Royal Bank Of Scotland Shares Rise After Asian Disposal

August 04 2009 - 4:53AM

Dow Jones News

Shares in Royal Bank Of Scotland Group PLC (RBS) climbed 3.1%

Tuesday after it confirmed it had raised $418 million from the sale

of some of its Asian operations and said it was in advanced talks

about the sale of its businesses in India and China.

The bank said overnight that it has agreed to sell retail and

commercial banking operations in Taiwan, Hong Kong, Singapore, and

Indonesia and its institutional businesses in the Philippines,

Vietnam and Taiwan to Australia & New Zealand Banking Group

Ltd. (ANZ.AU).

Shares in RBS were up 1.4 pence, or 3.1%, to 48 pence at 0817

GMT, the leading gainer on the FTSE 100. RBS has been among the

hardest hit by the credit crunch and global recession and its

shares have lost more than two-thirds of their value in the last

year.

"The agreement represents substantial progress in RBS' announced

strategic restructuring and allows improved visibility over the

execution time frame, potential value creation and post-crisis RBS

structure," brokerage Shore Capital said.

The sale forms part of dramatic restructuring for the

Edinburgh-based bank, which is now 70% owned by the U.K.

government. It said in February it was bundling its troubled

operations into a non-core unit, equivalent to about 20% of its

total assets, with a view to run down or dispose of them in the

next three to five years.

The $418 million it receives from the sale is $50 million more

than the assets' book value, it said.

"RBS remains in advanced discussions with bidders for the

remaining assets it has decided to sell in Asia and will make

further announcements, as appropriate, in due course," it said in a

statement.

ANZ Chief Executive Mike Smith said his company had decided

against buying the China and India operations due to concerns over

price and a lack of banking licenses.

The U.K.'s Standard Chartered PLC (STAN.LN) is thought to be

among the bidders for the China and India assets.

Standard Chartered Asia CEO Jaspal Bindra said Tuesday that the

bank was in talks with a company to buy some of its assets in India

and China. He declined to name the company or give any details.

RBS said Feb. 26 it was looking to sell businesses in Asia in

order to refocus on a smaller number of key markets.

Company Web site: www.rbs.com

-By Michael Carolan, Dow Jones Newswires; 44-20-7842-9278;

michael.carolan@dowjones.com

(Aries Poon and Chester Yung in Hong Kong contributed to this

report.)

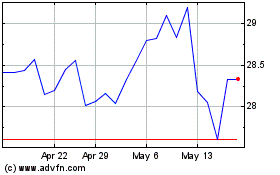

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From May 2024 to Jun 2024

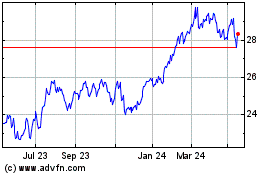

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jun 2023 to Jun 2024