RBS Close To Selling Asian Assets To HSBC - Sources

December 09 2009 - 6:57AM

Dow Jones News

Royal Bank of Scotland Group PLC (RBS) is close to selling its

retail- and commercial-banking assets in China, India and Malaysia

to U.K. peer HSBC Holdings PLC (HBC), people familiar with the

situation said.

According to the people, regulatory approval is pending for the

deal, which is expected to close this month but could still fall

through.

The assets in those countries are the final piece of an auction

that began earlier this year, as the U.K. lender continues to trim

operations to repay a government bailout during the financial

crisis.

In August, Australia & New Zealand Banking Group Ltd.

(ANZ.AU) bought RBS' retail- and commercial-banking operations in

Taiwan, Singapore, Indonesia and Hong Kong, and its institutional

businesses in Taiwan, the Philippines and Vietnam for $550 million.

Pakistan's MCB Bank Ltd. bought the Pakistan operations.

Rival Standard Chartered PLC (STAN.LN) was at some point in

exclusive talks with RBS over the Indian, Chinese and Malaysian

assets, but the talks stalled over price, a person familiar with

the situation has said.

The person said Standard Chartered was willing to pay $200

million to $250 million for the assets but RBS was expecting

more.

RBS will soon see the U.K. government owning 84% of the bank,

from 70% currently, after it decided to participate in a state

insurance scheme to protect it against big impairment losses.

The bank is going through a massive restructuring following a

total GBP45.5 billion capital injection by the government since

last year. The bank expanded aggressively under former Chief

Executive Sir Fred Goodwin, including through the acquisition of

part of ABN Amro Holding NV in 2007.

RBS paid GBP10 billion for its part of ABN, which included the

Asian businesses and wholesale-banking operations in Europe.

By selling its Asia retail and commercial operations, RBS will

pare its list of 10,000 corporate clients to fewer than 1,000.

The bank is retaining its investment-banking operations and

corporate-banking business in the region.

Meanwhile, HSBC's interest for the assets underscore the bank's

hunger to continue growing in Asia, where it is already focused

on.

Because of its exposure to the region, U.K.-based HSBC has been

able to weather the financial crisis better than its peers.

Banks have been eyeing expansion in China in particular, a

country that has continued to grow despite the global

recession.

HSBC currently has 87 outlets across China, one of the largest

networks among foreign banks in the country.

It has said its goal is to have around 120 outlets by the end of

next year.

-By Patricia Kowsmann, Dow Jones Newswires. Tel

+44(0)207-842-9295, patricia.kowsmann@dowjones.com

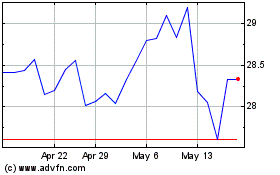

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From May 2024 to Jun 2024

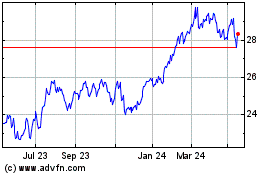

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jun 2023 to Jun 2024