TIDMTMT

RNS Number : 9615I

TMT Investments PLC

18 August 2021

18 August 2021

TMT INVESTMENTS PLC

("TMT" or the "Company")

Half-year report for the six months to 30 June 2021

TMT Investments Plc, the venture capital company investing in

high-growth, technology companies across a number of core

specialist sectors, is pleased to announce its unaudited interim

results for the half-year ended 30 June 2021.

The interim report will shortly be available on the Company's

website, www.tmtinvestments.com .

Highlights :

-- COVID-19's overall effect on portfolio companies is mostly positive

-- NAV per share of US$7.49 (up 22.8% from US$6.10 as of 31 December 2020)

- US$1.6 million from two full profitable exits

- US$3.3 million in proactive (non-transaction based) negative

revaluations

-- A number of portfolio companies raised fresh equity capital

at higher valuations during the period, further validating their

business models

-- US$14.1 million of investments across 13 new and existing

portfolio companies in 6 months to 30 June 2021

-- 5-year NAV-based IRR of 34.2% per annum

-- Only two portfolio companies (31.4% of the investment portfolio) are valued on multiples

-- US$14.3 million in cash reserves as of 17 August 2021

Post period end

Completed a further 7 investments totalling US$8.3 million in

new (Collectly, VertoFX, MetroSpeedy and Academy of Change) and

existing (Postoplan, Novakid and Backblaze) companies

- Collectly, Inc., a tech-enabled patient billing platform ( www.collectly.co )

- VertoFX Ltd, a UK-based cross-border payments and foreign

exchange solution facilitating commerce for modern businesses,

rapidly expanding in Africa ( www.vertofx.com )

- Metro Speedy Technologies Inc., a technology based local

delivery company providing on-demand, same day or scheduled

delivery services ( www.metrospeedy.com )

- Academy of Change, a personalised educational service for

women on lifestyle topics ( www.akademiaperemen.ru )

Alexander Selegenev, Executive Director of TMT, commented:

" We are delighted with our portfolio companies' performance

since the beginning of the year, which has sustained the trend of

positive revaluations and cash realisations. Most of TMT's investee

companies are continuing to benefit from the accelerated shift to

online consumer habits and remote working, led by outstanding

management teams and supportive shareholders.

"The US$41m windfall generated by the disposal of our investment

in Pipedrive at the end of 2020 placed TMT in an excellent position

to actively reinvest the proceeds during the course of 2021 to date

into successful existing portfolio as well as new companies. We

added to investments in existing portfolio companies that are

performing well and invested in new companies that meet our

investment criteria in sectors we know well and where we believe we

have a competitive advantage. TMT's investment criteria are

stringent but fundamental to success given the multitude of

opportunities available. Coupled with TMT's global investment

horizons they have led TMT to invest early in 3 portfolio companies

that have reached unicorn status since TMT's admission to AIM in

December 2010 (Wrike, Pipedrive and Bolt). We are strongly

encouraged by the propitious environment for technology companies

and continue to scour the globe for the most attractive investment

opportunities, adding value to shareholders through the

construction and management of a diversified portfolio of

high-growth technology companies.

"We expect a number of positive revaluations across our

portfolio in the coming months and will update shareholders on

relevant developments as appropriate".

For further information contact:

TMT Investments Plc +44 (0)1534 281 800

Alexander Selegenev (Computershare - Company Secretary)

Executive Director

www.tmtinvestments.com alexander.selegenev@tmtinvestments.com

Strand Hanson Limited

(Nominated Adviser)

James Bellman / James Dance +44 (0)20 7409 3494

Cenkos Securities plc

(Joint Broker)

Ben Jeynes +44 (0)20 7397 8900

Hybridan LLP

(Joint Broker)

Claire Louise Noyce +44 (0)20 3764 2341

Kinlan Communications +44 (0)20 7638 3435

David Hothersall davidh@kinlan.net

This announcement is released by TMT Investments plc and

contains inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) 596/2014 (MAR), and is disclosed in

accordance with the Company's obligations under Article 17 of

MAR.

About TMT Investments Plc

TMT Investments Plc invests in high-growth technology companies

across a number of core specialist sectors and has a significant

number of Silicon Valley investments in its portfolio. Founded in

2010, TMT has a current investment portfolio of over 45 companies

and net assets of US$218 million as of 30 June 2021. The Company's

objective is to generate an attractive rate of return for

shareholders, predominantly through capital appreciation. The

Company is traded on the AIM market of the London Stock Exchange.

www.tmtinvestments.com .

Twitter

LinkedIn

Facebook

EXECUTIVE DIRECTOR'S STATEMENT

The first half of 2021 saw continued growth across the TMT

Investments Plc ("TMT" or the "Company") portfolio, with structural

business and economic drivers continuing to benefit the Company's

global portfolio of high growth technology investee companies as a

result of evolving customer trends and the accelerated shift to

remote working. The period also saw sustained investor interest in

the high-growth potential of business models based on digital,

online and remote technologies, resulting in a significant increase

in fundraising activities by technology companies around the world.

These two factors resulted in a continued trend of positive

revaluations and cash realisations across TMT's portfolio.

Following the disposal of our investment in Pipedrive, Inc

("Pipedrive") at the end of 2020 for US$41 million, we have been

busy directing those proceeds towards investing in successful

existing as well as new portfolio companies that meet our

investment criteria of having outstanding management teams, a

product or service that can be scaled up globally, fast revenue

growth, Series A / Pre-Series A stage and viable exit

opportunities.

NAV per share

The Company's NAV per share in the first half of 2021 increased

by 22.8% to US$7.49 (from US$6.10 as of 31 December 2020), mainly

as a result of the significant upward revaluation of our

investments in Bolt and PandaDoc. If, pursuant to the Company's

bonus plan, the bonus attributable to the NAV increase from 1

January 2021 to 30 June 2021 had been accrued during the period, it

would have resulted in an additional bonus charge of US$4,108,784,

equivalent to approximately US$0.14 per share and reducing the NAV

to US$7.35 per share as of 30 June 2021.

Operating expenses

In the first half of 2021, the Company's administrative expenses

of US$802,919 were above the corresponding 2020 levels

(US$560,093), reflecting the Company's significantly increased

level of investment and business development activities.

Previous years' bonus pool adjustment

Due to a technical error in the calculation of the bonus pools

in the bonus periods from July 2016 to December 2020 (the "Affected

Bonus Periods"), the bonus pools in each of the Affected Bonus

Periods were calculated on the basis of the opening position being

the previous period's "adjusted NAV before bonus". Pursuant to the

terms of the Company's bonus plan, each of the Affected Bonus

Periods should have seen the calculation assess the annual growth

in NAV from an opening position of "adjusted NAV after bonus". As a

result, the amount of bonuses actually accrued in the Affected

Bonus Periods were understated by an aggregate of US$372,556 (the

"Underpaid Bonus"). As the total amount of the Underpaid Bonus is

considered immaterial, the error has been corrected, and the

Underpaid Bonus has been included in the current financial

statements as an additional charge for the current period. The

exact allocation of the Underpaid Bonus is expected to be approved

and paid to the participants of the Company`s bonus plan shortly

after the publication of this interim report.

Financial position

As of 30 June 2021, the Company had no financial debt and cash

reserves of approximately US$22.9 million. As of 17 August 2021,

the Company had cash reserves of approximately US$14.3 million, as

a result of the deployment of a significant amount of capital into

new investments in the period after 30 June 2021.

Outlook

TMT has a diversified investment portfolio of over 45 companies,

focused primarily on big data/cloud, e-commerce, SaaS

(software-as-a-service), marketplaces and EdTech, most of which

continue to benefit from the accelerated shift to online consumer

habits and remote working. Indeed, some of the portfolio companies

recently added to TMT's portfolio have already raised further funds

at significantly higher valuation levels. The general trends in the

digital technology sector continue to generate new exciting

investment and exit opportunities and the tech venture capital

investment space continues to be one of the few beneficiaries of

the new market environment caused by COVID-19.

The first half of 2021 further demonstrated increased investor

interest in the high-growth potential of business models based on

digital, online and remote technologies, leading to a significant

increase in fundraising activities by technology companies around

the world. We expect a number of positive revaluations across our

portfolio in the coming months and will update shareholders on

relevant developments as appropriate.

Alexander Selegenev

Executive Director

17 August 2021

PORTFOLIO DEVELOPMENTS

We are delighted with our portfolio companies' performance since

the beginning of the year, which has sustained the trend of

positive revaluations and cash realisations. A number of portfolio

companies received further validation for their business models by

raising fresh equity capital at higher valuations during the

period. In tandem, most of our other portfolio companies have

continued to grow their businesses quietly in the background. In

addition, the Company continues its policy of seeking to reduce the

value of underperforming investees as soon as there is enough

evidence to support such decisions.

Portfolio performance:

The following developments have had an impact on and are

reflected in the Company's NAV and/or financial statements as of 30

June 2021 in accordance with applicable accounting standards:

Full and partial cash exits, and positive revaluations:

-- 3S Money Club, a UK-based bank challenger providing corporate

clients with multi-currency bank accounts ( www.3s.money ),

completed a new equity funding round. The transaction represented a

revaluation uplift of US$1.9 million (or 305%) in the fair value of

TMT's investment, compared to the previous reported amount as of 31

December 2020 (adjusted for the value of TMT's additional

investments made in 3S Money in the first half of 2021).

-- Klear, an influencer marketing platform ( www.klear.com ),

was acquired by Meltwater B.V., a leading global SaaS provider of

media intelligence and social analytics, for a total consideration

of US$17.8 million, funded by a combination of cash and earn-out.

TMT's total expected cash proceeds from this disposal is US$0.5

million. The transaction represented a revaluation uplift of US$0.3

million (or 211%) in the fair value of TMT's investment, compared

to the previous reported amount as of 31 December 2020.

-- PandaDoc, a proposal automation and contract management

software provider ( www.pandadoc.com ), completed a new equity

funding round. The transaction represented a revaluation uplift of

US$10.4 million (or 286%) in the fair value of TMT's investment,

compared to the previous reported amount as of 31 December

2020.

-- KitApps, trading as Attendify, a SaaS-based virtual and hybrid event management platform ( www.attendify.com ), was acquired by event management platform Hopin. TMT's total expected cash proceeds from this disposal is US$1.2 million, with US$1.06 million already received. The transaction represented a revaluation uplift of US$0.5 million (or 91%) in the fair value of TMT's investment, compared to the previous reported amount as of 31 December 2020.

-- Novakid, an online English language school for children (

www.novakidschool.com ), completed a new equity funding round. The

transaction represented a revaluation uplift of US$1.8 million (or

362%) in the fair value of TMT's investment, compared to the

previous reported amount as of 31 December 2020.

-- eAgronom, a farm management software provider for grain

producers ( www.eagronom.com ), completed a new equity funding

round. The transaction represented a revaluation uplift of US$0.2

million (or 55%) in the fair value of TMT's investment, compared to

the previous reported amount as of 31 December 2020.

-- Bolt, a ride-hailing and food delivery platform ( www.bolt.eu

), completed a new equity funding round. The transaction

represented a revaluation uplift of US$30 million (or 83%) in the

fair value of TMT's investment, compared to the previous reported

amount as of 31 December 2020.

Negative revaluations:

The following of the Company's portfolio investments were

negatively revalued in the first half of 2021:

Portfolio Write-down Reduction as Reasons for write-down

Company amount (US$) % of fair value

reported as

of 31 Dec 2020

Lack of progress in the last

Wanelo 1,223,149 67% 2 years

-------------- ----------------- -----------------------------

Lack of progress in the last

Anews 670,000 67% 2 years

-------------- ----------------- -----------------------------

Market changes outside of

Scalarr 1,378,281 50% Scalarr's control

-------------- ----------------- -----------------------------

Key developments for the five largest portfolio holdings in the

first half of 2021 (source: TMT's portfolio companies):

Backblaze (cloud storage provider):

-- Double-digit annualised revenue growth continued

-- Cloud-to-cloud migration programme and Object Lock for ransomware protection launched

Bolt (ride-hailing and food delivery service):

-- Active in over 300 cities globally (up from over 200 cities as of 31 December 2020)

-- Proprietary food delivery brand gains pace both in terms of

the client base and countries of operation

PandaDoc (proposal automation and contract management

software):

-- Double-digit annualised revenue growth continued

-- Over 27,000 paying clients (from over 23,000 as of 31 December 2020)

Depositphotos (stock photo and video marketplace):

-- Stable revenue growth continued

-- New graphic design software product Crello continued growing at faster rate

Scentbird (Perfume, wellness and beauty product subscription

service):

-- Double-digit annualised revenue growth continued

-- The company continues to launch new products

New investments:

TMT continued its intensive investing mode and made the

following investments in the first half of the year:

-- Additional GBP1,971,825 (via acquisition of new and existing

shares) in 3S Money Club Limited, a UK-based online banking service

focusing on international trade ( www.3s.money );

-- Additional US$228,933 (via acquisition of existing shares) in

Workiz, a SaaS solution for the field service industry (

www.workiz.com );

-- Additional US$2,000,000 in Affise, a performance marketing

SaaS solution ( https://affise.com/en/ );

-- Additional GBP399,997 in Qumata (previously HealthyHealth),

an InsurTech and HealthTech company ( www.healthyhealth.com );

-- US$1,000,000 in 3DLook Inc., a body scanning and measuring

technology solution for the online retail industry ( www.3dlook.me

);

-- Additional EUR575,000 in Postoplan OÜ, a social network

marketing platform, which helps create, schedule, and promote

content ( www.postoplan.app );

-- GBP200,000 in Balanced Ventures Limited, trading as FemTech

Lab, Europe's first tech accelerator focused on female founders (

www.femtechlab.com );

-- US$300,000 in Agendapro, Inc., a SaaS-based scheduling,

payment and marketing solution for the beauty and wellness industry

in Latin America ( www.agendapro.com );

-- US$2,000,000 in Muncher Inc., a dark kitchen and virtual food

brand operator in Latin America ( www.muncher.com.co );

-- US$1,000,000 in Aurabeat Technology International Limited,

the producer of air purifiers that are FDA-certified to destroy

viruses and bacteria ( www.aurabeat-tech.com );

-- US$500,000 in Cyberwrite Inc., a platform offering

third-party cyber risk quantification and proactive mitigation (

www.cyberwrite.com );

-- US$2,000,000 in CloudBusiness Inc., trading as Synder, an

accounting solution for e-commerce businesses ( www.synderapp.com

); and

-- EUR500,000 in Outvio, a fulfilment and delivery platform for

the e-commerce industry ( www.outvio.com ).

Events after the reporting period:

In July 2021, the Company invested an additional EUR400,000 in

Postoplan OÜ, a social network marketing platform, which helps

create, schedule, and promote content ( www.postoplan.app ).

In July 2021, the Company invested an additional US$640,000 in

Novakid, an online English language school for children (

www.novakidschool.com ).

In July 2021, the Company invested US$2,000,000 in Collectly,

Inc., a tech-enabled patient billing platform ( www.collectly.co

).

In July 2021, the Company invested US$1,099,999 in VertoFX Ltd,

a UK-based cross-border payments and foreign exchange solution

facilitating commerce for modern businesses, rapidly expanding in

Africa ( www.vertofx.com ).

In July 2021, the Company invested US$1,000,000 in Metro Speedy

Technologies Inc., a technology based local delivery company

providing on-demand, same day or scheduled delivery services (

www.metrospeedy.com ).

In August 2021, the Company invested US$1,000,000 in Academy of

Change, a personalised educational service for women on lifestyle

topics ( www.akademiaperemen.ru ).

In August 2021, the Company invested an additional US$2,000,000

in cloud storage provider Backblaze ( www.backblaze.com ).

These events after the reporting period are not reflected in the

NAV and/or the financial statements as of 30 June 2021.

FINANCIAL STATEMENTS

Statement of Comprehensive Income (unaudited)

For the For the

six months six months

ended 30/06/2021 ended 30/06/2020

Notes USD USD

Gains/(Losses) on investments 2 41,971,813 (1,264,916)

Dividend income - 70,868

------------------------------------ ------ ------------------ ------------------

Total investment income/(loss) 41,971,813 (1,194,048)

------------------------------------ ------ ------------------ ------------------

Expenses

Bonus scheme payment charge 6 (372,556) -

Administrative expenses 5 (802,919) (560,093)

Operating gain/(loss) 40,796,338 (1,754,141)

Net finance income 7 - 52,868

Currency exchange loss (81,059) (23,938)

------------------------------------ ------ ------------------ ------------------

Gain/(Loss) before taxation 40,715,279 (1,725,211)

Taxation 8 - -

------------------------------------ ------ ------------------ ------------------

Gain/(Loss) attributable to equity

shareholders 40,715,279 (1,725,211)

Total comprehensive income/(loss)

for the year 40,715,279 (1,725,211)

------------------------------------ ------ ------------------ ------------------

Gain/(Loss) per share

Basic and diluted gain/(loss) per

share (cents per share) 9 139.5 (5.91)

------------------------------------ ------ ------------------ ------------------

Statement of Financial Position

At 30 June At 31 December

2021 2020

USD USD

Unaudited Audited

Notes

Non-current assets

Financial assets at FVPL 10 199,108,188 144,803,154

Total non-current assets 199,108,188 144,803,154

Current assets

Trade and other receivables 11 779,225 487,838

Cash and cash equivalents 12 22,870,620 39,004,288

Total current assets 23,649,845 39,492,126

Total assets 222,758,033 184,295,280

Current liabilities

Trade and other payables 13 4,120,047 6,372,573

Total current liabilities 4,120,047 6,372,573

Total liabilities 4,120,047 6,372,573

Net assets 218,637,986 177,922,707

----------------------------- ------ -------------------- ------------------------

Equity

Share capital 14 34,790,174 34,790,174

Retained profit 183,847,812 143,132,533

Total equity 218,637,986 177,922,707

----------------------------- ------ -------------------- ------------------------

Statement of Cash Flows (unaudited)

For the six For the six

months ended months ended

30/06/2021 30/06/2020

Notes USD USD

Operating activities

Operating gain/(loss) 40,796,338 (1,754,141)

---------------------------------------------- ----- ------------- -------------

Adjustments for non-cash items:

Changes in fair value of financial

assets at FVPL 3 (41,852,901) 1,181,529

Currency exchange loss (81,059) (23,938)

(1,137,622) (596,550)

---------------------------------------------- ----- ------------- -------------

Changes in working capital:

Increase in trade and other receivables 11 (291,387) (428,642)

Decrease in trade and other payables 13 (2,252,526) (518,281)

Net cash used in operating activities (3,681,535) (1,543,473)

---------------------------------------------- ----- ------------- -------------

Investing activities

Interest received 7 - 52,868

Purchase of financial assets at FVPL 10 (14,081,056) (1,020,870)

Proceeds from sale of financial assets

at FVPL 10 1,628,923 -

---------------------------------------------- ----- ------------- -------------

Net cash used in investing activities (12,452,133) (968,002)

---------------------------------------------- ----- ------------- -------------

Financing activities

Net cash from financing activities - -

---------------------------------------------- ----- ------------- -------------

Decrease in cash and cash equivalents (16,133,668) (2,511,475)

---------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at the beginning

of the period 12 39,004,288 11,700,074

---------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at the end

of the period 12 22,870,620 9,188,599

---------------------------------------------- ----- ------------- -------------

Statement of Changes in Equity (unaudited)

Share capital Retained profit Total

USD USD USD

Balance at 01 January 2020 34,790,174 68,023,856 102,814,030

-------------------------------------------- -------------- ---------------- ------------

Gain for the year - 75,108,677 75,108,677

Total comprehensive income for the year - 75,108,677 75,108,677

Balance at 31 December 2020 34,790,174 143,132,533 177,922,707

-------------------------------------------- -------------- ---------------- ------------

Gain for the period - 40,715,279 40,715,279

Total comprehensive income for the period - 40,715,279 40,715,279

-------------------------------------------- -------------- ---------------- ------------

Balance at 30 June 2021 34,790,174 183,847,812 218,637,986

-------------------------------------------- -------------- ---------------- ------------

NOTES TO THE FINANCIAL STATEMENTS FOR THE SIX MONTHSED 30 JUNE

2021

1. Company information

TMT Investments Plc ("TMT" or the "Company") is a company

incorporated in Jersey with its registered office at 13 Castle

Street, St Helier, JE1 1ES, Channel Islands.

The Company was incorporated and registered on 30 September 2010

in Jersey under the Companies (Jersey) Law 1991 (as amended) with

registration number 106628 under the name TMT Investments Limited.

The Company obtained consent from the Jersey Financial Services

Commission pursuant to the Control of Borrowing (Jersey) Order 1985

on 30 September 2010. On 1 December 2010, the Company re-registered

as a public company and changed its name to TMT Investments Plc.

The Company's ordinary shares were admitted to trading on the AIM

market of the London Stock Exchange on 1 December 2010.

The memorandum and articles of association of the Company do not

restrict its activities and therefore it has unlimited legal

capacity. The Company's ability to implement its investing policy

and achieve its desired returns will be limited by its ability to

identify and acquire suitable investments. Suitable investment

opportunities may not always be readily available.

The Company will seek to make investments in any region of the

world.

Financial statements of the Company are prepared by and approved

by the Directors in accordance with International Financial

Reporting Standards, International Accounting Standards and their

interpretations issued or adopted by the International Accounting

Standards Board as adopted by the European Union ("IFRSs"). The

Company's accounting reference date is 31 December.

2. Summary of significant accounting policies

2.1 Basis of presentation

Interim financial statements for the six months ended 30 June

2021 and 2020 are unaudited and were approved by the Directors on

17 August 2021. They do not constitute statutory accounts as

defined in section 434 of the Companies Act 2006. The financial

statements for the year ended 31 December 2020 were prepared in

accordance with International Financial Reporting Standards as

adopted by the EU. The report of the auditor on those financial

statements was unqualified and did not draw attention to any

matters by way of emphasis of matter.

The principal accounting policies applied by the Company in the

preparation of these unaudited financial statements are set out

below and have been applied consistently.

The financial statements have been prepared on a going concern

basis, under the historical cost basis as modified by the fair

value of financial assets at ("FVPL"), as explained in the

accounting policies below, and in accordance with IFRS. Historical

cost is generally based on the fair value of the consideration

given in exchange for assets.

2.2 Foreign currency translation

(a) Functional and presentation currency

Items included in the financial statements of the Company are

measured in United States Dollars ('US dollars', 'USD' or 'US$'),

which is the Company's functional and presentation currency.

(b) Transactions and balances

Foreign currency transactions are translated into US$ using the

exchange rates prevailing at the dates of the transactions.

Exchange differences arising from the translation at the year-end

exchange rates of monetary assets and liabilities denominated in

foreign currencies are recognised in the statement of comprehensive

income.

Conversation rates, USD

-----------------------------------------------------------

Currency At 30/06/2021 Average rate,

for six months

ended 30/06/2021

----------------- -------------- ------------------

British pounds,

GBP 1.3819 1.3882

Euro, EUR 1.1862 1.2051

--------------------- -------------- ------------------

2.3 New IFRSs and interpretations

The following standards and amendments became effective from 1

January 2021, but did not have any material impact on the

Company:

-- Amendments to IFRS 4 "Insurance Contracts" - Deferral of IFRS

9

-- Amendments to IFRS 9 "Financial Instruments"

-- Amendments to IAS 39 "Financial Instruments: Recognition and

Measurement"

-- Amendments to IFRS 7 "Financial Instruments: Disclosures"-

Interest Rate Benchmark Reform - Phase 2

3 Gain/(Loss) on investments

For six months ended 30/06/2021 For six months

ended 30/06/2020

USD USD

Gross interest income from convertible notes receivable 18,844 34,013

Net interest income from convertible notes receivable 18,844 34,013

Gains/(Losses) on changes in fair value of financial assets at FVPL 41,852,901 (1,181,529)

Other gains/(losses) on investment 100,068 (117,400)

Total gain/(loss) on investments 41,971,813 (1,264,916)

---------------------------------------------------------------------- ----------- ------------------

4 Segmental analysis

Geographic information

The Company has investments in six principal geographical areas

- USA, Estonia, the United Kingdom, BVI, Cyprus and the Cayman

Islands.

Non-current financial assets

As at 31/12/2020

United

USA Israel BVI Cyprus Estonia Kingdom Total

USD USD USD USD USD USD USD

-------------------- ----------- -------- ---------- ---------- ----------- ---------- ------------

Equity investments 90,078,690 155,000 1,780,250 - 36,711,439 7,718,112 136,443,491

Convertible

notes & SAFEs 6,827,998 - - 1,350,000 181,665 - 8,359,663

-------------------- ----------- -------- ---------- ---------- ----------- ---------- ------------

Total 96,906,688 155,000 1,780,250 1,350,000 36,893,104 7,718,112 144,803,154

-------------------- ----------- -------- ---------- ---------- ----------- ---------- ------------

As at 30/06/2021

Cayman United

USA Islands BVI Cyprus Estonia Kingdom Total

USD USD USD USD USD USD USD

-------------------- ------------ ---------- ---------- ---------- ----------- ----------- ------------

Equity investments 106,244,120 - 1,780,250 - 67,502,624 13,147,379 188,674,373

Convertible

notes & SAFEs 7,195,030 1,030,000 - 1,350,000 858,785 - 10,433,815

-------------------- ------------ ---------- ---------- ---------- ----------- ----------- ------------

Total 113,439,150 1,030,000 1,780,250 1,350,000 68,361,409 13,147,379 199,108,188

-------------------- ------------ ---------- ---------- ---------- ----------- ----------- ------------

5 Administrative expenses

Administrative expenses include the following amounts:

For six months ended 30/06/2021 For six months ended

30/06/2020

USD USD

--------------------------- -------------------------------- ---------------------

Staff expenses (note 6) 395,818 326,349

Professional fees 228,715 115,522

Legal fees 83,048 14,102

Bank and LSE charges 8,034 8,364

Audit and accounting fees 17,851 14,371

Rent - 47,298

Other expenses 69,453 34,087

802,919 560,093

--------------------------- -------------------------------- ---------------------

The foreign exchange loss in the current financial period has

been presented separately from administrative expenses.

Accordingly, the respective amount of foreign exchange loss in the

period ended 30 June 2020 has also been presented separately for

comparison. As a result, administrative expenses for the six months

ended 30 June 2020 decreased by 4.1% from US$584,031 to US$560,093.

The relevant amounts in the Statement of Cash Flows for the period

ended 30 June 2020 have been affected correspondingly.

6 Staff expenses

For six months ended 30/06/2021 For six months ended 30/06/2020

USD USD

-------------------- -------------------------------- --------------------------------

Directors' fees 103,218 92,589

Wages and salaries 292,600 233,760

395,818 326,349

-------------------- -------------------------------- --------------------------------

Wages and salaries shown above include fees and salaries

relating to the six months ended 30 June. Bonus Plan costs are not

included in administrative expenses and are shown separately.

The Directors' fees for the six months ended 30 June 2021 and

2020 were as follows:

For six months ended 30/06/2021 For six months ended

30/06/2020

USD USD

---------------------- -------------------------------- ---------------------

Alexander Selegenev 55,000 50,000

Yuri Mostovoy 27,500 25,000

James Joseph Mullins 15,218 12,589

Petr Lanin 5,500 5,000

---------------------- -------------------------------- ---------------------

103,218 92,589

---------------------- -------------------------------- ---------------------

The Directors' fees shown above are all classified as 'short

term employment benefits' under International Accounting Standard

24. The Directors do not receive any pension contributions or other

benefits. The average number of staff employed (excluding

Directors) by the Company during the six months ended 30 June was 7

(six months ended 30 June 2020: 6).

Key management personnel of the Company are defined as those

persons having authority and responsibility for the planning,

directing and controlling the activities of the Company, directly

or indirectly. Key management of the Company are therefore

considered to be the Directors of the Company. There were no

transactions with the key management, other than their Directors

fees, bonuses and reimbursement of business expenses.

Under the Company's bonus plan, subject to achieving a minimum

hurdle NAV and high watermark conditions, the team receives an

annual cash bonus equal to 10% of the net increases in the

Company's NAV, adjusted for any changes in the Company's equity

capital resulting from issuance of new shares, dividends, share

buy-backs and similar corporate transactions. The Company`s bonus

year runs from 1 January to 31 December.

If, pursuant to the Company's bonus plan, the bonus attributable

to the NAV increase from 1 January 2021 to 30 June 2021 had been

accrued during the period, it would have resulted in an additional

bonus charge of US$4,108,784. As the NAV increase attributable to

the first half of 2021 has not yet been realised, the respective

bonus expenses have not been accrued in the current financial

statements.

Due to a technical error in the calculation of the bonus pools

in the bonus periods from July 2016 to December 2020 (the "Affected

Bonus Periods"), the bonus pools in each of the Affected Bonus

Periods were calculated on the basis of the opening position being

the previous period's "adjusted NAV before bonus". Pursuant to the

terms of the Company's bonus plan, each of the Affected Bonus

Periods should have seen the calculation assess the annual growth

in NAV from an opening position of "adjusted NAV after bonus". As a

result, the amount of bonuses actually accrued in the Affected

Bonus Periods were understated by an aggregate of US$372,556 (the

"Underpaid Bonus"). As the total amount of the Underpaid Bonus is

considered immaterial, the error has been corrected, and the

Underpaid Bonus has been included in the current financial

statements as an additional charge for the current period. The

exact allocation of the Underpaid Bonus is expected to be approved

and paid to the participants of the Company`s bonus plan shortly

after the publication of this interim report.

Of the US$372,556 Underpaid Bonus amount, US$93,972 relates to

directors of the Company.

7 Net finance income

For six months ended 30/06/2021 For six months ended 30/06/2020

USD USD

Interest income - 52,868

- 52,868

---------------------------------- ---------------- --------------------------------

The Company had no deposits in the six months ended 30 June

2021.

8 Income tax expense

The Company is incorporated in Jersey. No tax reconciliation

note has been presented as the income tax rate for Jersey companies

is 0%.

9 Gain/(Loss) per share

The calculation of basic gain per share is based upon the net

gain for the six months ended 30 June 2021 attributable to the

ordinary shareholders of US$ 40,715,279 (for the six months ended

30 June 2020: net loss of US$ 1,725,211 ) and the weighted average

number of ordinary shares outstanding calculated as follows:

Gain/(Loss) per share For the six months ended 30/06/2021 For six months ended 30/06/2020

-------------------------------------------- ------------------------------------ --------------------------------

Basic gain/(loss) per share (US$ cents per

share) 139.5 (5.91)

Gain/(Loss) attributable to equity holders

of the entity 40,715,279 (1,725,211)

-------------------------------------------- ------------------------------------ --------------------------------

The weighted average number of ordinary shares outstanding was

calculated as follows:

For the six months ended 30/06/2021 For the six months ended 30/06/2020

---------------------------------------- ------------------------------------ ------------------------------------

Weighted average number of shares in

issue

Ordinary shares 29,185,831 29,185,831

29,185,831 29,185,831

---------------------------------------- ------------------------------------ ------------------------------------

During the six months ended 30 June 2021 and 30 June 2020 there

were no dilutive instruments in issue.

10 Non-current financial assets

Reconciliation of fair value measurements of non-current

financial assets:

At 30 June 2021 At 31 December 2020

USD USD

Investments held at fair value through profit and loss

- unlisted shares (i) 188,674,373 136,443,491

- promissory notes (ii) 1,428,815 2,753,663

- SAFEs (iii) 9,005,000 5,606,000

-------------------------------------------------------- ---------------- --------------------

199,108,188 144,803,154

-------------------------------------------------------- ---------------- --------------------

At 30 June 2021 At 31 December 2020

USD USD

Opening valuation 144,803,154 91,207,190

Purchases (including consulting and legal fees) 14,081,056 12,503,095

Disposal proceeds (1,628,923) (41,201,387)

Impairment losses in the year - (585,745)

Realised gain 873,923 29,314,214

Unrealised gains 40,978,978 53,565,787

Closing valuation 199,108,188 144,803,154

------------------------------------------------- ---------------- --------------------

Movement in unrealised gains

Opening accumulated unrealised gains 111,980,464 68,114,510

Movement in unrealised gains 40,978,978 53,565,787

Transfer of previously unrealised gains to realised reserve on disposal of Investments - (9,699,833)

Closing accumulated unrealised gains 152,959,442 111,980,464

---------------------------------------------------------------------------------------- ------------ ------------

Reconciliation of investments, if held under the cost (less

impairment) model:

Historical cost basis

Opening book cost 32,822,690 23,092,680

Purchases (including consulting & legal fees) 14,081,056 12,503,095

Disposals on sale of investment (755,000) (2,187,340)

Impairment losses in the year - (585,745)

Closing book cost 46,148,746 32,822,690

----------------------------------------------- ----------- ------------

Valuation methodology

Revenue multiple 62,595,291 62,595,291

Cost and price of recent investment (reviewed for impairment and fair value adjustment) 136,512,897 82,207,863

199,108,188 144,803,154

---------------------------------------------------------------------------------------- ------------ ------------

Financial assets at fair value through profit or loss are

measured at fair value, and changes therein are recognised in

profit or loss.

When measuring the fair value of a financial instrument, the

Company uses relevant transactions during the year or shortly after

the year end, which gives an indication of fair value and considers

other valuation methods to provide evidence of value. The "price of

recent investment" methodology is used mainly for venture capital

investments, and the fair value is derived by reference to the most

recent equity financing round or sizeable partial disposal. Fair

value change is only recognised if that round involved a new

external investor. The Company may assess the fair value in the

absence of a relevant independent equity transaction by relying on

other market observable data and valuation techniques, such as the

analysis of revenue multiples of comparable companies and/or

comparable transactions. The nature of such valuation techniques is

highly judgmental and dependent on the market sentiment at the time

of the analysis.

(i) Equity investments as at 30 June 2021:

Investee Date Value Additions Conversions Gain/loss Disposals, Value Equity

company of initial at to equity from from changes USD at 30 stake

investment 1 Jan investments loan in fair Jun 2021, owned

2021, during notes, value of USD

USD the period, USD equity

USD investments,

USD

----------------- ------------ ------------ ------------ ------------ ------------- ----------- ------------ -------

DepositPhotos 26.07.2011 10,836,105 - - - - 10,836,105 16.67%

Wanelo 21.11.2011 1,825,596 - - (1,223,149) - 602,447 4.69%

Backblaze 24.07.2012 56,004,337 - - - - 56,004,337 9.97%

Remote.it 13.06.2014 3,025,285 - - - - 3,025,285 1.64%

Anews 25.08.2014 1,000,000 - - (670,000) - 330,000 9.41%

Klear 01.09.2014 155,000 - - 327,798 (482,798) - -

Bolt 15.09.2014 36,201,527 - - 30,019,969 - 66,221,496 1.42%

PandaDoc 11.07.2014 3,621,279 - - 10,367,205 - 13,988,484 1.32%

Full Contact 11.01.2018 244,506 - - - - 244,506 0.19%

ScentBird 13.04.2015 6,590,954 - - - - 6,590,954 4.43%

Workiz 16.05.2016 768,845 228,933 - - - 997,778 2.32%

Vinebox 06.05.2016 450,015 - - - - 450,015 2.42%

Hugo 19.01.2019 1,780,250 - - - - 1,780,250 3.55%

MEL Science 25.02.2019 2,663,696 - - - - 2,663,696 3.58%

Qumata

(HealthyHealth) 06.06.2019 415,737 545,156 - - - 960,893 3.03%

eAgronom 31.08.2018 288,224 - - 158,863 - 447,087 1.70%

Rocket Games

(Legionfarm) 16.09.2019 200,000 - - - - 200,000 2.00%

Timbeter 05.12.2019 221,688 - - - - 221,688 4.64%

Classtag 03.02.2020 200,000 - - - - 200,000 1.18%

3S Money

Club 07.04.2020 620,870 2,713,976 - 1,894,517 - 5,229,363 9.00%

Hinterview 21.09.2020 660,197 1,398 - - - 661,595 6.44%

Virtual

Mentor

(Allright) 12.11.2020 772,500 - - - - 772,500 3.00%

NovaKid 13.11.2020 500,000 - - 1,809,854 - 2,309,854 1.22%

MTL Financial

(OutFund) 17.11.2020 1,322,100 - - - - 1,322,100 5.25%

Scalarr 15.08.2019 2,756,563 - - (1,378,281) - 1,378,282 7.66%

Accern 21.08.2019 1,282,705 - - - - 1,282,705 5.11%

Feel 13.08.2020 2,035,512 - - - - 2,035,512 8.60%

Affise 18.09.2019 - 2,068,902 1,401,968 - - 3,470,870 8.63%

3DLook 03.03.2021 - 999,999 - - - 999,999 3.77%

Fem Tech 30.03.2021 - 274,220 - - - 274,220 9.63%

Muncher 23.04.2021 - 2,059,999 - - - 2,059,999 4.77%

CyberWrite 20.05.2021 - 500,000 - - - 500,000 3.71%

Outvio 22.06.2021 - 612,353 - - - 612,353 4.00%

----------------- ------------ ------------ ------------ ------------ ------------- ----------- ------------ -------

Total 136,443,491 10,004,936 1,401,968 41,306,776 (482,798) 188,674,373

------------------------------- ------------ ------------ ------------ ------------- ----------- ------------ -------

(ii) Convertible loan notes as at 30 June 2021:

Investee Date of Value at Additions Conversions Gain/loss Disposals, Value at Term, Interest

company initial 1 Jan to to equity, from USD 30 Jun years rate, %

investment 2021, convertible USD changes in 2021, USD

USD note fair value

investments of

during the convertible

period, USD notes, USD

----------- ------------ ---------- ------------ ------------ ------------ ------------ ---------- ------ ---------

Sharethis 26.03.2013 570,030 - - - - 570,030 5.0 1.09%

KitApps 10.07.2013 600,000 - - 546,125 (1,146,125) - - -

Affise 18.09.2019 1,401,968 - (1,401,968) - - - - -

Postoplan 08.12.2020 181,665 677,120 - - - 858,785 1.0 2.00%

Total 2,753,663 677,120 (1,401,968) 546,125 (1,146,125) 1,428,815

------------------------- ---------- ------------ ------------ ------------ ------------ ---------- ------ ---------

(iii) SAFEs as at 30 June 2021:

Investee company Date of initial Value at 1 Jan Additions to Gain/loss Disposals, USD Value at 30

investment 2021, SAFE from changes Jun 2021, USD

USD investments in fair value

during the of SAFE

period, USD investments,

USD

----------------- ---------------- --------------- -------------- -------------- --------------- ---------------

Spin Technology 17.12.2018 300,000 - - - 300,000

Cheetah (Go-X) 29.07.2019 350,000 - - - 350,000

Retarget 24.09.2019 1,350,000 - - - 1,350,000

Rocket Games

(Legionfarm) 24.09.2019 1,200,000 - - - 1,200,000

Classtag 03.02.2020 200,000 - - - 200,000

Moeco 08.07.2020 1,000,000 - - - 1,000,000

Volumetric 24.07.2020 206,000 - - - 206,000

Study Free 08.12.2020 1,000,000 - - - 1,000,000

Agendapro 15.04.2021 - 309,000 - - 309,000

Aurabeat 03.05.2021 - 1,030,000 - - 1,030,000

Synder (Cloud

Business Inc) 26.05.2021 - 2,060,000 - - 2,060,000

----------------- ---------------- --------------- -------------- -------------- --------------- ---------------

Total 5,606,000 3,399,000 - - 9,005,000

----------------------------------- --------------- -------------- -------------- --------------- ---------------

11 Trade and other receivables

At 30 June 2021 At 31 December 2020

USD USD

----------------------------------------- ---------------- --------------------

Prepayments 67,190 26,631

Other receivables 655,087 272,779

Interest receivable on promissory notes 56,948 188,428

779,225 487,838

----------------------------------------- ---------------- --------------------

The fair values of trade and other receivables approximate to

their carrying amounts as presented above. During the six months

ended 30 June 2021 and 2020 no balances were past due or impaired,

and no credit losses had been expected.

Other receivables as of 30 June 2021 represent amounts due from

the disposal of the investments in Klear and KitApps.

12 Cash and cash equivalents

The cash and cash equivalents as at 30 June 2021 include cash on

hand and in banks.

Cash and cash equivalents comprise the following:

At 30 June 2021 At 31 December 2020

USD USD

--------------- ---------------- --------------------

Bank balances 22,870,620 39,004,288

--------------- ---------------- --------------------

22,870,620 39,004,288

--------------- ---------------- --------------------

The following table represents an analysis of cash and

equivalents by rating agency designation based on Moody`s Investors

Service and Standards & Poor`s credit rating or their

equivalent:

At 30 June 2021 At 31 December 2020

USD USD

--------------- ---------------- --------------------

Bank balances

BBB+ rating 22,870,620 39,004,288

--------------- ---------------- --------------------

22,870,620 39,004,288

--------------- ---------------- --------------------

13 Trade and other payables

At 30 June 2021 At 31 December 2020

USD USD

------------------------- ---------------- --------------------

Salaries payable 105,833 40,000

Directors' fees payable 28,282 22,954

Bonus payable 3,940,083 6,257,560

Trade payables 35,284 27,491

Other accrued expenses 10,565 24,568

4,120,047 6,372,573

------------------------- ---------------- --------------------

The fair values of trade and other payables approximate to their

carrying amounts as presented above.

14 Share capital

On 30 June 2021 the Company had an authorised share capital of

unlimited ordinary shares of no par value and had issued ordinary

share capital of:

At 30 June 2021 At 31 December 2020

USD USD

----------------------------- ----------------- --------------------

Share capital 34,790,174 34,790,174

Issued capital comprises: Number Number

Fully paid ordinary shares 29,185,831 29,185,831

----------------------------- ----------------- --------------------

Number of shares Share capital,

USD

----------------------------- ----------------- ----------------------

Balance at 31 December 2020 29,185,831 29,185,831

Balance at 30 June 2021 29,185,831 29,185,831

----------------------------- ----------------- ----------------------

There have been no changes to the Company's ordinary share

capital between 30 June 2021 and the date of approval of these

financial statements.

15 Related party transactions

The Company's Directors receive fees and bonuses from the

Company, details of which can be found in Note 6.

16 Subsequent events

In July 2021, the Company invested additional EUR400,000 in

Postoplan OÜ, a social network marketing platform, which helps

create, schedule, and promote content ( www.postoplan.app ).

In July 2021, the Company invested additional US$640,000 in

Novakid, an online English language school for children (

www.novakidschool.com ).

In July 2021, the Company invested US$2,000,000 in Collectly,

Inc., a tech-enabled patient billing platform ( www.collectly.co

).

In July 2021, the Company invested US$1,099,999 in VertoFX Ltd,

a UK-based cross-border payments and foreign exchange solution

facilitating commerce for modern businesses, rapidly expanding in

Africa ( www.vertofx.com ).

In July 2021, the Company invested US$1,000,000 in Metro Speedy

Technologies Inc., a technology based local delivery company

providing on-demand, same day or scheduled delivery services (

www.metrospeedy.com ).

In August 2021, the Company invested US$1,000,000 in Academy of

Change, a personalised educational service for women on lifestyle

topics ( www.akademiaperemen.ru ).

In August 2021, the Company invested an additional US$2,000,000

in cloud storage provider Backblaze ( www.backblaze.com ).

These events after the reporting period are not reflected in the

NAV and/or the financial statements as of 30 June 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UBVRRAKUWAUR

(END) Dow Jones Newswires

August 18, 2021 02:00 ET (06:00 GMT)

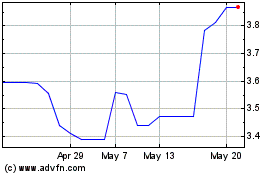

TMT Investments (AQSE:TMT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

TMT Investments (AQSE:TMT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024