Alumina Cautions On Volatile Prices In 2012 After Profit Jump

February 15 2012 - 8:21PM

Dow Jones News

Alumina Ltd. (AWC.AU), a partner in the world's largest producer

of the key ingredient in aluminum, Thursday cautioned that prices

are likely to remain volatile in 2012 after falling sharply toward

the end of last year and even as the industry cuts smelting

capacity.

The Australian company said its 2011 profit increased more than

three times as aluminum and alumina prices increased and production

at its Alcoa World Alumina & Chemicals venture with Alcoa Inc.

(AA) reached a record.

"Toward the end of 2011, conditions deteriorated with

significantly reduced aluminum and alumina prices and the

Australian dollar remaining at high levels against the U.S.

dollar," said John Bevan, chief executive of Alumina. "We are

cautious on the outlook for 2012."

The company said demand remains reasonably firm despite the fall

in prices and aluminum demand should grow between 5% and 7%

globally in 2012.

A number of companies have cut smelting capacity as prices

weakened, and Alcoa earlier this month said it was reviewing the

viability of its Point Henry smelter in Australia in the face of

tough global economic conditions.

"The outlook may see further curtailments of high-cost smelters

globally, although new smelters in China and the Middle East will

ensure global production remains in full supply," it said, adding

higher-cost alumina refineries are expected to reduce capacity only

if the demand from smelters is reduced.

Alumina's net profit jumped to US$126.6 million in 2011 from

US$34.6 million a year earlier, the company said. Revenue at the

Alcoa World venture, owned 40-60 with Alcoa, increased 22% to

US$6.67 billion from US$5.46 billion.

Alcoa declared a final dividend of 3 cents a share, bring the

total to 6 cents for the year, in line with the year before.

"The dividend decision is a material surprise to us,

particularly in light of the cautious--and clearly

appropriate--management comments around the outlook for 2012,"

analysts at Macquarie said in a research note to clients.

Underlying earnings were broadly in line with consensus

expectations, they said.

Alumina's Bevan said Alcoa World is expected to benefit from a

continued shift to pricing based on the spot market. The company

during 2011 had converted about 20% of its third-party

smelter-grade alumina sales to pricing based on the spot market,

and said it expected that, by the end of this year, 40% of sales

will be priced this way.

Alcoa world produced a record 15.7 million metric tons during

the year, up from 15.2 million in 2010, and Alumina said it was

targeting 15.9 million tons of alumina and 360,000 tons of aluminum

this year.

-By Robb M. Stewart, Dow Jones Newswires; +61 3 9292 2094;

robb.stewart@dowjones.com

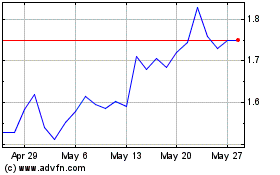

Alumina (ASX:AWC)

Historical Stock Chart

From Jan 2025 to Feb 2025

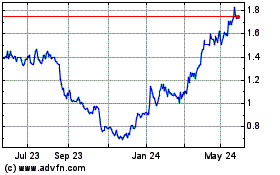

Alumina (ASX:AWC)

Historical Stock Chart

From Feb 2024 to Feb 2025