TIDMWTG

RNS Number : 6092K

Watchstone Group PLC

03 September 2021

Watchstone Group plc

("Watchstone" or the "Company" or the "Group")

Response document in respect of the Final Offer by Polygon

Global Partners LLP ("Polygon") issued

The Board of Watchstone Group Plc will today post its response

circular ("Final Response Document") to Watchstone shareholders in

respect of the mandatory cash offer of 38.0 pence per Ordinary

Share on behalf of Polygon for the whole of the issued and to be

issued share capital of Watchstone ("the Final Offer"). As required

by the City Code on Takeovers and Mergers, the Board has obtained

independent advice in respect of the Final Offer from SPARK

Advisory Partners Limited ("SPARK").

The text of the letter from the Chairman of the Company (set out

in full within the Final Response Document) is reproduced below.

The Final Response Document and related documents will also be

published on the Company's website at www.watchstonegroup.com .

"Dear Shareholder

Response to the increased final offer by Polygon Global Partners

LLP ("Polygon") for Watchstone Group plc ("Watchstone" or

"Group")("Final Offer")

1. Introduction

On 1 July 2021, Polygon announced an unsolicited mandatory offer

for the Ordinary Shares it does not already own of 34.0 pence in

cash per Ordinary Share ("Initial Offer") which the Directors

recommended Shareholders to reject.

On 9 August 2021, Polygon announced that the Initial Offer was

being extended and would remain open for acceptance until 20 August

2021 and that Polygon had received valid acceptances in respect of

a total of 474,309 Ordinary Shares, representing approximately 1.03

per cent. of the issued share capital of Watchstone.

On 23 August 2021, Polygon announced that the Initial Offer was

being further extended and would remain open for acceptance until

31 August 2021 and that Polygon had received valid acceptances in

respect of a total of 560,550 Ordinary Shares, representing

approximately 1.21 per cent. of the issued share capital of

Watchstone.

On 31 August 2021, Polygon announced that the Initial Offer was

being increased to a final offer of 38.0 pence per Ordinary Share

("Final Offer Price") representing an increase in offer price of

11.76% over the Initial Offer Price and that Polygon had received

valid acceptances in respect of a total of 631,902 Ordinary Shares,

representing approximately 1.37 per cent. of the issued share

capital of Watchstone.

The Directors do not believe that the Final Offer reflects an

adequate premium for control and significantly undervalues

Watchstone and its prospects. Accordingly, the Directors recommend

that Shareholders should reject the Final Offer.

TO REJECT THE FINAL OFFER YOU NEED TO TAKE NO ACTION

This document sets out the valuation, control and other

considerations taken into account by the Directors in reaching

their conclusion.

2. The Final Offer is opportunistic and undervalues the Group

The Directors believe that the Final Offer still significantly

undervalues Watchstone and its prospects, both in respect of the

lack of premium to the current share price and the underlying value

of the Group's assets. The Final Offer values the entire issued and

to be issued share capital of Watchstone at approximately GBP17.49

million and represents:

- a discount of 6.2 per cent. to the closing price of 40.5 pence

per Ordinary Share on 15 July 2021 (being the last Business Day

prior to posting of the Initial Offer Document);

- a discount of 15.5 per cent. to the 30-day average closing

price to 30 June 2021 (being the last Business Day prior to

commencement of the Offer Period);

- a discount of 29.6 per cent. to the 90-day average closing

price to 30 June 2021 (being the last Business Day prior to

commencement of the Offer Period); and

- no premium to the closing mid-price of 38.0 pence per Ordinary

Share on 30 August 2021 (being the last Business Day prior to

announcement of the Final Offer).

As detailed in the Group's unaudited interim results for the six

months ended 30 June 2021 on 16 August 2021 ("Interim Accounts")

and in the Group's audited Report and Accounts for the year ended

31 December 2020 ("FY20 Accounts"):

- As at 30 June 2021, the Group had cash of GBP14.3m (31

December 2020: GBP16.7m) and amounts placed in escrow by the Group

as security of costs in respect of certain of its litigation

assets, included within Other Receivables of GBP1.8m (31 December

2020: GBP1.9m);

- As at 13 August 2021, the Group had cash of GBP14.1m and GBP1.8m held in escrow; and

- Litigation in relation to the historic activities of the Group

is being pursued including claims against PricewaterhouseCoopers

LLP ("PwC") and Aviva Canada Inc ("Aviva Canada"). The Group also

expects to initiate a claim against its former auditor, KPMG LLP

("KPMG"), in respect of its audit of the Group's accounts for the

year ended 31 December 2013. These give rise to contingent assets

which are not recognised within the FY20 Accounts or the Interim

Accounts due to the lack of certainty as to the outcome, despite

their potential to result in material cash inflows to the

Group.

Since 13 August 2021, there have been no announceable

developments in respect of the Group's litigation, other assets and

liabilities, or operations.

The Final Offer value is only a 13.6 per cent. premium to the

net assets as at 30 June 2021, and does not recognise any

significant value for the contingent litigation assets.

The Directors would expect a price to be paid which reflects the

Group's net assets and the potential for cash inflow from its

litigation assets, as well as a premium for control. In aggregate,

they would expect a meaningful premium to the current share

price.

The Directors believe that the Final Offer undervalues the

Company and its prospects and should not be accepted by

Shareholders.

3. Implications for Watchstone shareholders of Polygon becoming a majority shareholder

Immediately prior to its latest share purchase, Polygon was

Watchstone's largest shareholder, with an aggregate percentage

interest in Ordinary Shares of 29.9 per cent. Polygon has stated

that it does not intend there to be any effect on Watchstone's

broader strategic plans as a result of the Final Offer and it has

been a consistent supporter of the actions taken by the Board over

the past few years.

However, your Directors wish to highlight that, if Polygon

receives sufficient acceptances for the Final Offer to increase its

interests to 50 per cent. or more of the voting rights, it could

use its voting power as a majority shareholder to take actions that

may be to the potential detriment of other Shareholders including

passing any ordinary resolution on its own.

Shareholders should also be aware that, if Polygon receives

sufficient acceptances for the Final Offer to increase its

interests to 75 per cent. or more of the voting rights, following

completion of the Final Offer, Polygon's ability to carry the vote

and this lack of influence for other Shareholders would extend to

any special resolution put to Shareholders. The Directors also draw

your attention to the fact that in that scenario, Polygon intends

that an application will be made to AQSE to cancel trading in

Ordinary Shares on the AQSE Growth Market.

The Directors believe that, while the cancellation of the

Company's trading facility on AQSE will save costs in the short

term, it is not in the interests of Shareholders for the following

reasons:

- it will significantly reduce the liquidity and marketability

of Ordinary Shares held by Shareholders who have not accepted the

Final Offer, prejudicing their ability to realise (and have access

to a readily available valuation of) their investment in the

Company;

- Shareholders who have not accepted the Final Offer will own

Ordinary Shares in an unlisted company and will not have the

benefit of the transparency or the regulatory oversight afforded to

companies traded on AQSE; and

- as mentioned above, remaining Shareholders will have limited

ability to influence the affairs of the Company by the exercise of

their voting rights and will have only limited statutory protection

against the conduct of the Company's affairs in a manner which is

unfairly prejudicial to their interests.

If Polygon increases its shareholding to 50 per cent. or more,

it will have significantly more influence over the Group and may

use that influence to the detriment of the interests of other

Shareholders.

4. Other factors Shareholders should consider

Shareholders should also consider the following reasons why they

may wish to accept the Final Offer:

- The Final Offer represents an opportunity for Shareholders to

realise their investment for cash at a price of 38.0 pence per

Ordinary Share and without dealing costs;

- Watchstone's remaining assets are legal cases in England and

Canada. As with any legal case, even where the advice received by

the Board is positive and confidence in prospects is high, there

are risks attached. Cases may be unsuccessful, resulting in adverse

cost consequences, or the amounts recovered by the Company in

damages and/or costs may be lower than anticipated;

- the Company continues to incur significant operating costs in

the pursuit of successful case outcomes and in dealing with its

legacy issues; and

- there is a risk of claims being brought against the Group in

the future, although Shareholders should note that it is now more

than 18 months since a threat of new litigation against the Group

was last received and in 2020, the SFO notified the Company that

its investigation into the Group's historical business and

accounting practices was closed.

5. The Directors' views on the effect of the implementation of

the Final Offer on Watchstone's interests, employees and

locations

The Code requires the Directors to give their views on the

effects of the implementation of the Final Offer on all

Watchstone's interests, including, specifically, employment, and

their views on Polygon's strategic plans for Watchstone and their

likely repercussions on employment and the locations of

Watchstone's places of business.

In fulfilling their obligations under the Code, the Directors

can only comment on the details provided in the Final Offer

Document and the Final Offer Document and, in doing so, have

considered, in particular, paragraph 5 of Part 1 of both the

Initial Offer Document and the Final Offer Document (which states

there has been no material change to Polygon's plans). The

Directors note that Polygon has not set out any detailed or

considered plans about its intentions for the business of

Watchstone, its management or employees following completion of the

Final Offer. Without information regarding Polygon's detailed plans

for Watchstone, the Directors cannot be certain as to the full

repercussions of the Final Offer on the Company's interests and are

unable to comment further.

The Directors welcome Polygon's statements that (i) it does not

intend to cause Watchstone to effect any material change with

regard to the continued employment of its employees and managers

and the conditions of employment or balance of skills and functions

of the management of Watchstone, in each case as a result of the

Final Offer and; (ii) it intends to ensure that, in the event of

completion of the Final Offer, the existing statutory employment

rights, including any pension rights, of the management and

employees of Watchstone will be fully safeguarded.

The Directors also welcome Polygon's statement that it does not

intend there to be any effect on Watchstone's broader strategic

plans or places of business (including its headquarters and

headquarters functions) as a result of the Final Offer and that it

intends to support management in its existing objective of

generating value through the maximisation of its remaining

assets.

However, the Directors note that the foregoing are statements of

intention and not undertakings with binding effect under the Code.

Accordingly, there can be no certainty that Polygon will not alter

the strategy of Watchstone in the future.

6. Current trading and Cash position

In the Interim Accounts, Stefan Borson, Group Chief Executive

Officer set out the current status of the Group's contingent assets

as detailed in paragraph 7 below. Since that time there have been

no announceable developments in respect of its litigation or other

assets and liabilities.

In the Interim Results, the net assets of the Group at 30 June

2021 were stated as GBP15.4m (31 December 2020: GBP17.1m). This

primarily comprised cash of GBP14.3m (31 December 2020: GBP16.7m)

and amounts placed in escrow by the Group as security for costs in

respect of certain of its litigation assets, included within Other

Receivables of GBP1.8m (31 December 2020: GBP1.9m). As at 13 August

2021, the Group had cash of GBP14.1m and GBP1.8m held in

escrow.

7. Litigation

The attention of Shareholders is drawn to the Group Chief

Executive Officer's update on outstanding legacy matters included

in the Interim Accounts in respect of the Group's cases against

PwC, Aviva Canada and HMRC and, potentially, KPMG:

" The first half of 2021 has been occupied with progressing

realisation of our remaining litigation assets for the benefit of

shareholders.

As previously announced, in August 2020, we filed and served a

claim against PricewaterhouseCoopers LLP ("PwC") in the High Court.

The claim against PwC is for damages or equitable compensation of

GBP63m plus interest and costs. The claim is for breach of contract

and/or breach of confidence and/or breach of fiduciary duty and/or

unlawful means conspiracy. PwC has filed its defence and the matter

is not expected to go to trial before 2023. The first Case

Management Conference is scheduled to take place in late September

2021. As stated in those proceedings, we consider that PwC acted

contrary to our interests and in breach of the fundamental

principles of objectivity and integrity which represent the core of

the relationship between a client and its financial adviser. We are

satisfied that we have a very strong case and are determined to

take the claim to trial, should that prove necessary.

The preliminary work for a claim against the former auditor of

the Group, KPMG LLP ("KPMG") is advanced and, if not settled, we

expect to file the claim before the end of 2021. The claim is in

respect of the audit of the Group's accounts for the year ended 31

December 2013 which were restated in the subsequent financial

year.

Our claim for the recovery of historic VAT paid in the former

ingenie business, to which we retain the economic benefits, is

expected to go to a Tribunal in December 2021 and finally, our

Canadian subsidiary's claim against Aviva Canada Inc. is

ongoing."

The Directors also draw your attention to the following excerpts

from the FY20 Accounts which explain why no account is taken of

these contingent assets in the Group's accounts or interim

accounts:

1. Critical Accounting judgements and key sources of estimation uncertainty - note 4

"The Group is involved with a number of actual or potential

legal cases which, if successful, could result in material cash

inflows to the Group. The relative merits of these cases and the

assessment of their likely outcome is highly judgemental by nature.

Similarly, management recognise the hurdle set by accounting

standards to recognise an asset or disclose a contingent asset is

very high and therefore neither is recognised or disclosed within

these Financial Statements."

2. Contingent Assets and Liabilities - note 30

"Litigation in relation to the historic activities of the Group

is being pursued including claims against PricewaterhouseCoopers

LLP and Aviva Canada Inc. The Group expects to initiate a claim

against its former auditor, KPMG LLP, in respect of its audit of

the Group's accounts for the year ended 31 December 2013. These

give rise to contingent assets, which are not recognised within the

Financial Statements due to lack of certainty as to the outcome,

despite an inflow of economic benefit being considered

probable."

8. Recommendation of the Board

Your decision as to whether to accept the Final Offer will

depend upon your individual circumstances. If you are in any doubt

as to what action you should take, you should seek your own

independent professional advice.

However, the Directors, who have been so advised by SPARK as to

the financial terms of the Final Offer, consider that the Final

Offer undervalues Watchstone and its prospects and, in light of

this, and notwithstanding the other considerations outlined above,

unanimously recommend that Shareholders reject the Final Offer.

SPARK is providing independent financial advice to the Directors

for the purposes of Rule 3 of the Code and, in doing so, has taken

into account the commercial assessments of the Directors.

Accordingly, the Directors unanimously recommend that YOU SHOULD

TAKE NO ACTION in relation to the Final Offer and that YOU SHOULD

NOT SIGN ANY DOCUMENT WHICH POLYGON OR ITS ADVISERS S TO YOU.

If you have already accepted the Initial Offer or the Final

Offer, there are certain circumstances in which you can withdraw

your acceptance and a summary of the rights of withdrawal is set

out in paragraph 3 of Appendix 1 Part B of the Final Offer

Document.

The Directors who hold Ordinary Shares do not intend to accept

the Final Offer in respect of their own beneficial interests in

those Ordinary Shares.

Yours faithfully

Richard Rose

Non-Executive Chairman"

For further information:

Watchstone Group plc Tel: 03333 448048

investor.relations@watchstonegroup.com

WH Ireland Limited, Adviser and broker Tel: 020 7220 1666

Chris Hardie

Lydia Zychowska

-------------------

Spark Capital Advisers, Rule 3 Adviser Tel: 020 3368 3550

Andrew Emmott

Adam Dawes

-------------------

Each of WH Ireland and SPARK are authorised and regulated in the

United Kingdom by the Financial Conduct Authority and are acting

exclusively for Watchstone and no one else in connection with the

Final Offer and will not be responsible to anyone other than

Watchstone for providing the protections afforded to their clients

or for providing advice in relation to the Final Offer, the

contents of this document or any other matters referred to in this

document.

In accordance with Rule 26.1 of the Takeover Code, a copy of

this announcement will be available (subject to certain

restrictions) on the Company's website at www.watchstonegroup.com

by no later than 12 noon on 3 September 2021. The content of the

Company's website is not incorporated into and does not form part

of this announcement.

This announcement is not intended to and does not, constitute or

form part of an offer, invitation or the solicitation of an offer

to purchase, otherwise, acquire, subscribe for, sell or otherwise

dispose of, any securities whether pursuant to this announcement or

otherwise.

Dealing and Opening Disclosure requirements of the Takeover

Code

Under Rule 8.3(a) of the Takeover Code, any person who is

interested in 1 per cent. or more of any class of relevant

securities of an offeree company or of any securities exchange

offeror (being any offeror other than an offeror in respect of

which it has been announced that its offer is, or is likely to be,

solely in cash) must make an Opening Position Disclosure following

the commencement of the offer period and, if later, following the

announcement in which any securities exchange offeror is first

identified. An Opening Position Disclosure must contain details of

the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s). An Opening

Position Disclosure by a person to whom Rule 8.3(a) applies must be

made by no later than 3.30 p.m. (London time) on the 10th business

day following the commencement of the offer period and, if

appropriate, by no later than 3.30 p.m. (London time) on the 10th

business day following the announcement in which any securities

exchange offeror is first identified. Relevant persons who deal in

the relevant securities of the offeree company or of a securities

exchange offeror prior to the deadline for making an Opening

Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Takeover Code, any person who is, or

becomes, interested in 1 per cent. or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange

offeror(s), save to the extent that these details have previously

been disclosed under Rule 8. A Dealing Disclosure by a person to

whom Rule 8.3(b) applies must be made by no later than 3.30 p.m.

(London time) on the business day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3 of the Takeover Code. Opening

Position Disclosures must also be made by the offeree company and

by any offeror and Dealing Disclosures must also be made by the

offeree company, by any offeror and by any persons acting in

concert with any of them (see Rules 8.1, 8.2 and 8.4 of the

Takeover Code).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure

Availability of hard copies

You may request hard copies of any document published on

Watchstone's website in connection with the Final Offer by

contacting Watchstone's registrars, Link Group, 10(th) Floor

Central Square, 29 Wellington Street, Leeds, LS1 4DL (telephone

number: 0371 664 0300). You may also request that all future

documents, announcements, and information to be sent to you in

relation to the Final Offer should be in hard copy form.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXSSIFWEEFSESU

(END) Dow Jones Newswires

September 03, 2021 02:00 ET (06:00 GMT)

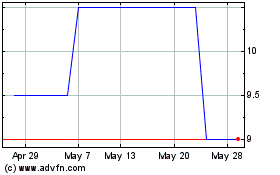

Watchstone (AQSE:WTG)

Historical Stock Chart

From Nov 2024 to Dec 2024

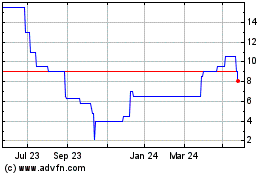

Watchstone (AQSE:WTG)

Historical Stock Chart

From Dec 2023 to Dec 2024