UPDATE: ANZ Bank May Take Another Look At RBS Assets In China

October 06 2009 - 12:06AM

Dow Jones News

Australia & New Zealand Banking Group Ltd. (ANZBY) may take

another look at Royal Bank of Scotland Group PLC's (RBS.LN) banking

assets in China after Standard Chartered PLC pulled out of talks to

buy the operations, a spokesman for the Melbourne-based bank said

Tuesday.

"Our chief executive Mike Smith has previously said ANZ would be

prepared to look at the RBS assets in China if financial sense

could be made of that," the spokesman said.

"At present, however, our priority is around regulatory

approvals and integration planning for the assets in the six

countries where we have already reached agreement with RBS," the

spokesman said.

ANZ Bank isn't currently in any discussions with RBS on the

China operations, he said.

Smith, a former HSBC executive, wants to transform

Melbourne-based ANZ into a "super regional bank" competing with the

likes of HSBC and Citigroup. He hopes to generate 20% of ANZ's

revenues from Asia by 2012 amid intense competition and slowing

loan growth in its home markets.

In what it described as a stepping stone into the region, ANZ

agreed in August to buy some of RBS' retail and commercial banking

operations in Asia for US$550 million.

Under that deal, ANZ will buy RBS' retail and commercial banking

operations in Taiwan, Singapore, Indonesia and Hong Kong, and its

institutional businesses in Taiwan, the Philippines and

Vietnam.

But it baulked at buying the China operations due to price,

Smith said at the time.

ANZ already has some presence in China. It holds banking

licenses in three major cities, and holds stakes in Bank of Tianjin

and Shanghai Rural Commercial Bank. It is also in the process of

getting local incorporation in China.

Talks between Standard Chartered and RBS for the sale of RBS'

assets in China, India and Malaysia failed over price, a person

familiar with the matter told Dow Jones Newswires Saturday.

The person said Standard Chartered was willing to pay US$200

million to US$250 million for the assets, but RBS was expecting

much more.

ANZ Bank still has significant cash to help fund any

acquisitions, even after striking a EUR1.1 billion deal last month

to buy out its Australian wealth management venture partner ING

Groep to boost its share in the fast growing sector.

Australia's well capitalized banks have been taking advantage of

the distressed positions of some of their global peers to build

market share.

ANZ has indicated that it isn't interested in RBS' banking

operations in India at this stage, given it doesn't have a banking

license in that country.

"While India remains a priority market, our immediate focus

there is working to progress the application for a banking license

that ANZ made in late 2008," the spokesman said.

-By Lyndal McFarland, Dow Jones Newswires; 61-3-9292-2093;

lyndal.mcfarland@dowjones.com

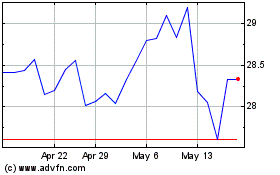

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From May 2024 to Jun 2024

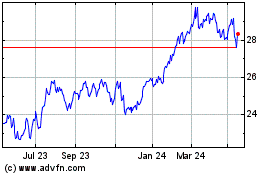

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jun 2023 to Jun 2024