TIDMFSJ

RNS Number : 0283Q

Fisher (James) & Sons plc

25 October 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No 596/2014.

25 October 2021

James Fisher and Sons plc

Trading update

James Fisher and Sons plc (FSJ.L) ('James Fisher', 'the Group'),

the leading marine service provider, today publishes a trading

update.

-- Following a difficult start to the year, improvement in the

Fendercare ship-to-ship transfer business remains below the rate

previously expected, with some growing evidence of market shifts in

some key territories.

-- JFD has reached an impasse in negotiations over c.GBP2m due

on a long-term project and is no longer forecasting a resolution in

2021.

-- Customers of the Group's Marine Contracting, Decommissioning

and Nuclear businesses have further delayed projects in recent

weeks. The projects were previously expected to commence, and in

some cases finish, in 2021. The continuing challenges presented by

the global pandemic, particularly in the safe mobilisation of teams

to work sites, have influenced customer decision-making

processes.

-- A recent deterioration in the condition of a financially

distressed customer has increased bad debt risk by c.GBP2m.

-- Tankships experienced a poor month in September and as a

result has a more cautious outlook for the full year.

-- Revenue in the quarter ended 30 September 2021 was 7.6%

higher than Q3 2020 and 8.7% higher than Q2 of 2021. Year to date

revenue is 3.9% below prior year.

-- The Board now anticipates Underlying Operating Profit for the

full year, before separately disclosed items, to be in the range of

GBP27m - GBP32m.

The Group continues to trade within its banking covenants (which

are formally measured at each half year end) and at 30 September

had headroom of c.GBP100m against its revolving credit

facilities.

In response to the latest short-term trading outlook, management

is performing a detailed review of the Group's cost base and

balance sheet. Aligned with the Board's commitment to 'fix or exit'

non-core and underperforming businesses, the Group is continuing to

advance at pace the divestment of non-core businesses and assets

aimed at generating significant proceeds over the next year, to

reduce net debt and financial leverage as well as to simplify the

business.

Notwithstanding some revenue opportunity moving from Q4 2021 to

2022, the Board currently expects this to be materially offset by

the continuation of challenges the Group is currently experiencing

with customer demand and the safe mobilisation of teams to work

sites.

The Board remains confident in the Group's strategy to deliver

sustainable profitable growth from the significant market

opportunities that are available to it and remains committed to

executing on its long-term strategy.

Divisional Summary

Marine Support

The Fendercare ship-to-ship transfer business has continued to

improve, but still not at the rate previously expected. There is

growing evidence of market shifts in some key territories and the

management team is conducting a detailed review of locations and

trading partners to ensure that the business has the optimal mix of

each.

Marine Contracting is trading ahead of prior year but has

suffered from recent customer and weather delays that have pushed

projects into H1 2022. Within our Renewables franchise EDS, the

high voltage specialist, continues to perform well and has recently

signed two multi-year, multi-million pound contracts with tier 1

contractors for monitoring services in Northern Europe, and more of

these contracts remain in the sales pipeline. There has been no

material change in the situation in Mozambique. The LNG projects

remain suspended and dispute resolution discussions with our

clients are ongoing. The Digital and Data Services businesses are

in line with expectations and have strong order books.

Offshore Oil

The ScanTech businesses continue to perform well, showing strong

growth over 2020 as demand for well-testing services, compressors

and other asset rentals continues. ScanTech's bubble curtain

offering to the Renewables market is continuing to see high demand

with YTD revenue twice that achieved in the same period of 2020.

RMSpumptools remains in line with expectations. The James Fisher

Offshore business has experienced multiple delays to awarded

projects and, following a recent deterioration in the condition of

a financially distressed customer has increased bad debt risk of

c.GBP2m. The most recent example being a customer delaying a

multi-million dollar decommissioning project scheduled for Q4 2021

into 2022. Although frustrating, the order book is strong and

demand for decommissioning services continues to show growth.

Specialist Technical

JFD's short-cycle diving equipment and training revenues remain

soft, as previously announced, and are expected to remain so until

well into 2022. In addition, the business has reached an impasse in

negotiations over c.GBP2m due on a long-term project and is no

longer forecasting a resolution in 2021.

The nuclear decommissioning business is in line with

expectations at the end of Q3, however a major customer has

unexpectedly deferred the award of new projects planned for Q4 2021

into 2022, leaving JFN with a shortfall for the remainder of the

year. The business is focusing on short-term cost saving measures

to mitigate the impact.

Tankships

Following a consistent trend of improvements in trading from

February to August, the Tankships division experienced lower

volumes of cargo and subdued market spot rates in September. It is

not expected that the business will be able to recover the

September shortfall and management has a more cautious outlook for

the remainder of the year.

Group Revenue (unaudited)

GBPm 2020 2021 Quarter on Cumulative

quarter variance

variance

Q1 129.4 109.3 -15.5% -15.5%

------ ------ ----------- -----------

Q2 128.7 124.4 -3.3% -9.5%

------ ------ ----------- -----------

Q3 125.7 135.2 +7.6% -3.9%

------ ------ ----------- -----------

Q4 134.4

------ ------ ----------- -----------

For further information

Chief Executive

Officer

James Fisher and Eoghan O'Lionaird Chief Financial

Sons plc Duncan Kennedy Officer 020 7614 9508

FTI Consulting Richard Mountain 020 3727 1340

--------------------------------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPGGGUUPGPGC

(END) Dow Jones Newswires

October 25, 2021 02:00 ET (06:00 GMT)

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

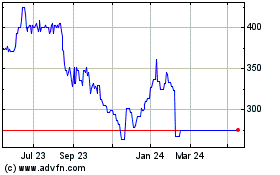

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024