UPDATE: RBS Strategy Edges Along With Asian Disposal

August 04 2009 - 6:54AM

Dow Jones News

Royal Bank Of Scotland Group PLC (RBS) made further progress

Tuesday in its plan to shrink its business and return to

profitability with the $418 million sale of some of its Asian

operations.

The bank, which is 70% owned by the U.K. government, unveiled

plans in February to cut costs and sell its banking businesses

outside of the U.K., Ireland and the U.S., as part of an effort to

put it on sounder financial footing and eventually regain

independence.

It is due Friday to report first-half results, which will

include an update on that strategic plan.

RBS announced overnight that Australia & New Zealand Banking

Group Ltd. (ANZ.AU) has agreed to buy its retail and commercial

banking operations in Taiwan, Hong Kong, Singapore, and Indonesia,

and its institutional businesses in the Philippines, Vietnam and

Taiwan.

It said it is also in advanced talks about the sale of its

businesses in India and China.

"The agreement represents substantial progress in RBS' announced

strategic restructuring and allows improved visibility over the

execution time frame, potential value creation and post-crisis RBS

structure," brokerage Shore Capital said.

Shares in RBS rose as much as 4% on the news. At 1015 GMT, the

stock was up 0.75 pence, or 1%, at 47 pence. RBS has been among the

hardest hit by the financial crisis and global recession and its

shares have lost more than two-thirds of their value in the last

year.

Since the financial crisis threatened to topple the bank in

October, it has sold its stake in Bank of China and January and

raised EUR426 million in April from its 50% stake in Spanish

insurer Linea Directa.

Those units, and the ones sold Tuesday, were among a set of

"non-core" holdings equivalent to about 20% of the bank's total

assets that have been earmarked for disposal in the next three to

five years.

Other parts of the strategic plan include paring GBP2.5 billion

from its cost base and radically restructuring its investment bank.

For the first half, analysts are expecting a sharp rise in revenue

at RBS' investment banking unit, but the gain will be offset by an

expected quadrupling in loan impairments. The average first-half

pretax profit estimate from a Dow Jones Newswires survey of five

analysts is GBP1.3 billion.

While RBS had long flagged the likely sale of the Asian

operations, it said in May that the overall pace of disposals would

be slowed to make sure it got the best prices. Tuesday, it said the

$418 million raised from the Asian operations is $50 million more

than the assets' book value.

Meanwhile, the remaining India and China assets are expected to

be sold to Standard Chartered PLC (STAN.LN). RBS said Tuesday

discussions about the units are advanced, without naming the

potential buyer, while Standard Chartered said Tuesday it is in

talks about buying assets in the two countries.

Company Web site: www.rbs.com

-By Margot Patrick and Michael Carolan, Dow Jones Newswires;

44-20-7842-9451; margot.patrick@dowjones.com

(Aries Poon and Chester Yung in Hong Kong contributed to this

report.)

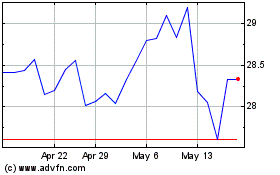

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Sep 2024 to Oct 2024

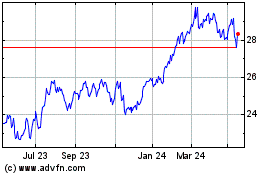

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Oct 2023 to Oct 2024