TIDMEDEN

RNS Number : 5376E

Eden Research plc

28 February 2020

28 February 2020

Eden Research Plc

("Eden" or "Company")

Placing, Subscription & Open Offer

Eden Research plc (AIM: EDEN), the AIM-quoted company that

develops and supplies breakthrough biopesticide products and

natural microencapsulation technologies to the global crop

protection, animal health and consumer products industries, today

announces that it has conditionally raised GBP10.1 million (before

expenses) by way of a Placing and Subscription of new Ordinary

Shares at the Issue Price of 6p per share to certain institutional

and other investors. Furthermore, to enable other Shareholders not

able to participate in the Placing an opportunity to subscribe for

additional Ordinary Shares, the Company is proposing to raise up to

an additional GBP0.5 million (before expenses) by way of an Open

Offer made to Qualifying Shareholders of up to 8,287,573 new

Ordinary Shares at the Issue Price.

Eden is currently the only UK-quoted company focused on

biopesticides for sustainable agriculture and is well positioned to

capitalise on the rapidly growing biopesticides market, which is

projected to be worth over GBP10 billion by 2025. The Company

expects to apply the net proceeds of the Fundraise to advance the

development, registration and commercialisation of new key product

categories, including new insecticide formulations and seed

treatments.

Transaction Highlights

-- Placing of 151,666,834 new Ordinary Shares at the Issue Price

with new and existing investors to raise GBP9.1 million (before

expenses)

-- Subscription for 16,666,500 new Ordinary Shares by Sipcam

Oxon S.p.A. at the Issue Price to raise in aggregate GBP1.0 million

(before expenses)

-- Open Offer to Qualifying Shareholders at the Issue Price to

raise up to an additional GBP0.5 million (before expenses)

-- The Directors intend to use the net proceeds from the Fundraise for the following purposes:

o c. GBP6.0 million to develop and commercialise the Company's

first insecticide products and seed treatments; and

o c. GBP2.0 million to develop use of Sustaine ä with

traditional agrochemicals; and

o c. GBP2.0 million to expand the Company's product portfolio in

seed treatments, broad-acre crops and the home and garden

market.

The Company will shortly be posting a Notice of General Meeting

and an accompanying circular (the "Circular") to existing

shareholders following this announcement. All relevant documents

will be available to download at https://www.edenresearch.com/

.

Sean Smith, Chief Executive Officer of Eden, said :

"Eden has been making good progress with the commercialisation

of our products and technologies. As momentum continues to build,

we remain focussed upon providing sustainable solutions for global

agriculture. Furthermore, we are eager to accelerate the

commercialisation of new products for new categories including

insecticides and seed treatments. Now is the right time to invest

and capitalise on the opportunities in our pipeline. We have a

clear ambition to be a global leader in sustainable chemistry, and

this fundraise will allow us to enter new and significant markets

from a position of strength.

The outlook for the biopesticides market is undoubtedly

positive, with a clear demand from a growing consumer market for

sustainably grown produce and a notable shift towards greener

farming practices. Eden's biopesticide solutions combine high

levels of efficacy that are comparable to synthetic pesticides and

are aligned with the direction of regulatory travel, which has seen

restrictions and, in some cases, the removal of conventional

products from the market."

Introduction

The Company announces a proposed Placing, Subscription and Open

Offer, pursuant to which it proposes to raise, subject to certain

conditions (i) GBP10.1 million (before expenses) by the conditional

Placing and Subscription of 168,333,334 new Ordinary Shares at the

Issue Price to certain institutional and other investors including

Sipcam; and (ii) up to approximately GBP0.5 million (before

expenses) by way of an Open Offer made to Qualifying Shareholders

of up to 8,287,573 new Ordinary Shares at the Issue Price.

The net proceeds of the Placing, Subscription and Open Offer

will be used to advance the development, registration and

commercialisation of new product categories, including new

insecticide formulations and seed treatments, as well as to provide

additional working capital for the Group associated with the new

development areas, as described in more detail in this

announcement. The Placing, Subscription and Open Offer are

conditional (amongst other things) upon the Company obtaining

approval from its Shareholders to disapply statutory pre-emption

rights and to grant the Board authority to allot and issue the New

Ordinary Shares. The Issue Price equates to a discount of 23.9 per

cent to the closing middle market price of 7.88 pence per Ordinary

Share on 27 February 2020 (being the last Business Day before

publication of this Announcement).

Background to and rationale for the Fundraise

The Company's vision is to become the leader in sustainable

bioactive products and the Board believes Eden is well positioned

to capitalise on the global shift towards more environmentally

friendly methods of crop protection, as demonstrated by the

European Chemicals Agency's proposed EU-wide restriction on the use

of intentionally added microplastic particles. Eden is currently

the only UK-quoted company focused on biopesticides for sustainable

agriculture. Eden develops and supplies innovative biopesticide

products to the global crop protection market, using the Company's

patented microencapsulation technology, Sustaine ä . Sustaine ä

microcapsules are naturally sourced, plastic-free, biodegradable

micro-spheres derived from yeast extract. Importantly, the Sustaine

ä microencapsulation technology enables the technical viability of

naturally occurring terpenes for use in commercial crop

protection.

The Company is pursuing the Fundraise to continue to drive

commercial progress and to build the foundations for the next stage

of its development in significant markets. The Company intends to

use the net proceeds from the Fundraise to (i) register and

commercialise the Company's first insecticide product, (ii) develop

the use of Sustaine ä with conventional agrochemicals, (iii) expand

the Company's product portfolio and (iv) to capitalise on

opportunities arising from its relationship with Corteva

Agriscience.

Market Opportunity for Biopesticides

While the use of effective pesticides has been fundamental to

the farming revolution over the last 100 years, governments and

consumers have increasingly begun to acknowledge the risk to the

environment and human health posed by conventional pesticides. This

has led to the banning or restriction (especially in Europe) of

some common pesticides such as Neonicotinoids and

Chlorothalonil.

This has subsequently increased the use of biopesticides and, as

a result, the biopesticides market is growing at a CAGR of

approximately 15% per annum and is projected to be worth more than

$10 billion by 2025.

Eden's biopesticide solutions solve a number of the issues of

conventional pesticides. Using plant derived active ingredients

that are generally accepted as safe by regulators around the world

means that the products are not subject to residue limits, long

per-harvest intervals and can be used as a post-harvest treatments,

subject to regulatory approval.

In addition, the Company's yeast based Sustaine(TM)

encapsulation technology allows Eden's products and conventional

pesticides to be used without the presence of plastics. There are

currently global concerns regarding the volume of micro-plastics in

the environment and the impact their presence has on human health

and wildlife. In response, there have been new regulations proposed

which could restrict the intentional addition of plastic to

pesticides, which has created a need for the major pesticide

producers to actively look for alternative approaches to

encapsulation of existing chemical treatments. These restrictions

mean that the time and cost of bringing new agrochemical products

to market has increased to around 10 to 12 years and approximately

$300 million.

From a broader perspective, concerns regarding the impact on

human health of pesticides has increased the consumer appetite for

organic products and encouraged regulators to put stricter controls

around spraying of crops and residue limits.

Another advantage of Eden's proposition is that its three

EU-registered active ingredients, geraniol, eugenol and thymol,

were all approved for use in organic farming in January 2020,

following inclusion in the EU's Organic Production Regulation.

Entry into the organic farming arena opens up new commercial

opportunities for the Company and is relevant to all products that

utilise the Company's three EU-registered active ingredients. In

2017, Organic farming covered 12.6 million hectares of agricultural

land in the EU Member States, equivalent to 7% of the total

utilised agricultural area. Between 2012-2017, land assigned for

organic growing within these Member States increased by 25%. In two

of the Company's key territories, Italy and Spain, the share of

organic production totals 15.2% and 9.3% respectively.

Eden's Current Products and Technology

Sustaine ä - Microencapsulation Technology

Eden proposes to use part of the proceeds to actively develop

formulations with traditional chemical products using its Sustaine

ä microencapsulation technology. Following the Fundraise, it plans

to undertake trials to demonstrate the range of benefits that

Sustaine ä offers to potential partners.

By 2025 in the EU, pesticides containing synthetic polymer

microplastics are likely to be severely restricted or banned

entirely and removed from the market. The Directors believe that

the only acceptable alternative is the substitution with

biodegradable formulations. Reformulated products will likely need

to be evaluated and registered within the five-year transition

period.

Eden has developed a natural formulation technology,

Sustaine(TM) using particles derived from natural yeast cells. The

technology was originally developed as a drug delivery method for

human health applications before Eden adapted it for use in the

encapsulation of pesticides. By creating a stabilised aqueous

emulsion, Sustaine ä enables the formulation of pesticides using a

number of terpene based active ingredients which would not be

functional without being encapsulated. The encapsulation provides

for the sustained release of these ingredients when in contact with

water and closing once dry, enabling their safe, more efficient

use. The benefit of Sustaine ä is that it is cost effective, useful

for a wide range of active ingredients, plastic-free, high

capacity, robust, sustainable and facilitates reduced

phytotoxicity.

Sustaine ä is a proven and viable solution to the microplastics

problem in formulations requiring encapsulation. Even before the EU

regulation of microplastics, the Company has a small number of

projects underway where it is testing the compatibility of Sustaine

ä with third-party active ingredients to determine whether benefits

such as formulation stability, dose reduction or resistance

management could be achieved. However, the new, proposed

restriction of microplastic particles may open up a further,

significant opportunity for Eden to deploy its Sustaine ä

technology on a very large scale.

Mevalone ä - Fungicide Product

Eden's first biopesticide, Mevalone ä , is a fungicide used in

the prevention and treatment of botrytis in table and wine grapes,

as well as the control of powdery mildew on grapevines and, in

certain territories, the treatment of botrytis on a range of crops

ranging from kiwis to onions.

During 2016, Mevalone ä was approved and distribution was in

place to cover four southern European countries and Kenya. The

first commercial sales of Mevalone ä were made in the same year in

Kenya, Greece, Italy and Spain. Approval in France for table and

wine grapes followed in 2017. During 2018, the Company initiated

the approval process for Mevalone ä and the three associated active

substances (terpenes) with the US Environmental Protection Agency

(EPA) and currently expects to receive approval during 2020. It is

also currently undergoing the regulatory approval process in a

number of additional countries, including key wine growing regions

Australia and New Zealand.

In 2019, Mevalone ä received an emergency use authorisation in

France for the treatment of postharvest storage diseases on apples.

Over one third of apples produced in France go into storage, and it

is under storage conditions that a number of diseases can develop.

It has been demonstrated that Mevalone ä , when applied shortly

before harvest, is effective at combating storage diseases and that

the product provided a solution that met the requirements of

growers where there is a lack of suitable commercially available

alternatives.

The Company currently has distribution agreements for Mevalone ä

with Sipcam and Sumi Agro for the major territories. A full list of

the regulatory approvals for Mevalone ä can be found in the

Appendix to the Chairman's letter.

Cedroz ä - Nematicide Product

In addition to Mevalone ä , Eden has developed a nematicide

product which is used to tackle nematode infestations which can

damage crops and affect yield. Nematodes are parasites that affect

a wide range of crops grown in open fields and in greenhouses.

In 2016, Eden signed an exclusive distribution agreement with

Eastman Chemical for the nematicide product which has since been

branded Cedroz ä . Eastman acquired the rights to register and sell

Cedroz ä in 29 countries. Cedroz ä recently received its first

zonal approval from Malta in February 2019 and was granted approval

for emergency use in Italy in April 2019. It has since been

approved in Belgium and Mexico. Additional applications for Cedroz

ä have been made for certain larger markets such as Italy, Spain

and France. The Company also submitted an application for

registration to the EPA in the US in 2018. A full list of the

regulatory approvals for Cedroz ä can be found in the Appendix to

the Chairman's letter.

The Corteva Agreement

The Fundraise will allow the Company to capitalise on

opportunities arising from its relationship with Corteva

Agriscience. Eden signed an exclusive evaluation agreement with

Corteva Agriscience, the world's fourth largest agriculture input

company, in January 2020 . Significantly for Eden, regulatory

change led to the withdrawal of one of Corteva Agriscience's key

seed treatment in the EU. Initial trials by Corteva Agriscience

have shown strong results using Eden's products and formulation

technology. Eden's formulation technology has been shown to be

stable, environmentally friendly and complies with emerging EU

regulations concerning polymers.

Further trials will be undertaken under a one-year evaluation

agreement and, subject to the results, Corteva Agriscience and Eden

will look to sign a distribution agreement for the EU, Russia,

Ukraine and Turkey giving Eden the opportunity to capture a

significant share of this market. The Directors estimate that, if

successful, there is the opportunity to generate up to c. EUR40

million of revenue for Eden from European geographies alone

(current market) from this product.

Insecticide Opportunity

The Company intends to use a proportion of the proceeds to

pursue the registration and commercialisation of its first

insecticide product. The funding will enable a more efficient and

concurrent approach to registration as the Company will be able to

run efficacy trials in parallel, rather than in sequence, which are

necessary for regulatory product authorisations around the world.

By funding these trials directly, it is expected that Eden will be

able to fully control and ultimately commercially leverage its

intellectual property and product authorisations. The Company may

seek to appoint local distributors where appropriate, thereby

optimising and significantly simplifying the value chain resulting

in margin expansion.

The insecticide product will be an addition to the Company's

current suite of products, and follows an assessment of various new

product development opportunities, one of which addresses

significant unmet needs in the agrochemical insecticide market.

Using a combination of Eden's active ingredients, which are

registered in the EU already, and various co-formulants, Eden has

developed an effective insecticide product with good activity

against multiple key insect pests including whitefly, aphids,

thrips and mites, as proven in a number of Good Experimental

Practice standard field trials undertaken by well-known Contract

Research Organisations.

The Company has identified this market as having a strong need

for an effective alternative to conventional insecticides due to

strong consumer and regulatory pressure driven by persistence,

bio-accumulation, toxicity and susceptibility to resistance. To

open this significant market opportunity for Eden, the Company will

need to complete a number of further efficacy and safety trials in

target markets. The initial investment will target the highest

value markets such as mites in the highest value crops (citrus,

tree fruit and grapes).

Estimated Market Sizes

(EURm) Mites Whitefly Thrips Aphids Total

----------------------- -------- --------- ------- -------- --------

US EUR159m EUR5m EUR59m EUR107m EUR330m

Europe (incl. Turkey) EUR147m EUR97m EUR85m EUR192m EUR521m

Company estimates

Product Portfolio Expansion

For some time, the Company has been aware of potential

commercial opportunities in seed treatments and broad-acre crops.

To date, investment in developing products for these areas of

application has been limited due to general resource constraints.

However, given the success that the Company has seen with the

commercialisation of its existing products, it now wishes to

expedite development of these additional product areas.

The funds will be used to undertake laboratory screening,

formulation work and pot/field trials. This should, where

successful, allow Eden to bring these products to a stage where

they can be registered and commercialised through the Company's

distribution channels.

Company Strategy

The Company's near-term focus is to maximize the opportunity for

sales of its two approved products, Mevalone ä and Cedroz ä , the

use of Sustaine ä with third party active ingredients, the

exploitation of seed treatment opportunities with Corteva

Agriscience and the development of its insecticide product. The

Company continues to explore additional business line

diversification including ongoing work with Bayer Animal Health, as

well as potential for consumer product launches. In addition, the

Company will seek to expand the crops and diseases treated by its

products and will look to undertake further geographic

diversification (seasonal and climatic variation).

Use of Proceeds

The Directors intend to use the net proceeds from the

Fundraising of up to GBP10.0 million for the following

purposes:

-- GBP6.0 million to develop and commercialise the Company's

first insecticide product and seed treatments;

-- GBP2.0 million to develop use of Sustaine ä with traditional agrochemicals; and

-- GBP2.0 million to expand the Company's product portfolio in

seed treatments, broad-acre crops and the home and garden.

Current Trading and Prospects

On 14 January 2020, the Company provided a trading update for

the year ended 31 December 2019. The Company reported that revenue

for the year is expected to be approximately GBP2.0 million (2018:

GBP2.8 million) and operating loss for the year will be

approximately GBP1.4 million (2018: loss of GBP0.5 million), in

line with market expectations. The Company confirmed that GBP1.7

million of the GBP2.0 million of revenue was derived from product

sales (2018: GBP1.6 million), achieved despite unfavourable growing

conditions in the Southern EU, with milestone and upfront payments

making up the balance.

The well-publicised hot and dry growing conditions across

southern Europe during the peak 2019 growing season negatively

impacted the development of Botrytis and this resulted in

botryticide usage generally being impacted. Despite the resulting

overall contraction of the botryticide market, product sales

revenue increased as a whole compared to the previous year.

During 2020, the Company expects to build on the sales achieved

in the territories where it had approvals during 2019 as well as

seeing further sales from the territories where it announced new

approvals at the end of last year (Belgium and Mexico). In

addition, the Company expects to see sales arising from new

approvals for Cedroz ä in Spain, Italy, France, Belgium, the

Netherlands and the United Kingdom where the applications for

registrations have now been outstanding from the early part of 2019

and the constituent active ingredients are already approved.

The Company also currently expects approval during 2020 of

Mevalone ä and Cedroz ä from the EPA so that the products can be

sold into the United States. However, these will constitute

entirely new approvals and timing is harder to predict. Although

the Company might expect to see some level of channel stocking, the

overall levels of sales will depend in part on the timing during

the year when the approvals come through in relation to the growing

season.

Directors' participation, appointment rights and LTIP

Directors' participation in the Placing

As part of the Fundraise, certain Directors and their connected

persons intend to subscribe (either personally or through a

nominee) for an aggregate of 416,500 Placing Shares at the Issue

Price. Details of the Placing Shares for which the Directors intend

to subscribe (either personally or through a nominee) are displayed

below:

Number Value of

of Placing Placing

Shares Shares

Number intended intended

of existing to be to be

Ordinary subscribed subscribed

Name Title Shares(#) for(#) for(#)

Chief Executive

Sean Smith Officer 433,393 183,333 GBP 11,000

Chief Financial

Alex Abrey Officer 1,152,824 150,000 GBP9,000

Robin Cridland Non-Executive Director 47,000 83,167 GBP 4,990

# The number of Ordinary Shares presented in this table as being

held or subscribed for by Directors refers to the number of

Ordinary Shares held or subscribed for by them either personally or

through a nominee.

LTIP

It is proposed that, following First Admission and Second

Admission, the Company will implement a new long term incentive

plan (LTIP) to award the performance of the executive management

team. The new LTIP would replace the Company's existing LTIP, and

is deemed a more appropriate scheme to incentivise management given

the Company's stage of development. Pursuant to the new LTIP, the

Company will grant options over 10.5 million new Ordinary Shares in

Eden, at a strike price of 6p each, in the amounts of 6 million

awarded to Sean Smith and 4.5 million awarded to Alex Abrey. The

options will vest immediately and will lapse in three equal

tranches in June 2022, June 2023 and June 2024. For the first five

years following the grant of options, no shares arising from the

exercise of these options may be sold unless the Company's

prevailing share price is equal to or in excess of 10p. The LTIP

will include a net cashless mechanism whereby a number of shares

may be deducted from the participant's option pool upon exercise,

equivalent to half the exercise cost based on the prevailing market

price of Eden's Ordinary Shares, and provided the remaining

exercise cost is paid in cash. The shares arising from exercise of

options shall be subject to a one-year lock-in restriction,

followed by a one-year orderly market restriction. Further details

of the LTIP will be announced following First Admission and Second

Admission once formally implemented.

Director appointment right

As part of their placing participation of 58,333,000 Placing

Shares (amounting to approximately GBP3.5 million), BGF has been

granted the right to appoint a director to the board of the Company

for as long as it retains a minimum interest of five per cent. of

the issued share capital of the Company.

Details of the Placing and the Subscription

Eden is proposing to raise GBP9.1 million (before expenses)

pursuant to the Placing. The Placing has conditionally raised a

total of approximately GBP5.2 million through the placing of the

EIS/VCT Placing Shares and a total of approximately GBP3.9 million

through the placing of the General Placing Shares. Admission of the

Ordinary Shares to trading on AIM will occur over two Business Days

to assist investors in the EIS/VCT Placing Shares to claim certain

tax reliefs available to EIS and VCT investors.

Subject to, inter alia, the passing of the Resolutions at the

General Meeting, the EIS/VCT Placing Shares are expected to be

admitted to trading on or around on 19 March 2020, being one

Business Day prior to admission to trading on AIM of the General

Placing Shares and Subscription Shares, which are expected to be

admitted to trading on AIM or around 20 March 2020 . The allotment

of the EIS/VCT Placing Shares will be conditional on First

Admission occurring. The allotment of the General Placing Shares

will be conditional on Second Admission occurring. Shareholders and

potential investors should be aware of the possibility that the

First Admission and Second Admission may not occur.

Although the Company currently expects to satisfy the relevant

conditions for EIS/VCT Placing Shares, and the Directors are not

aware of any subsequent change in the qualifying conditions or the

Company's circumstances that would prevent the EIS/VCT Placing

Shares from being eligible for EIS and VCT investments on this

occasion, neither the Directors nor the Company, nor Cenkos, nor

any of their respective directors, officers, employees, affiliates

or advisers give any warranty or undertaking or other assurance

that relief will be available in respect of any investment in the

EIS/VCT Placing Shares, nor do they warrant or undertake or

otherwise give any assurance that the Company will conduct its

activities in a way that qualifies for or preserves its status.

As the rules governing EIS and VCT reliefs are complex and

interrelated with other legislation, if Shareholders, or other

potential investors, are in any doubt as to their tax position,

require more detailed information, or are subject to tax in a

jurisdiction other than the United Kingdom, they should consult

their professional adviser.

In addition, Eden has entered into a conditional Subscription

Agreement with Sipcam, one of its commercial partners, pursuant to

which Sipcam will subscribe for 16,666,500 new Ordinary Shares

conditional on passing the resolutions at the General Meeting and

Second Admission. The Issue Price of 6 pence per share equates to a

discount of 23.8 per cent. to the closing price of 7.88 pence on 27

February 2020, the latest Business Day prior to publication of this

announcement.

The Placing Shares and Subscription Shares will represent

approximately 44 per cent. of the Enlarged Share Capital (on the

assumption that the maximum number of Placing Shares and

Subscription Shares are issued pursuant to the Placing and

Subscription and that the Open Offer is fully subscribed). The New

Ordinary Shares will, following each of the First Admission and the

Second Admission, rank in full for all dividends and distributions

declared, made or paid in respect of the issued Ordinary Share

capital of the Company after the date of their respective issue and

will otherwise rank equally in all other respects with the Existing

Ordinary Shares.

The Placing and Open Offer Agreement

Pursuant to the terms of the Placing and Open Offer Agreement,

Cenkos Securities has conditionally agreed to use its reasonable

endeavours, as agent for the Company, to place the Placing Shares

with certain institutional and other investors. The Placing, the

Subscription and the Open Offer have not been underwritten.

The Placing and Open Offer Agreement is conditional upon, inter

alia:

-- Resolutions 1 and 2 being passed without amendment at the General Meeting;

-- compliance by the Company in all material respects with its

obligations under the Placing Agreement; and

-- with respect to the issue of the General Placing Shares only,

Second Admission becoming effective by not later than 8.00 a.m. on

20 March 2020 (or such later date as is agreed between the Company

and Cenkos, being not later than 8.00 a.m. on the Long Stop

Date).

The Placing and Open Offer Agreement contains warranties from

the Company in favour of Cenkos Securities in relation to, inter

alia, the accuracy of the information in this announcement and

other matters relating to the Group and its business. In addition,

the Company has agreed to indemnify Cenkos Securities in relation

to certain liabilities it may incur in respect of the Fundraise.

Cenkos has the right to terminate the Placing and Open Offer

Agreement in certain circumstances prior to First Admission and/or

Second Admission, in particular, in the event of a breach of the

warranties given to Cenkos in the Placing and Open Offer Agreement,

the failure of the Company to comply in any material respect with

its obligations under the Placing and Open Offer Agreement, the

occurrence of a force majeure event or a material adverse change

affecting the condition, or the earnings, management business,

affairs, solvency or prospects of the Group as a whole.

Details of the Open Offer

Eden is proposing to raise up to approximately GBP0.5 million

(before expenses) pursuant to the Open Offer. The Issue Price per

Open Offer Share equates to a discount of 23.9 per cent. to the

closing price of 7.88 pence on 27 February 2020, the latest

Business Day prior to publication of this announcement. All

Qualifying Shareholders are being given the opportunity to

participate in the Open Offer.

The Open Offer provides Qualifying Shareholders with the

opportunity to apply to acquire Open Offer Shares at the Issue

Price pro rata to their holdings of Existing Ordinary Shares as at

the Record Date on the following basis:

1 Open Offer Share for every 25 Existing Ordinary Shares

Entitlements to apply to acquire Open Offer Shares will be

rounded down to the nearest whole number and any fractional

entitlement to Open Offer Shares will be disregarded in calculating

the Basic Entitlement. Qualifying Shareholders who do not take up

their Basic Entitlements in full will experience a dilution to

their interests of approximately 43.86 per cent. following Second

Admission (assuming full subscription under the Placing,

Subscription and the Open Offer).

Qualifying Shareholders should note that the Open Offer Shares

have neither been placed under the Placing subject to clawback

under the Open Offer nor have they been underwritten, and that

neither the Placing nor the Subscription is conditional upon the

number of applications received under the Open Offer.

Further details of the Open Offer and the application process

relating to the Open Offer are set out in the Circular.

General Meeting

The Directors do not currently have authority to allot all of

the New Ordinary Shares and, accordingly, the Board is seeking the

approval of Shareholders to allot the New Ordinary Shares at the

General Meeting.

A notice convening the General Meeting, which is to be held at

the offices of DAC Beachcroft LLP, 25 Walbrook, London EC4N 8AF at

11.00 a.m. on 18 March 2020, will be set out at the end of the

Circular. At the General Meeting, the following Resolutions will be

proposed:

-- Resolution 1, which is an ordinary resolution, to authorise

the Directors to allot relevant securities for cash up to an

aggregate nominal amount of GBP1,766,209 being equal to 176,620,907

New Ordinary Shares (i.e. the maximum number of New Ordinary Shares

available under the Placing, Subscription and Open Offer); and

-- Resolution 2, which is conditional on the passing of

Resolution 1 and is a special resolution, to authorise the

Directors to allot 176,620,907 New Ordinary Shares for cash

pursuant to the Placing, Subscription and Open Offer on a

non-pre-emptive basis.

The authorities to be granted pursuant to the Resolutions will

expire on whichever is the earlier of (a) the conclusion of the

next Annual General Meeting of the Company; and (b) the date

falling six months from the date of the passing of the Resolutions

(unless renewed, varied or revoked by the Company prior to or on

that date) and shall be in addition to the Directors' authorities

to allot relevant securities and dis-apply statutory pre-emption

rights granted at the Company's Annual General Meeting held on 14

May 2019.

For the purposes of section 571(6)(c) of the Act, the Directors

determined the Issue Price after consideration of applicable market

and other considerations and having taken appropriate professional

advice.

Shareholders will find accompanying the Circular a Form of Proxy

for use in connection with the General Meeting. The Form of Proxy

should be completed and returned in accordance with the

instructions thereon so as to be received by Link Asset Services,

The Registry, 34 Beckenham Road, Beckenham, Kent, BR3 4TU, as soon

as possible and in any event not later than two Business Days

before the time of the General Meeting. Completion and return of

the Form of Proxy will not prevent a Shareholder from attending and

voting at the General Meeting.

Recommendation

The Directors believe the Placing, Subscription and the Open

Offer and the passing of the Resolutions to be in the best

interests of the Company and its Shareholders as a whole.

Accordingly, the Directors unanimously recommend Shareholders to

vote in favour of the Resolutions as they intend so to do in

respect of their beneficial shareholdings amounting to 1,991,717

Ordinary Shares, representing approximately 1 per cent. of the

existing issued ordinary share capital of the Company.

As the Placing and Subscription and Open Offer are conditional,

inter alia, upon the passing by Shareholders of the Resolutions at

the General Meeting, Shareholders should be aware that, if the

Resolutions are not passed and First Admission and Second Admission

do not take place, the proceeds of the Placing and Subscription

will not be received by the Company. In addition, the Open Offer

will not proceed. Whilst the Company has sufficient working capital

on its current business plan to fund its operations for the next 12

months, it is expected to remain loss making in the near term as it

funds the development and commercialisation of new products. If the

proceeds of the Fundraising are not received, the Company would

need to pursue additional or alternative funding sources in the

next 12 months. There would be no certainty of the terms under

which alternative financing would be made available or at all.

DEFINITIONS

Act the Companies Act 2006 (as amended)

AIM the market of that name operated by the London

Stock Exchange

AIM Rules the AIM Rules for Companies published by the

London Stock Exchange from time to time

Application Form the application form relating to the Open Offer

which accompanies the Circular (in the case

of Qualifying Non-CREST Shareholders only)

Basic Entitlement the number of Open Offer Shares which Qualifying

Shareholders are entitled to subscribe for

at the Issue Price pro rata to their holding

of Existing Ordinary Shares pursuant to the

Open Offer as described in Part III of the

Circular

Business Day a day (other than a Saturday or Sunday) on

which commercial banks are open for general

business in London, England

Cenkos or Cenkos Securities Cenkos Securities plc

certificated form or an Ordinary Share recorded on a company's share

in register as being

certificated form held in certificated form (namely, not in CREST)

Company or Eden Eden Research plc, a company incorporated and

registered in England and Wales under the Companies

Act 2006 with registered number 03071324

CREST the relevant system (as defined in the CREST

Regulations) in respect of which Euroclear

is the operator (as defined in those regulations)

CREST Manual the rules governing the operation of CREST,

consisting of the CREST Reference Manual, CREST

International Manual, CREST Central Counterparty

Service Manual, CREST Rules, Registrars Service

Standards, Settlement Discipline Rules, CREST

Courier and Sorting Services Manual, Daily

Timetable, CREST Application Procedures and

CREST Glossary of Terms (all as defined in

the CREST Glossary of Terms promulgated by

Euroclear on 15 July 1996 and as amended since)

as published by Euroclear

CREST member a person who has been admitted to CREST as

a system-member (as defined in the CREST Manual)

CREST member account the identification code or number attached

ID to a member account in CREST

CREST participant a person who is, in relation to CREST, a system-participant

(as defined in the CREST regulations)

CREST participant ID shall have the meaning given in the CREST Manual

issued by Euroclear

CREST payment shall have the meaning given in the CREST Manual

issued by Euroclear

CREST Regulations the Uncertificated Securities Regulations 2001

(SI 2001/3755) (as amended)

CREST sponsor a CREST participant admitted to CREST as a

CREST sponsor

CREST sponsored member a CREST member admitted to CREST as a sponsored

member

Dealing Day a day on which the London Stock Exchange is

open for business in London

Directors or Board the directors of the Company whose names are

set out in the Circular, or any duly authorised

committee thereof

EIS enterprise investment scheme

EIS/VCT Placing the Placing Shares to be issued under the Placing

and either (i) in respect of which EIS relief

is to be claimed; or (ii) constituting a qualifying

holding for VCT purposes

EIS/VCT Placing Shares the 86,182,500 new Ordinary Shares to be issued

and allotted to the Placees pursuant to the

EIS/VCT Placing

Enlarged Share Capital the entire issued share capital of the Company

following completion of the Placing, Subscription

and Open Offer following First Admission and

Second Admission

EU the European Union

Euroclear Euroclear UK & Ireland Limited, the operator

of CREST

Excess Application Facility to the extent that Basic Entitlements to Open

Offer Shares are not subscribed for by Qualifying

Shareholders in full, such Open Offer Shares

will be available to satisfy excess applications,

subject to a maximum of 8,287,573 Open Offer

Shares in aggregate, as described in Part III

of the Circular

Excess CREST Open Offer in respect of each Qualifying CREST Shareholder

Entitlement who has taken up his Basic Entitlement in full,

the entitlement to apply for Open Offer Shares

in addition to his Basic Entitlement credited

to his stock account in CREST, pursuant to

the Excess Application Facility, which may

be subject to scaling back in accordance with

the provisions of the Circular

Excess Entitlements the entitlement for Qualifying Shareholders

to apply to acquire any number of Open Offer

Shares subject to the limit on applications

under the Excess Application Facility, as described

in Part III of the Circular

Excess Shares Open Offer Shares applied for by Qualifying

Shareholders in accordance with the Excess

Application Facility

Ex-entitlement Date the date on which the Existing Ordinary Shares

are marked "ex" for entitlement under the Open

Offer, being 2 March 2020

Existing Ordinary Shares the 207,189,337 Ordinary Shares in issue at

the date of this announcement, all of which

are admitted to trading on AIM

FCA the UK Financial Conduct Authority

FDA the US Food and Drug Administration

First Admission the admission to trading on AIM of the EIS/VCT

Placing Shares

Form of Proxy the form of proxy for use in connection with

the General Meeting which accompanies the Circular

FSMA the Financial Services and Markets Act 2000

(as amended)

Fundraise the Placing, Subscription and the Open Offer

General Meeting the general meeting of the Company to be held

at the offices of DAC Beachcroft LLP, 25 Walbrook,

London EC4N 8AF at 11.00 a.m. on 18 March 2020

(or any adjournment of that general meeting),

notice of which is set out at the end of the

Circular

General Placing the General Placing Shares to be issued under

the Placing other than (i) in respect of which

EIS relief is to be claimed; or (ii) constituting

a qualifying holding for VCT purposes

General Placing Shares the 65,484,334 New Ordinary Shares to be issued

and allotted to the Placees pursuant to the

General Placing and which do not constitute

EIS/VCT Shares

Group the Company and its subsidiaries

HMRC Her Majesty's Revenue and Customs (which shall

include its predecessors, the Inland Revenue

and HM Customs and Excise)

ISIN International Securities Identification Number

Issue Price 6 pence per Placing Share, Subscription Share

and per Open Offer Share

Link Asset Services a trading name of Link Market Services Limited

or Link

London Stock Exchange London Stock Exchange plc

Long Stop Date 2 April 2020

Money Laundering Regulations The Money Laundering, Terrorist Financing and

Transfer of Funds (Information on the Payer)

Regulations 2017, the Criminal Justice Act

1993 and the Proceeds of Crime Act 2002

New Ordinary Shares together, the Placing Shares, the Subscription

Shares and the Open Offer Shares

Notice of General Meeting the notice convening the General Meeting which

is set out at the end of the Circular

Open Offer the conditional invitation made to Qualifying

Shareholders to apply to subscribe for the

Open Offer Shares at the Issue Price on the

terms and subject to the conditions set out

in Part III of the Circular and, where relevant,

in the Application Form

Open Offer Entitlement the entitlement of Qualifying Shareholders

to subscribe for Open Offer Shares allocated

to Qualifying Shareholders on the Record Date

pursuant to the Open Offer

Open Offer Shares up to 8,287,573 new Ordinary Shares being made

available to Qualifying Shareholders pursuant

to the Open Offer

Ordinary Shares ordinary shares of GBP0.01 each in the capital

of the Company

Overseas Shareholders a Shareholder with a registered address outside

the United Kingdom

Placee the subscribers for the Placing Shares pursuant

to the Placing

Placing the EIS/VCT Placing and General Placing

Placing Shares the EIS/VCT Placing Shares and the General

Placing Shares

Prospectus Regulation the EU Prospectus Regulation (Regulation (EU)

2017/1129) in relation to offers of securities

to the public and the admission of securities

to trading on a regulated market

Qualifying CREST Shareholders Qualifying Shareholders holding Existing Ordinary

Shares in a CREST account

Qualifying Non-CREST Qualifying Shareholders holding Existing Ordinary

Shareholders Shares in certificated form

Qualifying Shareholders holders of Existing Ordinary Shares on the

register of members of the Company at the Record

Date (but excluding any Overseas Shareholder

who has a registered address in the United

States or any other Restricted Jurisdiction)

Receiving Agents Link Asset Services

Record Date 6.00 p.m. on 27 February 2020 in respect of

the entitlements of Qualifying Shareholders

under the Open Offer

Regulatory Information has the meaning given in the AIM Rules for

Service Companies

Resolutions the resolutions set out in the Notice of General

Meeting

Restricted Jurisdiction each and any of Australia, Canada, Japan, New

Zealand, the Republic of South Africa or the

United States and any other jurisdiction where

the Offer would breach any applicable law or

regulations

Second Admission the admission to trading on AIM of the General

Placing Shares

Shareholders holders of Ordinary Shares

Sipcam S.I.P.C.A.M. Societa Italiana Prodotti Chimici

per l'Agricoltura Milano S.P.A.

Subscription the Subscription by Sipcam for the Subscription

Shares

Subscription Shares the 16,666,500 new Ordinary Shares to be subscribed

pursuant to the Subscription

UK or United Kingdom the United Kingdom of Great Britain and Northern

Ireland

Uncertificated or Uncertificated recorded on the relevant register or other

form record of the shares or other security concerned

as being held in uncertificated form in CREST,

and title to which, by virtue of the CREST

Regulations, may be transferred by means of

CREST

US Person has the meaning given in the United States

Securities Act 1933 (as amended)

VCT Venture Capital Trust

voting rights means all voting rights attributable to the

share capital of the Company which are currently

exercisable at a general meeting

GBP and p United Kingdom pounds sterling and pence respectively,

the lawful currency of the United Kingdom

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Record Date for the Open Offer 6.00 p.m. on 27 February

2020

Announcement of the Placing, Subscription 28 February

and the Open Offer, 2020

Publication and posting of the Circular, 2 March 2020

Form of Proxy and to Qualifying Non-CREST

shareholders only, the Application Form

Existing Ordinary Shares marked "ex" 8.00 a.m. on 2 March 2020

by the London Stock Exchange

Open Offer Entitlements and Excess Open 3 March 2020

Offer Entitlements credited to stock

accounts in CREST of Qualifying CREST

Shareholders

Recommended latest time and date for 4.30 p.m. on 11 March 2020

requesting withdrawal of Open Offer Entitlements

from CREST

Latest time and date for depositing Open 3.00 p.m. on 12 March 2020

Offer Entitlements and Excess CREST Open

Offer Entitlements in CREST

Latest time and date for splitting Application 3.00 p.m. on 13 March 2020

Forms (to satisfy bona fide market claims

only)

Latest time and date for receipt of completed 11.00 a.m. 16 March 2020

Forms of Proxy on

Record time and date for entitlement Close of business 16 March 2020

to vote at the General Meeting on

Latest time and date for receipt of completed 11.00 a.m. 17 March 2020

Application Forms and payment in full on

under the Open Offer or settlement of

relevant CREST instruction (as appropriate)

General Meeting 11.00 a.m. 18 March 2020

on

Announcement of result of General Meeting 18 March 2020

and the Open Offer

First Admission and commencement of dealings 8.00 a.m. on 19 March 2020

in the EIS/VCT Shares on AIM

Second Admission and commencement of 8.00 a.m. on 20 March 2020

dealings in the General Placing Shares,

the Subscription Shares and the Open

Offer Shares on AIM

New Ordinary Shares credited to CREST 19 March 2020

members' accounts in respect of the EIS/VCT

Shares

New Ordinary Shares credited to CREST 20 March 2020

members' accounts in respect of General

Placing Shares, the Subscription Shares

and the Open Offer Shares

Despatch of definitive share certificates by 26 March 2020

in certificated form

APPIX

Mevalone ä Regulatory Approval Log

Mevalone Registration Crops Regulatory Estimated Distributor

ä Territory Details position Market size

(EURm)

-------------------- ----------------------- ---------------- --------------- ---------------

France Apples, Apples Emergency 0.5 Sumi Agro

storage use approval

diseases

-------------------- ----------------------- ---------------- --------------- ---------------

France Botrytis Table grapes, Approved 51.7 Sumi Agro

in field Wine Grapes

-------------------- ----------------------- ---------------- --------------- ---------------

Malta Botrytis Table Grape, Approved <0.5 Sipcam

in field Wine grape

-------------------- ----------------------- ---------------- --------------- ---------------

Bulgaria Botrytis Table Grape, Approved 1.1 KNE Certis

in Field Wine grape

-------------------- ----------------------- ---------------- --------------- ---------------

Cyprus Botrytis Table Grape, Approved <0.5 KNE / Coststas

in field Wine grape Christodoulou

-------------------- ----------------------- ---------------- --------------- ---------------

Cyprus Minor Use Aubergine, Approved <0.5 KNE / Coststas

- Botrytis Kiwi, Pomegranate, Christodoulou

in field Spring onion

and glasshouse

-------------------- ----------------------- ---------------- --------------- ---------------

Portugal Botrytis Table Grape, Approved 1.2 Sipcam

in field Wine grape

-------------------- ----------------------- ---------------- --------------- ---------------

Italy Botrytis Table grape Approved 30.5 Sipcam

in open and Wine

field grape

-------------------- ----------------------- ---------------- --------------- ---------------

Italy Emergency Kiwi Emergency <0.5 Sipcam

Use Authorisations authorization

- botrytis period from

in field 18 June 2019

to 15 October

2019

-------------------- ----------------------- ---------------- --------------- ---------------

Italy Emergency STRAWBERRY Emergency 19.5 Sipcam

Use Authorisations AND SMALL authorization

- botrytis FRUITS (blackberries, period from

in field wild blackberries, 8 April 2019

and glasshouse raspberries, to 5 August

blueberries, 2019 (2)

American

giant blueberries,

currants,

gooseberries,

rose hips,

mulberries,

blueberries,

elderberries,

other berries)

-------------------- ----------------------- ---------------- --------------- ---------------

Italy Emergency Pomegranate Emergency <0.5 Sipcam

Use Authorisations authorization

- botrytis period from

in field 8 April 2019

to 5 August

2019 (2)

-------------------- ----------------------- ---------------- --------------- ---------------

Kenya Botrytis Squash, French Approved <0.5 Lachlan

in field Beans

and glasshouse

-------------------- ----------------------- ---------------- --------------- ---------------

Kenya Powdery Roses, Snow Approved 2.8 Lachlan

mildew and Peas

botrytis

in field

and glasshouse

-------------------- ----------------------- ---------------- --------------- ---------------

Spain Botrytis Table grape Approved 14.0 Sipcam

and control and wine

of powdery grapes

mildew

-------------------- ----------------------- ---------------- --------------- ---------------

Greece, Botrytis Table grapes, Approved 3.7 Efthymiadis

Balkans in field wine grapes

and glasshouse

-------------------- ----------------------- ---------------- --------------- ---------------

Greece, Minor Use Aubergines, Approved 5.4 Efthymiadis

Balkans - Botrytis kiwis, pomegranates

in field and spring

and glasshouse onions.

-------------------- ----------------------- ---------------- --------------- ---------------

FYROM Botrytis Table grapes, Approved <0.5 Efthymiadis

in field wine grapes

-------------------- ----------------------- ---------------- --------------- ---------------

FYROM Minor Use Aubergines, Approved <0.5 Efthymiadis

- Botrytis kiwis, pomegranates

in field and spring

and glasshouse onions.

-------------------- ----------------------- ---------------- --------------- ---------------

Albania Botrytis Table grapes, Approved <0.5 Efthymiadis

in field wine grapes

-------------------- ----------------------- ---------------- --------------- ---------------

Albania Minor Use Aubergines, Approved <0.5 Efthymiadis

- Botrytis kiwis, pomegranates

in field and spring

and glasshouse onions.

-------------------- ----------------------- ---------------- --------------- ---------------

Australia Botrytis Grapes Submitted <0.5 Sipcam

in field

-------------------- ----------------------- ---------------- --------------- ---------------

New Zealand Botrytis Grapes TBC 6.9 Sipcam

in field

-------------------- ----------------------- ---------------- --------------- ---------------

United States Botrytis Grapes Submitted 12.6 Eastman

in field to EPA

-------------------- ----------------------- ---------------- --------------- ---------------

Benelux Botrytis Grapes Dossier being Grape <0.5 Sipcam

in field finalised Other crops

for submission - 4.9

in 2020

-------------------- ----------------------- ---------------- --------------- ---------------

Germany Fungicide Grapes and Dossier being Grape Botrytis SumiAgro

and Poland for grapes Apples finalised - 14.0

and three and treatment for submission Apples -

other central of storage in 2020 0.1

European diseases

markets on apples

-------------------- ----------------------- ---------------- --------------- ---------------

Serbia Botrytis Table grape Submitted <0.5 KNE Certis

in field and wine 2019

grapes

-------------------- ----------------------- ---------------- --------------- ---------------

Romania Botrytis Table grape Submitted 1.3 KNE Certis

in field and wine 2019

grapes

-------------------- ----------------------- ---------------- --------------- ---------------

Cedroz ä Regulatory Approval Log

Cedroz Registration Crops Regulatory Estimated Distributor

ä details position Market

Territory size (EURm)

----------------- ------------------------------- ---------------- ------------- ------------

Malta Nematodes in cucurbitaceous Approved <0.5 Eastman

open fields and (cucumbers,

glasshouse for courgettes,

wide range of melons, pumpkins,

crops watermelons),

fruiting vegetables

(aubergine,

pepper, sweet

pepper, chili,

pepino), strawberries

----------------- ------------------------------- ---------------- ------------- ------------

Mexico Nematodes in Tomatoes, potato, Approved 4.8 Eastman

open fields and pepper, eggplant,

glasshouse for melon, watermelon,

wide range of cucumber, pumpkin,

crops chayote squash

----------------- ------------------------------- ---------------- ------------- ------------

Belgium Nematodes in strawberries Approved <0.5 Eastman

greenhouses for (production

wide range of field), strawberries

crops (selection

and multiplication

field), tomatoes,

bell pepper,

Spanish pepper,

aubergine/eggplant

and pepino,

cucumber, courgette/patisson,

melon, pumpkin

----------------- ------------------------------- ---------------- ------------- ------------

Italy Nematodes open tomato, peppers, Emergency 30.6 Eastman

field and in eggplant, chili, Approval

greenhouses melon, watermelon,

pumpkin, cucumber,

courgette,

strawberries

----------------- ------------------------------- ---------------- ------------- ------------

Spain Nematodes open tomato, peppers, Submitted 14.4 Eastman

fields and in eggplant, chili, and Pending

greenhouses melon, watermelon,

pumpkin, cucumber,

courgette,

strawberries

----------------- ------------------------------- ---------------- ------------- ------------

USA Nematodes open Fruiting Vegetables: Submitted 83.0 Eastman

fields and in Eggplant, Okra, and Pending

greenhouses Pepper, Tomato

Cucurbit

Vegetables:

Cantaloupe,

Cucumber, Muskmelon,

Pumpkin, Squash,

Watermelon,

Zucchini

----------------- ------------------------------- ---------------- ------------- ------------

United Nematodes in tomato, (sweet) Submitted <0.5 Eastman

Kingdom greenhouses. peppers, eggplant, and Pending

chili, pepino,

melon, pumpkin,

cucumber, courgette,

strawberries

----------------- ------------------------------- ---------------- ------------- ------------

Netherlands Nematodes in strawberries, Submitted 0.6 Eastman

greenhouses. Cucurbitaceae and pending

(edible peel), (decision

Cucurbitaceae expected

(not edible imminently)

peel), Solanaceae

----------------- ------------------------------- ---------------- ------------- ------------

France Nematodes in tomato, peppers, Submitted 5.0 Eastman

greenhouses eggplant, chili, and Pending

melon, pumpkin,

cucumber, courgette,

strawberries

----------------- ------------------------------- ---------------- ------------- ------------

Greece Nematodes open tomato, peppers, Dossier 3.2 Eastman

fields and in eggplant, chili, prepared

greenhouses melon, watermelon,

pumpkin, cucumber,

courgette,

strawberries

----------------- ------------------------------- ---------------- ------------- ------------

Portugal Nematodes open tomato, peppers, Dossier 1.9 Eastman

fields and in eggplant, chili, submitted

greenhouses melon, watermelon, and pending

pumpkin, cucumber,

courgette,

strawberries

----------------- ------------------------------- ---------------- ------------- ------------

Morocco Nematodes open tomato, peppers, In progress 6.3 Eastman

fields and in eggplant, chili,

greenhouses melon, watermelon,

pumpkin, cucumber,

courgette,

strawberries,

(raspberry

and green bean)

----------------- ------------------------------- ---------------- ------------- ------------

Costa Rica Nematodes open tomato, melon, Trials 0.4 Eastman

fields potato, peppers done. Dossier

being prepared

----------------- ------------------------------- ---------------- ------------- ------------

Guatemala, Nematodes open tomato, melon, In progress 0.9 Eastman

fields potato, peppers

----------------- ------------------------------- ---------------- ------------- ------------

Honduras Nematodes open tomato, melon, In progress <0.5 Eastman

fields potato, peppers

----------------- ------------------------------- ---------------- ------------- ------------

Israel Nematodes open Multiple, TBC In progress TBC Eastman

fields

----------------- ------------------------------- ---------------- ------------- ------------

The information contained within this announcement (the

"Announcement") is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014. Upon the publication of this Announcement via

Regulatory Information Service, this inside information is now

considered to be in the public domain.

For further information contact:

Eden Research plc www.edenresearch.com

Sean Smith

Alex Abrey 01285 359 555

Cenkos Securities (Nominated advisor and

broker)

Giles Balleny / Cameron MacRitchie (corporate

finance)

Michael Johnson (sales) 020 7397 8900

Hawthorn Advisors (Financial PR)

Lorna Cobbett eden@hawthornadvisors.com

Jana Tsiligiannis

Notes:

Eden Research is an AIM quoted company that develops and

supplies breakthrough biopesticide products and natural

microencapsulation technologies to the global crop protection,

animal health and consumer products industries

Eden's Sustaine encapsulation technology harnesses the biocidal

efficacy of naturally occurring chemicals produced by plants

(terpenes) and can be used with both natural and synthetic

compounds to enhance their performance and ease-of-use.

Sustaine microcapsules are naturally derived, plastic-free,

biodegradable micro-spheres derived from yeast extract. They

produce stabilised aqueous suspensions which, are easy to mix and

apply, have phased release patterns, are safer for the environment

and the crops themselves.

The European Chemicals Agency (ECHA) has proposed an EU-wide

restriction on the placing on the market or use of

"intentionally-added" microplastic particles. The proposed

restriction includes the use of microplastics for agricultural and

horticultural purposes, including polymers utilized for

controlled-release fertilizers, encapsulated plant protection

products (PPPs), seed coatings, and biocides.

By 2025 in the EU, pesticides containing synthetic polymer

microplastics are likely to be banned and removed from the market.

The only acceptable alternative is the substitution with

biodegradable formulations. Reformulated products will need to be

evaluated and registered within the five-year transition

period.

Sustaine is one of the only viable, proven and immediately

registerable solutions to the microplastics problem in formulations

requiring encapsulation.

Historically, terpenes have had limited commercial use in the

agrochemical sector due to their volatility, phytotoxicity and poor

solubility. Sustaine provides a unique, environmentally friendly

solution to these problems and enables terpenes to be used as

effective, low-risk agrochemicals.

Eden is developing these technologies through innovative

research and a series of commercial production, marketing and

distribution partnerships.

The Company has a number of patents and a pipeline of products

at differing stages of development targeting specific areas of the

global agrochemicals industry. To date, the Company has invested in

the region of GBP14m in developing and protecting its intellectual

property and seeking regulatory approval for products that rely

upon the Company's technologies. Revenues earned by the Company

have been modest whilst the Company has concentrated on securing

patent protection for its intellectual property, gaining regulatory

approvals, identifying suitable industrial partners, and entering

into commercial agreements.

In May 2013, the three actives that comprise Eden's first

commercial product, Mevalone, were approved as new ingredients for

use in plant protection products by the European Commission ("EC").

This represented a major milestone in the commercialisation of

Eden's technology and is a significant accomplishment for any

company. To illustrate this point, one should note that in 2013,

Eden's approvals represented 3 of only 10 new active ingredients

approved by the EC.

Mevalone is a foliar fungicide which has been authorised for

sale in Kenya, Malta, Greece, Bulgaria,

Spain, Italy, France, Cyprus, Albania, Portugal and

Macedonia.

Cedroz is a nematicide which has been authorised for sale in

Malta, Belgium and Mexico.

Eden was admitted to trading on AIM on 11 May 2012 and trades

under the symbol EDEN.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOESESFDAESSEDE

(END) Dow Jones Newswires

February 28, 2020 08:35 ET (13:35 GMT)

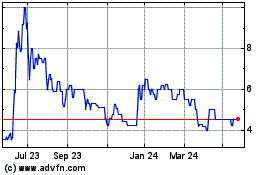

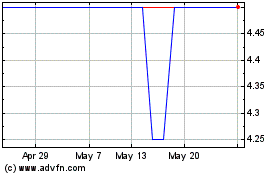

Eden Research (AQSE:EDEN.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eden Research (AQSE:EDEN.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024