TMT Investments PLC Portfolio Update (9345Q)

November 01 2021 - 9:00AM

UK Regulatory

TIDMTMT

RNS Number : 9345Q

TMT Investments PLC

01 November 2021

1 November 2021

TMT INVESTMENTS PLC

("TMT" or the "Company")

Portfolio Update

TMT Investments Plc (AIM: TMT.L), the venture capital company

investing in high-growth technology companies, notes the

announcement released by 3D Systems (NYSE:DDD) on 27 October 2021

in respect of its agreement to acquire Volumetric Biotechnologies.

Inc. ("Volumetric") (the "Acquisition"). According to the

announcement released by 3D Systems, the Acquisition is to be

structured as a US$45 million closing payment, with up to US$355

million of further consideration due on an earnout basis subject to

the achievement of certain milestones linked to the attainment of

significant steps in the demonstration of human applications (the

"Contingent Consideration"), with all such payments comprising

approximately half cash and half equity in 3D Systems. The

Acquisition is expected to close in the fourth quarter of 2021.

TMT invested US$200,000 in Volumetric in July 2020 by way of a

simple agreement for future equity ("SAFE") with a 20 per cent.

discount on conversion subject to a valuation cap of US$12.5

million, which TMT expects will be converted and sold as part of

the Acquisition.

The Company does not currently have any further information in

relation to the milestones linked to the Contingent Consideration,

and there can be no certainty that such milestones will ultimately

be achieved.

For further information contact:

TMT Investments Plc +44 (0)1534 281 800

Alexander Selegenev (Computershare - Company Secretary)

Executive Director

www.tmtinvestments.com alexander.selegenev@tmtinvestments.com

Strand Hanson Limited

(Nominated Adviser)

James Bellman / James Dance +44 (0)20 7409 3494

Cenkos Securities plc

(Joint Broker)

Ben Jeynes +44 (0)20 7397 8900

Hybridan LLP

(Joint Broker)

Claire Louise Noyce +44 (0)20 3764 2341

Kinlan Communications +44 (0)20 7638 3435

David Hothersall davidh@kinlan.net

About TMT Investments Plc

TMT Investments Plc invests in high-growth technology companies

across a number of core specialist sectors and has a significant

number of Silicon Valley investments in its portfolio. Founded in

2010, TMT has a current investment portfolio of over 50 companies

and net assets of US$218 million as of 30 June 2021. The Company's

objective is to generate an attractive rate of return for

shareholders, predominantly through capital appreciation. The

Company is traded on the AIM market of the London Stock Exchange.

www.tmtinvestments.com .

Twitter

LinkedIn

Facebook

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUUASURAKUARAA

(END) Dow Jones Newswires

November 01, 2021 09:00 ET (13:00 GMT)

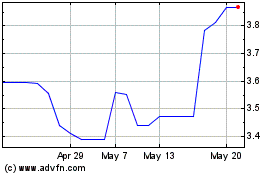

TMT Investments (AQSE:TMT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

TMT Investments (AQSE:TMT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024