UPDATE: Samurai Market Reborn As Foreign Banks Sell Bonds

February 20 2009 - 4:33AM

Dow Jones News

Two more foreign banks offered Samurai bonds in Japan on Friday,

the latest sign that a market that ground to a halt after the

failure of Lehman Brothers Holdings Inc. last fall is whirring back

to life.

Export Development Canada sold Y31.6 billion worth of five-year

floating-rate Samurai bonds - yen-denominated debt issued in Japan

by foreign borrowers. The bonds carry a coupon of 35 basis points

above three-month London interbank offered rates.

Meanwhile, Netherlands' Cooperatieve Centrale

Raiffeisen-Boerenleenbank B.A., which is also known as Rabobank,

raised Y27.5 billion in a five-year floating-rate note, paying a

coupon of 140 basis points above Libor.

The two deals underscore how the market has come back from the

dead since last September, when Lehman's failure shuttered what was

one of the more active funding markets since the financial crisis

hit. With Japanese investors less and less receptive to foreign

credits, several companies canceled their planned Samurai sales,

including Deutsche Bank AG and National Grid Gas.

The market's resurrection began in early February when

Australia's Westpac Banking Corp. offered the first-ever

government-guaranteed Samurai, worth Y201.3 billion.

Australia & New Zealand Banking Group. later followed suit,

issuing a total of Y180 billion government-backed yen bonds in

Japan's wholesale and retail markets.

One reason behind the recent revival is that, with the markets

relatively calm lately, overseas issuers are in a hurry to raise

funds before any other potential shock can hit, analysts say.

But others say a government guarantee - or an equivalent

assurance - is a must for successful Samurai sales right now.

"One main theme for the Samurai market at the moment is support

from government," said Akira Nomura, a credit analyst at Mizuho

Securities. "Japanese investors are unlikely to be able to buy

Samurais without government backing," as their portfolios - and

risk appetite - have been damaged by the financial turmoil.

Friday's two issues fit the case: Export Development Canada is

wholly owned by the Canadian government.

Although Rabobank's bonds aren't directly guaranteed by the

government, the top ratings from Standard & Poor's and Moody's

Investors Service and the Dutch government's October bailout of ING

Groep N.V. provided similar security to domestic buyers, analysts

say.

The fact that investors were willing to purchase Rabobank's debt

without an explicit government guarantee could be "one sign of a

gradual recovery of the credit market," said Kazuhide Tanaka, head

of international debt syndication at Mitsubishi UFJ Securities,

which co-led the Rabobank deal.

But he added, "it's still being tested how much room investors

have to absorb a flood of Samurai issuance in a shrinking

market."

Without the government guarantee, of course, Rabobank was forced

to pay a far wider spread than Export Development Canada. Still,

Mizuho's Nomura said other issuers may now decide to come back to

the Samurai market, "if the investor base broadens on factors such

as increased money flow from pension funds and easiness in tracing

current prices."

-By Megumi Fujikawa, Dow Jones Newswires; 813-5255-2929; megumi.fujikawa@dowjones.com

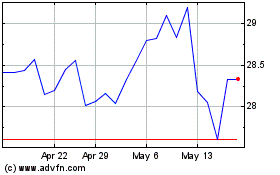

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Sep 2024 to Oct 2024

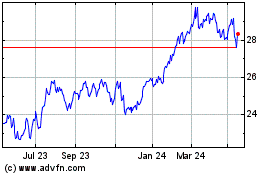

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Oct 2023 to Oct 2024