TIDMNICL

RNS Number : 1678H

Nichols PLC

26 July 2023

26 July 2023

Nichols plc

2023 INTERIM RESULTS

Encouraging trading performance and strategic progress

Nichols plc ('Nichols' or the 'Group'), the diversified soft

drinks group, announces its unaudited Interim Results for the half

year ended 30 June 2023 (the 'period').

Half year Half year

ended ended Movement

30 June 2023 30 June 2022

GBPm GBPm

-------------- -------------- -----------

Group Revenue 85.5 80.2 +6.6%

-------------- -------------- -----------

Adjusted Profit Before

Tax (PBT) 1 12.3 11.3 +9.1%

-------------- -------------- -----------

Profit Before Tax (PBT) 11.2 10.1 +10.5%

-------------- -------------- -----------

Adjusted PBT Margin 1 14.4% 14.0% +0.4ppts

-------------- -------------- -----------

PBT Margin 13.0% 12.6% +0.4ppts

-------------- -------------- -----------

Statutory EBITDA 2 11.6 12.4 (6.5%)

-------------- -------------- -----------

Adjusted Earnings per Share

(basic) 1 25.70p 24.80p +3.6%

-------------- -------------- -----------

Earnings per Share (basic) 23.31p 22.22p +4.9%

-------------- -------------- -----------

Cash and Cash Equivalents 56.1 49.2 +14.2%

-------------- -------------- -----------

Free cash flow 3 5.4 (2.6) + 310.2%

-------------- -------------- -----------

Adjusted Return on capital

employed 4 25.9% 25.2% +0.7ppts

-------------- -------------- -----------

Statutory Return on capital

employed 5 14.3% (14.3%) +28.6ppts

-------------- -------------- -----------

Interim Dividend 12.6p 12.4p +1.6%

----------------------------- -------------- -------------- -----------

Strategic and operational highlights

-- Strong top line growth delivered across the business

o Focus on accelerating Packaged division in line with strategic

plan

o Continued accelerated momentum in International Packaged

geographies

-- Significant progress on implementation of Out of Home (OoH) Strategic Review

-- Impacts of inflation actively managed

Financial highlights

-- Group revenue increased by 6.6% to GBP85.5m (H1 2022: GBP80.2m)

o Packaged revenues +10.4% to GBP64.5m (H1 2022: GBP58.5m)

-- International Packaged revenues +24.6% to GBP21.5m (H1 2022:

GBP17.2m)

- Middle East revenue +17.5%

- Continued momentum in Africa leading to +26.1% growth

- ROW markets +29.8%

-- UK Packaged revenues +4.5% to GBP43.1m (H1 2022:

GBP41.3m)

- Ongoing focus on value over volume

o OoH revenues down 3.5% to GBP21.0m (H1 2022: GBP21.8m)

-- Reflects planned reduction in activity post OoH Strategic

Review

-- Gross margin % slightly lower at 41.1% (H1 2022: 42.8%)

o Absolute gross margin increased by GBP0.8m

o Cost of goods inflation recovered through price and mitigating

actions

-- Exceptional charge of GBP1.1m largely relating to the Group

Systems Review and OoH Strategic Review

-- Strong cash and cash equivalents at GBP56.1m (H1 2022:

GBP49.2m, 31 December 2022: GBP56.3m), increased interest

receipts

-- Increased interim dividend of 12.6p (H1 2022: 12.4p)

-- Confidence in 2023 Group expectations(6) which remain unchanged

Andrew Milne, Chief Executive Officer, commented:

"We are pleased with our encouraging first half performance

which again reflects the strength of the Vimto brand. Particularly

pleasing is the growth in our core Packaged business, and the

continued accelerated momentum across our international markets

with very strong performances in Africa, the Middle East and the

rest of the world.

The Group achieved significant strategic progress during the

period, particularly in relation to our Out of Home business where

we are making positive changes to simplify operations and focus on

the areas of greatest opportunity and profitability. We are

on-track to deliver the material benefits of these changes from FY

2024. Meanwhile, we remain focused on accelerating growth in

Packaged, both in the UK and internationally, in line with our

strategic plan.

We are mindful that consumer spend is still under pressure from

continuing high levels of inflation. However, the Group's track

record, strong brands and diversified business model, alongside the

resilience of the wider soft drinks market, support the Board's

confidence in the Group's long-term growth prospects, and that the

Group's Adjusted PBT(1) for FY 2023 will be in line with

expectations(6) ."

1 Excluding exceptional items

2 EBITDA is the statutory profit before tax, interest,

depreciation, and amortisation

3 Free Cash Flow is the net movement in cash and cash

equivalents before acquisition funding and dividends

4 Adjusted return on capital employed is the adjusted operating

profit divided by the average period-end capital employed

5 Statutory return on capital employed is the operating profit

divided by the average period-end capital employed

6 FY23 expectations refers to a Group compiled market consensus

of adjusted PBT GBP25.2m

Contacts

Nichols plc Telephone: 0192 522 2222

Andrew Milne, Group Chief Executive

Officer

David Taylor, Interim Chief Financial

Officer

--------------------------------------- ----------------------------------

Singer Capital Markets (NOMAD Telephone: 0207 496 3000

& Broker)

Website: www.singercm.com

Steve Pearce / Jen Boorer

----------------------------------

Hudson Sandler (Financial PR) Telephone: 0207 796 4133

Alex Brennan / Charlotte Cobb Email: nichols@hudsonsandler.com

/ Harry Griffiths

--------------------------------------- ----------------------------------

Notes to Editors:

Nichols plc is an international diversified soft drinks business

with sales in over 73 countries. The Group is home to the iconic

Vimto brand which is popular in the UK and around the world,

particularly in the Middle East and Africa. Other brands in its

portfolio include SLUSH PUPPiE, Starslush, ICEE, Levi Roots and

Sunkist.

For more information about Nichols, visit: www.nicholsplc.co.uk

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

Executive Review

Revenue

The Board is pleased to report an encouraging half year

performance with Group revenues of GBP85.5m, an increase of 6.6%

compared to the prior year (H1 2022: GBP80.2m).

The Group's Packaged route to market delivered a strong

performance across all regions with revenues increasing by 10.4% to

GBP64.5m (H1 2022: GBP58.5m).

Within this, the Group's International Packaged business

performed particularly strongly, with revenues up 24.6% and all

regions experiencing double digit growth. The significant growth

seen within Africa in previous years has continued into 2023, with

revenues up 26.1% to GBP13.1m (H1 2022: GBP10.4m), delivered

through a combination of new and existing geographies. Middle East

revenues in the period also improved, by 17.5%, with in-market

volumes performing well through Vimto's typically strong trading

period of Ramadan (+10%). The Group's rest of world markets saw

revenue growth of 29.8%, with the US and Europe continuing to

perform well, building on increased brand awareness and strong

in-market execution.

Within the UK Packaged route to market, the Group saw revenues

of GBP43.1m, 4.5% ahead of the prior year (H1 2022: GBP41.3m). The

business remains focused on its value over volume strategy in order

to protect margins.

Following the initial implementation of the previously announced

outputs of the Group's Out of Home (OoH) Strategic Review, as

expected, revenues within this segment declined by 3.5% to GBP21.0m

(H1 2022: GBP21.8m). The actions from the review will continue to

be implemented into the second half of the year, with the benefits

being realised from FY 2024.

The impact of movements in foreign exchange rates on revenue

year-on-year was immaterial, at approximately +GBP0.2m.

Gross Profit

Gross profit of GBP35.2m was GBP0.8m higher than H1 2022

(GBP34.4m) and 1.7 percentage points lower at 41.1%.

The cost of goods inflation experienced in 2022 continued into

the first half of the year, with underlying inflation at around

16%. The Group has been able to fully mitigate this by working with

its customers and suppliers across the whole of its supply chain,

identifying the optimal balance of mitigating actions and price

recovery. Excluding the impact of the input costs and the price

recovery, gross profit % was comparable with H1 2022.

The impact of movements in foreign exchange rates on gross

profit was +GBP0.2m.

Distribution Expenses

Distribution expenses within the Group are those associated with

the UK Packaged route to market, and for OoH are the distribution

costs incurred from factory to depot. Final leg distribution costs

within the OoH business are reported within Administrative

Expenses.

Distribution expenses increased by 7.7% to GBP5.0m (H1 2022:

GBP4.7m), reflecting inflationary pressures, particularly around

increased fuel prices, which were experienced in H2 2022 into H1

2023.

Administrative Expenses

Administration expenses excluding exceptional items totalled

GBP18.7m (H1 2022: GBP18.5m), an increase of GBP0.2m or 1.1%

year-on-year. Additional costs incurred in the period largely

relate to payroll and staff related costs in response to

cost-of-living pressures, alongside further investment in marketing

spend to drive brand equity within the Packaged business. These

additional expenses have been partially offset by savings across

other cost centres.

Segment Operating Profit

We have, for the first time, included an analysis of segment

profitability (see note 3) which identifies adjusted operating

profit by business route to market before central costs. Our

Packaged business has performed well, delivering an additional

GBP1.5m of profit despite substantial inflation within our supply

chain which has led to a slight fall in segment operating margin to

27.9% (H1 2022: 28.1%). OoH has also performed in line with our

strategic expectations during a period of considerable change for

the business, operating margins were lower at 6.4% (H1 2022: 7.5%).

Central costs have increased by GBP1.0m on the prior year

principally as a result of cost-of-living increases to wages and

salaries.

Exceptional Costs

The Group incurred GBP1.1m of exceptional costs during the

period (H1 2022: GBP1.2m).

Out of Home Strategic Review

In 2022 the Group completed a strategic review into its OoH

route to market, assessing customer and product mix as well as

reviewing ways to enhance net margin and profitability going

forward. T he Group incurred GBP0.6m of costs in the period as

these recommendations have begun to be implemented. Additional

costs will be incurred through the second half of 2023.

Historic incentive scheme

During 2022 the Group settled with HMRC the GBP4.3m tax and

interest charges relating to a historic incentive scheme and has

commenced recovery of debts from current and previous employees who

had indemnified the Company. The Group incurred legal costs in the

period of GBP0.1m in relation to the case.

Group Systems Review

The Group has commenced a project to implement a new enterprise

resource planning (ERP) system, focused on driving business

transformation and is expected to be operational at the end of

2024. Costs of GBP0.5m were incurred in the period.

Due to the one-off nature of these charges, the Board is

treating these items as exceptional costs and their impact has been

removed in all adjusted measures throughout this report.

Finance Costs

Net finance income of GBP0.8m (H1 2022: GBP0.1m) was

significantly up on the prior year, as the Group ensured the best

return for its deposits following the Bank of England interest rate

rises.

Profit before tax and tax rate

Adjusted profit before tax, pre-exceptional items, increased by

9.1% to GBP12.3m (H1 2022: GBP11.3m). The tax charge on adjusted

profit before tax for the period of GBP2.9m (H1 2022: GBP2.2m)

represents an effective tax rate of 23.8% (H1 2022: 19.5%). The

increase in the effective rate is consistent with published rates.

Reported profit before tax was GBP11.2m, an increase of 10.5%

compared to the prior year (H1 2022: GBP10.1m).

Balance Sheet and Cash and Cash Equivalents

The continued strength of the Group's closing balance sheet

reflects its diversified routes to market and asset light

model.

Cash and cash equivalents at the end of the period remained

strong at GBP56.1m (H1 2022: GBP49.2m, 31 December 2022:

GBP56.3m).

The Group has seen its working capital marginally increase since

the start of the year (+GBP3.2m), principally driven by debtors and

strong Q2 sales. Capital expenditure in the period was GBP0.1m (H1

2022: GBP0.9m) and was historically weighted towards our OoH

business where a re-focus on capital allocation and spend has been

actioned following the strategic review.

The Group's current Return on Capital Employed is 25.9% (H1

2022: 25.2%).

Earnings per share

Total adjusted basic EPS increased to 25.70 pence (H1 2022:

24.80p) with basic EPS at 23.31 pence (H1 2022: 22.22p). On an

adjusted basis, diluted EPS was 25.68 pence (H1 2022: 24.77p).

Dividend

In line with the Group's dividend policy, dividend cover is

broadly 2x the adjusted earnings of the Group. As a result, the

interim dividend for 2023 will be 12.6p per share, to be paid on 8

September 2023 with a record date of 4 August 2023 and an

ex-dividend date of 3 August 2023.

Pensions

The Group operates two employee benefit plans, a defined benefit

plan that provides benefits based on final salary, which is now

closed to new members, and a defined contribution group personal

plan. At 30 June 2023, the Group recognised a surplus on its UK

defined benefit scheme of GBP4.3m (31 December 2022: surplus

GBP4.1m).

Outlook

The Board is pleased with the Group's trading performance and

strategic progress in the first half of 2023. The progress in the

UK and International Packaged businesses during the first half will

support the long-term performance of the business.

We are mindful that consumer spend is still under pressure from

continuing high levels of inflation. However, the Group's track

record, strong brands and diversified business model, alongside the

resilience of the wider soft drinks market, support the Board's

confidence in the Group's long-term growth prospects, and that the

Group's Adjusted PBT(1) for FY 2023 will be in line with

expectations(2) .

Andrew Milne

Chief Executive Officer

David Taylor

Interim Chief Financial Officer

26 July 2023

1 Excluding exceptional items

2 FY23 expectations refers to a Group compiled market consensus of adjusted PBT GBP25.2m

CONSOLIDATED INCOME STATEMENT

Unaudited

Unaudited Half year Audited

Half year to Year ended

to 30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 85,546 80,232 164,926

Cost of sales (50,356) (45,880) (93,905)

---------------------------------------- ------------ ----------- -------------

Gross profit 35,190 34,352 71,021

---------------------------------------- ------------ ----------- -------------

Distribution expenses (5,009) (4,651) (10,677)

Administrative expenses (19,846) (19,667) (46,888)

---------------------------------------- ------------ ----------- -------------

Operating profit 10,335 10,034 13,456

---------------------------------------- ------------ ----------- -------------

Finance income 866 126 514

Finance expenses (48) (63) (134)

---------------------------------------- ------------ ----------- -------------

Profit before taxation 11,153 10,097 13,836

---------------------------------------- ------------ ----------- -------------

Taxation (2,649) (1,969) (2,201)

---------------------------------------- ------------ ----------- -------------

Profit for the period 8,504 8,128 11,635

---------------------------------------- ------------ ----------- -------------

Earnings per share (basic) 23.31p 22.22p 31.86p

Earnings per share (diluted) 23.29p 22.19p 31.82p

Adjusted for exceptional items

Operating profit 10,335 10,034 13,456

Exceptional items 1,144 1,173 11,146

Adjusted operating profit 11,479 11,207 24,602

Profit before taxation 11,153 10,097 13,836

Exceptional items 1,144 1,173 11,146

Adjusted profit before taxation 12,297 11,270 24,982

Adjusted earnings per share (basic) 25.70p 24.80p 55.38p

Adjusted earnings per share (diluted) 25.68p 24.77p 55.32p

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Unaudited

Unaudited Half year Audited

Half year to Year ended

to 30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Profit for the financial period 8,504 8,128 11,635

Items that will not be classified

subsequently to profit or loss:

Re-measurement of net defined

benefit liability 69 910 (2,071)

Deferred taxation on pension obligations

and employee benefits (17) (228) 459

Other comprehensive income/(expense)

for the period 52 682 (1,612)

------------------------------------------- ------------ ----------- -------------

Total comprehensive income for

the period 8,556 8,810 10,023

------------------------------------------- ------------ ----------- -------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

ASSETS GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 10,247 16,073 10,958

Intangibles 297 5,226 88

Pension surplus 4,257 6,621 4,125

-------------------------------- ---------- ---------- -------------

Total non-current assets 14,801 27,920 15,171

Current assets

Inventories 10,595 14,751 10,432

Trade and other receivables 42,001 38,548 39,561

Corporation tax receivable 986 1,017 695

Cash and cash equivalents 56,128 49,167 56,296

-------------------------------- ---------- ---------- -------------

Total current assets 109,710 103,483 106,984

-------------------------------- ---------- ---------- -------------

Total assets 124,511 131,403 122,155

-------------------------------- ---------- ---------- -------------

LIABILITIES

Current liabilities

Trade and other payables 29,533 30,193 30,711

Provisions - 4,242 -

------------------------------- ---------- ---------- -------------

Total current liabilities 29,533 34,435 30,711

Non-current liabilities

Other payables 2,378 1,953 2,038

Deferred tax liabilities 687 3,307 670

-------------------------------- ---------- ---------- -------------

Total non-current liabilities 3,065 5,260 2,708

-------------------------------- ---------- ---------- -------------

Total liabilities 32,598 39,695 33,419

-------------------------------- ---------- ---------- -------------

Net assets 91,913 91,708 88,736

-------------------------------- ---------- ---------- -------------

EQUITY

Share capital 3,697 3,697 3,697

Share premium reserve 3,255 3,255 3,255

Capital redemption reserve 1,209 1,209 1,209

Other reserves 1,481 943 1,280

Retained earnings 82,271 82,604 79,295

-------------------------------- ---------- ---------- -------------

Total equity 91,913 91,708 88,736

-------------------------------- ---------- ---------- -------------

CONSOLIDATED STATEMENT OF CASH FLOWS

Unaudited

Half year Unaudited Audited

to Half year to Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Profit for the financial

period 8,504 8,128 11,635

Adjustments for:

Depreciation and amortisation 1,193 2,318 4,521

Impairment losses on intangible

and fixed assets - - 8,714

Loss on sale of property,

plant and equipment 74 61 186

Finance income (866) (126) (514)

Finance expense 48 63 134

Tax expense recognised in

the income statement 2,649 1,969 2,201

Increase in inventories (163) (5,045) (726)

Increase in trade and other

receivables (2,096) (2,939) (4,100)

(Decrease)/increase in trade

and other payables (928) 2,110 2,963

Decrease in provisions - - (4,242)

Change in pension obligations (63) (435) (920)

Fair value (gain)/loss on

derivative financial instruments (344) 515 662

------------------------------------- -------- -------- -------- --------- -------- ---------

(496) (1,509) 8,879

Cash generated from operating

activities 8,008 6,619 20,514

Tax paid (2,939) (2,319) (4,178)

------------------------------------- -------- -------- -------- --------- -------- ---------

Net cash generated from

operating activities 5,069 4,300 16,336

Cash flows from investing

activities

Finance income 866 126 514

Acquisition of property,

plant and equipment (138) (913) (1,245)

Payment of contingent consideration

(note 8) - (71) (71)

------------------------------------- -------- -------- -------- --------- -------- ---------

Net cash from/(used in)

investing activities 728 (858) (802)

Cash flows from financing

activities

Payment of lease liabilities (385) (554) (995)

Purchase of own shares - (5,534) (5,534)

Dividends paid (5,580) (4,861) (9,383)

------------------------------------- -------- -------- -------- --------- -------- ---------

Net cash used in financing

activities (5,965) (10,949) (15,912)

Net decrease in cash and

cash equivalents (168) (7,507) (378)

Cash and cash equivalents

at start of period 56,296 56,674 56,674

------------------------------------- -------- -------- -------- --------- -------- ---------

Cash and cash equivalents

at end of period 56,128 49,167 56,296

------------------------------------- -------- -------- -------- --------- -------- ---------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Called Share Capital Other Retained Total

up share premium redemption reserves earnings equity

capital reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2022 3,697 3,255 1,209 676 84,189 93,026

Dividends - - - - (4,861) (4,861)

Movement in ESOT - - - (2) - (2)

Credit to equity for

equity-settled share-based

payments - - - 269 - 269

Purchase of own shares - - - - (5,534) (5,534)

Transactions with

owners - - - 267 (10,395) (10,128)

----------------------------- ---------- --------- ------------ ---------- ---------- ---------

Profit for the period - - - - 8,128 8,128

Other comprehensive

income - - - - 682 682

----------------------------- ---------- --------- ------------ ---------- ---------- ---------

Total comprehensive

income - - - - 8,810 8,810

----------------------------- ---------- --------- ------------ ---------- ---------- ---------

At 30 June 2022 3,697 3,255 1,209 943 82,604 91,708

----------------------------- ---------- --------- ------------ ---------- ---------- ---------

Called Share Capital Other Retained Total

up share premium redemption reserves earnings equity

capital reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2023 3,697 3,255 1,209 1,280 79,295 88,736

Dividends - - - - (5,580) (5,580)

Movement in ESOT - - - (2) - (2)

Credit to equity for

equity-settled share-based

payments - - - 203 - 203

Transactions with

owners - - - 201 (5,580) (5,379)

----------------------------- ---------- --------- ------------ ---------- ---------- ---------

Profit for the period - - - - 8,504 8,504

Other comprehensive

income - - - - 52 52

----------------------------- ---------- --------- ------------ ---------- ---------- ---------

Total comprehensive

income - - - - 8,556 8,556

----------------------------- ---------- --------- ------------ ---------- ---------- ---------

At 30 June 2023 3,697 3,255 1,209 1,481 82,271 91,913

----------------------------- ---------- --------- ------------ ---------- ---------- ---------

NOTES

1. Basis of Preparation

The financial information set out in this Interim Report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 31 December 2022, prepared in accordance with

International Accounting Standards in conformity with the

requirements of the Companies Act 2006 have been filed with the

Registrar of Companies. The Auditor's Report on those financial

statements was unqualified and did not contain a statement under

Section 498 (2) or (3) of the Companies Act 2006.

These condensed consolidated interim financial statements for

the half year reporting period ended 30 June 2023 have been

prepared in accordance with IAS 34 Interim financial reporting and

also in accordance with the measurement and recognition principles

of UK adopted international accounting standards. The Interim

Report has not been audited or reviewed in accordance with the

International Standard on Review Engagement 2410 issued by the

Auditing Practices Board.

The interim financial statements were authorised for issue by

the Board of Directors on 26 July 2023.

2. Going Concern

In assessing the appropriateness of adopting the going concern

basis in preparing the Interim Report and financial statements, the

Directors have considered the current financial position of the

Group, its principal risks and uncertainties. The review performed

considers severe but plausible downside scenarios that could

reasonably arise within the period.

Our modelling has sensitised the impacts of Russia's continued

invasion of Ukraine, in particular their impact on global supply

chains and macroeconomic inflationary factors. Alternative

scenarios, including the potential impact of key principal risks

from a financial and operational perspective, have been modelled

with the resulting implications considered. In all cases, the

business model remained robust. The Group's diversified business

model and strong balance sheet provide resilience against these

factors and the other principal risks that the Group is exposed to.

At the 30 June 2023 the Group had cash and cash equivalents of

GBP56.1m with no external bank borrowings.

On the basis of these reviews, the Directors consider the Group

has adequate resources to continue in operational existence for the

foreseeable future (being at least one year following the date of

approval of this Interim Report and financial statements) and,

accordingly, consider it appropriate to adopt the going concern

basis in preparing the financial statements.

3. Segmental Reporting

The Board, as the entity's chief operating decision maker,

analyses the Group's internal reports to enable an assessment of

performance and allocation of resources. The operating segments are

based on these reports.

During the year, the Group changed its reportable segments to

ensure the appropriate strategic focus across the business given

the differing strategic challenges between its Packaged and Out of

Home routes to market. The Group is now segmented into the

operating segments Packaged, Out of Home and Central. This replaces

the operating segments, Stills and Carbonates used in previous

reporting periods.

The new segmental reporting allows the Group to deliver on its

strategic ambitions of accelerated growth across the Packaged

business, both in the UK and Internationally, and maximise value

within the Out of Home business, whilst providing oversight to

manage central overheads from a total Group perspective.

This is the first time results have been presented in these

segments within the Group's Interim financial statements and thus

the results reported for the previous half year to 30 June 2022 and

financial year to 31 December 2022 have also been re-presented for

comparison purposes.

The accounting policies of the reportable segments are the same

as the Group's accounting policies. Segment performance is

evaluated based on adjusted operating profit (excluding exceptional

items), finance income and exceptional items. This is the measure

reported to the Board for the purpose of resource allocation and

assessment of segment performance.

Half year to Packaged

----------------------------------------------------

30 June 2023 UK Middle Africa Rest Total Out Total Central(1) Total

East of World Packaged of Home Segments Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 43,097 4,905 13,081 3,466 64,549 20,997 85,546 - 85,546

------------------ -------- -------- -------- ---------- ---------- --------- ---------- ----------- --------

Adjusted

operating

profit 17,988 1,352 19,340 (7,861) 11,479

Net finance

income 818

Adjusted profit

before tax 12,297

Exceptional items (1,144)

------------------ -------- -------- -------- ---------- ---------- --------- ---------- ----------- --------

Profit before

tax 11,153

------------------ -------- -------- -------- ---------- ---------- --------- ---------- ----------- --------

Half year to Packaged

----------------------------------------------------

30 June 2022 UK Middle Africa Rest Total Out Total Central(1) Total

East of World Packaged of Home Segments Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 41,258 4,176 10,372 2,670 58,476 21,756 80,232 - 80,232

------------------ -------- -------- -------- ---------- ---------- --------- ---------- ----------- --------

Adjusted

operating

profit 16,453 1,621 18,074 (6,867) 11,207

Net finance

income 63

Adjusted profit

before tax 11,270

Exceptional items (1,173)

------------------ -------- -------- -------- ---------- ---------- --------- ---------- ----------- --------

Profit before

tax 10,097

------------------ -------- -------- -------- ---------- ---------- --------- ---------- ----------- --------

Year ended Packaged

----------------------------------------------------

31 December 2022 UK Middle Africa Rest Total Out Total Central(1) Total

East of World Packaged of Home Segments Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 82,813 11,752 18,870 6,420 119,855 45,071 164,926 - 164,926

----------------- -------- -------- -------- ---------- ---------- --------- ---------- ----------- ---------

Adjusted

operating

profit 34,338 3,537 37,875 (13,273) 24,602

Net finance

income 380

Adjusted profit

before tax 24,982

Exceptional

items (11,146)

----------------- -------- -------- -------- ---------- ---------- --------- ---------- ----------- ---------

Profit before

tax 13,836

----------------- -------- -------- -------- ---------- ---------- --------- ---------- ----------- ---------

(1) Central includes the Group's central and corporate costs,

which relate to salaries and head office overheads such as rent and

rates, insurance and IT maintenance as well as the costs associated

with the Board and Executive Leadership Team, Governance and Listed

Company costs.

A geographical split of revenue is provided below:

Half year Half year Year ended

to to 31 December

30 June 30 June 2022

2023 2022

GBP'000 GBP'000 GBP'000

Geographical split of revenue

Middle East 4,905 4,176 11,752

Africa 13,081 10,372 18,870

Rest of the World 3,301 3,059 7,350

----------- ----------- --------------

Total exports 21,287 17,607 37,972

United Kingdom 64,259 62,625 126,954

----------- ----------- --------------

Total revenue 85,546 80,232 164,926

----------- ----------- --------------

4. Exceptional items

Half year Half year Year ended

to to 31 December

30 June 30 June 2022

2023 2022

GBP'000 GBP'000 GBP'000

Out of Home Strategic Review 569 48 518

Historic incentive scheme 56 54 134

Group Systems Review 519 - 316

Review of UK packaged supply chain - 1,071 1,464

Impairment of intangibles and fixed

assets - - 8,714

1,144 1,173 11,146

----------- ----------- -------------

The Group incurred GBP1.1m of exceptional costs during the

period (H1 2022: GBP1.2m).

Out of Home Strategic Review

In 2022 the Group completed a strategic review into its OoH

route to market, assessing customer and product mix as well as

reviewing ways to enhance net margin and profitability going

forward. T he Group incurred GBP0.6m of costs in the period as

these recommendations have begun to be implemented. Additional

costs will be incurred through the second half of 2023.

Historic incentive scheme

During 2022 the Group settled with HMRC the GBP4.3m tax and

interest charges relating to a historic incentive scheme and has

commenced recovery of debts from current and previous employees who

had indemnified the Company. The Group incurred legal costs in the

period of GBP0.1m in relation to the case.

Group Systems Review

The Group has commenced a project to implement a new enterprise

resource planning (ERP) system, focussed on driving business

transformation and is expected to be operational at the end of

2024. Costs of GBP0.5m were incurred in the period.

Due to the one-off nature of these charges, the Board is

treating these items as exceptional costs and their impact has been

removed in all adjusted measures throughout this report.

5. Earnings per share

Basic earnings per share is calculated by dividing the profit

after tax for the period of the Group by the weighted average

number of ordinary shares in issue during the period. The weighted

average number of ordinary shares is calculated by adjusting the

shares in issue at the beginning of the period by the number of

shares bought back or issued during the period multiplied by a

time-weighting factor. Diluted earnings per share is calculated by

adjusting the weighted average number of ordinary shares in issue

assuming the conversion of all potentially dilutive ordinary

shares.

The earnings per share calculations for the period are set out

in the table below:

Weighted average

Earnings number of shares Earnings per

share

GBP'000

30 June 2023

Basic earnings per share 8,504 36,478,934 23.31p

Dilutive effect of share options 38,891

Diluted earnings per share 8,504 36,517,825 23.29p

Adjusted earnings per share before exceptional items has been

presented in addition to the earnings per share as defined in IAS

33 Earnings per share, since in the opinion of the Directors, this

provides shareholders with a more meaningful representation of the

earnings derived from the Group's operations. It can be reconciled

from the basic earnings per share as follows:

Weighted average

Earnings number of shares Earnings per

share

GBP'000

30 June 2023

Basic earnings per share 8,504 36,478,934 23.31p

Exceptional items after taxation 872

Adjusted basic earnings per

share 9,376 36,478,934 25.70p

Diluted effect of share options 38,891

Adjusted diluted earnings per

share 9,376 36,517,825 25.68p

6. Non-current Assets

Property,

Plant

& Equipment Intangibles

GBP'000 GBP'000

Cost

At 1 January 2023 35,311 9,760

Additions 765 -

Transfers (238) 238

Disposals (1,626) -

At 30 June 2023 34,212 9,998

------------- --------------

Depreciation and Amortisation

At 1 January 2023 24,353 9,672

Charge for the period 1,164 29

On disposals (1,552) -

At 30 June 2023 23,965 9,701

-------- ------

Net book value

At 1 January 2023 10,958 88

At 30 June 2023 10,247 297

------- ----

7. Defined Benefit Pension Scheme

The Group operates a defined benefit plan in the UK. A full

actuarial valuation was carried out on 5 April 2020 and updated

at

30 June 2023 by an independent qualified actuary.

A summary of the pension surplus position is provided below:

Pension surplus GBP'000

At 1 January 2023 4,125

Current service cost (44)

Net interest income 96

Actuarial gains 69

Contributions by employer 11

At 30 June 2023 4,257

--------

8. Contingent Consideration

Within the Statement of Cash Flows there is a GBP0.1m cash

outflow in the prior period in relation to the payment of

contingent consideration. This payment relates to the final stage

of contingent consideration paid for an acquisition made in

previous financial years.

9. Provisions

During the second half of FY22, the Group settled with HMRC the

tax and interest charges regarding the historic incentive scheme

provided at 30 June 2022 (GBP4.2m). Recovery of debts from current

and previous management who had indemnified the Company has

commenced during FY23. Included within other receivables is a

reimbursement asset in respect of these historic contracts.

10. Dividends

Dividend cover is broadly 2x adjusted earnings of the Group. As

a result, the interim dividend for 2023 will be 12.6p per share to

be paid on 8 September 2023 with a record date of 4 August

2023.

Cautionary Statement

This Interim Report has been prepared solely to provide

additional information to shareholders to assess the Group's

strategies and the potential for those strategies to succeed. The

Interim Report should not be relied on by any other party or for

any other purpose.

-Ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UVVNROAUBUAR

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

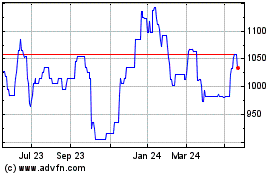

Nichols (AQSE:NICL.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

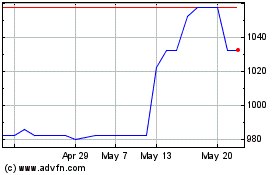

Nichols (AQSE:NICL.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024