123

121

2

%

Other

(39

)

(31

)

(26

)

%

Adjusted Total Segment EBITDA

$

362

$

374

(3

)

%

For the six months ended December

31,

2019

2018

% Change

(in millions)

Better/(Worse)

Adjusted Revenues:

News and Information Services

$

2,426

$

2,495

(3

)

%

Subscription Video Services

1,074

1,127

(5

)

%

Book Publishing

854

914

(7

)

%

Digital Real Estate Services

577

602

(4

)

%

Other

1

1

-

Adjusted Total Revenues

$

4,932

$

5,139

(4

)

%

Adjusted Segment EBITDA:

News and Information Services

$

199

$

220

(10

)

%

Subscription Video Services

160

197

(19

)

%

Book Publishing

112

156

(28

)

%

Digital Real Estate Services

226

226

-

Other

(84

)

(66

)

(27

)

%

Adjusted Total Segment EBITDA

$

613

$

733

(16

)

%

The following tables reconcile reported revenues and Segment

EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA

by segment for the three months ended December 31, 2019 and

2018.

For the three months ended

December 31, 2019

As Reported

Impact of Acquisitions

Impact of Divestitures

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

News and Information Services

$

1,241

$

(5

)

$

-

$

15

$

-

$

1,251

Subscription Video Services

501

-

-

25

-

526

Book Publishing

442

-

-

2

-

444

Digital Real Estate Services

294

-

-

8

-

302

Other

1

-

-

-

-

1

Total Revenues

$

2,479

$

(5

)

$

-

$

50

$

-

$

2,524

Segment EBITDA:

News and Information Services

$

142

$

(2

)

$

-

$

1

$

-

$

141

Subscription Video Services

70

-

-

4

-

74

Book Publishing

63

-

-

-

-

63

Digital Real Estate Services

118

-

-

5

-

123

Other

(38

)

-

-

-

(1

)

(39

)

Total Segment EBITDA

$

355

$

(2

)

$

-

$

10

$

(1

)

$

362

For the three months ended

December 31, 2018

As Reported

Impact of Acquisitions

Impact of Divestitures

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

News and Information Services

$

1,257

$

-

$

(5

)

$

-

$

-

$

1,252

Subscription Video Services

562

-

-

-

-

562

Book Publishing

496

-

-

-

-

496

Digital Real Estate Services

311

-

-

-

-

311

Other

1

-

-

-

-

1

Total Revenues

$

2,627

$

-

$

(5

)

$

-

$

-

$

2,622

Segment EBITDA:

News and Information Services

$

112

$

-

$

-

$

-

$

-

$

112

Subscription Video Services

84

-

-

-

-

84

Book Publishing

88

-

-

-

-

88

Digital Real Estate Services

121

-

-

-

-

121

Other

(35

)

-

-

-

4

(31

)

Total Segment EBITDA

$

370

$

-

$

-

$

-

$

4

$

374

The following tables reconcile reported revenues and Segment

EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA

by segment for the six months ended December 31, 2019 and 2018.

For the six months ended December

31, 2019

As Reported

Impact of Acquisitions

Impact of Divestitures

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

News and Information Services

$

2,390

$

(14

)

$

-

$

50

$

-

$

2,426

Subscription Video Services

1,015

-

-

59

-

1,074

Book Publishing

847

-

-

7

-

854

Digital Real Estate Services

566

(7

)

-

18

-

577

Other

1

-

-

-

-

1

Total Revenues

$

4,819

$

(21

)

$

-

$

134

$

-

$

4,932

Segment EBITDA:

News and Information Services

$

198

$

(2

)

$

-

$

3

$

-

$

199

Subscription Video Services

151

(1

)

-

10

-

160

Book Publishing

112

-

-

-

-

112

Digital Real Estate Services

200

16

-

10

-

226

Other

(85

)

-

-

-

1

(84

)

Total Segment EBITDA

$

576

$

13

$

-

$

23

$

1

$

613

For the six months ended December

31, 2018

As Reported

Impact of Acquisitions

Impact of Divestitures

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

News and Information Services

$

2,505

$

-

$

(10

)

$

-

$

-

$

2,495

Subscription Video Services

1,127

-

-

-

-

1,127

Book Publishing

914

-

-

-

-

914

Digital Real Estate Services

604

-

(2

)

-

-

602

Other

1

-

-

-

-

1

Total Revenues

$

5,151

$

-

$

(12

)

$

-

$

-

$

5,139

Segment EBITDA:

News and Information Services

$

221

$

-

$

(1

)

$

-

$

-

$

220

Subscription Video Services

197

-

-

-

-

197

Book Publishing

156

-

-

-

-

156

Digital Real Estate Services

226

-

-

-

-

226

Other

(72

)

-

-

-

6

(66

)

Total Segment EBITDA

$

728

$

-

$

(1

)

$

-

$

6

$

733

NOTE 3 – ADJUSTED NET INCOME (LOSS) ATTRIBUTABLE TO NEWS

CORPORATION STOCKHOLDERS AND ADJUSTED EPS

The Company uses net income (loss) attributable to News

Corporation stockholders and diluted earnings per share (“EPS”)

excluding expenses related to U.K. Newspaper Matters, impairment

and restructuring charges and “Other, net”, net of tax, recognized

by the Company or its equity method investees, as well as the

settlement of certain pre-Separation tax matters (“adjusted net

income (loss) attributable to News Corporation stockholders” and

“adjusted EPS,” respectively), to evaluate the performance of the

Company’s operations exclusive of certain items that impact the

comparability of results from period to period, as well as certain

non-operational items. The calculation of adjusted net income

(loss) attributable to News Corporation stockholders and adjusted

EPS may not be comparable to similarly titled measures reported by

other companies, since companies and investors may differ as to

what type of events warrant adjustment. Adjusted net income (loss)

attributable to News Corporation stockholders and adjusted EPS are

not measures of performance under generally accepted accounting

principles and should not be construed as substitutes for

consolidated net income (loss) attributable to News Corporation

stockholders and net income (loss) per share as determined under

GAAP as a measure of performance. However, management uses these

measures in comparing the Company’s historical performance and

believes that they provide meaningful and comparable information to

investors to assist in their analysis of our performance relative

to prior periods and our competitors.

The following tables reconcile reported net income (loss)

attributable to News Corporation stockholders and reported diluted

EPS to adjusted net income attributable to News Corporation

stockholders and adjusted EPS for the three and six months ended

December 31, 2019 and 2018.

For the three months ended

For the three months ended

December 31, 2019

December 31, 2018

(in millions, except per share data)

Net income attributable to

stockholders

EPS

Net income attributable to

stockholders

EPS

Net income

$

103

$

$

119

$

Less: Net income attributable to

noncontrolling interests

(18

)

(24

)

Net income attributable to News

Corporation stockholders

$

85

$

0.14

$

95

$

0.16

U.K. Newspaper Matters

(1

)

-

4

0.01

Impairment and restructuring charges

29

0.05

19

0.03

Other, net

(2

)

-

(7

)

(0.01

)

Tax impact on items above

(5

)

(0.01

)

(6

)

(0.01

)

Impact of noncontrolling interest on items

above

(1

)

-

(2

)

-

As adjusted

$

105

$

0.18

$

103

$

0.18

For the six months ended

For the six months ended

December 31, 2019

December 31, 2018

(in millions, except per share data)

Net (loss) income available to

stockholders

EPS

Net income available to

stockholders

EPS

Net (loss) income

$

(108

)

$

$

247

$

Less: Net income attributable to

noncontrolling interests

(34

)

(51

)

Net (loss) income available to News

Corporation stockholders

$

(142

)

$

(0.24

)

$

196

$

0.33

U.K. Newspaper Matters

1

-

6

0.01

Impairment and restructuring charges

(a)

326

0.55

37

0.06

Other, net

(6

)

(0.01

)

(27

)

(0.05

)

Tax impact on items above

(46

)

(0.08

)

(10

)

(0.01

)

Impact of noncontrolling interest on items

above

(2

)

-

(2

)

-

As adjusted

$

131

$

0.22

$

200

$

0.34

(a)

During the six months ended December 31, 2019, the Company

recognized $292 million of non-cash impairment charges, primarily

at News America Marketing.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200206005972/en/

Investor Relations Michael Florin

212-416-3363 mflorin@newscorp.com

Leslie Kim 212-416-4529 lkim@newscorp.com

Corporate Communications Jim

Kennedy 212-416-4064 jkennedy@newscorp.com

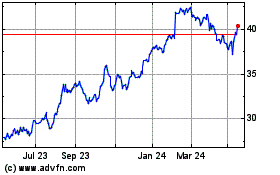

News (ASX:NWS)

Historical Stock Chart

From Oct 2024 to Nov 2024

News (ASX:NWS)

Historical Stock Chart

From Nov 2023 to Nov 2024