TIDMOCI

RNS Number : 3732M

Oakley Capital Investments Limited

14 September 2023

14 September 2023

Oakley Capital Investments Limited

Interim results for the Six Months ended 30 June 2023

Oakley Capital Investments Limited(1) ("OCI" or the "Company")

is pleased to announce its interim results for the six months ended

30 June 2023. OCI is a listed investment company providing

consistent, long-term returns in excess of the FTSE All-Share Index

by investing in the Funds managed by Oakley Capital(2) ("Oakley"),

thereby capturing the outperformance of a leading private equity

manager.

The Oakley Funds(3) invest primarily in unquoted, profitable,

pan-European businesses with recurring revenues, and across four

sectors: Technology, Consumer, Education and Business Services.

Oakley's origination capabilities combined with proven value

creation drivers help management teams accelerate growth and

produce consistently superior returns for investors.

Resilient NAV and strengthened balance sheet

Highlights for the six months ended 30 June 2023

-- Net Asset Value ("NAV") per share of 663 pence and NAV of GBP1,169 million

-- Total NAV return per share, including dividends, of 0.5% since 31 December 2022 (+3 pence)

-- Total shareholder return of 5.3%

-- Additional investments made of GBP96 million and share of proceeds of GBP240 million

-- Net cash of GBP248 million

-- Total outstanding Oakley Fund commitments of GBP893 million

-- Undrawn revolving credit facility extended and increased to GBP175 million post-period end

-- Half-year dividend of 2.25 pence to be paid on 20 October

2023 to shareholders on the register on or before 21 September

2023

Portfolio highlights

-- Average portfolio company year-on-year EBITDA growth of 21% (FY2022: 22%)

-- Average portfolio company valuation multiple (EV/EBITDA) of 16.9x (FY2022: 15.9x)

-- Average net debt/EBITDA ratio of 4.0x (FY2022: 4.3x)

-- The key drivers of NAV were:

o Portfolio companies (+17 pence): valuation gains in the

underlying investments, with Idealista and Time Out being the

largest contributors

o Foreign exchange impact (-15 pence): 3% change in EUR:GBP

Portfolio overview

A resilient portfolio of tech-enabled businesses continued to

perform well:

-- Growth - an average 21% organic EBITDA growth demonstrates

the ability of a largely digitally disruptive portfolio to take

market share, countering the impact of macro-economic weakness

-- Valuation - an increase in the average valuation multiple to

16.9x reflects the portfolio activity in the period, leading to a

greater weighting towards the higher rated Technology sector. The

modest increase in asset value reflects the Company's cautious

approach to trading outlook and valuation multiples and the fact

that half of the NAV was not subject to change in the period. This

is the result of approximately 50% of the asset value being held in

cash, or investments that were valued based upon a transaction in

the last twelve months

-- Leverage - a fall in average net debt/EBITDA to 4.0x

underlines the portfolio company earnings growth and Oakley's

prudent approach to leverage. Of realised returns to date only 1%

has been attributable to the use of debt, in contrast to organic

earnings growth which has accounted for 65%

Proceeds

OCI's share of proceeds from realisations totalled GBP240

million. The primary contribution was Fund III's disposal of IU

Group, the largest and fastest growing university in Germany, and a

global leader in education technology.

Investments

During the period, OCI made a total look-through investment of

GBP96 million comprising:

-- IU Group (Fund V) - GBP66 million - Reinvestment to benefit

from the next phase of the Group's growth, focusing on accelerated

internationalisation, to further its vision of democratising

education

-- Thomas's London Day Schools (Fund IV) - GBP14 million - a top

rated group of co-educational independent schools in London

-- vLex (Origin Fund) - GBP7 million - bolt-on acquisition of

Fastcase, a leading US intelligence business, to form the world's

largest law firm subscriber base

-- Affinitas Education (Fund IV) - GBP2 million - bolt-on

acquisition of XIC, a single-site school in Spain, which brings the

total group to 12 schools, educating more than 10,000 students

-- OCI also made GBP1 million of look-through investments in

PROfounders III portfolio companies during the period.

Cash & commitments

A significant growth in liquid resources in the period:

-- Cash - OCI's net cash grew 126% to GBP248 million as at 30 June 2023

-- Credit facility - post-period end, OCI renewed and expanded

its revolving credit facility, raising total committed lending to

GBP175 million for a two-year term. As at 13 September 2023, the

facility was undrawn

-- Commitments - following OCI's $100 million commitment to

Oakley Touring Venture Fund during the period, OCI's total

outstanding commitments to the Oakley Funds amounted to GBP893

million. This is expected to be deployed into new investments over

the next five years

Outlook

The outlook for the global economy will remain uncertain in the

period ahead, which will present challenges, but also opportunity.

Oakley has decades of experience investing through economic cycles,

and Oakley's active management, and proven value creation

strategies are expected to continue driving NAV growth:

-- The portfolio of 27 European businesses continues to profit

from long-term megatrends including the shift to online solutions

by businesses and consumers, and the demand for mission-critical,

tech-enabled services

-- Oakley continues to demonstrate its forward thinking and

innovation, exploring new technologies such as AI and developing

new sectors such as Business Services

-- Enhanced balance sheet liquidity to take advantage of a

significant period of investment opportunities

Caroline Foulger, Chair of Oakley Capital Investments Limited,

commented:

"We are pleased to report the continued performance of the

Oakley Funds and their portfolio companies, which underpinned OCI's

robust asset value in the first half of the year. In contrast to

the wider market, Oakley has remained active with a high level of

investee company M&A and a meaningful realisation, the proceeds

from which have significantly strengthened the OCI balance

sheet.

Most importantly OCI has delivered one of the sector's highest

shareholder returns over the last 12 months. The Company is well

positioned to continue this performance as we enter a period that

is anticipated to present a high level of attractive investment

opportunities for the Oakley Funds."

Peter Dubens, Managing Partner of Oakley Capital Limited,

commented:

"The perceived negative impacts of macro-economic turbulence and

intimidating new technologies like generative AI are dominating

headlines, however we see significant opportunities ahead in both

of these themes.

The threats presented by both are undoubted. But entrepreneurs

often thrive, and a partnership with Oakley is most valued, during

periods of disruption to the established order.

With our network of pioneering founders, dry powder ready to

deploy and new strategies in place such as the AI focused Oakley

Touring Venture Fund, we are well positioned to take advantage of a

rapidly changing marketplace."

The unaudited Interim Report and Accounts are available on the

Company's website at

https://www.oakleycapitalinvestments.com/investor-centre/results-and-reports/

A video overview of the 6-month performance is also available

here

https://www.oakleycapitalinvestments.com/news-and-media/videos/

The Company's Q3 2023 trading update is expected to be released

on 26 October 2023.

- ends -

Results presentation

A live presentation of the results, delivered by Oakley Capital

Partner Steven Tredget, will take place at 9:00am today, Thursday

14 September 2023 . The presentation will be available to view via

video webcast at the following link:

https://www.investis-live.com/oakley-capital/64dc97390120c60d0008b333/gdrt

For further information please contact:

Oakley Capital Limited

+44 20 7766 6900

Steven Tredget

Greenbrook Communications Limited

+44 20 7952 2000

Rob White / Michael Russell

Liberum Capital Limited (Financial Adviser & Broker)

+44 20 3100 2000

Chris Clarke / Darren Vickers / Owen Matthews

Notes:

LEI Number: 213800KW6MZUK12CQ815

(1) About Oakley Capital Investments Limited ("OCI")

OCI is a Specialist Fund Segment ("SFS") traded investment

vehicle that aims to provide shareholders with consistent long-term

capital growth in excess of the FTSE All-Share Index by providing

liquid access to private equity returns through investment in the

Oakley Funds.

A video introduction to OCI is available at

https://oakleycapitalinvestments.com/videos/

The contents of the OCI website are not incorporated into, and

do not form part of, this announcement.

(2) Oakley Capital, the Investment Adviser

Founded in 2002, Oakley Capital Limited has demonstrated the

repeated ability to source attractive growth assets at attractive

prices. To do this it relies on its sector and regional expertise,

its ability to tackle transaction complexity and its deal

generating entrepreneur network.

(3) The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity

III, Oakley Capital IV, Oakley Capital V and Oakley Capital Origin

Fund and are unlisted lower-mid to mid-market private equity funds

that aim to provide investors with significant long-term capital

appreciation. The investment strategy of the Funds is to focus on

buy-out opportunities in industries with the potential for growth,

consolidation and performance improvement. The Oakley family of

funds also includes Oakley PROfounders Fund III and Oakley Touring

Venture Fund, which are venture capital funds focused on

investments in entrepreneur-led, disruptive, technology led

companies.

Important information

Specialist Fund Segment securities are not admitted to the

Official List of the Financial Conduct Authority. Therefore, the

Company has not been required to satisfy the eligibility criteria

for admission to listing on the Official List and is not required

to comply with the Financial Conduct Authority's Listing Rules.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment.

This announcement may include "forward-looking statements".

These forward-looking statements are statements regarding the

Company's objectives, intentions, beliefs or current expectations

with respect to, amongst other things, the Company's financial

position, business strategy, results of operations, liquidity,

prospects and growth. Forward-looking statements are subject to

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. Accordingly

the Company's actual future financial results, operational

performance and achievements may differ materially from those

expressed in, or implied by, the statements. Given these

uncertainties, prospective investors are cautioned not to place any

undue reliance on such forward-looking statements, which speak only

as at the date of this announcement. The Company expressly

disclaims any obligation or undertaking to update or revise any

forward-looking statements contained herein to reflect actual

results or any change in the Company's expectations with regard to

them or any change in events, conditions or circumstances on which

any such statements are based unless required to do so by the

Financial Services and Markets Act 2000, the Listing Rules or

Prospectus Regulation Rules of the Financial Conduct Authority or

other applicable laws, regulations or rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUPCBUPWGBW

(END) Dow Jones Newswires

September 14, 2023 02:00 ET (06:00 GMT)

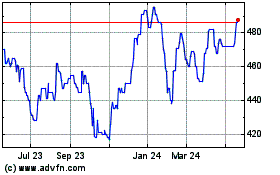

Oakley Capital Investments (AQSE:OCI.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

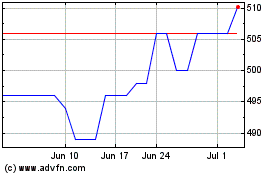

Oakley Capital Investments (AQSE:OCI.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024