LIVESTOCK HIGHLIGHTS: Top Stories of the Day

May 10 2018 - 6:03PM

Dow Jones News

TOP STORIES

Red Meat Export Sales Drop -- Market Talk

09:29 ET - Last week was a bad one for U.S. meat merchants. The

USDA says exporters sold 11,300 metric tons of beef for 2018 in the

week ended May 3, down 30% from a week earlier and 41% from the

average of the previous four weeks. Pork sales of 16,500 tons were

down slightly from the previous week and 21% lower than the recent

average. With large domestic production pressuring livestock

prices, traders are looking for healthy exports to keep supplies in

check. The start of U.S. grilling season is helping lift demand for

beef and certain cuts of pork, which has recently helped meat

prices. (benjamin.parkin@wsj.com; @b_parkyn)

IR, Sales-Data Changes Could Help Domino's Enterprises -- Market

Talk

0502 GMT - Shares of Domino's Pizza Enterprises have steadily

slid from August 2016's record high in Australia, with the

franchisee losing nearly half its value. To regain lost ground,

longtime bull Morgan Stanley suggests more-precise metrics on

same-store-sales growth to account for store splits and even

suggests a permanent staff for investor relations; management

currently handles that. Despite some profit warnings recently,

Morgan Stanley still contends the stock trades at a deep discount

to global peers. Shares are up 1.1% today, cutting the year's drop

to 8.4%. (mike.cherney@wsj.com; @Mike_Cherney)

STORIES OF INTEREST

Cropland Prices, Incomes Fall in Parts of Midwest -- Market

Talk

10:00 ET - Cropland values dropped alongside incomes in parts of

the Farm Belt during 1Q, according to a report by the Federal

Reserve Bank of St Louis. Farm income fell for the 17th consecutive

session in the Fed district--which includes parts of states like

Illinois, Indiana and Missouri--while prices for "quality" farmland

declined 1.4% versus year-ago levels. Prices for ranch and

pastureland rose 13%. Farm bankers are growing more optimistic

about the agricultural economy as crop prices have risen this year,

but a prolonged strain on farm incomes may be driving higher loan

demand, the report said. Nearly one-quarter of bankers surveyed

said more than half of their farm borrowers would face "severe

financial difficulty" without income from off the farm.

(jesse.newman@wsj.com; @jessenewman13)

Wm Morrison Posts Strong 1Q in Tough Environment, Says Analyst

-- Market Talk

1052 GMT - Wm. Morrison Supermarkets managed a strong

first-quarter performance in an increasingly difficult U.K. grocery

sector that looks like it could get even tougher if the

Asda-Sainsbury merger gets the green light, says Neil Wilson, chief

market analyst at markets.com. Morrison reported 1Q like-for-like

sales growth--excluding fuel--of 3.6% that Mr. Wilson says included

a 1.8% contribution from wholesale, which remains a strong growth

area for the grocer. Morrison shares are up 2.4% at 251.20 pence.

(maryam.cockar@dowjones.com)

FUTURES MARKETS

Livestock Futures Climb; Meat Supplies, Demand Growing

Cattle futures rose as traders waited for the week's physical

trade to develop.

Meatpackers were mostly bidding around $120 per 100 pounds for

cattle to slaughter, according to market observers, while feedyards

were asking for $127 to $128. Prices last week averaged $125. Even

though many expected values to fall this week, some analysts say

the futures market will likely have to rise in order to close a

historic discount to cash prices.

CASH MARKETS

Zumbrota, Minn Hog Steady At $37.00 - May 10

Barrow and gilt prices at the Zumbrota, Minn., livestock market are

steady at $37.00 per hundredweight.

Sow prices are steady. Sows weighing 400-450 pounds are at $33.00-$35.00,

450-500 pounds are $33.00-$35.00 and those over 500 pounds are $37.00-$39.00.

The day's total run is estimated at 100 head.

Prices are provided by the Central Livestock Association.

Estimated U.S. Pork Packer Margin Index - May 10

All figures are on a per-head basis.

Date Standard Margin Estimated margin

Operating Index at vertically -

integrated operations

*

May 10 +$16.17 +$ 24.03

May 9 +$16.23 +$ 23.23

May 8 +$17.05 +$ 21.99

* Based on Iowa State University's latest estimated cost of production.

A positive number indicates a processing margin above the cost of

production of the animals.

Beef-O-Meter

This report compares the USDA's latest beef carcass composite

values as a percentage of their respective year-ago prices.

Beef

For Today Choice 93.6

(Percent of Year-Ago) Select 92.3

USDA Boxed Beef, Pork Reports

Wholesale choice-grade beef prices Thursday rose 11 cents per

hundred pounds to $231.07, according to the USDA. Select-grade

prices rose 19 cents per hundred pounds to $209.14. The total load

count was 111. Wholesale pork prices rose 37 cents to $71.58 a

hundred pounds, based on Omaha, Neb., price quotes.

(END) Dow Jones Newswires

May 10, 2018 17:48 ET (21:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

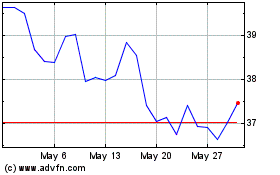

Dominos Pizza Enterprises (ASX:DMP)

Historical Stock Chart

From Oct 2024 to Nov 2024

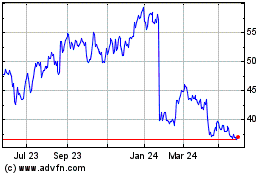

Dominos Pizza Enterprises (ASX:DMP)

Historical Stock Chart

From Nov 2023 to Nov 2024