Global X Launches Permanent ETF (PERM) - ETF News And Commentary

February 20 2012 - 6:02AM

Zacks

Global X, the New York-based ETF issuer best known for its

unique global sector products, recently launched the latest

addition to its lineup in what looks to be a bit of a departure

from usual targets of the innovative issuer. In the release, the

company looks to at least temporarily get away from its sector

focus, offering up a ‘one stop shop’ for exposure across sectors

and asset classes. The new Permanent ETF

(PERM) will hold a

variety of products, looking to give investors solid exposure

across all market environments and conditions.

The new fund seeks to do this by allocating evenly among assets

that can do well during four different economic conditions

including; increasing growth, decreasing growth, increasing

inflation, and decreasing inflation. This is done by putting

one-fourth of the fund in each of the following categories; short

term government bonds, long term government bonds, precious metals,

and stocks. With this focus, stocks and short-term bonds look to

play opposite sides of the growth story, while the precious metals

and long term bonds look to do the same for inflation trends. As a

result, the fund looks to be evenly distributed and a solid choice

for those with a long time horizon that are unwilling to risk a

significant amount in equities (see ETFs vs. ETNs: What’s The

Difference?).

Holdings of PERM

In terms of individual holdings, the fund has a nice mix of

commodity ETFs, bonds, stock ETFs and individual equities, making

it unique in that respect among most products in the diversified

space. The top individual holding goes to ETF Securities’

Physical Gold ETF (SGOL)

at nearly 20% of the total, while U.S. Treasury bonds round out

most of the rest of the top ten holdings. Beyond this, two Vanguard

ETFs make up decent allocations in the fund—Vanguard Small

Cap ETF (VB) and

Vanguard FTSE All-World

(VEU)—at about 3.1%

each, while a series of individual equities comprise the rest of

the fund, making up between 0.53% and 0.17% of the assets in the

product. This technique gives PERM a total of 87 holdings in total

while charging investors 49 basis points a year in fees and

rebalancing on an annual basis. Interestingly, not a single Global

X fund is held in PERM’s assets, despite the company having nearly

40 other ETFs at its disposal (read Alternative Weighting

Methodologies 101).

Competition

In terms of competing products, it is quite hard to find a pure

match. Some could argue that a product such as the iShares

S&P Target Date Retirement Income Index Fund

(TGR) could be decent

given its holdings of fixed income and equities. However, the fund

doesn’t have any exposure to commodities and it refrains from

holding individual securities in its portfolio. Beyond this fund,

investors also have a few more in the diversified segment with

Cambria Global Tactical ETF

(GTAA) standing out

among its peers as a competitor to PERM. That is because GTAA holds

roughly half of its assets in bonds and has chunks of exposure that

go to commodities and currencies as well (read ETFs vs. Mutual

Funds).

With that being said, investors should note that the products

listed above have had mixed success in terms of attracting assets.

GTAA has close to $130 million while TGR has amassed less than $7.5

million in comparison. This suggests that PERM’s road to gaining

assets is by no means certain, implying that the fund will have to

show solid performance in order to be demanded by the investing

public. Yet, given the solid and diversified methodology, the

product may turn out to be a hit for those seeking diversified

exposure with minimal holdings in relatively volatile equities

(read Do You Need A Floating Rate Bond ETF?).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Author is long VB.

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

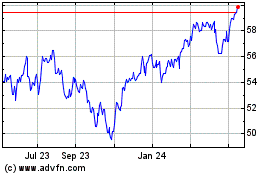

Vanguard FTSE All World ... (AMEX:VEU)

Historical Stock Chart

From Nov 2024 to Dec 2024

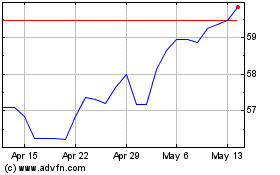

Vanguard FTSE All World ... (AMEX:VEU)

Historical Stock Chart

From Dec 2023 to Dec 2024