Kasei Holdings Plc Investment Strategy Update

November 24 2023 - 2:01AM

UK Regulatory

TIDMKASH

Kasei Holdings plc (`Kasei' or the `Company')

Investment Strategy Update

Kasei Holdings PLC (AQSE: KASH), a digital asset and web 3.0 investment company,

is pleased to announce the following updates with respect to the Company's

investment strategy.

Core Portfolio:

The core portfolio as of 31/10/23 was as follows:

Underlying Quantity Price $ Valuation $

BTC 27.75 34,425.00 955,292.03

GBTC 6,500.00 26.50 172,250.00

ETH 253.13 1,800.00 455,641.02

QNT 2,500.00 101.50 253,750.00

SOL 773.17 36.25 28,027.41

LINK 5,000.00 11.25 56,250.00

DAG 2,500,000.00 0.0325 81,250.00

AR 2,500.00 5.75 14,375.00

AVAX 1,000.00 11.35 11,350.00

HBAR 250,000.00 0.0515 12,875.00

HNT 2,502.18 1.55 3,878.38

LTX 50,000.00 0.0915 4,575.00

ALGO 13,070.54 0.10 1,307.05

ADS 250,000.00 0.08 20,000.00

Total 2,070,820.89

The main addition has been the inception of a position in the Grayscale Bitcoin

Trust as the discount to NAV reached historic levels. Recent news flow around

potential ETF approvals has led to a significant contraction in the discount as

per the Company's expectation.

Yield Generating strategies:

Ethereum:

The Company has staked 192 ETH in the ETH 2.0 staking program at a current yield

of 3.29%.

Solana:

The Company has staked 775 SOL at current yield of 5.01%.

Avalanche:

The Company has staked 1000 AVAX at current yield of 7.85%.

Staking rewards are paid in native tokens and as such yields are token based and

subject to change. The company also intends to use its remaining BTC and ETH in

alternative yield generating strategies.

For further information please contact:

Kasei Holdings PLC Jai.patel@kaseiholdings.com

Jai Patel

Chief Investment Officer

VSA Capital Limited (AQSE Corporate Adviser) +44 (0)203 005 5000

Simon Barton / Thomas Jackson (Corporate Finance)

About Kasei Holdings

Kasei is a team of experienced financial experts who came together through a

shared interest in the digital asset ecosystem and the belief that blockchain

technology will transform industries and have significant global economic

impact.

Kasei's cumulative 100 years plus experience in navigating traditional financial

markets, in particular highly volatile asset classes, provides the Company with

a solid grounding to build a balanced portfolio positioned to take advantage of

the disruptive innovation in this space.

Despite Kasei's belief that these assets are positioned for highly significant

long-term gains, the Company employ a balanced risk-and-reward strategy. This

provides shareholders with an actively managed portfolio of crypto assets, as

well as exposure to investments in blockchain enabled companies and technology,

all in the form of one listed security.

LinkedIn: Kasei Holdings PLC: Overview |

LinkedIn (https://www.linkedin.com/company/kasei-holdings

-plc/?originalSubdomain=uk)

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/kasei-holdings-plc/r/investment-strategy-update,c3881895

END

(END) Dow Jones Newswires

November 24, 2023 02:01 ET (07:01 GMT)

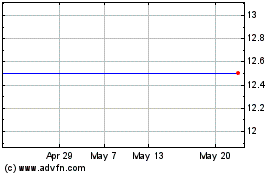

Kasei (AQSE:KASH)

Historical Stock Chart

From Oct 2024 to Nov 2024

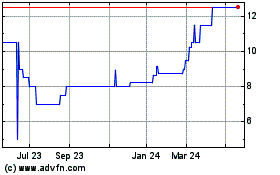

Kasei (AQSE:KASH)

Historical Stock Chart

From Nov 2023 to Nov 2024