TIDMMPO

RNS Number : 7634Q

Macau Property Opportunities Fund

23 February 2023

23 February 2023

Macau Property Opportunities Fund Limited

("MPO" or "the Company")

Interim results for the six-month period ended 31 December

2022

Macau Property Opportunities Fund Limited announces its results

for the period ended 31 December 2022. The Company, which is

managed by Sniper Capital Limited, holds strategic property

investments in Macau.

FINANCIAL HIGHLIGHTS

Fund performance

-- MPO's portfolio value (1) was US$224.9 million as at 31

December 2022, an increase of 1.4% over the six-month period.

-- Adjusted Net Asset Value (NAV) was US$99.5million, which

translates to US$1.61 (133 pence (2) ) per share, a decline of 3.8%

over the period.

-- IFRS NAV was US$73.6 million as at the period end, equating

to US$1.19 (98 pence (2) ) per share, a drop of 5.1%.

Capital management

-- The aggregated cash and deposit balances were US$2.3 million,

of which US$1.9 million was pledged as collateral for credit

facilities.

-- Gross borrowings stood at US$117.2 million, equating to a loan-to-value ratio of 51.6%.

-- Debt repayment of US$14 million was achieved during the period.

Extension of Company life

-- At the Company's Annual General Meeting in December,

shareholders agreed to a further extension of the Company's life

until 31 December 2023.

([1]) Calculation was adjusted to reflect like-for-like

comparisons to 31 December 2022 due to the divestment of properties

during the period.

([2]) Based on the US Dollar/Sterling exchange rate of 1.210 on

31 December 2022.

PORTFOLIO HIGHLIGHTS

-- The Waterside

- Challenging market conditions hindered the Company's strata

sales programme, with the sale of only one unit completed during

the six month period.

- Since the period end, MPO has entered into contracts for the

sale of six further units for a combined consideration of US$14.6

million. This brings the total units sold to date in The Waterside

to eleven.

- Two of these six latest transactions have now completed in

full and security deposits have been received for the remaining

four properties, with completions due over the next three

months.

- As of the end of 2022, around 32% of The Waterside's

apartments were occupied and the average rent stood at US$2.2 per

square foot per month. The occupancy rate has subsequently risen to

37% as of the date of this release.

-- The Fountainside

- No further sales were secured during the period. The Manager

is maintaining a flexible marketing strategy for The Fountainside's

four villas, targeting both individual unit and en bloc sales.

- Reconfiguration of the two duplex units to create three

smaller apartments and two car parks has been completed with

government inspections conducted in January 2023. Government

approval is expected in Q2 2023.

-- Penha Heights

- Marketing this trophy home has been challenging as in-person

viewings were made difficult by travel restrictions until the new

year.

- Ongoing viewings are taking place and the manager will

continue to work with specialist agents to explore all possible

channels for an optimal exit from the asset.

Mark Huntley, Chairman of Macau Property Opportunities Fund,

said:

"Throughout the period, our divestment process continued against

a very difficult backdrop, with a consistent focus on marketing

more units at The Waterside. We have maintained a pragmatic,

measured approach to market conditions, balancing our need for debt

reduction and working capital with the market's emerging upside

potential.

"The dramatic effects of the easing of COVID-related

restrictions can only benefit the outlook for Macau, leading to a

more supportive environment for the Company as it pursues its

divestment strategy."

For more information, please visit www.mpofund.com for the

Company's full Interim Report 2023.

The Manager will be available to speak to analysts and the

media. If you would like to arrange a call, please contact Sniper

Capital Limited at info@snipercapital.com .

- End -

About Macau Property Opportunities Fund

Premium listed on the London Stock Exchange, Macau Property

Opportunities Fund Limited is a closed-end investment company

registered in Guernsey and is the only quoted property fund

dedicated to investing in Macau, the world's leading gaming market

and the only city in China where gaming is legalised.

Launched in 2006, the Company targets strategic property

investment and development opportunities in Macau. Its current

portfolio comprises prime residential property assets.

The Company is managed by Sniper Capital Limited , an Asia-based

property investment manager with an established track record in

fund management and investment advisory.

Stock Code

London Stock Exchange: MPO

LEI

213800NOAO11OWIMLR72

For further information:

Manager

Sniper Capital Limited

Group Communications

Tel: +853 2870 5151

Email: info@snipercapital.com

Corporate Broker

Liberum Capital

Darren Vickers / Owen Matthews

Tel: +44 20 3100 2234

Company Secretary & Administrator

Ocorian Administration (Guernsey) Limited

Kevin Smith

Tel: +44 14 8174 2742

MACAU PROPERTY OPPORTUNITIES FUND LIMITED

INTERIM REPORT FOR THE SIX-MONTH PERIODED 31 DECEMBER 2022

CHAIRMAN'S MESSAGE

I present my report for the first six months of our current

financial year and the second half of the calendar year 2022.

The period ended with an unexpected and broadly welcome

development: the removal of all travel restrictions to Macau and

within the region following a decision by Chinese authorities to

end their dynamic-zero approach to COVID control.

This rapid change of circumstances had not been foreseen.

Indeed, Macau was still slowly recovering from the effects of a

major COVID outbreak in July that prompted citywide lockdowns and

multiple rounds of mass-testing. Although the lifting of COVID

control measures resulted in an "exit wave" of COVID infections

across the territory, which affected the Company's operations, it

has ultimately led to several very positive developments.

The border with mainland China - Macau's primary source of

tourists - has fully reopened, daily ferry services to Hong Kong

have recommenced, travel on the Hong Kong-Zhuhai-Macau Bridge has

resumed and quarantine-free entry to the territory has been

restored for visitors from foreign countries. Macau's gaming

revenues have reflected this surge in visitors, notably Hong Kong

residents who had been prevented from travelling freely to the

territory.

In contrast to the difficult situation that persisted for much

of the period, this dramatic and much-hoped-for change will enable

us to make renewed progress on our divestment strategy. However,

these changes occurred so recently that a solid timeframe for

divestment is difficult to anticipate.

Conditions in Macau were challenging in the lead-up to these

changes, with low visitor numbers and a poor economic performance

in gaming and other tourism-related revenues that saw the economy

depressed further by travel restrictions and a lockdown in the

third quarter. This had a huge impact on confidence, and the

ongoing difficulties involved in visiting the territory hampered

efforts to achieve divestment of our property portfolio.

In the high-end property segment, to which we are exposed,

transaction volumes remained low. Just one unit at The Waterside

was sold during the period, in addition to four previously reported

sales. These disposals came amid the continuing negative effect of

COVID restrictions and property market anti-speculation measures

that affected both sentiment and pricing. It will be interesting to

see whether recent events spark a rekindling of investor interest

and an end to the "wait and see" approach that has become

established in the market.

The recent marked rebound in visitor numbers, gross gaming

revenue and the hospitality trade, which has included a significant

increase in hotel occupancy, are all encouraging. However, any

sense of optimism must be tempered by an awareness that the route

out of any prolonged lockdown has been shown in other jurisdictions

to be painful both socially and economically.

Throughout the period, our divestment process continued against

this difficult backdrop, with a consistent focus on marketing more

units at The Waterside. We have maintained a pragmatic, measured

approach to market conditions, balancing our need for debt

reduction and working capital with the market's emerging upside

potential.

It is pleasing to report that since the calendar year-end, the

improved market sentiment has allowed the Manager to accelerate the

strata sales programme at The Waterside, with the divestment of a

further six apartments. Of these, two transactions have completed

in full and security deposits have been received for the remaining

four properties, with completions due over the next three months.

This will bring the total number of units sold to 11, which

represents 19% of The Waterside's gross floor area.

Careful management of sales has ensured ongoing upside potential

for the remaining units in terms of both valuations and investor

interest, driven in part by the units' size, layouts and floor

height. Most sales have been on the mid- and lower levels of the

tower, leaving the more valuable higher floor apartments available

and the Company well placed to benefit from any market upswing and

price strengthening. It is important to note, however, that a

recovery in economic conditions may take time to percolate through

to our segment of the property market.

Occupancy at The Waterside had improved to a level of 32% at the

end of the period, and some long-term tenants may also have an

interest in purchasing units.

There have been delays to approvals for the reconfigured units

at The Fountainside, partly due to the impact of Macau's COVID exit

wave. A long-awaited inspection has now been completed, but

pre-sale initiatives will commence only once the final permits are

successfully confirmed. The Fountainside's larger villas remain an

ongoing sales focus, but the likely improvement in the economy will

need to prove robust to deliver satisfactory divestments.

For Penha Heights , the restored ability of overseas buyers to

visit Macau improves the prospects of divestment, but further lead

time will be required.

Financial Performance

As at 31 December 2022, the Company's unaudited adjusted net

Asset Value (NAV) was US$99.5 million. This is equivalent to

US$1.61 (133 pence*) per share and represents a decline of 3.8%

over the period.

* Based on the following US Dollar/Sterling exchange rates 1.210

on 31 December 2022 and 1.212 on 30 June 2022.

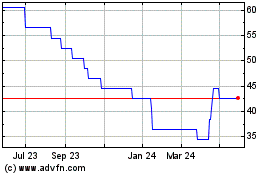

MPO's share price recovered by 37% since 30 June 2022 to 52.25

pence at the end of 2022, which represents a 61% discount to its

adjusted NAV per share.

Cash management and debt reduction remain a key priority of the

Company, with rising interest rates increasing what was already our

largest expense. As more fully explained in Note 6 of the financial

statements, the Company repaid US$14 million of bank loans during

the period. This reduced gross borrowings to US$117.2 million and

lowered the overall loan-to-value ratio from 53.3% to 51.6% as at

31 December 2022. This is estimated to fall further to 50.2%

following the completion of the Company's latest six

divestments.

The Company's consolidated cash balance, including deposits

pledged for banking facilities, was US$2.3 million, of which US$1.9

million represented a 6 month interest reserve, pledged and

classified as a non-current asset. The majority of the balance of

US$0.4 million represents deposits on contracted sales and usage of

which remains subject to the prior consent of the lender.

MPO's free cash situation has improved since the period end as a

result of further sales which will generate incremental cash

proceeds of US$14.6m.

Outcome of Annual General Meeting

At our Annual General Meeting (AGM) in December, shareholders

approved an extension to the life of the Company for a further year

until 31 December 2023. The Board and the Manager greatly

appreciate the overwhelming support shown for allowing the Company

to continue with the orderly liquidation of its remaining

assets.

As a consequence of the approval, and as prefaced in the update

that accompanied the notice of the AGM, the management agreement

between the Company and Sniper Capital has been extended for a

further year on terms similar to those that applied in 2022. In all

respects the fees remain consistent with the arrangements of the

previous year, and aim to contribute towards the Manager's

operating costs. This is an essential step in terms of accelerating

the pace of our divestment programme after an exceedingly

challenging 2022.

Corporate Governance

The Board continued to function well during the period, with

increased interaction required between scheduled board meetings to

ensure oversight and control of the sales process and ongoing

management of our loan facilities. We remained vigilant in respect

of our environmental, social and governance through this difficult

period, and it remains an important component of the many

challenges we must work through in the current circumstances.

Outlook

In presenting this report, it is difficult to avoid

communicating anything but a more optimistic view for the second

half of our financial year.

While inflationary pressures, including labour and other

shortages, are already mounting - albeit from a muted level when

compared to other jurisdictions - the dramatic effects of the

easing of COVID-related restrictions can only benefit the outlook

for Macau, leading to a more supportive environment for the

Company. Maintaining caution seems sensible in the circumstances,

but amid further sales and an improved operating environment,

writing this report has been a much more encouraging experience

than in recent years.

As stated, we will continue to do all that is practically

possible to achieve further sales and to reduce debt levels related

to our assets. This will lower our operating costs as we work

towards delivering the upside potential we see in our remaining

properties.

MARK HUNTLEY

CHAIRMAN

MACAU PROPERTY OPPORTUNITIES FUND LIMITED

22 February 2023

MANAGER'S REPORT

FINANCIAL OVERVIEW

31 December 30 June

2022 2022

NAV (IFRS) (US$ million) 73.6 77.6

NAV per share (IFRS) (US$) 1.19 1.25

Adjusted NAV (US$ million) 99.5 103.4

Adjusted NAV per share (US$) 1.61 1.67

Adjusted NAV per share (pence)(1) 133 138

Share price (pence) 52.25 38.2

Share price discount to Adjusted

NAV per share (%) 60.7% 72.3%

Portfolio valuation (US$

million) 224.9 242.0

Loan-to-value ratio (%) 51.6% 53. 3 %

1 Based on the following US Dollar/Sterling exchange rates 1.210

on 31 December 2022 and 1.212 on 30 June 2022.

Financial Review

Macau's economy came under severe pressure in the second half of

2022 as the territory waged a dynamic zero-COVID war against the

highly transmissible Omicron variant of the virus. A large-scale

summer outbreak - the first since the start of the pandemic -

brought the city to a standstill as almost all non-essential

activity, including gaming, was shut down.

Macau's twin economic engines - gaming and tourism - bore the

brunt of these measures as potential visitors were deterred by

travel restrictions and the fear of being unexpectedly locked down.

The already weak property sector suffered further headwinds as the

territory recorded one of the worst periods of economic turbulence

in its history.

Under these challenging conditions, the Company's strata sales

programme at The Waterside made slow progress in the second half of

2022, with the sale of only one unit in addition to the four

already reported, while marketing efforts for The Fountainside and

Penha Heights remained hampered by fragile sentiment and restricted

access to Macau for most of the period.

However, in tandem with mainland China, Macau dramatically and

swiftly announced a complete reversal of its almost three-year-long

zero-COVID strategy in December. The rapid and complete reopening

led to an immediate increase in enquiries into real estate in the

territory, resulting in the agreed sale post the period end, of a

further six units at The Waterside for a combined USD14.6m. While

encouraging, achieving further near-term asset disposals will

remain heavily dependent on a sustained rebound in Macau's

vulnerable, tourism-dependent, economy.

Half-year financial results

The value of MPO's portfolio, which comprises three main assets,

was US$224.9 million as at 31 December 2022. On a like-for-like

comparison, taking account of disposals, the valuation has

increased by 1.4% over the six-month period.

Adjusted Net Asset Value (NAV) was US$99.5million, which

translates to US$1.61(133 pence) per share, a drop of 3.8% over the

period. IFRS NAV was US$73.6 million as of the period's end,

equating to US$1.19 (98 pence) per share, a decline of 5.1%. The

cost of debt servicing was a primary factor behind the decline.

As at 31 December 2022, MPO's share price was 52.25 pence,

representing a 60.7% discount to its Adjusted NAV per share.

Capital management

As at 31 December 2022, MPO had total assets worth US$201.4

million, offsetting combined liabilities of US$127.7 million. The

Company's consolidated cash balance was US$2.3 million, of which

US$1.9 million was pledged as collateral for credit facilities.

Gross borrowing stood at US$117.2 million, equating to a

loan-to-value (LTV) ratio of 51.6 %

Subsequent to the period end, the Company secured sales of six

units located at The Waterside which generated US$14.6 million in

total sales proceeds. Approximately US$11 million of this amount

(75%) has been designated for loan repayments as per the terms of

the facility agreement; and will fully cover the two upcoming

repayment tranches on 19 March and 19 June 2023.

The above-mentioned loan repayments will result in the Company's

total bank borrowings falling to US$106.3 million, leading to an

improved LTV of 50.2%.

As the Company endeavours to advance its divestment plan, we

will remain focused on cash and capital management to strengthen

the balance sheet and operating cash flow. We remain concentrated

on containing costs, with debt facilities reviewed and refinanced

where appropriate to obtain the most cost-efficient terms.

Company life extended and management fees extended

Macau pursued a zero-COVID strategy throughout most of 2022, and

the ensuing lockdowns and travel restrictions severely constrained

the Manager's efforts to divest the portfolio properties. A

shareholder resolution was therefore proposed, and subsequently

passed, at the Company's Annual General Meeting in December to

further extend the life of the Company for a year to facilitate the

orderly divestment of the portfolio. The Company thanks all

Shareholders for their continued support in this regard.

In connection to the extension of the Company's life, the Board

and the Manager have also agreed to extend the management and other

fees payable to the Manager. Full details are set out in Note

10.

Portfolio Updates

PORTFOLIO OVERVIEW AS AT 31 DECEMBER 2022

Sector No. of Units Costs Market Changes Composition

(US$ million) Valuation in Market (Based on

(US$ million) Value market value)

Since 30

June 2022

The Waterside

Tower Six of

One

Central Luxury

Residences* residential 54 91.4 164.1 1.7%** 73.0%

The Low-density

Fountainside** residential 7 6.3 18.4 0.5% 8.2%

Luxury

Penha Heights residential - 28.5 42.4 0.4% 18.8%

Total 126.2 224.9 1.4%** 100%

* One Central is a trademark registered in Macau SAR under the

name of Basecity Investments Limited. Sniper Capital Limited, Macau

Property Opportunities Fund Limited, MPOF Macau (Site 5) Limited,

Bela Vista Property Services Limited and The Waterside are not

associated with Basecity Investments Limited, Shun Tak Holdings

Limited or Hongkong Land Holdings Limited.

** Calculation is based on adjusted figures made to 30 June 2022

to reflect like-for-like comparisons to 31 December 2022 due to

property sales during the period.

T hroughout most of the second half of 2022, the divestment of

the portfolio remained severely hindered by Macau's pursuit of its

zero-COVID policy.

Although the Company adjusted its strategy to capture pockets of

investor interest, market sentiment and restricted access to Macau

saw the sale of only one additional unit at The Waterside during

the period. The Manager was unable to progress beyond enquiries

relating to the other two portfolio properties as investor appetite

for in-person viewings diminished while travel restrictions

remained in place.

Post the end of 2022, however, as zero-COVID was abandoned and

Macau opened up, the Manager took advantage of an rise in enquiries

to negotiate USD14.6 million of incremental sales at The

Waterside.

The Waterside

T he Waterside is the Company's landmark asset in downtown

Macau, now comprising 48 of an original 59 luxury residential

apartments available for lease and sale.

Following the agreed sale of four units in the Company's first

strata sales campaign in the first half, conditions in the second

half proved extremely challenging, and despite attractive pricing,

only one additional apartment was sold. This situation reversed

rapidly at the end of the year as zero-COVID ended and investor

interest in luxury properties showed early signs of reviving.

MPO secured the sale of six units subsequent to the Company's

period end. The total consideration of the six units was US$14.6

million - an overall average discount of 10% to their end-2022

valuations. Two of these sales have now completed in full

generating gross proceeds of US$5.0 million, with the remaining

four due to complete over the next several months. Upon completion

of the six sales, the Company will utilise approximately US$11

million (75%) of the proceeds for loan repayments, with the balance

earmarked for working capital.

As of the end of 2022, 32% of the Company's units were leased at

an average rent of US$2.18 per square foot per month.

The Fountainside

T he Fountainside is a low-density, freehold residential

development originally comprising 42 homes and 30 car-parking

spaces in Macau's popular Penha Hill district. Three smaller units

created by reconfiguring two duplexes have been awaiting final

government approval, which is now expected in Q2 2023, before the

sales process can begin. Several price enquiries from existing

Fountainside residents have already been received.

The Company is maintaining a flexible sales approach for The

Fountainside's four villas, and will entertain both individual and

en bloc offers.

Penha Heights

P enha Heights is a prestigious, colonial-style villa with a

gross floor area of approximately 12,000 square feet, located in

the exclusive residential enclave of Penha Hill and surrounded by

lush greenery.

Marketing this trophy home has been challenging as in-person

viewings were made difficult by travel restrictions until the new

year. With the lifting of restrictions, we expect to facilitate a

larger number of viewings by Hong Kong and overseas investors.

MACROECONOMIC OUTLOOK

Macau's economy took a severe hit in the second half of 2022 due

to ongoing zero-COVID measures in the territory and across mainland

China. With the flow of mainland Chinese tourists largely halted by

lockdowns and travel restrictions, Macau's economic engines of

gaming and tourism, were operating far below their pre-pandemic

levels.

Recognising the economic impact of containing COVID, Macau's

government had begun rolling back travel restrictions during the

second half, albeit cautiously, while working with the mainland

Chinese government to restore pre-pandemic easing of travel to the

territory. In December, following mainland China's lead in

reversing zero-COVID policies, Macau moved at lightning speed to

remove zero-COVID measures, and by 8 January 2023 had largely

discarded measures that had previously restricted travel to the

territory.

Zero-COVID: A pendulum swing

Two major COVID outbreaks bookended the second half in Macau,

but the ways in which the outbreaks were managed contrasted

starkly. In July, with approximately 2,000 reported cases, dynamic

zero-COVID measures saw Macau almost locked down, multiple rounds

of city-wide mass testing conducted, and schools and non-essential

businesses closed - including casinos, which shut for 12 days. In

December, with zero-COVID abandoned, despite rapid, widespread

community transmission, Macau dismantled its mass-testing sites and

pressed ahead with reopening its borders.

Between the two outbreaks, cautious steps were taken from

November onwards to enable overseas visitors to travel more easily

to Macau, including the reduction and finally lifting of the hugely

prohibitive hotel quarantine period. The restoration of the

Individual Visit Scheme and e-Visas for mainland Chinese visitors

in November was also a key boost to Macau's economy.

These tentative steps were followed by an abrupt about-turn in

the management of COVID-19 in the territory following the sudden

reversal of zero-COVID policies in mainland China. In a series of

rapid-fire announcements, Macau simultaneously removed containment

measures - including the testing of high-risk groups - and restored

pre-pandemic ease of travel. In addition to abolishing most

COVID-related health requirements for tourists and health codes for

entry to public places and facilities, the government also restored

ferry and bus services to Hong Kong and scheduled international

flights.

Although Macau's business sector welcomed these developments

with great enthusiasm, there was grave concern over the potential

impact of a zero-COVID "exit wave", a phenomenon observed across

the globe as COVID restrictions have been lifted. By mid-January

2023, health officials estimated that at least 70% of Macau's

population had been infected by COVID in the month following the

end of zero-COVID. This resulted in labour shortages across the

territory that led to temporary closures of outlets in the gaming

and tourism sectors, while the healthcare sector struggled with a

concurrent outpouring in patients seeking treatment and COVID

infections among frontline health workers.

Nevertheless, Macau is likely to weather its exit wave far

better than mainland China. The territory's 94% COVID vaccination

rate and the availability of mRNA vaccines free of charge is better

protecting its residents from serious illness and death compared to

mainland China, allowing a quicker recovery from the surge. The

government has also distributed antigen test kits and basic

medication to Macau residents to enable them to manage their

symptoms at home.

Despite the short-term disruptions, the reopening of Macau's

borders and the restoration of ease of travel has seen a surge of

visitors at all entry points, particularly from January 2023 and

mostly from mainland China and Hong Kong. Tourist arrivals during

the Chinese New Year holiday outperformed expectations, exceeding

64,000 daily arrivals, an upsurge of 300% year on year (YoY). This

bodes well for Macau's economy, with the tourism and gaming sectors

being the immediate beneficiaries, with spillover gains in other

sectors such as the property market in the medium and longer

term.

Economic activity in 2022

Macau's economic performance in 2022 reflects the disruptive

impact of zero-COVID measures on its twin drivers of growth, and

also lends credence to the government's policy of reducing the

territory's reliance on gaming. Gross domestic product plummeted

33% YoY in Q3 2022 amid a drop of 28% for the first nine months of

the year. For full-year 2022, the territory is expected to register

a YoY GDP decline of 17%. Unemployment among local residents rose

as high as 4.7% in the second half of 2022, compared to an average

of 2% pre-pandemic. Inflation was relatively benign at 1% during

the same period.

Macau's credit score has not been revised since early 2022, when

Fitch Ratings affirmed the territory's long-term rating at "AA"

with a stable outlook. Fitch has since said that Macau's GDP may

rebound 46% YoY in 2023, although that observation preceded recent

reopening measures.

Gaming: Light at the end of the tunnel

Macau's gaming sector went through a dismal period in 2022, with

gross gaming revenue (GGR) declining 51% YoY over the full year to

its weakest annual revenue since 2004, at US$5.3 billion, just 14%

of 2019's pre-pandemic level.

The VIP gaming segment, which prior to the commencement of

China's corruption clampdown in 2014 accounted for almost 70% of

GGR in Macau, declined further over the year to a new low and now

accounts for only c.24% of GGR. This is ultimately a positive

factor for Macau's gaming operators due the higher profitability

generated by mass market gaming.

Macau's six incumbent licence holders were awarded fresh 10-year

operating licences

The highlight of the period was confirmation that the six

incumbent licence holders had been awarded fresh 10-year operating

licences under the territory's new gaming laws. In line with

Macau's emphasis on diversification, the six gaming operators have

announced a combined investment of US$15 billion in new projects,

more than 90% of which has been earmarked for exploring customer

markets other than mainland China and developing non-gaming

tourism, such as the convention and exhibition business,

entertainment and performances, sports events, culture, art,

healthcare and theme parks. The gaming operators will be required

to make further non-gaming investments for every year that GGR

exceeds an annual threshold of US$22.4 billion.

Following the reopening of the border in early January, Macau

recorded a surge in January GGR to US$1.43 billion, up 83% YoY and

47% of the pre-pandemic level.

Tourism: Recovering amid easier travel

Tourist arrivals in Macau in FY2022 fell 26% YoY. Although the

October Golden Week saw the second-highest number of daily visitors

of the year, at approximately 37,000, visitor numbers around other

traditional peak periods such as the Macau Grand Prix and the

year-end holidays were disappointing. Hotel occupancy also weakened

by 12% YoY to 38% for FY2022, with average room rates of MOP750

(US$94).

From mid-January 2023, there was a steady rise in visitor

numbers, with daily averages of 52,000, and the territory

registered more than 64,000 daily visitors over the Chinese New

Year period.

The upturn comes following measures to restore ease of travel to

Macau, particularly for travellers from mainland China, Hong Kong

and Taiwan, who were not required to present negative COVID test

results for entry to Macau from 8 January. The resumption of

international flights to Macau, and of bus and ferry services

between Hong Kong and Macau, will also facilitate travel to Macau,

with operators expected to increase frequencies to pre-pandemic

levels over the next few months.

Hotel bookings soared during Chinese New Year, a traditional

peak travel period. Hotel occupancy of 86% was recorded for the

seven-day holiday period, with hotel room prices doubling and even

tripling from 2022 levels. With arrivals of tour groups to Macau

officially resuming in February, the number of visitors is expected

to multiply, underpinning the territory's economic recovery.

PROPERTY MARKET OVERVIEW

Macau's property market remained under pressure in the second

half of 2022, in tandem with other parts of the economy.

Transactions in residential units for H2 2022 declined 51% YoY to

1,318 units and prices declined further, with the average price per

square feet measured in gross floor area dropping by 4% YoY to

approximately HKD6,200 (US$790).

In 2022, unit transaction volumes fell by half YoY to a total of

2,950 units, marking the territory's worst year for residential

sales in four decades. Based on our analysis, the luxury

residential segment, to which the Company is exposed, saw

transactions fall by 35% YoY in 2022, with the sector accounting

for 17% of all residential property transactions in Macau during

the period.

Realtor Centaline believes that prices in Macau's residential

property market have bottomed out and are unlikely to deteriorate

further. Property agents expect the market to recover from Q2 2023

onwards as Macau's economy benefits from a sustained revival in

tourism and gaming.

However, in tandem with USD interest rates, there have been

eight consecutive interest rate hikes in Macau since March 2022,

taking the city's Prime Lending Rate to a 15-year high of c.5%.

With potential purchasers facing higher borrowing costs, this could

dent demand. Furthermore, higher interest rates may lead to

existing property owners being unable to service their mortgage

repayments which could trigger sales.

The poor performance of Macau's property market has prompted

calls for the government to ease measures it has put in place over

the past decade to curb speculation. Citing credit easing and other

measures recently introduced in mainland China to throw a lifeline

to the country's troubled property sector, Macau property players

have urged the government to consider similar measures to strike a

better balance in matching housing supply and pricing with

demand.

Current measures in Macau to curb real estate speculation

include additional ad valorem stamp duty of up to 20% if a property

is resold within two years of purchase, buyer's stamp duty of 10%

for properties purchased by companies or non-residents, and an

additional stamp duty of up to 10% for those owning more than one

residential property. The residential mortgage lending ratio for

buyers was tightened in 2018, resulting in maximum financing levels

of only 40%-50% of purchase prices for properties valued in excess

of MOP8 million (approximately US$1 million).

According to the Land and Urban Construction Bureau of the

Macau, only 500 residential units received occupancy permits in

2022, a drop of 80% YoY reflecting constrained supply. At the end

of 2022, there were a total of 9,285 units in the pipeline, but 76%

of these units were at the design stage, 22% were under

construction, and fewer than 2% had been completed. Furthermore,

the vast majority of developers' new units are in the affordable

segment and include properties such as one-bedroom homes or studios

aimed at first-time buyers and, as such, are not competing with the

Company's portfolio properties.

Looking Ahead

Investor sentiment towards Macau has become significantly more

buoyant in the last month, but we remain cautious in the near term,

since the economy is likely to grapple with labour shortages and

public health issues as it begins to recover from its sharpest

declines in almost two decades.

Analysts' estimates for GGR growth suggest that 2023 will be a

transitionary year, and that in 2024, GGR will rebound to US$27

billion, with net revenue at 77% of 2019 levels.

The recovery of Macau's gaming and tourism sectors, with the

attendant improvement in GGR and tourist spending, is expected to

set the economy on a long-awaited road to revival. However, a

sustained return in investor sentiment will be required for the

Company's divestment programme to continue to make meaningful

progress in terms of achieving further timely sales and lowering

debt levels.

Directors' statement of Responsibilities

The Directors are responsible for preparing this half-yearly

financial report in accordance with applicable law and

regulations.

The Directors confirm that to the best of their knowledge:

-- the interim condensed consolidated financial statements have

been prepared in accordance with IAS 34 Interim Financial

Reporting; and

-- the Chairman's Message and Manager's Report meet the

requirements of an interim management report, and include a fair

review of the information required by:

a. DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the interim

condensed consolidated financial statements; and a description of

the principal risks and uncertainties for the year to date and the

remaining six months of the year; and

b. DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

On behalf of the Board

Mark Huntley

Chairman

22 February 2023

Interim Condensed Consolidated Statement of Financial Position

(Unaudited)

As at 31 December 2022

Unaudited Unaudited Audited

31 Dec 2022 31 Dec 2021 30 Jun 2022

Note US$'000 US$'000 US$'000

ASSETS

Non-current assets

Investment property 3 164,100 196,450 181,520

Deposits with lenders 4 1,878 6,416 1,561

Trade and other receivables 16 16 16

165,994 202,882 183,097

Current assets

Inventories 5 34,872 34,725 34,635

Trade and other receivables 92 124 53

Deposits with lenders 4 384 - 1,895

Cash and cash equivalents 13 23 531 355

35,371 35,380 36,938

Total assets 201,365 238,262 220,035

EQUITY

Capital and reserves attributable

to the Company's equity holders

Share capital 12 618 618 618

Retained earnings 57,975 77,182 62,349

Distributable reserves 15,791 15,791 15,791

Foreign currency translation

reserve (746) (364) (1,182)

Total equity 73,638 93,227 77,576

LIABILITIES

Non-current liabilities

Deferred taxation provision 11 8,720 11,431 9,706

Taxation provision 11 279 418 579

Interest-bearing loans 6 87,319 103,165 104,852

96,318 115,014 115,137

Current liabilities

Trade and other payables 2,176 955 2,019

Interest-bearing loans 6 29,233 29,066 25,303

31,409 30,021 27,322

Total liabilities 127,727 145,035 142,459

Total equity and liabilities 201,365 238,262 220,035

Net Asset Value per share

(US$) 8 1.19 1.51 1.25

Adjusted Net Asset Value

per share (US$) 8 1.61 1.96 1.67

The interim condensed consolidated financial statements were

approved by the Board of Directors and authorised for issue on 22

February 2023.

The notes form part of these interim condensed consolidated

financial statements.

Interim Condensed Consolidated Statement of Comprehensive Income

(Unaudited)

For the six-month period from 1 July 2022 to 31 December

2022

Unaudited Unaudited Audited

6 months 6 months 12 months

1 Jul 2022- 1 Jul 2021- 1 Jul 2021-

31 Dec 2022 31 Dec 2021 30 Jun 2022

Note US$'000 US$'000 US$'000

Income

Income on sale of investment

property 3 17,254 - -

Income on sale of inventories 5 - 1,515 1,511

Rental income 543 567 1,082

Other income - - 129

17,797 2,082 2,722

Expenses

Net loss from fair value

adjustment on investment

property 3 8,541 2,530 16,380

Cost of sales of investment

property 3 9,602 - -

Cost of sales of inventories 5 - 522 521

Management fee 10 600 600 1,199

Realisation fee 10 27 23 23

Non-executive directors'

fees 10 79 92 170

Auditors' remuneration: audit

fees 52 70 131

Auditors' remuneration: other

professional services - - 9

Property operating expenses 624 705 1,372

Sales and marketing expenses 616 85 115

General and administration

expenses 207 313 615

Loss/(Gain) on foreign currency

translation 116 4 (298)

(20,464) (4,944) (20,237)

Operating loss for the period/year (2,667) (2,862) (17,515)

Finance income and expenses

Bank loan interest 6 (2,555) (1,404) (2,985)

Other financing costs (179) (212) (431)

Bank and other interest 2 - -

(2,732) (1,616) (3,416)

Loss for the period/year

before tax (5,399) (4,478) (20,931)

Taxation 11 1,025 220 1,840

Loss for the period/year

after tax (4,374) (4,258) (19,091)

Items that may be reclassified

subsequently to profit or

loss

Exchange difference on translating

foreign operations 436 (420) (1,238)

Total comprehensive loss

for the period/year (3,938) (4,678) (20,329)

Loss attributable to:

Equity holders of the Company (4,374) (4,258) (19,091)

Total comprehensive loss

attributable to:

Equity holders of the Company (3,938) (4,678) (20,329)

Unaudited Unaudited Audited

6 months 6 months 12 months

1 Jul 2022- 1 Jul 2021- 1 Jul 2021-

31 Dec 2022 31 Dec 2021 30 Jun 2022

Note US$ US$ US$

Basic and diluted loss per

Ordinary Share attributable

to the equity holders of

the Company during the period/year 7 (0.0707) (0.0689) (0.3087)

All items in the above statement are derived from continuing

operations.

The notes form part of these interim condensed consolidated

financial statements.

Interim Condensed Consolidated Statement of Changes in Equity

(Unaudited)

Movement for the six-month period from 1 July 2022 to 31

December 2022 (unaudited)

Share capital Retained Distributable Foreign Total

earnings reserves currency

translation

reserve

US$'000 US$'000 US$'000 US$'000 US$'000

Balance brought forward

at 1 July 2022 618 62,349 15,791 (1,182) 77,576

Loss for the period - (4,374) - - (4,374)

Items that may be reclassified

subsequently to profit

or loss

Exchange difference

on translating foreign

operations - - - 436 436

Total comprehensive

loss for the period - (4,374) - 436 (3,938)

Balance carried forward

at 31 December 2022 618 57,975 15,791 (746) 73,638

Movement for the six-month period from 1 July 2021 to 31

December 2021 (unaudited)

Share capital Retained Distributable Foreign Total

earnings reserves currency

translation

reserve

US$'000 US$'000 US$'000 US$'000 US$'000

Balance brought forward

at 1 July 2021 618 81,440 15,791 56 97,905

Loss for the period - (4,258) - - (4,258)

Items that may be reclassified

subsequently to profit

or loss

Exchange difference

on translating foreign

operations - - - (420) (420)

Total comprehensive

loss for the period - (4,258) - (420) (4,678)

Balance carried forward

at 31 December 2021 618 77,182 15,791 (364) 93,227

Movement for the year from 1 July 2021 to 30 June 2022

(audited)

Share capital Retained Distributable Foreign Total

earnings reserves currency

translation

reserve

US$'000 US$'000 US$'000 US$'000 US$'000

Balance brought forward

at 1 July 2021 618 81,440 15,791 56 97,905

Loss for the year - (19,091) - - (19,091)

Items that may be reclassified

subsequently to profit

or loss

Exchange difference

on translating foreign

operations - - - (1,238) (1,238)

Total comprehensive

loss for the year - (19,091) - (1,238) (20,329)

Balance carried forward

at 30 June 2022 618 62,349 15,791 (1,182) 77,576

The notes form part of these interim condensed consolidated

financial statements.

Interim Condensed Consolidated Statement of Cash Flows

(Unaudited)

For the six-month period from 1 July 2022 to 31 December

2022

Unaudited Unaudited Audited

6 months 6 months 12 months

1 Jul 2022- 1 Jul 2021- 1 Jul 2021-

31 Dec 2022 31 Dec 2021 30 Jun 2022

Note US$'000 US$'000 US$'000

Net cash used in operating ( 2,200

activities 9 ) (424) (402)

Cash flows from investing

activities

Capital expenditure on investment

property 3 - (218) (288)

Proceeds from disposal of

investment property 17,254 - -

Movement in pledged bank

balances 1,194 416 3,376

Net cash generated from investing

activities 18,448 198 3,088

Cash flows from financing

activities

Proceeds from bank borrowings 6,532 9,383 9,457

Repayment of bank borrowings (20,845) (12,155) (13,673)

Interest and bank charges

paid (2,317) (1,425) (3,013)

Net cash used in financing

activities (16,630) (4,197) (7,229)

Net movement in cash and

cash equivalents (3 82 ) (4,423) (4,543)

Cash and cash equivalents

at beginning of period/year 355 5,003 5,003

Effect of foreign exchange

rate changes 50 (49) (105)

Cash and cash equivalents

at end of period/year 13 23 531 355

The notes form part of these interim condensed consolidated

financial statements.

Notes to the Interim Condensed Consolidated Financial Statements

(Unaudited)

For the six-month period from 1 July 2022 to 31 December

2022

General information

Macau Property Opportunities Fund Limited (the "Company") is a

Company incorporated and registered in Guernsey under The Companies

(Guernsey) Law, 1994. This law was replaced by the Companies

(Guernsey) Law, 2008 on 1 July 2008. The Company is an authorised

entity under the Authorised Closed-Ended Investment Schemes Rules

2008 and is regulated by the Guernsey Financial Services

Commission. The address of the registered office is given

below.

The interim condensed consolidated financial statements for the

six months ended 31 December 2022 comprise the interim financial

statements of the Company and its subsidiaries (together referred

to as the "Group"). The Group invests in residential property in

Macau.

There have been no changes to the Group's principal risks and

uncertainties in the six-month period to 31 December 2022 and the

Board of Directors does not anticipate any changes to the principal

risks and uncertainties in the second half of the year. Principal

risks and uncertainties are further discussed in the Annual Report

on page 55.

The interim condensed consolidated financial statements are

presented in US Dollars ("US$") and are rounded to the nearest

thousand ($'000).

These interim condensed consolidated financial statements were

approved for issue by the Board of Directors on 22 February

2023.

1. Significant accounting policies

Basis of accounting

The annual consolidated financial statements have been prepared

in accordance with International Financial Reporting Standards

("IFRS"), applicable legal and regulatory requirements of Guernsey

Law and under the historical cost basis, except for financial

assets and liabilities held at fair value through profit or loss

("FVPL") and investment properties that have been measured at fair

value. The accounting policies and valuation principles adopted are

consistent with those of the previous financial year.

The interim condensed consolidated financial statements have

been prepared in accordance with International Accounting Standard

("IAS") 34, Interim Financial Reporting. The same accounting

policies and methods of computation are followed in the interim

financial statements as compared with the annual financial

statements. The interim condensed consolidated financial statements

do not include all information and disclosures required in the

annual financial statements and should be read in conjunction with

the Group's annual financial statements as of 30 June 2022.

New and amended standards and interpretations applied

The following amendments to existing standards and

interpretations are effective for the year ended 30 June 2023 and

therefore were applied in the current period but did not have a

material impact on the Group:

-- Annual Improvements to IFRSs 2018-2020 (effective 1 January 2022)

-- Amendment to IAS 37: Onerous Contracts: Cost of fulfilling a

Contract (effective 1 January 2022)

Going concern

The Group continues to meet its capital requirements and

day-to-day liquidity needs through the Group's cash resources. As

part of their assessment of the going concern of the Group as at 31

December 2022, the Directors have reviewed the comprehensive cash

flow forecasts prepared by management which make assumptions based

upon current and expected future market conditions, including

predicted future sales of properties taking into consideration

current market circumstances. It is the Directors' belief that,

based upon these forecasts and their assessment of the Group's

committed banking facilities, it is appropriate to prepare the

financial statements of the Group on a going concern basis.

The Directors, after the continuation resolution was passed at

the Annual General Meeting of the Company on 22 December 2022

extending the Fund's life until the 2023 Annual General Meeting,

assessed whether the continuation vote before the end of 2023 gives

rise to a material uncertainty that might cast significant doubt on

the Fund's ability to continue as a going concern. The Directors

have also considered the going concern assumption outside the

primary going concern horizon. The Directors currently expect to

receive continuation support from major shareholders and over 50%

of shareholder support is required in December 2023 to ensure

continuation; it is likely that returns from the sale of properties

could well be significantly lower if the Fund was forced to sell as

a result of discontinuation and it is therefore commercially

rational for the Fund to continue in business. Therefore, the

Directors believe it is appropriate to prepare the financial

statements of the Group on the going concern basis based upon

existing cash resources, the forecasts described above, the

extension of the life of the Company until the 2023 Annual General

Meeting agreed at the Annual General Meeting on 13 December 2022

and the Directors' assessment of the Group's committed banking

facilities and expected continuing compliance with related

covenants.

The continuing impact of the COVID-19 pandemic has not prevented

a number of sale transactions in the current period and has not had

a significant impact on the loan covenants held by the Group. The

overall uncertainty brought about by COVID-19 and its impact on the

Group is continuing to be closely monitored by the Board.

Seasonal and cyclical variations

The Group does not operate in an industry where significant or

cyclical variations as a result of seasonal activity are

experienced during the financial year.

2. Segment reporting

The Chief Operating Decision Maker (the "CODM") in relation to

Macau Property Opportunities Fund Limited is deemed to be the Board

itself. The factors used to identify the Group's reportable

segments are centred on asset class, differences in geographical

area and differences in regulatory environment. Furthermore,

foreign exchange and political risk are identified, as these also

determine where resources are allocated.

Based on the above and a review of information provided to the

Board, it has been concluded that the Group is currently organised

into one reportable segment based on the single geographical

sector, Macau.

This segment refers principally to residential properties.

Furthermore, there are multiple individual properties that are held

within each property type. However, the CODM considers, on a

regular basis, the operating results and resource allocation of the

aggregated position of all property types as a whole, as part of

their on-going performance review. This is supported by a further

breakdown of individual property groups only to help support their

review and investment appraisal objectives.

3. Investment property

Unaudited Unaudited Audited

1 Jul 2022- 1 Jul 2021- 1 Jul 2021-

31 Dec 2022 31 Dec 2021 30 Jun 2022

US$'000 US$'000 US$'000

At beginning of the period/year 181,520 199,629 199,629

Capital expenditure on property - 218 288

Disposal of property (9,602) - -

Fair value adjustment (8,541) (2,530) (16,380)

Exchange difference 723 (867) (2,017)

Balance at end of the period/year 164,100 196,450 181,520

Valuation losses (fair value adjustment) from investment

property are recognised in profit and loss for the period and are

attributable to changes in unrealised losses relating to investment

property held at the end of the reporting period.

The valuation process is initiated by the Investment Adviser

with the Board consent and approval, who appoints a suitably

qualified valuer to conduct the valuation of the investment

property. The results are overseen by the Investment Adviser. Once

satisfied with the valuations based on their expectations, the

Investment Adviser reports the results to the Board. The Board

periodically meets with the valuer and reviews the latest

valuations based on their knowledge of the property market and

compare these to previous valuations.

The Group's investment properties were revalued at 31 December

2022 by an independent, professionally-qualified valuer: Savills

(Macau) Limited ("Savills"). The valuation has been carried out in

accordance with the current Royal Institution of Chartered

Surveyors (RICS) Appraisal and Valuation Standards to calculate the

market value of the investment properties in their existing state

and physical condition, with the assumptions that:

-- The owner sells the property in the open market without any

arrangement, which could serve to affect the value of the

property.

-- The property is held for investment purposes.

-- The property is free from encumbrances, restrictions and

outgoings of any onerous nature which could affect its value.

The fair value of investment property is independently

determined by Savills, using recognised valuation techniques. The

technique deployed was the income capitalisation method. The

determination of the fair value of investment property requires the

use of estimates such as future cash flows from assets (such as

lettings, tenants' profiles, future revenue streams, capital values

of fixtures and fittings, plant and machinery, any environmental

matters and the overall repair and condition of the property) and

discount rates applicable to those assets. These estimates are

based on local market conditions existing at the reporting

date.

See Note 11 in relation to deferred tax liabilities on

investment property.

During the current period, five residential units of The

Waterside were sold for a total consideration of US$17.3 million

against a total cost of US$10.2 million which resulted in a net

profit of US$7.1 million after all associated fees and transaction

costs but before financing and other related holding costs.

Capital expenditure on property during the prior period relates

to fit-out costs for The Waterside.

Rental income arising from The Waterside of US$539,000 (6 months

ended 31 December 2021: US$566,000, 12 months ended 30 June 2022:

US$1,079,000) was received during the period. Direct operating

expenses of US$389,000 (6 months ended 31 December 2021:

US$451,000, 12 months ended 30 June 2022: US$866,000) arising from

rented units were incurred during the six-month period. Direct

operating expenses during the period arising from vacant units

totalled US$134,000 (6 months ended 31 December 2021: US$200,000,

12 months ended 30 June 2022: US$369,000).

The table below shows the assumptions used in valuing the

investment properties which are classified as Level 3 in the fair

value hierarchy:

Property Carrying Valuation Input Unobservable Other key

information amount/fair technique and observable information

value as inputs used

at 31 December in determination

2022: US$'000 of

fair values

Name The Waterside 164,100 Term and Term rent HK$17.2 Age of building

Reversion (inclusive psf (30

Analysis of management June 2022:

fee and HK$17.5

furniture) psf)

Type Residential/Completed Term yield 1.4%-2.2% Remaining

apartments (exclusive (30 June useful life

of management 2022: 1.4%-2.2%) of building

fee and

furniture)

Location One Central Reversionary HK$13.1

Tower 6 rent (exclusive psf (30

Macau of management June 2022:

fee and HK$13.16

furniture) psf)

Reversionary 1.55%

yield

(30 June

2022: 1.55%)

The fair value of The Waterside is determined using the income

approach, more specifically a term and reversion analysis, where a

property's fair value is estimated based on the rent receivable and

normalised net operating income generated by the property, which is

divided by the capitalisation (discount) rate. The difference

between gross and net rental income includes the same expense

categories as those for the discounted cash flow method with the

exception that certain expenses are not measured over time, but

included on the basis of a time weighted average, such as the

average lease up costs. Under the income capitalisation method,

over and under-rent situations are separately capitalised

(discounted).

If the estimated reversionary rent increased/decreased by 5%,

(and all other assumptions remained the same), the fair value of

The Waterside would increase by US$7.8 million (6 months ended 31

December 2021: US$10 million, 12 months ended 30 June 2022: US$8.3

million) or decrease by US$7.8 million (6 months ended 31 December

2021: US$10 million, 12 months ended 30 June 2022: US$8.3

million).

If the term and reversionary yield or discount rate

increased/decreased by 5%, (and all other assumptions remained the

same), the fair value of The Waterside would decrease by US$7.6

million (6 months ended 31 December 2021: US$9 million, 12 months

ended 30 June 2022: US$7.9 million) or increase by US$8.2 million

(6 months ended 31 December 2021: US$10 million, 12 months ended 30

June 2022: US$8.8 million).

The same valuation method was deployed in June 2022 and December

2022.

The Waterside is currently valued at its highest and best use.

There is no extra evidence available to suggest that it has an

alternative use that would provide a greater fair value

measurement.

There have been no transfers between levels during the period or

any change in valuation technique since the last period.

4. Deposits with lenders

Pledged bank balances represent cash deposits pledged to the

banks to secure the banking facilities granted to the Group.

Deposits amounting to US$1.9 million (31 December 2021: US$6.4

million, 30 June 2022: US$1.6 million) have been pledged to secure

long-term banking facilities and are, therefore, classified as

non-current assets. There are no other significant terms and

conditions associated with these pledged bank balances.

Unaudited Unaudited Audited

31 Dec 2022 31 Dec 2021 30 Jun 2022

US$'000 US$'000 US$'000

Non-current 1,878 6,416 1,561

Current 384 - 1,895

2,262 6,416 3,456

5 . Inventories

Unaudited Unaudited Audited

1 Jul 2022- 1 Jul 2021- 1 Jul 2021-

31 Dec 2022 31 Dec 2021 30 Jun 2022

US$'000 US$'000 US$'000

Cost

Balance brought forward 34,635 34,924 34,924

Additions 88 475 595

Disposals - (522) (518)

Exchange difference 149 (152) (366)

Balance carried forward 34,872 34,725 34,635

Additions include capital expenditure, development costs and

capitalisation of financing costs.

Under IFRS, inventories are valued at the lower of cost and net

realisable value. The carrying amounts for inventories as at 31

December 2022 amounts to US$34,872,000 (6 months ended 31 December

2021: US$34,725,000, 12 months ended 30 June 2022: US$34,635,000).

Net realisable value as at 31 December 2022 as determined by the

independent, professionally-qualified valuer, Savills, was

US$58,932,000 (6 months ended 31 December 2021: US$62,319,000, 12

months ended 30 June 2022: US$58,661,000).

During the six month period to 31 December 2022, no units of The

Fountainside were sold.

During the year ended 30 June 2022, one residential unit of The

Fountainside was sold for a total consideration of US$1.5 million

(HK$11.8 million) against a total cost of US$0.6 million (HK$4.4

million) which resulted in a net profit of US$0.9 million (HK$7.4

million) after all associated fees and transaction costs.

During the period ended 31 December 2021, one residential unit

of The Fountainside was sold for a total consideration of US$1.5

million (HK$11.8 million) against a total cost of US$0.5 million

(HK$4.1 million) which resulted in a net profit of US$1.0 million

(HK$7.7 million) after all associated fees and transaction

costs.

6. Interest-bearing loans

Unaudited Unaudited Audited

31 Dec 2022 31 Dec 2021 30 Jun 2022

US$'000 US$'000 US$'000

Bank loans - Secured

- Current portion 29,233 29,066 25,303

- Non-current portion 87,319 103,165 104,852

116,552 132,231 130,155

There are interest-bearing loans with three banks:

Hang Seng Bank

The Group has a term loan facility with Hang Seng Bank for The

Waterside.

In September 2020, the Group executed a HK$540 million (US$69.7

million) five-year term loan facility (Tranche 7) to refinance

previous tranches which were due for settlement in September 2020.

In March 2021, the Group executed a HK$250 million (US$32.2

million) four-year term facility (Tranche 8) to refinance previous

tranches which were due for settlement in March 2021. In September

2022, the Group executed a HK$50 million (US$6.4 million) nine

month term facility (Tranche 9) to partially refinance previous

tranches which were due for settlement in September 2022.

As at 31 December 2022, three tranches remained outstanding.

Tranche 6 matured on 19 September 2022 and was fully repaid (31

December 2021: HK$108 million (US$13.8 million), 30 June 2022:

HK$108 million (US$13.8 million)). Tranche 7 had an outstanding

balance of HK$476 million (US$60.9 million) (31 December 2021:

HK$512 million (US$65.7 million), 30 June 2022: HK$512 million

(US$65.2 million)); Tranche 8 had an outstanding balance of HK$225

million (US$28.8 million) (31 December 2021: HK$238 million

(US$30.5 million), 30 June 2022: HK$225 million (US$28.7 million));

Tranche 9 had an outstanding balance of HK$33.6 million (US$4.3

million) (31 December 2021: HK$nil (US$nil), 30 June 2022: HK$nil

(US$nil)).

The interest rates applicable to Tranche 7 and Tranche 8 are

1.8% per annum over the 1-, 2-or 3-month HIBOR rate. The interest

rate applicable to Tranche 9 is 2.2% per annum over the 1-, 2-or

3-month HIBOR rate. The choice of rate is at the Group's

discretion. Tranche 7 matures in September 2025 and the principal

is to be repaid in nine instalments commencing from December 2020

with 57.59% of the principal due upon maturity. Tranche 8 matures

in March 2025 and the principal is to be repaid in seven

instalments commencing from December 2021 with 34% of the principal

due upon maturity. Tranche 9 matures in June 2023 and the principal

is to be repaid in two instalments commencing in March 2023 with

60% of the principal due upon maturity. The loan-to-value covenant

is 60%. As at 31 December 2022, the loan-to-value ratio for the

Hang Seng One Central facility was 57.30%. The facility is secured

by means of a first registered legal mortgage over all unsold units

at The Waterside as well as a pledge of all income from the units.

The Company is the guarantor for the credit facility. In addition,

the Group is required to maintain a cash reserve equal to six

months' interest with the lender.

The Group has a loan facility for The Fountainside.

The Facility amount is HK$96 million (US$12.3 million) divided

into 2 tranches, with a tenor of 4 years to mature in March 2024.

Tranche A is a facility for an amount of HK$89 million (US$11.4

million). Tranche B is a facility for an amount of HK$7 million

(US$0.9 million) for financing the alteration costs of The

Fountainside. The facility of Tranche A has an outstanding balance

of HK$38.7 million (US$5.0 million) and the facility for Tranche B

has an outstanding balance of HK$5.2 million (US$0.7 million). The

interest rates applicable to Tranche A and Tranche B are 2.8% per

annum and 3.3% per annum, respectively, over the 1-, 2- or 3-month

HIBOR rate. The choice of rate is at the Group's discretion. The

principal of Tranche A is to be repaid half-yearly with remaining

instalments commencing in September 2023, with 26.93% of the

principal due upon maturity, while repayment for Tranche B is due

in full at maturity. The loan-to-value covenant is 55%. The

facility is secured by means of a first registered legal mortgage

over all unsold units and car parking spaces of The Fountainside as

at the loan facility date as well as a pledge of all income from

the units and the car parking spaces. The Company is the guarantor

for the credit facility. In addition, the Group is required to

maintain a cash reserve equals to six months' interest with the

lender.

As at 31 December 2022, the facility had an outstanding balance

of HK$43.9 million (US$5.6 million) (31 December 2021: HK$42

million (US$5.4 million), 30 June 2022: HK$43 million (US$5.5

million)). As at 31 December 2022, the loan-to-value ratio for this

facility was 30.55%.

The Group has two loan facilities for Penha Heights:

Banco Tai Fung

The loan facility with Banco Tai Fung originally had a term of

two years and the facility amount was HK$70 million, which expired

in June 2022 and was subsequently renewed for another term of seven

years. Interest was Prime Rate minus 2.25% per annum. The principal

is to be repaid in 28 quarterly instalments of HK$2.5 million

(US$319,969) each, commencing in September 2022. As at 31 December

2022, the facility had an outstanding balance of HK$67.5 million

(US$8.6 million) (31 December 2021: HK$70 million (US$9.0 million),

30 June 2022: HK$70 million (US$8.9 million)). This facility is

secured by a first legal mortgage over the property as well as a

pledge of all income from the property. The Company is the

guarantor for this term loan. Interest is paid quarterly for the

first six month and monthly thereafter on this loan facility. As at

31 December 2022, the loan-to-value ratio for this facility was

44.70%. There is no loan-to-value covenant for this loan.

Banco Comercial de Macau, S.A. ("BCM Bank")

During the prior year, the Group executed a loan facility with

BCM Bank to refinance the credit facility with the Industrial and

Commercial Bank of China (Macau) Limited in relation to Penha

Heights. The facility amount is HK$70 million (US$9.0 million) with

a tenor of 2 years to mature in December 2023. The interest rate is

2.55% per annum over the 3-month HIBOR rate. The principal is to be

repaid in quarterly instalments commencing in March 2023 with 85%

of the principal due upon maturity. As at 31 December 2022, the

facility had an outstanding balance of HK$70 million (US$9.0

million) (31 December 2021: HK$70 million (US$9.0 million), 30 June

2022: HK$70 million (US$8.9 million)). This facility is secured by

a first legal mortgage over the property as well as a pledge of all

income from the property. The Company is the guarantor for this

term loan. In addition, the Group is required to maintain a cash

reserve equal to six months' interest with the lender. Interest is

paid monthly on this loan facility. The loan-to-value covenant is

50%. As at 31 December 2022, the loan-to-value ratio for this

facility was 38.89%.

Bank Loan Interest

Bank loan interest paid during the period was US$2,555,000 (6

months ended 31 December 2021: US$1,404,000, 12 months ended 30

June 2022: US$2,985,000). As at 31 December 2022, the carrying

amount of interest-bearing loans included unamortised prepaid loan

arrangement fee of US$688,000 (31 December 2021: US$1,043,000, 30

June 2022: US$837,000).

Fair Value

Interest-bearing loans are carried at amortised cost. The fair

value of fixed rate financial assets and liabilities carried at

amortised cost are estimated by comparing market interest rates

when they were first recognised with current market rates for

similar financial instruments.

The estimated fair value of fixed interest bearing loans is

based on discounted cash flows using prevailing market interest

rates for debts with similar credit risk and maturity. As at 31

December 2022, the fair value of the financial liabilities was

US$727,000 higher than the carrying value of the financial

liabilities (31 December 2021: US$79,000 lower than the carrying

value of the financial liabilities, 30 June 2022: US$462,000 lower

than the carrying value of the financial liabilities).

The Group's interest-bearing loans have been classified within

Level 2 as they have observable inputs from similar loans. There

have been no transfers between levels during the period or a change

in valuation technique since last period.

7. Basic and diluted loss per Ordinary Share

Basic and diluted loss per equivalent Ordinary Share is based on

the following data:

Unaudited Unaudited Audited

6 months 6 months 12 months

1 Jul 2022- 1 Jul 2021- 1 Jul 2021-

31 Dec 2022 31 Dec 2021 30 Jun 2022

Loss for the period/year (US$'000) (4,374) (4,258) (19,091)

Weighted average number of

Ordinary Shares ('000) 61,836 61,836 61,836

Basic and diluted loss per

share (US$) (0.0707) (0.0689) (0.3087)

8 . Net asset value reconciliation

Unaudited Unaudited Audited

31 Dec 2022 31 Dec 2021 30 Jun 2022

US$'000 US$'000 US$'000

Net assets attributable to

ordinary shareholders 73,638 93,227 77,576

Uplift of inventories held

at cost to market value 25,883 28,224 25,844

Adjusted Net Asset Value 99,521 121,451 103,420

Number of Ordinary Shares Outstanding

('000) 61,836 61,836 61,836

NAV per share (IFRS) (US$) 1.19 1.51 1.25

Adjusted NAV per share (US$) 1.61 1.96 1.67

Adjusted NAV per share (GBP)* 1.33 1.45 1.38

* US$:GBP rates as at relevant period/year end

The NAV per share is arrived at by dividing the net assets as at

the date of the consolidated statement of financial position, by

the number of Ordinary Shares in issue at that date.

Under IFRS, inventories are carried at the lower of cost and net

realisable value. The Adjusted NAV includes the uplift of

inventories to their market values before any tax consequences or

adjustments.

The Adjusted NAV per share is derived by dividing the Adjusted

NAV as at the date of the consolidated statement of financial

position, by the number of Ordinary Shares in issue at that

date.

There are no potentially dilutive instruments in issue.

9. Cash flows from operating activities

Unaudited Unaudited Audited

6 months 6 months 12 months

1 Jul 2022- 1 Jul 2021- 1 Jul 2021-

31 Dec 2022 31 Dec 2021 30 Jun 2022

US$'000 US$'000 US$'000

Cash flows from operating activities

Loss for the period/year before

tax (5,399) (4,478) (20,931)

Adjustments for:

Net loss from fair value adjustment

on investment property 8,541 2,530 16,380

Fair value gain on disposal

of investment property (7,652) - -

Net finance costs 2,732 1,616 3,416

Operating cash flows before

movements in working capital (1,778) (332) (1,135)

Effect of foreign exchange

rate changes 116 1 (298)

Movement in trade and other

receivables (39) 474 545

Movement in trade and other

payables (249) (400) 775

Movement in inventories (88) 47 (77)

Net change in working capital (376) 121 1,243

Taxation paid (162) (214) (212)

Net cash used in operating

activities ( 2,200 ) (424) (402)

Cash and cash equivalents (which are presented as a single class

of assets on the face of the interim condensed consolidated

statement of financial position) comprise cash at bank and other

short-term, highly-liquid investments with a maturity of three

months or less.

10. Related party transactions

Directors of the Company are all Non-Executive and by way of

remuneration, receive only an annual fee which is denominated in

Sterling.

Unaudited Unaudited Audited

6 months 6 months 12 months

1 Jul 2022- 1 Jul 2021- 1 Jul 2021-

31 Dec 2022 31 Dec 2021 30 Jun 2022

US$'000 US$'000 US$'000

Directors' fees 79 92 170

The Directors are considered to be the key management personnel

(as defined under IAS 24) of the Company. Directors' fees

outstanding as at 31 December 2022 were US$41,000 (31 December

2021: US$46,000, 30 June 2022: US$41,000).

Sniper Capital Limited is the Manager to the Group and received

management fees during the period as detailed in the Interim

Condensed Consolidated Statement of Comprehensive Income.

Management fees are paid quarterly in advance and amounted to

US$600,000 (6 months ended 31 December 2021: US$600,000, 12 months

ended 30 June 2022: US$1,199,000) at a quarterly fixed rate of

US$300,000 per annum. Management fees outstanding as at 31 December