TIDMTFW

RNS Number : 8509P

Thorpe(F.W.) PLC

12 October 2023

Results

for the year ended 30 June 2023

FW Thorpe Plc - a group of companies that de sign, manufacture

and supply professional lighting systems - is pleased to announce

its preliminary results for the year ended 30 June 2023.

Key points:

Continuing operations 2023 2022 Exc.

SchalLED/

Zemper

acquisition

------------------------------------- --------- --------- --------- ------------

Revenue GBP176.7m GBP143.7m 23.0% 10.7%

increase increase

Operating profit (before acquisition GBP29.8m GBP25.8m 15.6% 7.9%

adjustments)* increase increase

Operating profit GBP27.8m GBP24.7m 12.6% 8.8%

increase increase

Profit before tax GBP26.9m GBP24.1m 11.7% 10.2%

increase increase

9.1% 9.2%

Basic earnings per share 18.72p 17.16p increase increase

------------------------------------- --------- --------- --------- ------------

* Acquisition adjustments are amortisation of acquisition

related intangible assets

-- Total interim and final dividend of 6.46p (2022: 6.15p) - an increase of 5.0%

-- Final dividend of 4.84p (2022: 4.61p) - an increase of 5.0%

-- Strong revenue growth across the Group, both organically with

service levels returning to normal and from the contributions of

acquisitions

-- Solid operating profit growth despite inflationary cost pressures

-- Expanded our presence in Germany with the addition of SchahlLED in September 2022

-- Net cash generated from operating activities remained strong - GBP31.9m (2022: GBP19.7m)

-- Solid start to 2023/24, with operating performance in line with the start of the prior year

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 (MAR) as supplemented

by The Market Abuse (Amendment) (EU Exit) Regulations (SI 2019/310)

("UK MAR").

For further information please contact:

FW Thorpe Plc

Mike Allcock - Chairman, Joint Chief Executive 01527 583200

Craig Muncaster - Joint Chief Executive, Group

Financial Director 01527 583200

Singer Capital Markets - Nominated Adviser

James Moat / Sam Butcher 020 7496 3000

Chairman's statement

Financial year 2022/23 was to a large extent less turbulent than

the previous few years, notwithstanding some special challenges to

deal with upon occasion. It has been the intention of the Board to

make no further acquisitions whilst the Group builds its cash

reserves and fully integrates recent acquisitions, in order to

formulate more efficient Group activities whilst not losing the

ability for individual companies to be autonomous and flourish.

Financial performance overall was strong, with significant

organic revenue increases for most companies, primarily due to much

improved material availability and the consequential fulfilment of

the previous year's order backlog. All companies wrestled with

inflationary effects on material and labour costs, and some were

better able than others to adjust selling prices to maintain

margins.

Group companies' service levels have returned to being good, and

the order book and forecast situation is generally fine. Whilst

material inflation is showing signs of slowing or even reversing,

wage and salary inflation remains high.

The Annual Report and Accounts contains a more detailed

appraisal of each company's individual achievements and

challenges.

Group results

Group revenue increased by 23% to GBP176.7m (an organic 11%

increase excluding the SchalLED and Zemper acquisitions) whilst

operating profit increased by 13% to GBP27.8m. Operating profit

before acquisition adjustments, removing the impact of amortisation

of intangible assets established at purchase, grew 16% to

GBP29.8m.

Revenue and operating profits were supported by the recent

acquisitions of Zemper and SchahlLED. Last year's report included

only nine months of Zemper's figures, with nine months of

SchahlLED's figures included this year. Excluding Zemper and

SchahlLED acquisition effects, for comparison's sake, like-for-like

revenue increased by 11% to GBP159.1m and operating profit by 9% to

GBP26.9m.

General overview

The Group's stand-out performer this year was Thorlux Lighting,

which benefitted from its ability to deliver its order backlog,

which had previously been caused by component shortages, especially

microchips and electronic components.

The Dutch operations made a wonderful contribution overall,

although their recent growth trajectory took a bit of a breather

this year, with the companies struggling to grow revenue, whilst

Lightronics also saw its margins squeezed by inflationary

pressures.

Portland Lighting's profit reduced significantly because the

company lacked a typical large roll-out project for outdoor retail

sign lighting and because business costs increased as the company

built its product range and operations to diversify into road sign

lighting - namely with the Portland Traffic division. This new

division has developed well, won some successful small orders and

will make a more significant contribution to 2023/24 figures.

TRT Lighting increased its profit but, at only a 3%

profit-to-sales ratio, profit remains significantly below Group

expectations and must improve. In recent months the TRT Board

structure has been altered and strengthened, with a new operations

director and new sales director, and the sales team has been

refreshed. TRT is also developing some interesting technical

innovations to enhance its product portfolio. These changes have

started well and will result in further improved performance in the

current financial year.

The Group welcomed Zemper for its first full year - a year of

getting to know each other better and a year for strategy and

future planning. Zemper's facility in Spain is a credit to its

founding family's professionalism. The company is very

self-sufficient, with ownership of all its intellectual property,

and with its own laboratory test facilities and state-of-the-art

manufacturing equipment. In the year there were several exchange

visits between Group company engineers and executives, and some

significant technological projects are underway to harness Zemper's

design, technical and manufacturing know-how. These projects will

support the Group's electronic operations and its aspirations for

premium connected technology in the emergency lighting sector.

Zemper's profit contribution to the Group in 2022/23 was

marginally lower than forecast, with orders down in the first half

year; however, various new products and marketing supported growth

in the second half to recover the full year's numbers to be in line

with the prior year's numbers. There was notable growth in both the

French and Belgian markets - which, prior to Zemper's acquisition,

were largely untapped by the Group - whilst the local Spanish

market was tighter than in the previous year.

SchahlLED, since joining the Group this financial year, has

continued to grow its customer base, primarily in the German

market, for high technology SmartScan industrial luminaires. It is

a pleasure to welcome the SchahlLED team, which excels at rooting

out discerning industrial customers willing to pay for high quality

luminaires with the latest Thorlux energy saving and controls

technology. In the year, SchahlLED added nine months of revenue to

the consolidated figures of GBP16.9m and operating profit of

GBP2.3m before acquisition adjustments.

The Group's joint venture with Ratio Electric BV commenced with

the opening of a UK operation close to the Group HQ in Redditch,

headed by a young Thorlux design engineer. Investments in the year

have already resulted in the UK operation's own sales and marketing

team, a website, preliminary manufacturing capabilities, and a new

pillar standalone-style twin 22kW electric vehicle (EV) charger -

the Ratio io7 - available for sale by all Group companies. The

charger, developed with common components from a Thorlux outdoor

luminaire, is widely recognised as an innovative and stylish

product; it is suitable for many applications but is mainly

targeted at workplace charging, which matches the Group's core

market of professional users. Availability of the new EV charging

pillar has been limited due to production capacity restraints, but

Ratio hopes to be able to better satisfy the Group's sales teams in

coming months, who are chomping at the bit to get going. In the

Netherlands, at the Ratio HQ, operations have been adjusting to the

fast moving EV marketplace, and investments in smart charging

technology and connectivity have dented returns.

For many years some shareholders have questioned the rationale

behind the Group holding large cash reserves. The Board chooses to

maintain a large reserve as one never knows what is around the

corner, as proven recently by the COVID lockdown. The Board remains

prudent, with no plans to move away from this philosophy, and will

not fund further growth unless it can do so from cash reserves.

Although reserves have reduced with recent acquisitions activity

and with stock control complexities, even with future earn-out

provisions and commitments the Board remains confident that the

current GBP35.0m at the year end, which remains well above its

desirable minimum target, will more than suffice.

There are targets around the Group to reduce stock - of

components, in particular. The easing of the recent supply shortage

situation has now inevitably created an overstock in most Group

companies and elsewhere throughout the extensive supply chain.

Stock levels are being actively managed, in particular to ensure

agility in Group businesses and to reduce possible obsolescence.

Whilst stock increased last year from GBP32.8m to GBP33.4m, the

number reduced from an interim high of GBP37.9m and will fall

further.

On the capital investment front, I am pleased to report that

investment at Famostar has completed, with a new substantial

factory/warehouse extension (GBP1.9m) setting up Famostar for

growth for some years to come. The extension was almost entirely

funded by savings from closing external rented accommodation that

had been used for storing stock. The new facility has solar PV, in

keeping with the Group's sustainability targets, the investment

having an excellent payback period due to recent increases in

energy costs.

At Zemper, the Group has invested in a new and dedicated

injection moulding shop (GBP0.7m) next to the current electronics

factory in Ciudad Real, moving plant from an older facility some

distance away. Opened in July 2023, this new factory has already

started to produce some critical parts for the Thorlux SmartScan

wireless transmitter housing and has capacity to take on more if

this idea of insourcing becomes attractive. The new plant has the

capacity to increase Zemper's productivity by 50%, and having local

production cuts costs and CO(2) emissions. The factory also has its

own solar PV array, which is particularly powerful, of course, in

Spain. Finally, Zemper has purchased a new electronic production

line to improve its capacity.

Sustainability is one of the key pillars for the Group, one that

interests many of its shareholders and will continue to be a focus.

All Group companies are now certified independently to ISO 14001,

an international standard for providing a systematic framework for

the continuous improvement of a company's environmental

performance. Due to the Group's renowned carbon offsetting

programme on its own land in Devauden, Wales, the Group is now

independently certified as carbon neutral for Scope 1 and 2

emissions (those emissions produced by companies' own activities

such as use of electricity, gas and diesel). To date, since the

programme's inception in 2009, the Group has planted an amazing

179,412 trees and has now run out of land. Therefore, in July 2023,

the Group purchased a further 195 acres of land, in Longtown,

Hereford, which should satisfy its carbon offsetting plans for the

next decade or more.

Beyond carbon offsetting, the Group continually looks to lower

its carbon footprint; this is good news for the environment but

also, in most cases, lowers Group operating costs. All companies

within the Group have specific KPIs that focus on general carbon

reduction objectives and increasingly move towards the circularity

of products, the impacts of the materials selected, and reducing

waste.

Early in September 2023 the Group showed its commitment to

achieving net-zero, by signing a Science Based Targets initiative

(SBTi) letter of commitment and therefore commencing the process.

The Group's own emissions data has been well accounted for many

years as part of its carbon offsetting programme, but net-zero

takes a large step forward by also measuring the impact of the

Group's international supply chain and the impacts of the Group's

products when installed and in use at customers' premises. The

Group has been supported throughout the process by third party

consultants, but nevertheless, to calculate the required emissions

for all Group activities, upstream and downstream, has been an

enormous task.

Now that emissions have been calculated, the SBTi commitment

letter defines both the Group's near term (2030) targets and

net-zero date. By 2030 the Group has set a target, relative to the

baseline year 2020/21, to reduce Scope 1 and 2 emissions by 42%,

and Scope 3 emissions by 51.6% per GBPm revenue. This will be done

in a variety of ways but, in particular, by decarbonisation of

Group resources and energy supplies - for example reducing gas use

and switching to greener sources such as solar PV supplied

electricity, using electric vehicles and making Group products even

more efficient - together with increasing the use of SmartScan

energy saving technology. The ultimate objective is to achieve

net-zero, and the Group's target date is 2040 (ten years ahead of

the UK Government's commitment); by this date the Group needs to

have reduced its emissions by 90% (allowing for offsetting the

remaining 10%). Watch this space.

To finish on a high, Thorlux is very proud to have successfully

illuminated the famous Big Ben - or, more correctly, the Elizabeth

Tower - in the City of London. Big Ben is one of the most

photographed and most iconic buildings in the world. Thorlux

developed special products between 2016 and 2022 which provide

colour-tuneable illumination of all four clock faces and the

balconies above, a new Ayrton Light (a special lighthouse style

lamp used to indicate when Parliament is sitting), illumination of

the clock mechanism, the bells, including floodlighting the Big Ben

bell itself, all internal rooms, and the 340 steps, and all

emergency lighting. SmartScan features heavily in the controls for

ancillary areas. The project has been kept secret until now, even

during the 2023 New Year celebrations. This year's Annual Report

and Accounts is therefore adorned with some iconic Thorlux

installation photographs.

Personnel

I would like to thank all Group employees for their dedication

and commitment throughout the financial year. I would also like to

thank, again, David Taylor and Tony Cooper, who, as retiring

directors, have spent a total of over 65 years serving the Group; I

wish them a long and happy retirement.

Dividend

Performance as a whole for the year to 30 June 2023 allows the

Board to recommend an increased final dividend of 4.84p per share

(2022: 4.61p), which gives a total for the year of 6.46p (2022:

6.15p excluding special dividend).

Outlook

All Group companies are forecasting some sales growth and all

are charged with keeping costs under control and a close eye on

sales margins. The Board would like to see further improvements in

profitability - especially at the lower performing companies in the

Group, which need to step up and do their bit. As the Group becomes

larger, costs of managing non-value-added activities become larger

too; this means Group companies need to work harder to achieve a

good return on sales.

The Group nowadays has excellent resilience to changing

conditions, having a firm footprint in numerous geographical

territories and across many market sectors.

As a whole, the outlook from the sales teams is positive. At the

start of this new financial year, orders are slightly lower than in

the same time period last year, and there is some evidence of

projects slowing. Costs are under control and some margin

improvements have been made, which will provide an improved return

on sales. Revenues, however, are expected to see slower growth than

in the recent few years.

Mike Allcock

Chairman and Joint Chief Executive

12 October 2023

Consolidated Results

Consolidated Income Statement

For the year ended 30 June 2023

2023 2022

Notes GBP'000 GBP'000

----------------------------------------- ----- -------- --------

Continuing operations

Revenue 2 176,749 143,715

Cost of sales (98,891) (80,440)

----------------------------------------- ----- -------- --------

Gross profit 77,858 63,275

----------------------------------------- ----- -------- --------

Distribution costs (19,214) (15,501)

Administrative expenses (31,292) (23,482)

Other operating income 480 423

----------------------------------------- ----- -------- --------

Operating profit 27,832 24,715

Finance income 716 527

Finance expense (1,094) (1,367)

Share of (loss)/profit of joint ventures (520) 228

----------------------------------------- ----- -------- --------

Profit before income tax 26,934 24,103

Income tax expense 3 (5,000) (4,030)

----------------------------------------- ----- -------- --------

Profit for the year 21,934 20,073

----------------------------------------- ----- -------- --------

Earnings per share from continuing operations attributable to

the equity holders of the Company during the year (expressed in

pence per share).

2023 2022

Basic and diluted earnings per share Notes pence pence

------------------------------------- ----- ------ ------

- Basic 8 18.72 17.16

- Diluted 8 18.70 17.13

------------------------------------- ----- ------ ------

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2023

2023 2022

Notes GBP'000 GBP'000

---------------------------------------------------------- ------ -------- --------

Profit for the year: 21,934 20,073

------------------------------------------------------------------ -------- --------

Other comprehensive income/(expenses)

Items that may be reclassified to profit or loss

Exchange differences on translation of foreign operations 231 (268)

------------------------------------------------------------------ -------- --------

231 (268)

Items that will not be reclassified to profit or

loss

Revaluation of financial assets at fair value through

other comprehensive income (105) (57)

Movement on associated deferred tax 26 14

Actuarial (loss)/gain on pension scheme (123) 953

Movement on unrecognised pension scheme surplus 177 (1,143)

------------------------------------------------------------------ -------- --------

(25) (233)

----------------------------------------------------------------- -------- --------

Other comprehensive income/(expense) for the year,

net of tax 206 (501)

------------------------------------------------------------------ -------- --------

Total comprehensive income for the year 22,140 19,572

------------------------------------------------------------------ -------- --------

Consolidated Statement of Financial Position

For the year ended 30 June 2023

2023 2022

GBP'000 GBP'000

---------------------------------------------------- -------- --------

Assets

Non-current assets

Property, plant and equipment 5 38,763 33,818

Intangible assets 6 70,891 51,865

Investments in subsidiaries - -

Investment property 1,986 1,984

Financial assets at amortised cost 1,587 1,124

Equity accounted investments and joint arrangements 5,592 6,112

Financial assets at fair value through other

comprehensive income 3,364 3,470

Deferred income tax assets 382 120

---------------------------------------------------- -------- --------

Total non-current assets 122,565 98,493

---------------------------------------------------- -------- --------

Current assets

Inventories 33,437 32,758

Trade and other receivables 35,733 33,018

Financial assets at amortised cost 1,266 1,800

Short-term financial assets 7 4 5,079

Cash and cash equivalents 35,013 35,505

---------------------------------------------------- -------- --------

Total current assets 105,453 108,160

---------------------------------------------------- -------- --------

Total assets 228,018 206,653

---------------------------------------------------- -------- --------

Liabilities

Current liabilities

Trade and other payables (37,457) (35,801)

Financial liabilities (1,435) (332)

Lease liabilities (812) (506)

Current income tax liabilities (1,143) (641)

---------------------------------------------------- -------- --------

Total current liabilities (40,847) (37,280)

---------------------------------------------------- -------- --------

Net current assets 64,606 70,880

---------------------------------------------------- -------- --------

Non-current liabilities

Other payables (11,987) (12,880)

Financial liabilities (1,461) (1,830)

Lease liabilities (3,822) (2,510)

Provisions for liabilities and charges (3,299) (2,536)

Deferred income tax liabilities (6,261) (4,264)

---------------------------------------------------- -------- --------

Total non-current liabilities (26,830) (24,020)

---------------------------------------------------- -------- --------

Total liabilities (67,677) (61,300)

---------------------------------------------------- -------- --------

Net assets 160,341 145,353

---------------------------------------------------- -------- --------

Equity

Issued share capital 1,189 1,189

Share premium account 2,976 2,827

Capital redemption reserve 137 137

Foreign currency translation reserve 2,039 1,808

Retained earnings

---------------------------------------------------- -------- --------

At 1 July 139,392 131,631

Profit for the year attributable to the owners 21,934 20,073

Other changes in retained earnings (7,326) (12,312)

---------------------------------------------------- -------- --------

154,000 139,392

---------------------------------------------------- -------- --------

Total equity 160,341 145,353

---------------------------------------------------- -------- --------

Consolidated Statement of Changes in Equity.

For the year ended 30 June 2023

Foreign

Issued Share Capital currency

share premium redemption translation Retained Total

capital account reserve reserve earnings equity

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Balance at 1 July 2021 1,189 1,960 137 2,076 131,631 136,993

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Comprehensive income

Profit for the year to 30

June 2022 - - - - 20,073 20,073

Actuarial gain on pension

scheme - - - - 953 953

Movement on unrecognised pension

scheme surplus - - - - (1,143) (1,143)

Revaluation of financial assets

at fair value through other

comprehensive income - - - - (57) (57)

Movement on associated deferred

tax - - - - 14 14

Exchange differences on translation

of

foreign operations - - - (268) - (268)

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Total comprehensive income - - - (268) 19,840 19,572

Transactions with owners

Shares issued from exercised

options - 867 - - - 867

Dividends paid to shareholders 4 - - - - (12,079) (12,079)

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Total transactions with owners - 867 - - (12,079) (11,212)

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Balance at 30 June 2022 1,189 2,827 137 1,808 139,392 145,353

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Comprehensive income

Profit for the year to 30

June 2023 - - - - 21,934 21,934

Actuarial loss on pension

scheme - - - - (123) (123)

Movement on unrecognised pension

scheme surplus - - - 177 177

Revaluation of financial assets

at fair value through other

comprehensive income - - - - (105) (105)

Movement on associated deferred

tax - - - - 26 26

Exchange differences on translation

of

foreign operations - - - 231 - 231

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Total comprehensive income - - - 231 21,909 22,140

Transactions with owners

Shares issued from exercised

options - 149 - - - 149

Dividends paid to shareholders 4 - - - - (7,301) (7,301)

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Total transactions with owners - 149 - - (7,301) (7,152)

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Balance at 30 June 2023 1,189 2,976 137 2,039 154,000 160,341

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Consolidated Statement of Cash Flows

For the year ended 30 June 2023

2023 2022

GBP'000 GBP'000

---------------------------------------------------- -------- --------

Cash flows from operating activities

Cash generated from operations 9 36,216 24,789

Tax paid (4,341) (5,049)

---------------------------------------------------- -------- --------

Net cash generated from operating activities 31,875 19,740

---------------------------------------------------- -------- --------

Cash flows from investing activities

Purchases of property, plant and equipment (7,739) (5,510)

Proceeds from sale of property, plant and equipment 535 423

Purchases of intangible assets (2,255) (2,366)

Purchases of subsidiaries (net of cash acquired) (12,602) (14,625)

Purchase of shares in subsidiaries (6,445) (15,219)

Purchase of investment property (22) (36)

Net sale of financial assets at fair value through

Other Comprehensive Income 1 268

Investment in joint venture - (4,958)

Property rental and similar income 93 113

Dividend income 209 246

Net withdrawal of short-term financial assets 5,075 18,524

Interest received 434 218

Repayment of loans 1,813 -

New loans granted (1,748) (806)

---------------------------------------------------- -------- --------

Net cash used in investing activities (22,651) (23,728)

---------------------------------------------------- -------- --------

Cash flows from financing activities

Net proceeds from the issuance of ordinary shares 149 867

Addition of lease liabilities 203 236

Proceeds from borrowings 1,039 -

Repayment of borrowings (2.532) (1,271)

Payment of lease liabilities (789) (535)

Payment of interest (339) (139)

Dividends paid to Company's shareholders 4 (7,301) (12,079)

---------------------------------------------------- -------- --------

Net cash used in financing activities (9,570) (12,921)

---------------------------------------------------- -------- --------

Effects of exchange rate changes on cash (146) 146

---------------------------------------------------- -------- --------

Net decrease in cash in the year (492) (16,763)

Cash and cash equivalents at beginning of year 35,505 52,268

---------------------------------------------------- -------- --------

Cash and cash equivalents at end of year 35,013 35,505

---------------------------------------------------- -------- --------

Notes

1 Basis of preparation

The consolidated and company financial statements of FW Thorpe

Plc have been prepared in accordance with UK adopted International

Accounting Standards and with the requirements of the Companies Act

2006 as applicable to companies reporting under those standards,

with future changes being subject to endorsement by the UK

Endorsement Board.

The financial statements have been prepared on a going concern

basis, under the historical cost convention except for the

financial instruments measured at fair value either through other

comprehensive income or profit and loss per the provisions of IFRS

9 and contingent consideration that are measured at fair value.

There are no other standards that are not yet effective that are

expected to have a material impact on the Group in the current or

future reporting periods and on foreseeable future

transactions.

The financial statements are presented in Pounds Sterling, which

is the Company's functional and presentation currency, rounded to

the nearest thousand.

The preparation of financial information in conformity with the

basis of preparation described above requires the use of certain

critical accounting estimates. It also requires management to

exercise its judgement in the process of applying the Company's and

Group's accounting policies.

The Company has elected to take the exemption under section 408

of the Companies Act 2006 from presenting the Company income

statement.

The directors confirm they are satisfied that the Group and

Company have adequate resources, with GBP35.0m cash to continue in

business for the foreseeable future, including the affect of

increased costs caused by the on-going Ukraine and Russia conflict,

where the Group has no sales, and other global events. The

directors have also produced a severe, but plausible downside

scenario that demonstrates that the Group could cover its cash

commitments over the following year from approving these accounts.

For this reason, the directors continue to adopt the going concern

basis in preparing the accounts.

The financial information set out in this document does not

constitute the statutory financial statements of the Group for the

year end 30 June 2023 but is derived from the Annual Report and

Accounts 2023. The auditors have reported on the annual financial

statements and issued an unqualified opinion.

2 Segmental Analysis

(a) Business segments

The segmental analysis is presented on the same basis as that

used for internal reporting purposes. For internal reporting FW

Thorpe is organised into twelve operating segments based on the

products and customer base in the lighting market - the largest

business is Thorlux, which manufactures professional lighting

systems for industrial, commercial and controls markets. The

business acquired through acquisition of Lumen Intelligence Holding

GmbH in September 2022 is included in this segment in accordance

with the Group's internal reporting. The businesses in the

Netherlands, Lightronics and Famostar, are material subsidiaries

and disclosed separately as Netherlands companies. The businesses

in the Zemper Group are also material and disclosed separately as

the Zemper Group.

The seven remaining operating segments have been aggregated into

the "other companies" reportable segment based upon their size,

comprising the entities Philip Payne Limited, Solite Europe

Limited, Portland Lighting Limited, TRT Lighting Limited, Thorlux

Lighting L.L.C., Thorlux Australasia Pty Limited and Thorlux

Lighting GmbH.

FW Thorpe's chief operating decision-maker (CODM) is the Group

Board. The Group Board reviews the Group's internal reporting in

order to monitor and assess performance of the operating segments

for the purpose of making decisions about resources to be

allocated. Performance is evaluated based on a combination of

revenue and operating profit. Assets and liabilities have not been

segmented, which is consistent with the Group's internal

reporting.

Inter- Total

Netherlands Zemper Other segment continuing

Thorlux companies Group companies adjustments operations

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Year to 30 June 2023

Revenue to external customers 101,859 36,226 19,328 19,336 - 176,749

Revenue to other group

companies 3,601 417 - 4,667 (8,685) -

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Total revenue 105,460 36,643 19,328 24,003 (8,685) 176,749

------------------------------ -------- ----------- -------- ---------- ------------ -----------

EBITDA 21,458 7,952 4,205 2,392 588 36,595

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Depreciation and amortisation 4,212 983 2,307 1,261 - 8,763

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Operating profit before

acquisition adjustments 18,062 7,187 2,801 1,131 588 29,769

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Operating profit 17,246 6,969 1,898 1,131 588 27,832

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Net finance expense (378)

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Share of loss of joint

ventures (520)

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Profit before income tax 26,934

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Included in the Thorlux segment are additional revenues from

SchahlLED of GBP16.9m and operating profits of GBP1.4m. Acquisition

adjustments includes amortisation of intangible assets.

Year to 30 June 2022

Revenue to external customers 78,912 34,676 14,152 15,975 - 143,715

Revenue to other group

companies 5,171 377 - 5,794 (11,342) -

------------------------------ ------ ------ ------ ------ -------- -------

Total revenue 84,083 35,053 14,152 21,769 (11,342) 143,715

------------------------------ ------ ------ ------ ------ -------- -------

EBITDA 16,887 8,514 3,107 2,692 506 31,706

------------------------------ ------ ------ ------ ------ -------- -------

Depreciation and amortisation 3,378 1,043 1,525 1,045 - 6,991

------------------------------ ------ ------ ------ ------ -------- -------

Operating profit before

acquisition adjustments 13,509 7,846 2,242 1,647 506 25,750

------------------------------ ------ ------ ------ ------ -------- -------

Operating profit 13,509 7,471 1,582 1,647 506 24,715

------------------------------ ------ ------ ------ ------ -------- -------

Net finance expense (840)

------------------------------ ------ ------ ------ ------ -------- -------

Share of profit of joint

ventures 228

------------------------------ ------ ------ ------ ------ -------- -------

Profit before income tax 24,103

------------------------------ ------ ------ ------ ------ -------- -------

Inter segment adjustments to operating profit consist of

property rentals on premises owned by FW Thorpe Plc, adjustments to

profit related to stocks held within the Group that were supplied

by another segment and elimination of profit on transfer of assets

between Group companies.

(b) Geographical analysis

The Group's business segments operate in five main areas, the

UK, the Netherlands, Germany, the rest of Europe and the rest of

the World. The home country of the Company, which is also the main

operating company, is the UK.

2023 2022

GBP'000 GBP'000

-------- -----------

(Restated)*

------------------ -------- -----------

UK 89,917 83,242

Netherlands 31,845 30,323

Germany 21,548 8,205

Rest of Europe 30,039 19,139

Rest of the World 3,400 2,806

------------------ -------- -----------

176,749 143,715

------------------ -------- -----------

* Figures are restated as a result of inclusion of Germany as

separate geographical segment in the current year.

3 Income Tax Expense

Analysis of income tax expense in the year:

2023 2022

GBP'000 GBP'000

-------------------------------------------------- -------- ---------

Current tax

Current tax on profits for the year 5,515 4,717

Adjustments in respect of prior years (313) (279)

-------------------------------------------------- -------- ---------

Total current tax 5,202 4,438

-------------------------------------------------- -------- ---------

Deferred tax

Origination and reversal of temporary differences (202) (408)

-------------------------------------------------- -------- ---------

Total deferred tax (202) (408)

-------------------------------------------------- -------- ---------

Income tax expense 5,000 4,030

-------------------------------------------------- -------- ---------

The tax assessed for the year is lower (2022: lower) than the

standard rate of corporation tax in the UK of 20.50%

(2022: 19.00%). The differences are explained below:

2023 2022

GBP'000 GBP'000

--------------------------------------------------------- -------- --------

Profit before income tax 26,934 24,103

--------------------------------------------------------- -------- --------

Profit on ordinary activities multiplied by the standard

rate in the UK of 20.5% (2022: 19.0%) 5,521 4,580

Effects of:

Expenses not deductible for tax purposes 1,150 329

Accelerated tax allowances and other timing differences (145) (348)

Adjustments in respect of prior years (313) (279)

Patent box relief (1,718) (812)

Foreign profit taxed at higher rate 505 560

--------------------------------------------------------- -------- --------

Tax charge 5,000 4,030

--------------------------------------------------------- -------- --------

The effective tax rate was 18.56% (2022: 16.72%). Adjustments in

respect of prior years relate to refunds received for prudent

assumptions on additional investment allowances and patent box

relief in the tax calculations.

The UK corporation tax rate increased from 19% to 25% from 1

April 2023, which was substantively enacted in May 2021 and an

average standard rate of 20.50% is applicable to the Company during

the current year. Deferred tax assets and liabilities have been

calculated based on a rate at which they are expected to

crystallise.

4 Dividends

Dividends paid during the year are outlined in the tables

below:

Dividends paid (pence per share) 2023 2022

--------------------------------- ---- -----

Final dividend 4.61 4.31

Special dividend (final) - 2.20

Interim dividend 1.62 1.54

Special dividend (interim) - 2.27

--------------------------------- ---- -----

Total 6.23 10.32

--------------------------------- ---- -----

A final dividend in respect of the year ended 30 June 2023 of

4.84p per share, amounting to GBP5,674,000 (2022: GBP5,403,000) is

to be proposed at the Annual General Meeting on 16 November 2023

and, if approved, will be paid on 24 November 2023 to shareholders

on the register on 27 October 2023. The ex-dividend date is 26

October 2023. These financial statements do not reflect this

dividend payable.

Dividends proposed (pence per share) 2023 2022

------------------------------------- ---- ----

Final dividend 4.84 4.61

------------------------------------- ---- ----

2023 2022

Dividends paid GBP'000 GBP'000

--------------------------- -------- --------

Final dividend 5,403 5,043

Special dividend (final) - 2,574

Interim dividend 1,898 1,803

Special dividend (interim) - 2,659

--------------------------- -------- --------

Total 7,301 12,079

--------------------------- -------- --------

2023 2022

Dividends proposed GBP'000 GBP'000

------------------- -------- --------

Final dividend 5,674 5,403

------------------- -------- --------

5 Property, Plant and Equipment

Freehold Plant Right-

land and and of-use

buildings equipment assets Total

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ---------- ---------- -------- --------

Cost

At 1 July 2022 25,354 33,795 4,356 63,505

Acquisition of subsidiaries* - 50 134 184

Additions 2,892 4,847 1,751 9,490

Disposals - (970) (278) (1,248)

Currency translation (27) (33) (21) (81)

----------------------------- ---------- ---------- -------- --------

At 30 June 2023 28,219 37,689 5,942 71,850

----------------------------- ---------- ---------- -------- --------

Accumulated depreciation

At 1 July 2022 5,477 22,518 1,692 29,687

Acquisition of subsidiaries* - - 38 38

Charge for the year 738 2,937 614 4,289

Disposals - (685) (220) (905)

Currency translation (4) (12) (6) (22)

----------------------------- ---------- ---------- -------- --------

At 30 June 2023 6,211 24,758 2,118 33,087

----------------------------- ---------- ---------- -------- --------

Net book amount

----------------------------- ---------- ---------- -------- --------

At 30 June 2023 22,008 12,931 3,824 38,763

----------------------------- ---------- ---------- -------- --------

* Acquisition of subsidiaries are the assets acquired from the

purchase of the Lumen companies with a fair value of

GBP146,000.

Freehold Plant Right-

land and and of-use

buildings equipment assets Total

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ---------- ---------- -------- --------

Cost

At 1 July 2021 22,094 27,662 895 50,651

Acquisition of subsidiaries* 975 3,965 3,534 8,474

Additions 2,241 3,037 232 5,510

Disposals (1) (884) (303) (1,188)

Currency translation 45 15 (2) 58

----------------------------- ---------- ---------- -------- --------

At 30 June 2022 25,354 33,795 4,356 63,505

----------------------------- ---------- ---------- -------- --------

Accumulated depreciation

At 1 July 2021 4,638 17,345 417 22,400

Acquisition of subsidiaries* 234 3,175 1,062 4,471

Charge for the year 600 2,703 456 3,759

Disposals - (714) (248) (962)

Currency translation 5 9 5 19

----------------------------- ---------- ---------- -------- --------

At 30 June 2022 5,477 22,518 1,692 29,687

----------------------------- ---------- ---------- -------- --------

Net book amount

----------------------------- ---------- ---------- -------- --------

At 30 June 2022 19,877 11,277 2,664 33,818

----------------------------- ---------- ---------- -------- --------

* Acquisition of subsidiaries are the assets acquired from the

purchase of the Zemper companies with a fair value of

GBP4,003,000

6 Intangible Assets

Development Brand Customer Fishing

Goodwill costs Technology name relationship Software Patents rights Total

Group 2023 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Cost

At 1 July 2022 32,778 16,320 2,895 3,845 9,460 3,344 159 182 68,983

Acquisition

of subsidiaries* 14,624 - - 1,354 5,759 38 - - 21,775

Additions - 1,874 - - - 381 - - 2,255

Disposals - - - - - (12) - - (12)

Write-offs - (4,228) - - - - - - (4,228)

Currency

translation (399) (10) (2) (35) (141) (4) - - (591)

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2023 47,003 13,956 2,893 5,164 15,078 3,747 159 182 88,182

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Accumulated

amortisation

At 1 July 2022 252 10,009 2,495 1,273 473 2,460 156 - 17,118

Charge for the

year - 2,152 151 434 1,350 367 - - 4,454

Disposals - - - - - (1) - - (1)

Write-offs - (4,228) - - - - - - (4,228)

Currency

translation (19) (8) (3) (5) (17) - - - (52)

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2023 233 7,925 2,643 1,702 1,806 2,826 156 - 17,291

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Net book amount

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2023 46,770 6,031 250 3,462 13,272 921 3 182 70,891

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

* Acquisition of subsidiaries are the assets acquired from the

purchase of the Lumen companies with a fair value of GBP7,151,000,

excluding goodwill.

Write-offs relate to development assets where no further

economic benefits will be obtained.

Development Brand Customer Fishing

Goodwill costs Technology name relationship Software Patents rights Total

Group 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Cost

At 1 July 2021 14,431 7,871 2,846 1,257 - 2,811 150 182 29,548

Acquisition

of subsidiaries* 18,320 6,346 45 2,588 9,468 266 6 - 37,039

Additions - 2,096 - - - 267 3 - 2,366

Currency

translation 27 7 4 - (8) - - - 30

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2022 32,778 16,320 2,895 3,845 9,460 3,344 159 182 68,983

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Accumulated

amortisation

At 1 July 2021 241 4,415 2,179 1,006 - 1,852 150 - 9,843

Acquisition

of subsidiaries* - 3,770 - - - 250 6 - 4,026

Charge for the

year - 1,820 308 262 465 358 - - 3,213

Currency

translation 11 4 8 5 8 - - - 36

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2022 252 10,009 2,495 1,273 473 2,460 156 - 17,118

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Net book amount

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2022 32,526 6,311 400 2,572 8,987 884 3 182 51,865

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

* Acquisition of subsidiaries are the assets acquired from the

purchase of the Zemper companies with a fair value of

GBP14,693,000, excluding goodwill.

7 Short-Term Financial Assets

2023 2022

GBP'000 GBP'000

------------------ -------- --------

Beginning of year 5,079 23,603

Net withdrawals (5,075) (18,524)

------------------ -------- --------

4 5,079

------------------ -------- --------

The short-term financial assets consist of term cash deposits

with an original term in excess of three months.

8 Earnings Per Share

Basic and diluted earnings per share for profit attributable to

equity holders of the Company

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year,

excluding ordinary shares purchased by the Company and held as

treasury shares.

Basic 2023 2022

----------------------------------------------------- ----------- -----------

Weighted average number of ordinary shares in issue 117,199,805 116,953,866

----------------------------------------------------- ----------- -----------

Profit attributable to equity holders of the Company

(GBP'000) 21,934 20,073

----------------------------------------------------- ----------- -----------

Basic earnings per share (pence per share) total 18.72 17.16

----------------------------------------------------- ----------- -----------

Diluted earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year,

excluding ordinary shares purchased by the Company and held as

treasury shares, plus the number of shares earnt for share options

where performance conditions have been achieved.

Diluted 2023 2022

----------------------------------------------------- ----------- -----------

Weighted average number of ordinary shares in issue

(diluted) 117,294,937 117,209,308

----------------------------------------------------- ----------- -----------

Profit attributable to equity holders of the Company

(GBP'000) 21,934 20,073

----------------------------------------------------- ----------- -----------

Diluted earnings per share (pence per share) total 18.70 17.13

----------------------------------------------------- ----------- -----------

9 Cash Generated from Operations

2023 2022

GBP'000 GBP'000

----------------------------------------------------- -------- --------

Profit before income tax 26,934 24,103

Depreciation charge 4,289 3,759

Depreciation of investment property 20 19

Amortisation of intangibles 4,454 3,213

Profit on disposal of property, plant and equipment (192) (197)

Net finance expense 378 855

Retirement benefit contributions less current

and past service charge 54 (190)

Share of joint venture loss/(profit) 520 (228)

Research and development expenditure credit (382) (306)

Effects of exchange rate movements 952 (520)

Changes in working capital

- Decrease/(increase) in inventories 3,117 (8,986)

- (Increase)/decrease in trade and other receivables (98) (603)

- (Decrease)/increase in payables and provisions (3,830) 3,870

----------------------------------------------------- -------- --------

Cash generated from operations 36,216 24,789

----------------------------------------------------- -------- --------

10 Business Combination

On 23 September 2022, the Group acquired 80% of the share

capital and hence control of Lumen Intelligence Holding GmbH, a

company that holds 100% equity interest in SchahlLED Lighting GmbH,

a turnkey provider of intelligent energy saving lighting products

for the industrial and logistics sectors. The company was acquired

for an initial consideration of EUR14.6m (GBP12.9m). There is a

fixed commitment to acquire the remaining shares, based on current

best estimates, a further EUR7.5m (GBP6.6m) could be payable, which

is subject to future performance conditions. Amounts recognised in

respect of this acquisition are shown below:

EUR'000 GBP'000

-------------------------------------------------- ------- -------

Intangible assets 8,124 7,151

Property, plant & equipment 57 50

Right of use assets 109 96

Deferred tax assets 150 132

Inventories 4,450 3,917

Trade and other receivables 3,856 3,394

Cash 324 286

Trade and other payables (4,466) (3,931)

Financial liabilities (2,563) (2,256)

Lease liabilities (549) (483)

Current income tax liabilities (729) (642)

Provisions for liabilities and charges (800) (704)

Deferred tax Liabilities (2,428) (2,137)

-------------------------------------------------- ------- -------

Total identifiable assets 5,535 4,873

Goodwill 16,616 14,624

-------------------------------------------------- ------- -------

Total purchase consideration 22,151 19,497

-------------------------------------------------- ------- -------

Total purchase consideration satisfied by:

Cash 14,643 12,888

Redemption liability 5,185 4,563

Contingent consideration 2,323 2,046

-------------------------------------------------- ------- -------

Total consideration 22,151 19,497

-------------------------------------------------- ------- -------

Net cash flow arising acquisition of subsidiaries

Cash consideration 14,643 12,888

Less cash in subsidiaries acquired (324) (286)

-------------------------------------------------- ------- -------

Cash outflow on acquisition of subsidiaries 14,319 12,602

-------------------------------------------------- ------- -------

On acquisition, a valuation exercise on the assets and

liabilities of Lumen Intelligence Holding GmbH has been performed;

the book value of all assets and liabilities except for warranties

are considered to represent fair value. For provision for

warranties, additional provision of EUR500,000 (GBP440,000) was

applied to reflect the longer term nature of these commitments.

Fair value of intangible assets was assessed and determined on

the basis of brand name and customer relationships acquired. Brand

name elements was determined using an industry typical royalty rate

over a ten years period and customer relationships was determined

using an industry typical royalty rate over a six years period, all

discounted to the present day.

The goodwill relates to the ongoing level of profitability of

the business model, opportunity to sell existing Group and third

party products into the German market and potential sourcing

benefits for Group companies.

The acquisition of Lumen Intelligence Holding GmbH has been

accounted for as if the Group acquired 100% of its share capital as

the Group has a commitment and obligation to acquire the remaining

outstanding shares in Lumen Intelligence Holding GmbH. Therefore,

any post-acquisition profits attributable to non-controlling

interests are treated as finance expense of the Group.

For the nine months to 30 June 2023 the Lumen companies

contributed EUR19.3m (GBP16.9m) to Group revenue and EUR1.2m

(GBP1.0m) to Group profit before tax for the current financial

year.

If the acquisition had occurred on 1 July 2022 the consolidated

pro-forma revenue and profit before tax for the year ended 30 June

2023 would have been EUR23.9m (GBP20.8m) and EUR1.3m (GBP1.1m)

respectively. These amounts have been calculated using the

subsidiary's results and adjusting them for:

-- differences in accounting policies between the Group and the subsidiary; and

-- the additional depreciation and amortisation that would have

been charged, assuming that the fair value adjustments to property,

plant and equipment and intangible assets had applied from 1 July

2022, together with the consequential tax benefits.

11 Events after the Statement of Financial Position date

On 17 July 2023, the Group completed its commitment to purchase

a piece of land in Wales for a consideration of GBP2.0m. The land

will be used to plant trees as part of the Group's effort to reduce

its carbon emission footprint.

On 3 October 2023, the Group paid the third tranche of payments

for the acquisition of Electrozemper S.A. totalling EUR5.0m

(GBP4.3m).

12 Cautionary statement

Sections of this report contain forward looking statements that

are subject to risk factors including the economic and business

circumstances occurring from time to time in countries and markets

in which the Group operates. By their nature, forward looking

statements involve a number of risks, uncertainties and future

assumptions because they relate to events and/or depend on

circumstances that may or may not occur in the future and could

cause actual results and outcomes to differ materially from those

expressed in or implied by the forward looking statements. No

assurance can be given that the forward-looking statements in this

preliminary announcement will be realised. Statements about the

Chairman's expectations, beliefs, hopes, plans, intentions and

strategies are inherently subject to change, and they are based on

expectations and assumptions as to future events, circumstances and

other factors which are in some cases outside the Company's

control. Actual results could differ materially from the Company's

current expectations. It is believed that the expectations set out

in these forward looking statements are reasonable but they may be

affected by a wide range of variables which could cause actual

results or trends to differ materially, including but not limited

to, changes in risks associated with the Company's growth strategy,

fluctuations in product pricing and changes in exchange and

interest rates.

13 Annual report and accounts

The annual report and accounts will be sent to shareholders on

16 October 2023 and will be available, along with this

announcement, on the Group's website (www.fwthorpe.co.uk) from 16

October 2023. The Group will hold its AGM on 16 November 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EANEFFFXDFFA

(END) Dow Jones Newswires

October 12, 2023 02:00 ET (06:00 GMT)

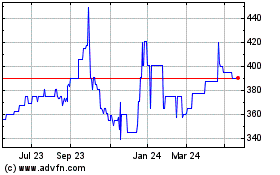

Thorpe (FW) (AQSE:TFW.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

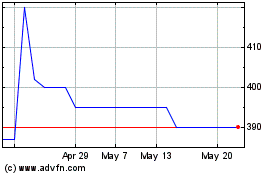

Thorpe (FW) (AQSE:TFW.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025