EUROBONDS: Primary Bond Market Stalls As Growth Concerns Dominate

September 09 2011 - 10:13AM

Dow Jones News

Concerns about the implications of slowing economic growth

pushed European debt insurance costs higher Friday and left the

primary bond market looking hopefully to next week for

issuance.

There were no new bonds on offer despite the reopening of the

investment-grade and high-yield corporate markets earlier in the

week.

Dutch Telecom company KPN NV (KPN.AE) issued the first

investment-grade corporate bond in over a month Thursday with a

EUR500 million, 10-year deal. Before that, the last deal was on

July 22 from BMW AG (BMW.XE).

The high-yield bond market reopened Wednesday, when Germany's

Fresenius Medical Care AG & Co. (FME.XE) broke the silence from

July 26.

Yet there is no guarantee these deals will encourage a rush of

issuance next week, as caution surrounding the sovereign debt

crisis and recession fears dominate, syndicate bankers said.

Corporate issuance next week "is contingent on how the market

performs through the early part of the week," said one banker.

Despite the deals this week, "we're still going to have to come in

Monday and take a look at what the market is telling us," he

said.

Another banker noted three sterling-denominated bond roadshows

ended this week and should launch next week. Wessex Water Services

Finance PLC, U.K. housing association Moat Homes, and Australian

gas infrastructure company APA Group (APA.AU) are all in the

sterling pipeline.

"The sterling market is going to be busy next week," the banker

said, adding "the rest of Europe will remain issuing one-off

deals."

There is also the potential for the first corporate hybrid bond

next week, although given the nature of hybrids the timing is less

dependent on market sentiment.

German utility EnBW Energie Baden-Wuerttemberg AG (EBK.XE) met

with investors Monday through Wednesday for a potential hybrid

bond, which combines features of debt and equity. These types of

bonds pay a higher return and rank lower in a bankruptcy than

standard corporate bonds, but strengthen a company's balance sheet

and can be used to support its credit rating.

The latter is important for this deal, a banker working on it

said. After the Fukushima disaster in Japan, the German government

quickened its plans to phase out nuclear power, something the three

credit rating companies have warned could put pressure on the

county's utilities companies.

"The structure [of the EnBW hybrid] is completely new. Investors

have asked for a bit more time to absorb this," she said.

Meanwhile, the sovereign and financials credit default swap

indexes continued to hover around their all-time widest levels,

according to data-provider Markit.

-By Art Patnaude, Dow Jones Newswires; +44 (0) 207 842 9259;

art.patnaude@dowjones.com (Serena Ruffoni contributed to this

report)

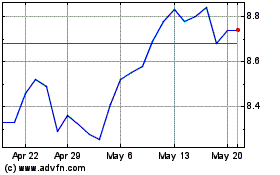

APA (ASX:APA)

Historical Stock Chart

From Oct 2024 to Nov 2024

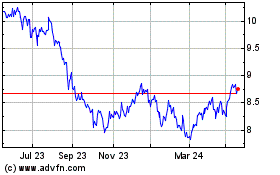

APA (ASX:APA)

Historical Stock Chart

From Nov 2023 to Nov 2024