TIDMBZT

RNS Number : 1918T

Bezant Resources PLC

23 November 2021

23 November 2021

Bezant Resources Plc

("Bezant" or the "Company")

Funding Facility

Bezant (AIM: BZT), the copper-gold exploration and development

company, is pleased to announce that the Company has yesterday

entered into an unsecured convertible loan funding facility (the

"Facility") for GBP1,000,000 with Sanderson Capital Partners Ltd

(the "Lender"), a long term shareholder in the Company, which is

convertible on fixed conversion terms at increasing prices of 0.19

pence per share, 0.225 pence per share and 0.25 pence per share

over three tranches. The Facility is a standby facility as a

potential additional source of working capital for the Company in a

period when 18 months on COVID-19 is still with us and the funding

market for junior exploration companies can be subject to market

volatility. The Company can use the Facility, at its discretion, to

fund the working capital requirements of the Company and its

subsidiaries as determined by the Company but is not required to

drawdown under the Facility.

Colin Bird, Executive Chairman said :

"The ongoing effects of COVID-19 around the world are still

unknown as whilst the U.K. has celebrated "freedom day" and life is

back towards normal Covid cases are again increasing and are at

around 38,000 a day the Covid news from European neighbours like

Netherlands, Austria and Germany is worrying and suggests we are

entering into new lockdowns in Europe which previously have been

followed by U.K. restrictions and lockdowns. On the vaccination

front the speed of vaccination development has been impressive as

have the vaccination programs in many developed countries but there

are still large swathes of Africa, Asia and South America were

vaccination rates are very low and vaccinations in short

supply.

At the corporate level it has reminded us that the unknown risk

is around the corner and it is against this background that the

Board has decided to put in place the Facility as insurance to

ensure the Company has the ability to obtain funding. The Facility

enables the Company to drawdown up to GBP1 million over the next 12

months in a staged manner with fixed conversion prices at

approximately 45%, 70% and 90% premiums to the placing price of

0.13 pence per share to the GBP1.2m placing announced on 21 October

2021. The Company is not obliged to make any drawdowns under the

Facility, and drawdowns can be used at its discretion to fund the

working capital requirements of the Company and its subsidiaries.

The Facility arrangement fee will be settled in new Shares

representing approximately 1 per cent. of the current issued share

capital. As a shareholder I prefer to avoid dilution but as

Chairman I know part of my role is to ensure that the Company has

access to sufficient working capital to develop its projects and

this is why we have arranged this loan facility as security against

uncertain times".

Working Capital Facility Agreement

Bezant has signed today an agreement with the Lender for a

facility of GBP1,000,000. The Facility is unsecured,

interest free and can be drawn down in three tranches as follows

-- GBP350,000 to be drawn down from 1 January 2022 or within 6

months of 1 January 2022 ("Loan Tranche 1");

-- GBP350,000 to be drawn down from 1 March 2022 or within 6

months of 1 March 2022 ("Loan Tranche 2"); and

-- GBP300,000 to be drawn down from 1 May 2022 or within 6

months of 1 May 2022 ("Loan Tranche 3").

The Company will provide a Loan drawdown notice if and when it

requires a drawdown. The Company has the option but not the

obligation to drawdown on part or all of the Facility. The Company

must use the funds advanced under the Facility to fund the working

capital requirements of the Company and its subsidiaries as

determined by the Company at its sole discretion.

Repayment and Conversion

Repayment

Unless otherwise converted, the Company must repay each Loan

Tranche on the first anniversary of the advance by the Lender of

the applicable Loan Tranche for each Tranche ("Maturity Date"). The

Company may prepay the whole or part of the Facility on any day

prior to the Maturity Date for a Loan Tranche upon giving not less

than 14 days' prior written notice to the Lender and paying in cash

a prepayment fee of 5% of the amount which the Borrower prepays in

cash before the Maturity Date. The Lender can during the 14 days'

notice period make an election for all or part of the Loan subject

to a prepayment notice to be repaid in Shares in which case the 5%

fee shall not apply to that proportion of the Loan repaid in

Shares.

Conversion of Loan Tranche by Lender

The Lender may at any time during the Facility Period elect to

convert all or part of any drawn down amount into such number of

new Bezant Ordinary Shares of GBP0.00002 each ("Shares") equal to

the amount of the Loan Tranche that is to be repaid at the date of

the election, divided by the agreed and fixed conversion price for

the relevant Loan Tranche (the "Conversion Shares"). The conversion

prices applicable to each of the tranches ("Conversion Prices") are

fixed and as follows:

-- 0.19 pence per Share for Loan Tranche 1;

-- 0.225 pence per Share for Loan Tranche 2; and

-- 0.25 pence per Share for Loan Tranche 3.

The closing share price on 22 November 2021 the latest

practicable date prior to this announcement was 0.17 pence per

Share and the placing price of the GBP1.2M placing announced on 21

October 2021 was 0.13 pence per Share.

Conversion of Loan by the Borrower

The Company may at any time during the Loan Period elect to

convert all or part of a Loan Tranche if the share price exceeds

0.35 pence for a period of five or more business days.

Interest and Fees

The Loan is interest free. The Lender shall be paid an

arrangement fee of 7% of the amount of the Facility to be settled

by the issue of 50,000,000 new Shares ("Facility Fee Shares")

credited as fully paid at an issue price of 0.14 p per Share (being

the lower of the Five Day VWAP of 0.155 pence on the date of

signing the Facility and 0.14 pence per Share).

On the drawdown of any Loan Tranche the Lender shall be paid a

further fee of 2% of the amount of the relevant Loan Tranche which

is to be settled by the issue of new Shares credited as fully paid

at the f ive -d ay VWAP on the date of the relevant Loan d rawdown

n otice .

Shareholding restriction

In the event that conversion of all or part of a Loan Tranche

into Conversion Shares would result in the Lender, its associates

and any person(s) acting in concert with the Lender owning more

than 20% of the issued share capital of the Company as enlarged by

the issue of the Conversion Shares (the "Shareholding Limit")

then:

-- The Company must convert any portion of the Loan and issue

such number of Conversion Shares to the Lender that would not

constitute a breach of the Shareholding Limit; and

-- in respect of the portion of the Loan repayment not converted

(the "Unconverted Portion"), the Borrower must pay the Lender the

Unconverted Portion in cash on or before the Maturity Date.

No short selling

The Lender has confirmed that neither the Lender nor its

associates will short sell the Company's Shares from the date of

the Facility agreement until the later of:

-- six months from Loan Tranche Three drawdown date; and

-- the repayment of the Loan.

Admission to AIM

Application will be made for the 50,000,000 Facility Fee Shares,

which will rank pari passu in all respects with the Company's

existing Shares, to be admitted to trading on AIM (" Admission ").

The Admission is expected to become effective on or around 29

November 2021. The Facility Fee Shares will represent 1% of the

Company's issued share capital as enlarged by the issue of the

Facility Fee Shares.

Total Voting Rights

On Admission of the New Shares, the Company will have

4,913,028,538 Ordinary Shares in issue with voting rights. Bezant

does not currently hold any shares in treasury. Accordingly, this

figure of 4,913,028,538 Ordinary Shares may be used by shareholders

in the Company as the denominator for the calculations by which

they will determine if they are required to notify their interest

in, or a change in their interest in, the share capital of the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

Warrants

On the drawdown of any Loan Tranche, the Lender shall be issued

three year warrants over Shares with a face value at the warrant

exercise price equal to 50% of the amount drawn down under the Loan

Tranche. The exercise price for the warrants applicable to each of

the tranches are as follows:

-- 0.25 pence per share for the drawdown of Tranche 1;

-- 0.30 pence per share for the drawdown of Tranche 2; and

-- 0.32 pence per share for the drawdown of Tranche 3.

If there are no drawdown's under two or more of the Loan

Tranches then on 1 November 2022 which is 6 months after the Loan

Tranche Three Drawdown Date of 1 May 2022 the Company will issue a

three year warrant to the Lender for an amount equal to 25% of the

Working Capital Facility Amount that has not been drawndown with an

exercise price of 0.32 pence per share.

Further AIM Disclosures

On 24 January 2020, the Company announced it was notified that

the ultimate beneficial holder of the 239,000,000 shares in the

Company, then representing 18.82% of the Company's issue share

capital as reported in the Form TR-1 submitted by Tavira Securities

Ltd, as announced on 6 January 2020 was Sanderson Capital Partners

Ltd. Sanderson Capital Partners Ltd have confirmed that they and

associates current hold 186,469,231 shares in the Company

representing 3.8% of the Company's current issued share capital.

Following the issue of the 50,000,000 Facility Fee Shares,

Sanderson will be interested in 236,469,231 Shares representing

4.81% of the Company's enlarged issued share capital on

Admission.

For further information, please contact:

Bezant Resources Plc

Colin Bird Executive Chairman +44 (0) 20 3416 3695

Beaumont Cornish (Nominated Adviser)

Roland Cornish +44 (0) 20 7628 3396

Novum Securities Limited (Broker)

Jon Belliss +44 (0) 20 7399 9400

or visit http://www.bezantresources.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBCBDBBDDDGBD

(END) Dow Jones Newswires

November 23, 2021 02:00 ET (07:00 GMT)

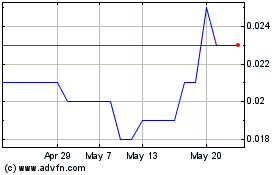

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

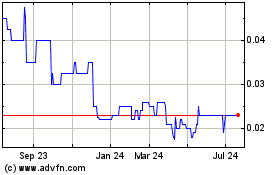

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025