TIDMFSJ

RNS Number : 3936D

Fisher (James) & Sons plc

29 June 2021

29 June 2021

James Fisher and Sons plc

Capital Markets Event and Pre Close Trading Update

James Fisher and Sons plc ("James Fisher", the "Company" or the

"Group"), the leading marine services provider, will today hold a

virtual Capital Markets Event in which it will present its new

strategy to drive performance and improve returns.

Pre Close Trading Update

Offshore Oil has continued to perform well, with tendering and

contract wins in oil and gas decommissioning projects growing

strongly. There are encouraging signs of a return to more

normalised volumes in Tankships and the Specialist Technical

division is trading in line with management's expectations. In

Marine Support, the ship-to-ship transfer market remains

challenging and is currently trading below our previous

expectations, however we are seeing further improvements in Marine

Contracting with recent wins in offshore wind projects at St.

Brieuc and Fécamp off the French coast and Sofia in the Dogger

Bank.

The Group has maintained its focus on managing net debt. As

anticipated, H1 will show a working capital outflow. This is

principally due to larger projects within the Specialist Technical

division moving towards milestones and invoicing in H2.

The Group continues to believe that it is on track to deliver

improved underlying operating profit* over that achieved in 2020,

with profits anticipated to be more weighted to the second half of

the year than historically. The new strategy announced today is

designed to begin realising the inherent potential of the Group for

this and future years.

Capital Markets Event

The event will include introductory remarks from Angus Cockburn,

Chairman, and presentations from Eoghan O'Lionaird, Chief Executive

Officer; Duncan Kennedy, Chief Financial Officer; Robin Stopford,

Group Head of Corporate Development; together with the business

leaders of JFD, James Fisher Marine Contracting and Fendercare.

James Fisher's new strategy aims to refocus the Group and

reinforce its competitive advantages to deliver value to all

stakeholders. It will do this by:

-- embarking on a purpose-led and values driven journey to drive

internal alignment and engagement;

-- bringing stakeholders into the heart of the Company to create

an intrinsically sustainable business and improving all areas of

ESG;

-- upgrading leadership talent, enabling effective decision making where it counts;

-- driving operational excellence through a divisional

structure, improving control and governance;

-- embedding a new capital allocation process and risk management culture;

-- advancing project management and commercial excellence processes across the whole Group; and

-- refocusing the portfolio on niche sectors within its chosen

markets, addressing underperforming assets and businesses and

accelerating investments into responsible energy transition.

The new strategy will focus on:

-- growing a portfolio of niche businesses with leading market

positions and strong barriers to entry;

-- maintaining focus on attractive and growing segments in marine, energy and defence markets;

-- reinforcing internal processes to support sustainable organic

growth, margin expansion and increased shareholder returns; and

-- engaging the Group's wider stakeholder group for mutual benefit.

Further, the Group's capital allocation policy will be to:

-- invest in driving sustainable profitable growth;

-- increase exposure to energy transition;

-- reduce leverage - in the short term through the sale of non-core assets; and

-- reintroduce a progressive and sustainable dividend policy at the right time.

Medium term financial targets

It is expected that the Group's financial framework and capital

allocation policy will achieve:

-- underlying operating margin* above 10%;

-- ROCE** above 15%;

-- net debt / EBITDA leverage of between 1.0 - 2.0x.

Eoghan O'Lionaird, Chief Executive Officer, commented:

"Today, James Fisher's Board and executive management team is

setting out its Purpose 'to pioneer safe and trusted solutions to

complex problems in harsh environments, to create a sustainable

future'. We are excited about our new holistic and purpose-led

strategic direction, which encompasses all stakeholders and will

create an intrinsically sustainable business.

"We have reset our strategy to reinforce our strengths and

realise our full potential. This strategy leverages the Group's

fundamental strengths in marine services, with a renewed focus on

driving better future performance and returns for all stakeholders.

Our goal is to improve the quality of our business by focusing on

structurally growing markets, improving operating margins and

returns, and sustainably delivering enhanced value for all our

stakeholders."

The virtual event will begin at 2.00pm and will be made

available on the Group's website www.james-fisher.com as soon as

practicable after the event.

For further information regarding the event, please contact

Becky West at FTI Consulting - becky.west@fticonsulting.com

Contacts

Eoghan O'Lionaird, Chief Executive

Officer

James Fisher and Duncan Kennedy, Chief Financial 01229 615

Sons plc Officer 400

Richard Mountain / Susanne

FTI Consulting Yule 020 3727 1000

* Underlying operating profit is defined as operating profit

before separately disclosed items, which comprise: acquisition

related income and expense (amortisation or impairment of acquired

intangible assets, acquisition expenses, adjustments to contingent

consideration), the costs of a material restructuring, litigation,

or asset impairment and the profit or loss relating to the sale of

businesses. Underlying operating profit margin is defined as

underlying operating profit divided by revenue.

** ROCE, is defined as underlying operating profit, less

notional tax, calculated by multiplying the effective tax rate by

the underlying operating profit, divided by average capital

employed. Capital employed is defined as net assets less

right-of-use assets, less cash and short-term deposits and after

adding back borrowings. Average capital employed is adjusted for

the timing of businesses acquired and after adding back cumulative

amortisation of customer relationships.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSEEFWAEFSEIM

(END) Dow Jones Newswires

June 29, 2021 02:00 ET (06:00 GMT)

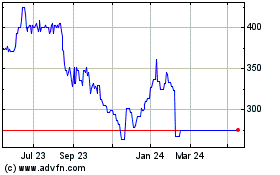

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024