TIDMADB

RNS Number : 0046I

Adnams PLC

12 April 2022

Adnams plc Results for the 12 Months to 31 December 2021

Adnams, the brewer, distiller and retailer has today published

its Report & Accounts for the 12 months to 31 December 2021,

showing sales of GBP57.4m and a GBP0.9m operating loss.

Commenting on 2021, Jonathan Adnams OBE, Chairman said: "Once

again, I was delighted to see how our customers adapted to multiple

changes to government restrictions as the year progressed and

people enjoyed our pubs and hotels with good cheer and a generosity

of spirit towards our frontline colleagues. The loyalty and support

of our customers throughout the pandemic has been vital and I would

like to take this opportunity to record my heartfelt thanks to

them".

The Adnams Report & Accounts headlines include:

-- Sales grew from 2020 to GBP57.4m

-- Beer volumes level with 2020

-- Net bank debt GBP11m

-- Positive EBITDA of GBP2.6m

-- No 2021 final dividend

After the early months of the year where restrictions were at

their most stringent, trading months operated ahead of

expectations, delivering GBP7m higher revenues than 2020. Strong

cost control and investment in our IT systems technology, enabled

the business to mitigate the financial impact of the pandemic and

position us well for 2022.

We won a number of awards in the year, including:

-- CAMRA awarded Adnams with a Golden Pints Award to mark their 50(th) Anniversary

-- Worlds Whiskies Awards: Gold for Rye Whisky - Best English

Rye Whisky, Silver for Single Malt Whisky and Bronze for Triple

Malt Whisky

-- International Beer Challenge Kobold English Lager won Gold

And launched various new products with an ESG theme:

-- Smidgin, part of our low and no offering, a gin that is

strong in flavour and so only a tiny measure is needed. 8 Smidgins

contains the alcohol content of one normal G&T

-- In-store refill stations offer the opportunity to purchase a

range of Adnams products in a refillable container

-- Wine in a box containing the equivalent to 3 bottles, their

carbon footprint is around 10 times smaller than a single-use

bottle due to their reduced weight

Ghost Ship in both 4.5% and 0.5% formats continued as the

company's best-selling beer and Copper House Dry Gin remained its

best-selling spirit.

Chairmans Statement (from accounts released on 12 April

2022)

When I sat down to write this statement it gave me the

opportunity to reflect on what a tumultuous two years the company

and the wider hospitality industry has faced. As we begin to move

from the pandemic to coronavirus being endemic and hopefully

subsiding within the population, we can look forward to things

returning to some normality. From Adnams' perspective that

normality includes being able to welcome our shareholders to our

AGM at Snape on the 12th May 2022, an event we look forward to.

The year began with the country in lockdown and the hospitality

industry closed. This meant that the company had to continue to

operate on a footing very similar to that which it operated for

much of 2020, namely: focusing on its online and off-trade business

and seeking to retain cash in the business. Whilst this situation

is very uncomfortable and incurs losses, the business has become

highly competent at managing itself in this situation and adapting

rapidly to changing rules, regulations and restrictions. As the

darker winter months gave way to an optimism associated with the

spring, on the 22nd February the Prime Minister announced his

roadmap to reopening the economy.

Key dates for our industry were; 12th April, when pubs were

allowed to open for outdoor service only, 17th May, when customers

were allowed inside following the rule of 6 or two households

mixing; and finally from 21st June all restrictions being removed.

The announcement was followed by the Budget speech on 3rd of March

where the Chancellor extended flexi-furlough until September and

announced a tapering of business rate relief together with VAT

remaining at 5% for a period before stepping up to 12.5%. As with

2020, support from HM Treasury was essential for hospitality

businesses the length and breadth of the country, with Adnams being

no exception. In 2020 we were closed or operating under restriction

for 280 days, in 2021 that number reduced to 220 days.

In 2021, the business generated turnover of GBP58m, an EBITDA of

GBP2.6m and an operating loss of GBP0.9m. Net debt at GBP11m

increased in line with expectations over the previous year as we

paid down prior year HMRC commitments, restocked following closure,

undertook maintenance in our pubs and reduced government support as

we reopened. Given large parts of the business were closed or

operating under restrictions for 31 weeks of the year this is

considered a creditable performance. The company traded well and

was cash generative once restrictions really began to be removed

from 17th May. The business undoubtedly benefited from foreign

travel restrictions and was well positioned to take advantage of

more people choosing to holiday in the UK. Beer and spirit volumes

in the on-trade took longer to re-establish themselves as free

trade customers and pubcos were understandably cautious about

overstocking whilst there was still uncertainty related to the

pandemic and the potential for further restrictions to be imposed.

Beer and spirits volumes remained largely flat with 2020 and relate

to similar trading patterns in both years.

Our development of technology has enabled us to control costs

well in the year and the premium nature of the Adnams brand has

enabled us to improve profit margins. Given the strong trading

position throughout the summer and our confidence in the Adnams

brand, the Board decided in January 2022 to pay an interim dividend

to reward shareholders who have loyally supported the company

through the pandemic. As the company continues to recover from the

crisis and rebuild its balance sheet, this payment should be viewed

as a one-off. Whilst the company wants to return quickly to a more

normal cycle of paying a final and interim dividend, it cannot yet

be precise around when this might happen although the Board will

keep the situation under continual review.

Concurrent with paying the interim dividend, the company is

repaying staff who took reductions in pay during the pandemic. I am

proud to say that the company is also a living wage employer, as

the cost of living crises disproportionately affects those on lower

pay. Our belief is that, in addition to being entirely the right

thing to do, paying the living wage creates a virtuous circle with

our colleagues demonstrating greater loyalty and commitment to

Adnams over the long term.

Once again, I was delighted to see how our customers adapted to

multiple changes to government restrictions as the year progressed

and people enjoyed our pubs and hotels with good cheer and a

generosity of spirit towards our frontline colleagues. The loyalty

and support of our customers throughout the pandemic has been vital

and I would like to take this opportunity to record my heartfelt

thanks to them. It was 1872 when my great grandfather Ernest and

his brother George made their way across southern England, arriving

in Southwold to found the modern-day Adnams. 2022 therefore

represents our 150th anniversary. Added to this, Broadside is 50

years old and we celebrate 30 years of our relationship with

Bitburger.

All this in the Platinum Jubilee year for Her Majesty The Queen,

meaning there is much to look forward to. We plan a number of

events throughout the year and, as you would expect, some

celebratory products. All of this will be communicated more fully

on our website as the year progresses, so watch this space.

As we moved into 2022 we were looking forward to the future with

optimism. However, as I write this statement, a dramatic event is

unfolding in Ukraine which besides being a catalyst for a

humanitarian crisis has the potential to disrupt commodity markets

around the world. Our thoughts are with the Ukrainian people at

this time and Adnams will do what it can to support agencies who

will be mobilising to provide relief to those affected. Returning

to the company, it has invested significantly in upgrading its back

office systems in the recent past and is implementing a greater

level of technology to serve our customers better. Early this year

we implemented a new checkout system in our stores that enables

colleagues to check out customers from anywhere in the store via a

mobile device; the system also integrates with our website and

enables us to have one view of the customer across the business. We

have also implemented a new website that enables us to improve the

user experience, share our stories and grow online sales still

further.

Throughout this whole uncertain period, Adnams values will guide

our response towards our customers, staff, shareholders and the

communities we operate within. Adnams aspires to be a model company

that can be relied upon to do the right thing and I hope we have

demonstrated that in 2021.

On behalf of the Board I would like to thank shareholders for

the continued support.

Jonathan Adnams OBE

Chairman

Adnams plc profit and loss account

For the year ended 31 December

2021 2020

GBP000 GBP000

--------- ---------

Turnover 57,368 50,661

--------- ---------

Other operating income 1,938 3,196

--------- ---------

Operating expenses (60,204) (57,599)

--------- ---------

Operating loss before highlighted items (898) (3,742)

--------- ---------

Highlighted items - operating expenses - (90)

--------- ---------

Operating loss (898) (3,832)

--------- ---------

Loss on disposal of assets (4) -

--------- ---------

Loss before interest and taxation (902) (3,832)

--------- ---------

Interest payable (352) (355)

--------- ---------

Other finance charge on pension scheme (134) (117)

--------- ---------

Loss before taxation (1,388) (4,304)

--------- ---------

Tax on loss on ordinary activities (254) 521

--------- ---------

Loss (1,642) (3,783)

--------- ---------

Earnings per share basic and diluted

--------- ---------

'A' Shares of 25p each (87.1)p (206.8)p

--------- ---------

'B' Shares of GBP1 each (348.3)p (827.2)p

--------- ---------

Balance sheet

As at 31 December

2021 2020

GBP000 GBP000

--------- ---------

Tangible fixed assets 38,913 40,816

--------- ---------

Current assets

--------- ---------

Stocks 9,779 8,719

--------- ---------

Debtors 4,202 3,562

--------- ---------

Cash at bank and in hand 1 435

--------- ---------

13,982 12,716

--------- ---------

Creditors: amounts falling due within

one year (13,439) (11,923)

--------- ---------

Net current assets 543 793

--------- ---------

Total assets less current liabilities 39,456 41,609

--------- ---------

Creditors: amounts falling due after

more than one year (9,867) (10,199)

--------- ---------

Provision for liabilities (623) -

--------- ---------

(10,490) (10,199)

--------- ---------

Net assets excluding pension liability 28,966 31,410

--------- ---------

Pension liability (4,988) (11,198)

--------- ---------

Net assets including pension liability 23,978 20,212

--------- ---------

Capital and reserves

--------- ---------

Called-up share capital 472 472

--------- ---------

Share premium 144 144

--------- ---------

Profit and loss account 23,362 19,596

--------- ---------

Equity shareholders' funds 23,978 20,212

--------- ---------

The Directors have not recommended a final dividend for the

financial year ending 31 December 2021, as was the case for

2020.

The information contained in the above profit and loss account

and balance sheet has been extracted from the audited accounts of

Adnams PLC for the year ended 31 December 2021. The statement

preceding the profit and loss account is unaudited.

A trading update will be released on 12(th) May 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXFLFISSRILLIF

(END) Dow Jones Newswires

April 12, 2022 02:01 ET (06:01 GMT)

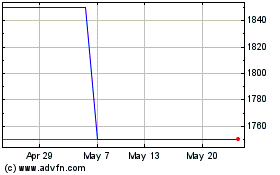

Adnams (AQSE:ADB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Adnams (AQSE:ADB)

Historical Stock Chart

From Feb 2024 to Feb 2025