Texas Blackout Boosts Australian Bank by Up to $215 Million

February 22 2021 - 10:38AM

Dow Jones News

By Joe Wallace

The deep freeze that plunged millions of Texans into darkness

last week produced a windfall of up to $215 million for Macquarie

Group Ltd., an Australian investment bank that is active in U.S.

power and gas markets.

The extreme weather froze wind turbines and oil-and-gas wells,

closed oil refiners and prompted power stations to trip offline,

sending a jolt through energy markets. Wholesale power prices

rocketed, as did spot prices for natural gas in Texas, Oklahoma,

Kansas and Arkansas.

The turbulence led to a bonanza for Macquarie's commodity

traders, who specialize in sending gas and electricity to clients

such as utility companies in unusual situations.

The bank bumped up its guidance Monday for earnings in the year

through March to reflect the windfall. It said that net profit

after tax would be 5% to 10% higher than in the 2020 fiscal year.

That equates to an increase of up to 273.1 million Australian

dollars, equivalent to around $215 million. In its previous

guidance, issued Feb. 9, Macquarie said it expected profits to be

slightly down on 2020.

"Extreme winter weather conditions in North America have

significantly increased short-term client demand for Macquarie's

capabilities in maintaining critical physical supply across the

commodity complex, and particularly in relation to gas and power,"

the bank said.

Macquarie describes itself as the second-largest marketer of

physical gas in North America behind BP PLC. The business, which

Macquarie has built out for over a decade, received a boost from

the acquisition of Cargill Inc.'s North America power and gas

division in 2017. It buys and sells on behalf of customers.

The Australian bank rents access to natural-gas pipelines and

electricity networks across the U.S., harnessing that capacity when

customers are in urgent need of fuel or power. That was the case

last week, when frozen pipelines and the closure of oil-and-gas

wells set off a scramble for natural gas among Texas power plants

and other consumers.

Macquarie sent large volumes of gas from the north of the U.S.

to the south, where the cold weather sent prices soaring last week,

a person familiar with the matter said.

At one point, natural gas changed hands for more than $900 per

million British thermal units at the ONEOK Gas Transportation hub

in Oklahoma, according to commodities data provider S&P Global

Platts. By Friday, prices at the hub had fallen back to about $14

per million British thermal units. That was still comparatively

high: Benchmark futures for U.S. natural gas, which are tied to

delivery at Henry Hub in Louisiana, have generally cost between

$2.50 and $3.50 per million British thermal units in recent

months.

Shares of Macquarie rose 3.4% in Sydney on Monday after the

company raised its profit outlook. They are now down 2.8% over the

past 12 months.

There have also been corporate losers from the blackouts. Shares

of Atmos Energy Corp. fell 3.1% Monday after the Dallas-based gas

supplier said it would have to pay between $2.5 billion and $3.5

billion for gas it bought at elevated prices in Texas, Colorado and

Kansas. Atmos may issue stock or raise debt to help to pay for the

purchases, it said Friday.

German energy company RWE AG said its 2021 earnings would be hit

by outages at the company's wind turbines, as well as from high

prices for electricity.

Write to Joe Wallace at Joe.Wallace@wsj.com

(END) Dow Jones Newswires

February 22, 2021 10:23 ET (15:23 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

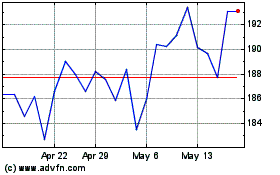

Macquarie (ASX:MQG)

Historical Stock Chart

From Oct 2024 to Nov 2024

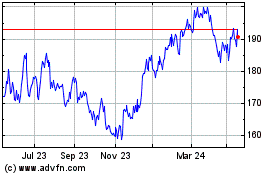

Macquarie (ASX:MQG)

Historical Stock Chart

From Nov 2023 to Nov 2024