0001823857

false

FY

0001823857

2022-01-01

2022-12-31

0001823857

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001823857

VHAQ:WarrantsMember

2022-01-01

2022-12-31

0001823857

VHAQ:UnitsMember

2022-01-01

2022-12-31

0001823857

us-gaap:RightsMember

2022-01-01

2022-12-31

0001823857

2022-06-30

0001823857

2023-08-22

0001823857

2022-12-31

0001823857

2021-12-31

0001823857

2021-01-01

2021-12-31

0001823857

us-gaap:CommonStockMember

2021-12-31

0001823857

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001823857

us-gaap:RetainedEarningsMember

2021-12-31

0001823857

us-gaap:CommonStockMember

2020-12-31

0001823857

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001823857

us-gaap:RetainedEarningsMember

2020-12-31

0001823857

2020-12-31

0001823857

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001823857

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001823857

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001823857

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001823857

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001823857

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001823857

us-gaap:CommonStockMember

2022-12-31

0001823857

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001823857

us-gaap:RetainedEarningsMember

2022-12-31

0001823857

us-gaap:IPOMember

VHAQ:PublicSharesMember

2020-12-28

2020-12-28

0001823857

us-gaap:IPOMember

VHAQ:PublicSharesMember

2020-12-28

0001823857

us-gaap:IPOMember

2020-12-28

2020-12-28

0001823857

us-gaap:IPOMember

VHAQ:PrivateWarrantsMember

2020-12-28

2020-12-28

0001823857

us-gaap:IPOMember

VHAQ:PrivateWarrantsMember

2020-12-28

0001823857

us-gaap:OverAllotmentOptionMember

2020-12-30

2020-12-30

0001823857

us-gaap:IPOMember

2022-01-01

2022-12-31

0001823857

us-gaap:IPOMember

2022-12-31

0001823857

2022-03-23

0001823857

2022-03-18

0001823857

2022-10-28

0001823857

2022-06-23

0001823857

2022-07-26

0001823857

2022-08-30

0001823857

2022-09-28

0001823857

2022-11-28

0001823857

2022-12-28

0001823857

srt:ScenarioForecastMember

2023-04-28

0001823857

srt:ScenarioForecastMember

2023-05-24

0001823857

us-gaap:SubsequentEventMember

2023-06-22

0001823857

us-gaap:SubsequentEventMember

2023-06-22

2023-06-22

0001823857

us-gaap:SubsequentEventMember

2023-06-27

0001823857

us-gaap:SubsequentEventMember

2023-07-27

0001823857

srt:MaximumMember

2022-07-13

2022-07-13

0001823857

srt:MinimumMember

2022-07-13

2022-07-13

0001823857

2022-07-13

2022-07-13

0001823857

2022-11-10

2022-11-10

0001823857

VHAQ:CleardayMember

us-gaap:SubsequentEventMember

2023-04-05

0001823857

VHAQ:CleardayMember

us-gaap:SubsequentEventMember

VHAQ:EarnoutSharesMember

2023-04-05

2023-04-05

0001823857

VHAQ:SeriesFCumulativeConvertiblePreferredStockMember

us-gaap:SubsequentEventMember

2023-04-05

0001823857

us-gaap:SubsequentEventMember

VHAQ:SeriesFCumulativeConvertiblePreferredStockMember

2023-04-05

2023-04-05

0001823857

VHAQ:SeriesACumulativeConvertiblePreferredStockMember

us-gaap:SubsequentEventMember

2023-04-05

0001823857

us-gaap:SubsequentEventMember

VHAQ:SeriesACumulativeConvertiblePreferredStockMember

2023-04-05

2023-04-05

0001823857

us-gaap:SubsequentEventMember

2023-04-05

0001823857

us-gaap:SubsequentEventMember

2023-04-05

2023-04-05

0001823857

us-gaap:SubsequentEventMember

VHAQ:CleardayMember

2023-04-05

2023-04-05

0001823857

us-gaap:SubsequentEventMember

VHAQ:NewMergerMember

2023-04-05

0001823857

us-gaap:SubsequentEventMember

VHAQ:ViveonEquityIncentivePlanMember

2023-04-05

0001823857

2022-08-16

0001823857

2022-11-25

0001823857

2022-03-27

0001823857

VHAQ:PublicWarrantsMember

2022-12-31

0001823857

VHAQ:PrivateWarrantsMember

2022-12-31

0001823857

VHAQ:RedeemableCommonStockMember

2022-01-01

2022-12-31

0001823857

VHAQ:NonRedeemableCommonStockMember

2022-01-01

2022-12-31

0001823857

VHAQ:RedeemableCommonStockMember

2021-01-01

2021-12-31

0001823857

VHAQ:NonRedeemableCommonStockMember

2021-01-01

2021-12-31

0001823857

us-gaap:IPOMember

2020-12-28

0001823857

2020-12-28

0001823857

us-gaap:PrivatePlacementMember

2022-12-31

0001823857

us-gaap:PrivatePlacementMember

2022-01-01

2022-12-31

0001823857

VHAQ:FounderSharesMember

2020-08-01

2020-08-31

0001823857

VHAQ:FounderSharesMember

2020-08-31

0001823857

VHAQ:FounderSharesMember

2020-12-01

2020-12-03

0001823857

VHAQ:FounderSharesMember

2020-12-21

2020-12-22

0001823857

us-gaap:OverAllotmentOptionMember

2020-12-21

2020-12-22

0001823857

VHAQ:FounderSharesMember

2020-12-30

2020-12-30

0001823857

VHAQ:FounderSharesMember

2022-01-01

2022-12-31

0001823857

VHAQ:FounderSharesMember

VHAQ:TransfereeMember

2020-12-23

2020-12-23

0001823857

2021-04-29

2021-04-30

0001823857

2021-04-30

0001823857

srt:ChiefFinancialOfficerMember

VHAQ:NoteAgreementsMember

2022-12-31

0001823857

srt:ChiefFinancialOfficerMember

VHAQ:PromissoryNoteMember

2022-12-26

2022-12-27

0001823857

VHAQ:PromissoryNoteMember

2022-12-31

0001823857

VHAQ:PromissoryNoteMember

2021-12-31

0001823857

srt:ChiefFinancialOfficerMember

VHAQ:PromissoryNoteMember

us-gaap:SubsequentEventMember

2023-01-01

2023-04-28

0001823857

srt:ChiefExecutiveOfficerMember

us-gaap:SubsequentEventMember

2023-04-02

2023-04-02

0001823857

srt:ChiefExecutiveOfficerMember

2022-12-31

0001823857

srt:ChiefExecutiveOfficerMember

2021-12-31

0001823857

VHAQ:ThreeInvestorsMember

us-gaap:SubsequentEventMember

2023-01-01

2023-04-07

0001823857

VHAQ:DipakVashirMember

2021-12-31

0001823857

VHAQ:UnsecuredSeniorPromissoryNoteAgreementsMember

2022-01-01

2022-12-31

0001823857

srt:ChiefFinancialOfficerMember

2022-12-31

0001823857

VHAQ:UnsecuredSeniorPromissoryNoteAgreementsMember

2022-12-31

0001823857

VHAQ:UnsecuredPromissoryNoteAgreementsMember

2022-12-31

0001823857

VHAQ:UnsecuredPromissoryNoteAgreementsMember

2022-01-01

2022-12-31

0001823857

us-gaap:SubsequentEventMember

VHAQ:SubscriptionWarrantsMember

2023-08-16

0001823857

us-gaap:WarrantMember

2022-03-21

2022-03-21

0001823857

us-gaap:WarrantMember

2022-03-23

2022-03-23

0001823857

us-gaap:WarrantMember

2022-04-04

2022-04-04

0001823857

us-gaap:WarrantMember

2022-04-27

2022-04-27

0001823857

us-gaap:WarrantMember

2022-05-09

2022-05-09

0001823857

us-gaap:WarrantMember

2022-10-27

2022-10-27

0001823857

us-gaap:WarrantMember

2022-11-25

2022-11-25

0001823857

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001823857

VHAQ:StrategicAdvisorMember

2021-05-18

0001823857

VHAQ:StrategicAdviserMember

2021-11-01

0001823857

VHAQ:ExclusiveFinancialAdvisorMember

2021-10-08

0001823857

VHAQ:SecondFinancialAdvisorMember

2021-11-01

0001823857

VHAQ:ThirdFinancialAdvisorMember

2021-11-02

0001823857

2021-11-05

0001823857

VHAQ:PlacementAgentsMember

2021-11-15

2021-11-15

0001823857

2022-02-17

2022-02-17

0001823857

VHAQ:PlacementAgentsMember

us-gaap:SubsequentEventMember

2023-05-09

2023-05-09

0001823857

us-gaap:SubsequentEventMember

2023-04-28

0001823857

us-gaap:SubsequentEventMember

2023-05-24

0001823857

us-gaap:CommonStockMember

2022-12-23

2022-12-23

0001823857

us-gaap:CommonStockMember

2022-12-23

0001823857

us-gaap:CommonStockMember

us-gaap:SubsequentEventMember

2023-12-23

0001823857

us-gaap:CommonClassAMember

us-gaap:SubsequentEventMember

2023-12-23

0001823857

us-gaap:WarrantMember

2022-12-31

0001823857

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001823857

us-gaap:IPOMember

2021-12-31

0001823857

us-gaap:PrivatePlacementMember

2021-12-31

0001823857

VHAQ:PrivateWarrantsMember

2022-01-01

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsMember

2022-01-01

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:MoneyMarketFundsHeldInTrustAccountMember

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:MoneyMarketFundsHeldInTrustAccountMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:MoneyMarketFundsHeldInTrustAccountMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:MoneyMarketFundsHeldInTrustAccountMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:PrivateWarrantLiabilityMember

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:PrivateWarrantLiabilityMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:PrivateWarrantLiabilityMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:PrivateWarrantLiabilityMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:SubscriptionWarrantLiabilityMember

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:SubscriptionWarrantLiabilityMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:SubscriptionWarrantLiabilityMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:SubscriptionWarrantLiabilityMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

2021-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

2021-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel2Member

2021-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel3Member

2021-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MutualFundMember

2021-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MutualFundMember

us-gaap:FairValueInputsLevel1Member

2021-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MutualFundMember

us-gaap:FairValueInputsLevel2Member

2021-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MutualFundMember

us-gaap:FairValueInputsLevel3Member

2021-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:PrivateWarrantLiabilityMember

2021-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:PrivateWarrantLiabilityMember

us-gaap:FairValueInputsLevel1Member

2021-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:PrivateWarrantLiabilityMember

us-gaap:FairValueInputsLevel2Member

2021-12-31

0001823857

us-gaap:FairValueMeasurementsRecurringMember

VHAQ:PrivateWarrantLiabilityMember

us-gaap:FairValueInputsLevel3Member

2021-12-31

0001823857

VHAQ:PrivateWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-12-31

0001823857

VHAQ:PrivateWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2021-12-31

0001823857

VHAQ:PrivateWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:MeasurementInputExpectedTermMember

2022-01-01

2022-12-31

0001823857

VHAQ:PrivateWarrantsMember

us-gaap:MeasurementInputExpectedTermMember

2021-01-01

2021-12-31

0001823857

VHAQ:PrivateWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2022-12-31

0001823857

VHAQ:PrivateWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2021-12-31

0001823857

VHAQ:PrivateWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2022-12-31

0001823857

VHAQ:PrivateWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2021-12-31

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-11-25

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-10-27

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-05-09

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-04-27

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-04-04

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-03-23

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-03-21

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputMarketDebtRateMember

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputMarketDebtRateMember

2022-11-25

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputMarketDebtRateMember

2022-10-27

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputMarketDebtRateMember

2022-05-09

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputMarketDebtRateMember

2022-04-27

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputMarketDebtRateMember

2022-04-04

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputExpectedTermMember

2022-01-01

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:MeasurementInputExpectedTermMember

2022-11-25

2022-11-25

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputExpectedTermMember

2022-10-27

2022-10-27

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputExpectedTermMember

2022-05-09

2022-05-09

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputExpectedTermMember

2022-04-27

2022-04-27

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputExpectedTermMember

2022-04-04

2022-04-04

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputExpectedTermMember

2022-03-23

2022-03-23

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:MeasurementInputExpectedTermMember

2022-03-21

2022-03-21

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2022-11-25

0001823857

us-gaap:FairValueInputsLevel3Member

us-gaap:MeasurementInputPriceVolatilityMember

2022-10-27

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2022-05-09

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2022-04-27

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2022-04-04

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2022-03-23

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2022-03-21

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputProbabilityOfCompletingABusinessCombinationMember

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputProbabilityOfCompletingABusinessCombinationMember

2022-11-25

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputProbabilityOfCompletingABusinessCombinationMember

2022-10-27

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputProbabilityOfCompletingABusinessCombinationMember

2022-05-09

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputProbabilityOfCompletingABusinessCombinationMember

2022-04-27

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputProbabilityOfCompletingABusinessCombinationMember

2022-04-04

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputProbabilityOfCompletingABusinessCombinationMember

2022-03-23

0001823857

VHAQ:SubscriptionWarrantsMember

VHAQ:MeasurementInputProbabilityOfCompletingABusinessCombinationMember

2022-03-21

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2022-11-25

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2022-10-27

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2022-05-09

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2022-04-27

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2022-04-04

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2022-03-23

0001823857

VHAQ:SubscriptionWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:MeasurementInputSharePriceMember

2022-03-21

0001823857

VHAQ:PrivateWarrantMember

2022-01-01

2022-12-31

0001823857

VHAQ:PrivateWarrantMember

VHAQ:UnsucessfulBusinessCombinationMember

2022-01-01

2022-12-31

0001823857

VHAQ:PrivateWarrantMember

VHAQ:UnsuccessfulBusinessCombinationMember

2022-12-31

0001823857

VHAQ:PrivateWarrantMember

VHAQ:SuccessfulBusinessCombinationMember

2022-01-01

2022-12-31

0001823857

VHAQ:PrivateWarrantMember

VHAQ:SuccessfulBusinessCombinationMember

2022-12-31

0001823857

VHAQ:PrivateAndSubscriptionWarrantsMember

2022-01-01

2022-12-31

0001823857

VHAQ:PrivateAndSubscriptionWarrantsMember

2021-01-01

2021-12-31

0001823857

VHAQ:SubscriptionWarrantsAtIssuanceOnMarchTwentyOneTwentyTwentyTwoMember

2022-01-01

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsAtIssuanceOnMarchTwentyThreeTwentyTwentyTwoMember

2022-01-01

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsAtIssuanceOnAprilFourTwentyTwentyTwoMember

2022-01-01

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsAtIssuanceOnAprilTwentySevenTwentyTwentyTwoMember

2022-01-01

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsAtIssuanceOnMayNineTwentyTwentyTwoMember

2022-01-01

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsAtIssuanceOnOctoberTwentySevenTwentyTwentyTwoMember

2022-01-01

2022-12-31

0001823857

VHAQ:SubscriptionWarrantsAtIssuanceOnNovemberTwentyFiveTwentyTwentyTwoMember

2022-01-01

2022-12-31

0001823857

us-gaap:DomesticCountryMember

2022-12-31

0001823857

us-gaap:DomesticCountryMember

2021-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2022

☐

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _________ to _________

Commission

file number 001-39827

VIVEON

HEALTH ACQUISITION CORP.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

85-2788202 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S

Employer

Identification

No.) |

3480 Peachtree Road NE

2nd Floor - Suite #112

Atlanta,

Georgia 30326

(Address

of principal executive offices and zip code)

(404)-861-5393

(Registrant’s

telephone number, including area code)

N/A

(Former

name, former address and former fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

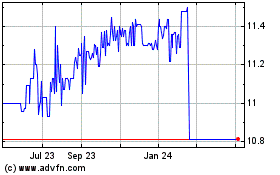

| Common

Stock |

|

VHAQ |

|

NYSE

American, LLC |

| Warrants |

|

VHAQW |

|

NYSE

American, LLC |

| Units |

|

VHAQ |

|

NYSE

American, LLC |

| Rights |

|

VHAQR |

|

NYSE

American, LLC |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that require a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☒ No ☐

The

aggregate market value of the outstanding shares of the registrant’s common stock, other than shares held by persons who may be

deemed affiliates of the registrant, computed by reference to the closing price for the common stock on June 30, 2022, as reported on

the Nasdaq Capital Market, was $103,157,271.

As

of August 22, 2023, there were 6,648,665

shares of the registrant’s common stock, par value $0.0001 per share, issued and outstanding.

VIVEON

HEALTH ACQUISITION CORP.

TABLE

OF CONTENTS

FORWARD

LOOKING STATEMENTS

This

Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, or the

Securities Act, and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. The statements contained in this report

that are not purely historical are forward-looking statements. Our forward-looking statements include, but are not limited to, statements

regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any

statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying

assumptions, are forward-looking statements. The words “anticipates,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “would” and similar expressions

may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking

statements in this report may include, for example, statements about our:

| |

● |

ability

to complete our initial business combination; |

| |

|

|

| |

● |

success

in retaining or recruiting, or changes required in, our officers, key employees or directors following our initial business combination; |

| |

|

|

| |

● |

officers

and directors allocating their time to other businesses and potentially having conflicts of interest with our business or in approving

our initial business combination, as a result of which they would then receive expense reimbursements; |

| |

|

|

| |

● |

potential

ability to obtain additional financing to complete our initial business combination; |

| |

|

|

| |

● |

pool

of prospective target businesses; |

| |

|

|

| |

● |

the

ability of our officers and directors to generate a number of potential investment opportunities; |

| |

|

|

| |

● |

potential

change in control if we acquire one or more target businesses for stock; |

| |

|

|

| |

● |

the

potential liquidity and trading of our securities; |

| |

|

|

| |

● |

the

lack of a market for our securities; |

| |

|

|

| |

● |

use

of proceeds not held in the trust account established at Continental Stock Transfer & Trust Company in connection with its initial

public offering (the “Trust Account”). or available to us from interest income on the Trust Account balance;

and |

| |

|

|

| |

● |

financial

performance following our initial public offering. |

The

forward-looking statements contained in this report are based on our current expectations and beliefs concerning future developments

and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated.

These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions

that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors.”

Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may

vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable

securities laws and/or if and when management knows or has a reasonable basis on which to conclude that previously disclosed projections

are no longer reasonably attainable.

PART

I

ITEM

1. BUSINESS

Introduction

Viveon

Health Acquisition Corp. (“Viveon,” “we,” “us,” or “our”)

is a Delaware company incorporated on August 7, 2020 as a blank check company for the purpose of entering into a merger, share exchange,

asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination, with one or more target businesses.

On

December 28, 2020, Viveon consummated its initial public offering (the “IPO”)

of 17,500,000 units (the “Units”), each Unit consisting of one

share of common stock of the Company, par value $0.0001 per share (the “Common

Stock”) and one redeemable warrant (“Warrant”),

entitling the holder thereof to purchase one-half of a share of Common Stock at a price of $11.50 per whole share, and one right to

receive one-twentieth (1/20) of a share of Common Stock. The Units were sold at a price of $10.00 per Unit, generating gross

proceeds to the Company of $175,000,000. On December 28, 2020, the underwriters of the IPO, Chardan Capital Markets, LLC

(“Chardan” or the “underwriters”) exercised the over-allotment option in

full, and the closing occurred on December 30, 2020 when Viveon sold 2,625,000 Over-Allotment Option Units at a price of $10.00 per

unit, generating additional gross proceeds of $26,250,000.

On

December 28, 2020, simultaneously with the consummation of the IPO, we consummated a private placement (“Private Placement”)

with Viveon Health, LLC (the “Sponsor”) of 18,000,000 warrants (the “Private Warrants”)

at a price of $0.50 per Private Warrant, generating total proceeds of $9,000,000. The Private Warrants are identical to the Warrants

(as defined below) sold in the IPO except that the Private Warrants are non-redeemable and may be exercised on a cashless basis, in each

case so long as they continue to be held by the Sponsor, or its permitted transferees. Additionally, our Sponsor agreed not to transfer,

assign, or sell any of the Private Warrants or underlying securities (except in limited circumstances, as described in the Private Placement

Warrants Subscription Statement) until the date we complete our initial business combination. The Sponsor was granted certain demand

and piggyback registration rights in connection with the purchase of the Private Warrants.

A

total of $203,262,500 of the net proceeds from the sale of Units in the IPO and the private placement were placed in a trust account

(the “Trust Account”) established for the benefit of the

Company’s public stockholders at J.P. Morgan Chase Bank, N.A. maintained by Continental Stock Transfer & Trust Company,

acting as trustee. At the time of the IPO, the Company’s amended and restated certificate of incorporation provided, among

other things that none of the funds held in trust will be released from the Trust Account, other than interest income to pay any tax

obligations, until the earlier of (i) the consummation of the Company’s initial business combination, (ii) the Company’s

failure to consummate a business combination by 15 months from the consummation of the IPO (March 18, 2022), and (iii) the

redemption of any public shares properly submitted in connection with a stockholder vote to amend Viveon’s amended and

restated certificate of incorporation (a) to modify the substance or timing of the ability of holders of Viveon’s public

shares to seek redemption in connection with Viveon’s initial business combination or Viveon’s obligation to redeem 100%

of its public shares if Viveon does not complete its initial business combination by 15 months from the consummation of the IPO

(March 28, 2022) or (b) with respect to any other provision relating to stockholders’ rights or pre-business combination

activity.

Extensions

of Business Combination Period and Amendment to Our Certificate of Incorporation

First

Extension and First Amendment

On

March 18, 2022, the Company held a stockholder meeting to seek approval to amend the Company’s amended and restated certificate

of incorporation (the “First Amendment”) to extend the date by which the Company has to consummate a business

combination from March 28, 2022 (the “Original Termination Date”) to June 28, 2022. The First Amendment (i)

extends the date by which we have to consummate a business combination for three months, from the Original Termination Date to June 30,

2022 and (ii) allows us, without another stockholder vote, to elect to extend the date to consummate a business combination on a monthly

basis for up to six times by an additional one month each time after June 30, 2023, upon five days’ advance notice and the deposit

of $240,000 per month prior to the applicable deadline, for a total of up to nine months after the Original Termination Date, unless

the closing of the proposed business combination with Suneva Medical, Inc. or any potential alternative initial business combination

shall have occurred.

The

stockholders approved the First Amendment at the meeting.

On

March 23, 2022, we filed the First Amendment with the Delaware Secretary of State. A copy of the First Amendment, as filed, is incorporated

by reference into this Annual Report as Exhibit 3.2.

As

a result of the First Amendment, on March 23, 2022, we also entered into an amendment (the “IMTA Amendment”)

to the Investment Management Trust Agreement, dated as of December 22, 2020, with Continental Stock Transfer & Trust Company, as

trustee (the “IMTA”). This IMTA Amendment amends and restates Sections 1(i), 7(c) and 7(j) of the IMTA to reflect

the changes based on the First Amendment. A copy of the IMTA Amendment, is incorporated by reference into this Annual Report as Exhibit

10.18.

In

connection with the First Amendment, the Company made a deposit into the Trust Account of $720,000 on March 23, 2022 and

stockholders redeemed 15,092,126 shares resulting in redemption payments out of the Trust Account to such redeeming stockholders

totaling approximately $152,451,819, without taking into account additional allocation of

payments to cover any tax obligation of the Company, such as franchise taxes, but not including any excise tax, since that

date.

On each of June 23, 2022, July 26, 2022, August

30, 2022, September 28, 2022, October 28, 2022 and November 25, 2022, the Company deposited $240,000 into the Trust Account to extend

the date to consummate a Business Combination through July 28, 2022, August 28, 2022, September 28, 2022, October 28, 2022, November

28, 2022 and December 28, 2022, respectively.

Second

Extension and Second Amendment

Viveon

held its 2022 Annual Meeting of Stockholders (“Annual Meeting”) on December 23, 2022 to seek approval to, among

other things, amend the Company’s amended and restated certificate of incorporation (the “Second Amendment”),

to allow the Company to extend the date to consummate a business combination from December 28, 2022 until June 30, 2023 (the “Second

Extended Date”). The Second Amendment allows us to elect to extend the date to consummate a business combination on a monthly

basis for up to six times by an additional one month each time after December 28, 2022, upon three calendar days’ advance notice

and the deposit of $100,000 per month prior to the applicable deadline, until June 30, 2023, unless the closing of the proposed business

combination with Suneva Medical, Inc. or any potential alternative initial business combination shall have occurred. The Stockholders

approved the Second Amendment at the Annual Meeting.

On

December 23, 2022, we filed the Second Amendment with the Delaware Secretary of State. A copy of the Second Amendment, as filed is incorporated

by reference into this Annual Report as Exhibit 3.3.

In

connection with the Second Amendment stockholders redeemed 3,188,100 shares resulting in redemption payments out of the Trust

Account to pay such redeeming stockholders, totaling approximately $34,004,514, without taking

into account additional allocation of payments to cover any tax obligation of the Company, such as franchise taxes, but not

including any excise tax, since that date.

As

a result of the Second Amendment, on January 20, 2023 we also entered into an IMTA amendment that amends and restates Sections 1(i),

7(c) and 7(j) of the original IMTA to reflect the changes based on the Second Amendment. A copy of the amendment, is included as

Exhibit 10.19 to this Annual Report.

In connection with the Second

Amendment, on each of December 27, 2022, January 26, 2023, February 27, 2023, March 27, 2023 and April 28, 2023, the Company deposited

$100,000 into the Trust Account to extend the date to consummate a Business Combination through January 31, 2023, February 28, 2023,

March 31, 2023, April 30, 2023 and May 31, 2023, respectively. Viveon made a final deposit of $100,000 on May 24, 2023 for a one month

extension until June 30, 2023.

Third

Extension and Third Amendment

On June 22, 2023, the Company

held a stockholder meeting (the “June 2023 Stockholders Meeting”) to seek approval to, among other things, to amend the Company’s

amended and restated certificate of incorporation (the “Third Amendment”), to allow the Company to (i) initially

extend the date by which the Company must consummate an initial business combination up to six times, each such extension for an additional

one month period, until December 31, 2023, by depositing into the Trust Account, the amount of $85,000 for each one-month extension until

December 31, 2023, and (ii) further extend the date by which the Company must consummate an initial business combination (without seeking

additional approval from the stockholders) for up to an additional three months, from January 1, 2024 to March 31, 2024, with no additional

deposits to be made into the Trust Account during such period, each such extension for an additional one month period, (the “Third

Extended Date”), upon one calendar day advance notice to the Trustee, prior to the applicable monthly deadline, unless

the closing of the proposed initial business combination with Clearday, Inc., or any potential alternative initial business combination

shall have occurred prior to the Third Extended Date; and (B) to amend the Company’s IMTA,

allowing the Company to (i) initially extend the date by which the Company must consummate an initial business combination up to six

times, each such extension for an additional one month period, until December 31, 2023, by depositing into the Trust Account, the amount

of $85,000 for each one-month extension until December 31, 2023, and (ii) further extend the date by which the Company must consummate

an initial business combination (without seeking additional approval from the stockholders) for up to an additional three months, from

January 1, 2024 to March 31, 2024, each such extension for an additional one month period, with no additional deposits to be made into

the Trust Account during such period from January 1, 2024 through March 31, 2024. The Stockholders approved the Third Amendment

at the June 2023 Stockholders Meeting.

On

June 27, 2023, we filed the Third Amendment with the Delaware Secretary of State. A copy of the Third Amendment, as filed is incorporated

by reference into this Annual Report as Exhibit 3.4.

In connection with the Third Amendment stockholders redeemed 227,359 shares

resulting in redemption payments out of the Trust Account to pay such redeeming stockholders, totaling $2,498,947,

without taking into account additional allocation of payments to cover any tax obligation of the

Company, such as franchise taxes, but not including any excise tax, since that date.

On June 27, 2023 and July 27, 2023,

the Company deposited $85,000 in the Trust Account, to extend the date by which the Company can complete an initial business combination

by one month to July 31, 2023 and August 31, 2023, respectively.

As a result of the Third Amendment, we also entered into an amendment

to the IMTA, dated as of July 27, 2023, that amends and restates Sections 1(i), 7(c) and 7(j) of the original IMTA to reflect the

change based on the Third Amendment. A copy of the amendment, is included as Exhibit 10.20 to this Annual Report.

Following all of the prior redemptions,

the Company has 1,617,415 shares of public common stock outstanding, and approximately $17,777,323 remaining in the Trust Account as

of the date hereof.

Termination

of Merger Agreement

As

disclosed in a Current Report on Form 8-K on January 12, 2022, Viveon Health Acquisition Corp., a Delaware corporation

(“Viveon”), entered into a Merger Agreement (the “Old Merger Agreement”) by and

among Viveon, VHAC Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Viveon (“Old Merger

Sub”), and Suneva Medical, Inc., a Delaware corporation (“Suneva”). Pursuant to the terms of

the Merger Agreement, a business combination between Viveon and Suneva was proposed to be effected through the merger of Merger Sub

with and into Suneva, with Suneva surviving the merger as a wholly owned subsidiary of Viveon (the “Old

Merger”). At the time of the signing of the Merger Agreement, the board of directors of Viveon had (i) approved and

declared advisable the Merger Agreement, the Old Merger and the other transactions contemplated thereby and (ii) resolved to

recommend approval of the Old Merger Agreement and related transactions by the stockholders of Viveon.

On

February 2, 2023, legal counsel for Viveon sent a letter informing Suneva’s legal counsel that Viveon decided, effective

immediately, to unilaterally terminate the Old Merger Agreement pursuant to Sections 10.2(a) and 10.2 thereof, based upon material

breaches of the Old Merger Agreement by Suneva. The termination letter was sent without prejudice and reserved all of Viveon, Old

Merger Sub and Viveon Health, LLC (Viveon’s sponsor) rights, claims and remedies, specifically including those within the Old

Merger Agreement, against Suneva and others associated with Suneva who participated in the merger discussions and arrangements, and

waived none.

Funding

for Extension and Working Capital

On March 21, 2022, March 23, 2022, April 4, 2022, April 27, 2022, May 9,

2022, October 27, 2022, and November 25, 2022, we entered into subscription agreements with several lenders for a loan of up to $4,000,000, in the aggregate (the “Subscription

Agreements”).

Pursuant

to the Subscription Agreements, we issued a series of unsecured senior promissory notes in the aggregate principal amount of up to $4,000,000

(the “Notes”) to the subscribers. Of the $4,000,000 in Notes, $1,955,000 was subscribed for by several related parties affiliated

with our sponsor, Viveon Health LLC, and the balance in the amount of $2,045,000 was subscribed for by parties that are not related to

our sponsor.

Pursuant to the terms of the Subscription

Agreements, the subscribers also received warrants to purchase one share of our common stock for every $2.00 of the funded principal amount

of the Notes up to 2,000,000 shares of our common stock, in the aggregate, at an exercise price of $11.50 per share, subject to adjustment

(the “Subscription Warrants”). The Subscription Warrant term commences on the Exercise Date (as hereinafter

defined) for a period of 49 months. The Subscription Warrants are exercisable commencing on the date of the initial business combination

(the “Exercise Date”) and have a cashless exercise feature that is available at any time on or after the Exercise

Date. Commencing on the date 13 months following the Exercise Date, the subscribers have the right, but not the obligation, to put the

Subscription Warrants to us at a purchase price of $5.00 per share. We have agreed to file, within thirty (30) calendar days after the

consummation of an initial business combination, a registration statement with the Securities and Exchange Commission to register for

resale the shares of common stock underlying the Subscription Warrants.

The

Notes do not bear interest and mature upon the earlier of (i) the closing of our initial business combination, and (ii) December 31,

2022 (the “Maturity Date”). The Notes provide for a credit line up to the maximum amount of $4,000,000. We

will not have the right to re-borrow any portion of any loans made under the Notes once repaid. As of December 31, 2022, a commitment

fee in the amount of $400,000, equal to 10% of the maximum principal amount of the Note, had been paid to the subscribers, on a pro rata

basis. In the event that we do not consummate a business combination by the Maturity Date, the Notes will be repaid only from amounts

remaining outside of our Trust Account, if any. Subsequent to December 31, 2022, in connection with the Merger Agreement

(as defined below) a majority of the holders of the Notes and Subscription Warrants have agreed to exchange such Notes and Subscription

Warrants pursuant to the terms of an exchange agreement with Viveon dated as of May 1, 2023 (the Exchange Agreement”) for a separate

series of Clearday senior convertible promissory notes (the “Clearday Senior Convertible Notes”). The Clearday

Senior Convertible Notes bear 8% interest per annum and mature upon the earlier of (i) June 30, 2024, or (ii) the date of any Change in

Control. Upon the consummation of the business combination and the exchange of

the Subscription Agreements for the Clearday Senior Convertible Notes, the lenders will forfeit their Subscription Warrants as part of

the exchange. One lender has

chosen not to convert to Clearday Senior Convertible Notes. The balance owed to this lender under the Notes is considered due upon demand

by the lender. As of the date of this filing of this Annual Report the lender has not requested payment of the Note.

On

March 21, 2022, an initial amount of $2,700,000 was drawn down from the Notes. $720,000 of the loan proceeds was deposited into our

Trust Account in connection with extending the business combination completion window from March 28, 2022 until June 28, 2022. After

June 28, 2022, we elected to continue to extend such date until December 28, 2022 by making a monthly deposit of $240,000 into the

Trust Account each month for each monthly period until December 28, 2022. See section titled “Extensions of Business

Combination Period and Amendments to Our Certificate of Incorporation” of this Annual Report for further

detail.

The

entry into the Subscription Agreement and the terms of the Notes and Subscription Warrants was approved by the Audit Committee of the

Board of Directors of the Company at a meeting held on March 21, 2022.

The

foregoing descriptions of the Note, the Subscription Warrant and the Subscription Agreement are qualified in their entirety by

reference to the full text of the Note, the Subscription Warrant and the Subscription Agreement, which are incorporated by reference

into this Annual Report as Exhibit 10.15, Exhibit 10.16 and Exhibit 10.17, respectively. The foregoing description of the Exchange Agreement is qualified in its entirety by reference to the full text of the Exchange Agreement

which filed as Exhibit 10.21 to this Annual Report.

Our Sponsor

agreed to loan the Company an aggregate of up to $500,000 to cover expenses related to the Initial Public Offering pursuant to a promissory

note (the “IPO Note”). This loan was non-interest bearing and payable on the earlier of March 31, 2021 or the

completion of the Initial Public Offering. On January 13, 2021, we paid the $228,758 balance on the note from the proceeds of the Initial

Public Offering. We no longer have the ability to borrow under the IPO Note.

Our Chief

Financial Officer loaned the Company $75,000 to cover expenses related to ongoing operations, which was funded on December 27, 2022. This

loan is non-interest bearing and payable upon consummation of the Company’s initial Business Combination. The loan agreement was

entered into on December 27, 2022.

As of December 31,

2022, and December 31, 2021, the outstanding balance of the loan was $75,000 and $0, respectively. Subsequent to December 31,

2022, our Chief Financial Officer loaned the Company an additional $555,000 through the date of this filing. These loans will be exchanged

for Clearday Senior Convertible Notes upon consummation of the Company’s initial Business Combination.

Our Chief

Executive Officer of the Company loaned the Company $100,000 to cover expenses related to ongoing operations, which was funded on April

2, 2023. This loan is non-interest bearing and payable upon consummation of the Company’s initial Business Combination. The loan

agreement was entered into on April 2, 2023. As of December 31, 2022, and December 31, 2021, the outstanding balance of the loan

was $0, respectively.

Subsequent

to December 31, 2022, three investors in our Sponsor, loaned the Company $100,000 in the aggregate, to cover expenses

related to ongoing operations, funded on April 5, 2023, and April 7, 2023.

These loans are non-interest bearing and payable upon consummation of the Company’s initial Business Combination. The loan agreements

were entered into on April 5, 2023, and April 7, 2023. As of December 31, 2022, and December 31, 2021, the outstanding balance of the

loans was $0, respectively.

On

May 12, 2023, the Company entered into an unsecured promissory note with Clearday (the “Clearday Note”). The

Clearday Note is non-interest bearing mature upon the earlier of (i) the first anniversary of the issuance date and (ii) December 31,

2022. Proceeds provided to us under the Clearday Note through the filing date were approximately $881,710 during fiscal year 2023. Funds

in the Trust Account may not be used to repay the obligations under the Clearday Note. We used such funds for general working capital

purposes. A copy of the Clearday Note is incorporated as Exhibit 10.22 of this Annual Report, and all references herein to the Clearday

Note are qualified in their entirety by reference to the full text of such agreement.

Delinquent

SEC Filings

As

previously reported in a Form 12b-25 Notification of Late Filing filed the Company on May 16, 2022, the Company was delayed in filing

with the Securities and Exchange Commission (the “SEC”) its Quarterly Report on Form 10-Q for the quarter ended

March 31, 2022 (the “Form 10-Q”) because the financial statements could not be completed in sufficient

time to solicit and obtain the necessary review of the Form 10-Q in a timely fashion prior to the due date of the report.

As

of May 23, 2022 the Company remained unable to file the Form 10-Q. As a result, on May 24, 2022, in accordance with standard

procedures related to the delayed filing of the Form 10-Q with the SEC, the Company received a late filer notification from the New

York Stock Exchange stating that the Company is not in compliance with the NYSE American’s continued listing requirements

under the timely filing criteria established in the NYSE American Company Guide. Under Section 1007 of the NYSE American Company

Guide, the Company could be granted up to 12 months to cure the late filer deficiency. The initial six month period to regain

compliance is automatic and the additional six months is only granted upon request by the Company and approval by the NYSE. The NYSE

notice has no immediate effect on the listing or trading of the Company’s securities on the NYSE American. On June 13, 2022,

the Company filed its 10-Q and fully regained compliance with the NYSE American’s continued listing requirements.

On

April 18, 2023, the Company received a notice letter (the “Notice”) from the NYSE Regulation Department (the

“Staff”) notifying the Company that, based upon the Company’s failure to timely file its Annual Report

on Form 10-K for the fiscal year ended December 31, 2022 (the “Annual Report”) by the filing due date, April

17, 2023 (the “Filing Delinquency”), it was not in compliance with the New York Stock Exchange American’s

continued listing requirements. The Company is now subject to the procedures and requirements set forth in Section 1007 of the New York

Stock Exchange American (“NYSE American” or the “Exchange”) Company Guide (the “Company

Guide”).

As

indicated in the Notice, during the six-month period from the date of the Filing Delinquency (the “Initial Cure Period”),

the Exchange will monitor the Company and the status of the Delinquent Report and any subsequent delayed filings, including through contact

with the Company, until the Filing Delinquency is cured. If the Company fails to cure the Filing Delinquency within the Initial Cure

Period, the Exchange may, in the Exchange’s sole discretion, allow the Company’s securities to be traded for up to an additional

six-month period (the “Additional Cure Period”) depending on the Company’s specific circumstances. If

the Exchange determines that an Additional Cure Period is not appropriate, suspension and delisting procedures will commence in accordance

with the procedures set out in Section 1010 of the Company Guide. If the Exchange determines that an Additional Cure Period of up to

six months is appropriate and the Company fails to file its delinquent report and any subsequent delayed filings by the end of that period,

suspension and delisting procedures will generally commence.

The

NYSE American may in its sole discretion decide (i) not to afford an issuer any Initial Cure Period or Additional Cure Period, as the

case may be, at all or (ii) at any time during the Initial Cure Period or Additional Cure Period, to truncate the Initial Cure Period

or Additional Cure Period, as the case may be, and immediately commence suspension and delisting procedures if the issuer is subject

to delisting pursuant to any other provision of the Company Guide, including if the Exchange believes, in the Exchange’s sole discretion,

that continued listing and trading of an issuer’s securities on the Exchange is inadvisable or unwarranted in accordance with Sections

1001-1006 of the Company Guide.

During

the Initial Cure Period and the Additional Cure Period, if applicable, the Company’s securities will continue to trade on the Exchange,

subject to the Company’s compliance with other continued listing requirements, with a late filer (“.LF”) indicator.

The .LF indicator will be removed when the Company has regained compliance with all applicable continued listing standards.

As

previously reported by the Company in its Form 12b-25 filed with the SEC

on each of March 31, 2023, May 15, 2023 and August 14, 2023, the Company required additional time to finalize its financial statements.

Recent

Developments

Merger

Agreement with Clearday

On

April 5, 2023, we entered into a Merger Agreement (the “Merger Agreement”), with Clearday, Inc., a

Delaware corporation (“Clearday”) VHAC2 Merger Sub, Inc., a Delaware corporation (“New Merger

Sub”), and our Sponsor in the capacity as the representative from and after the Effective Time (as defined in the

Merger Agreement) for the stockholders of Viveon (other than the Clearday Stockholders (as defined in the Merger Agreement)) as of

immediately prior to the Effective Time (and their successors and assigns) in accordance with the terms and conditions of the Merger

Agreement, and Clearday SR LLC, a Delaware limited liability company, in the capacity as the representative from and after the

Effective Time for the holders of Clearday Preferred Stock (as defined in the Merger Agreement) as of immediately prior to the

Effective Time (and their successors and assigns) in accordance with the terms and conditions of the Merger Agreement. Pursuant to

the terms of the Merger Agreement, a business combination between us and Clearday will be effected through the merger of New Merger

Sub with and into Clearday, with Clearday surviving the merger as a wholly owned subsidiary of ours and we will change our name to

“Clearday Holdings, Inc.” (the “Merger”). Our board of directors has (i) approved and declared

advisable the Merger Agreement, the Merger and the other transactions contemplated thereby and (ii) resolved to recommend approval

of the Merger Agreement, the Merger and related transactions by our stockholders. Capitalized terms used herein but not defined

shall have the meanings ascribed thereto in the Merger Agreement.

Consideration

Merger

Consideration

The

total consideration to be paid at Closing (the “Merger Consideration”) by us to Clearday security holders (and

holders who have the right to acquire Clearday capital stock) will be an amount equal to $250 Million (plus the aggregate exercise price

for all Clearday options and warrants). The Merger Consideration will be payable in shares of common stock, par value $0.0001 per share,

of our common stock, valued at $10 per share.

Earnout

Payments

In

addition, the holders of Clearday preferred stock will have the contingent right to earn up to 5,000,000 shares of our common stock,

in the aggregate (the “Earnout Shares”), if at any time during the period beginning on the date of the Closing

(the “Closing Date”) and ending on the fifth anniversary of the Closing Date (the “Earnout Eligibility

Period”), the Adjusted Net Income (as defined below) for any Earnout Period is a positive number for the first time during

the Earnout Eligibility Period (the “Earnout Milestone”). Under the Merger Agreement, Adjusted Net Income means

for any Earnout Period, the consolidated net income or loss for such period calculated in accordance with U.S. GAAP applied on a basis

consistent with past practice, of (a) for periods prior to the Closing, the Company and its subsidiaries (the “Company Group”),

and (b) for periods from and after the Closing, of us and our subsidiaries (including the Company Group), in each case before adjusting

for the following to the extent deducted/added in calculating consolidated net income or loss: (1) interest expense/income; (2) income

tax expense/tax credits; (3) depreciation and amortization; (4) transaction expenses; (5) extraordinary items; (6) any income or loss

attributable to us that accrues in accordance with U.S. GAAP on or prior to the Closing Date; and (7) all gains or losses in connection

with sales or dispositions of assets and investments not in the ordinary course of business.

If,

following the Closing Date and prior to end of the Earnout Eligibility Period, there is a Change of Control, then, immediately prior

to such Change of Control, all the Earnout Shares not yet earned shall be earned by the Clearday Earnout Holders and shall be released

from escrow and delivered to the Clearday Earnout Holders, and the Clearday Earnout Holders shall be eligible to participate in such

Change of Control transaction with respect to such Earnout Shares.

The

Earnout Shares will be placed in escrow and will not be released from escrow until they are earned as a result of the occurrence of the

Earnout Milestone or a Change of Control, if applicable. The Earnout Shares that are not earned on or before the expiration of the Earnout

Eligibility Period shall be automatically forfeited and cancelled.

Treatment

of Clearday Securities

Cancellation

of Securities. Each share of Clearday capital stock, if any, that is owned by Viveon, New Merger Sub, Clearday, or any of

their subsidiaries (as treasury stock or otherwise) immediately prior to the effective time of the Merger (the “Effective

Time”), will automatically be cancelled and retired without any conversion or consideration.

Preferred

Stock. At the Effective Time, each issued and outstanding share of Clearday’s Series F Cumulative Convertible Preferred

Stock, par value $0.001 per share (“Clearday Series F Preferred Stock”) (other than any such shares of Clearday

capital stock cancelled as described above and any dissenting shares), will be converted into the right to receive: (A) one (1) share

of Parent New Series F Preferred Stock plus (B) a number of Earnout Shares in accordance with, and subject to the contingencies, set

forth in the Merger Agreement.

Each

issued and outstanding share of Clearday’s Series A Convertible Preferred Stock, par value $0.001 per share (“Clearday

Series A Preferred Stock”) (other than any such shares of Clearday capital stock cancelled as described above and any dissenting

shares), will be converted into the right to receive: (A) one (1) share of Parent New Series A Preferred Stock plus (B) a number of Earnout

Shares in accordance with, and subject to the contingencies, set forth in the Merger Agreement.

Common

Stock. At the Effective Time, each issued and outstanding share of Clearday’s common stock, par value $0.001 per share

(“Clearday Common Stock”) (other than any such shares of Clearday capital stock cancelled as described above

and any dissenting shares) will be converted into the right to receive a number of shares of Viveon Common Stock equal to the Conversion

Ratio. The “Conversion Ratio” as defined in the Merger Agreement means an amount equal to (a)(i) the sum of $250 Million,

plus the aggregate exercise or conversion price of outstanding Clearday’s stock options and warrants (excluding unvested options

and options or warrants with an exercise or conversion price of $5.00 or more), divided by (ii) the number of fully diluted Clearday

capital stock (including Company Preferred Stock, warrants, stock options, convertible notes, and any other convertible securities) (excluding

unvested options and options or warrants with an exercise or conversion price of $5.00 or more and assuming a conversion price of Clearday

subsidiary securities as provided in the Merger Agreement); divided by (b) $10.00.

Merger

Sub Securities. Each share of common stock, par value $0.0001 per share, of New Merger Sub issued and outstanding

immediately prior to the Effective Time will be converted into and become one newly issued share of common stock of the surviving

corporation.

Stock

Options. At the Effective Time, each outstanding option to purchase shares of Clearday Common Stock will be converted into an

option to purchase, subject to substantially the same terms and conditions as were applicable under such options prior to the Effective

Time, shares of Viveon Common Stock equal to the number of shares subject to such option prior to the Effective Time multiplied by the

Conversion Ratio, at an exercise price per share of Viveon Common Stock equal to the exercise price per share of Clearday Common Stock

subject to such option divided by the Conversion Ratio.

Warrants.

Contingent on and effective as of immediately prior to the Effective Time, each outstanding warrant to purchase shares of Clearday

Preferred Stock or Clearday Common Stock will be treated in accordance with the terms thereof.

Convertible

Notes. Contingent on and effective as of immediately prior to the Effective Time, Clearday’s convertible notes outstanding

as of immediately prior to the Effective Time, will be treated in accordance with the terms of the relevant agreements governing such

convertible notes.

Subsidiary

Capital Stock. At and as of the Effective Time, the Subsidiary Capital Stock will remain in full force and effect with the right

to acquire the Company Common Stock with such adjustments noted in the terms of such Subsidiary Capital Stock.

Representations

and Warranties

The

Merger Agreement contains customary representations and warranties of the parties thereto with respect to, among other things, (a) corporate

existence and power, (b) authorization to enter into the Merger Agreement and related transactions; subsidiaries, (c) governmental authorization,

(d) non-contravention, (e) capitalization, (f) corporate records, (g) consents, (h) financial statements, (i) internal accounting controls,

(j) absence of certain changes, (k) properties; title to assets, (l) litigation, (m) material contracts, (n) licenses and permits, (o)

compliance with laws, (p) intellectual property, (q) privacy and data security, (r) employee matters and benefits, (s) tax matters, (t)

real property, (u) environmental laws, (v) finders’ fees, (w) directors and officers, (x) anti-money laundering laws, (y) insurance,

(z) related party transactions, and (aa) certain representations related to securities law and activity. Viveon has additional representations

and warranties, including (a) issuance of shares, (b) trust fund, (c) listing, (d) board approval, (e) SEC documents and financial statements,

(f) certain business practices, (g) expenses, indebtedness and other liabilities and (h) brokers and other advisors.

Covenants

The

Merger Agreement includes customary covenants of the parties with respect to operation of their respective businesses prior to consummation

of the Merger and efforts to satisfy conditions to consummation of the Merger. The Merger Agreement also contains additional covenants

of the parties, including, among others, access to information, cooperation in the preparation of the Registration Statement and Proxy

Statement (as each such terms are defined in the Merger Agreement) required to be filed in connection with the Merger and to obtain all

requisite approvals of each party’s respective stockholders. Viveon and Clearday have each also agreed to include in the Proxy

Statement the recommendation of its respective board that its stockholders approve all of the proposals to be presented at its respective

special meeting. In addition, each of Viveon and Clearday have agreed to use commercially reasonable efforts to solicit and finalize

definitive documentation for a committed equity in an aggregate amount that, together with the funds in the Trust Account after giving

effect to potential redemptions from Viveon’s public stockholders, together with financing programs available to Clearday after

the Closing, will provide to Clearday working capital to meet its short-term commercial development goals.

Viveon

has also agreed to prepare a proxy statement to seek the approval of its stockholders (the “Extension Proposal”)

to amend its organizational documents to extend the period of time Viveon is afforded under its organizational documents and IPO prospectus

to consummate an initial business combination for an additional three months, from June 30,2023 to September 30, 2023 (or such earlier

date as Viveon and Clearday may agree in writing).

Each

party’s representations, warranties and pre-Closing covenants will not survive Closing and no party has any post-Closing indemnification

obligations.

Viveon

Equity Incentive Plan

Viveon

has agreed to approve and adopt an equity incentive plan (the “Incentive Plan”) to be effective as of the Closing

and in a form mutually acceptable to Viveon and Clearday, subject to approval of the Incentive Plan by the Viveon stockholders. The Incentive

Plan will provide for an initial aggregate share reserve equal to 8% of the number of shares of Viveon Common Stock issued and outstanding

at the Closing and an “evergreen” provision that is mutually agreeable to Viveon and Clearday will provide for an automatic

increase on the first day of each fiscal year in the number of shares available for issuance under the Incentive Plan as mutually determined

by Viveon and Clearday.

Non-Solicitation

Restrictions

Each

of Viveon and Clearday has agreed that from the date of the Merger Agreement to the Effective Time or, if earlier, the valid termination

of the Merger Agreement in accordance with its terms, it will not initiate any negotiations with any party relating to an Alternative

Transaction (as such term is defined in the Merger Agreement) or enter into any agreement relating to such a proposal, other than as

expressly excluded from the definition of an Alternative Transaction. Each of Viveon and Clearday has also agreed to be responsible for

any acts or omissions of any of its respective representatives that, if they were the acts or omissions of Viveon and Clearday, as applicable,

would be deemed a breach of the party’s obligations with respect to these non-solicitation restrictions.

Conditions

to Closing

The

consummation of the Merger is conditioned upon, among other things, (i) the absence of any applicable law or order restraining, prohibiting

or imposing any condition on the consummation of the Merger and related transactions, (ii) the expiration or termination of the waiting

period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (iii) receipt of any consent, approval or authorization

required by any Authority (as defined in the Merger Agreement), (iv) Viveon having net tangible assets of at least $5,000,001 (as determined

in accordance with Rule 3a51-1(g)(1) of the Exchange Act), unless Viveon’s amended and restated certificate of incorporation shall

have been amended to remove such requirement prior to or concurrently with the Closing, (v) approval by Clearday’s stockholders

of the Merger and related transactions, (vi) approval by Viveon’s stockholders of the Merger and related transactions, (vii) the

conditional approval for listing by NYSE American (or an alternate exchange) of the shares of Viveon Common Stock to be issued in connection

with the transactions contemplated by the Merger Agreement and satisfaction of initial and continued listing requirements, and (viii)

the Registration Statement becoming effective in accordance with the provisions of the Securities Act of 1933, as amended (“Securities

Act”).

Solely

with respect to Viveon and New Merger Sub, the consummation of the Merger is conditioned upon, among other things, (i) Clearday

having duly performed or complied with all of its obligations under the Merger Agreement in all material respects, (ii) the

representations and warranties of Clearday, other than certain fundamental representations as defined in the Merger Agreement, being

true and correct in all respects unless failure would not have or reasonably be expected to have a Material Adverse Effect (as

defined in the Merger Agreement) on Clearday or any of its subsidiaries, (iii) certain fundamental representations, as defined in

the Merger Agreement, being true and correct in all respects, other than de minimis inaccuracies, (iv) no event having

occurred that would result in a Material Adverse Effect on Clearday or any of its subsidiaries, (v) Clearday and its securityholders

having executed and delivered to Viveon each Additional Agreement (as defined in the Merger Agreement) to which they each are a

party and (vi) Clearday delivering certain certificates to Viveon.

Solely

with respect to Clearday, the consummation of the Merger is conditioned upon, among other things, (i) Viveon and New Merger Sub

having duly performed or complied with all of their respective obligations under the Merger Agreement in all material respects, (ii)

the representations and warranties of Viveon and New Merger Sub, other than certain fundamental representations as defined in the

Merger Agreement, being true and correct in all respects unless failure to be true and correct would not have or reasonably be

expected to have a Material Adverse Effect on Viveon or New Merger Sub and their ability to consummate the Merger and related

transactions, (iii) certain fundamental representations, as defined in the Merger Agreement, being true and correct in all respects,

other than de minimis inaccuracies, (iv) no event having occurred that would result in a Material Adverse Effect on Viveon or New

Merger Sub, (v) the Amended Parent Charter (as defined in the Merger Agreement) being filed with, and declared effective by, the