0001375205false--12-31Q32024641910390410001.50270898900363796235000013752052024-01-012024-09-300001375205urg:USFederalDeposiInsuranceCorporationMember2024-09-300001375205urg:DisposalFeesMember2023-01-012023-09-300001375205urg:DisposalFeesMember2023-07-012023-09-300001375205urg:DisposalFeesMember2024-07-012024-09-300001375205urg:DisposalFeesMember2024-01-012024-09-300001375205urg:UThreeOEightSalesMember2023-01-012023-09-300001375205urg:UThreeOEightSalesMember2023-07-012023-09-300001375205urg:UThreeOEightSalesMember2024-07-012024-09-300001375205urg:UThreeOEightSalesMember2024-01-012024-09-300001375205urg:CustomerBMember2023-01-012023-09-300001375205urg:CustomerAMember2023-01-012023-09-300001375205urg:CustomerBMember2023-07-012023-09-300001375205urg:CustomerAMember2023-07-012023-09-300001375205urg:CustomerBMember2024-07-012024-09-300001375205urg:CustomerAMember2024-07-012024-09-300001375205urg:CustomerBMember2024-01-012024-09-300001375205urg:CustomerAMember2024-01-012024-09-300001375205us-gaap:StockOptionMember2023-07-012023-09-300001375205us-gaap:StockOptionMember2024-07-012024-09-300001375205us-gaap:StockOptionMember2023-01-012023-09-300001375205urg:RestrictedStockUnitsRsuOneMember2023-01-012023-09-300001375205urg:RestrictedStockUnitsRsuOneMember2023-07-012023-09-300001375205urg:RestrictedStockUnitsRsuOneMember2024-07-012024-09-300001375205urg:RestrictedStockUnitsRsuOneMember2024-01-012024-09-300001375205urg:RestrictedStockUnitsRsuOneMember2024-09-300001375205urg:WarrantsOneMember2021-02-280001375205urg:WarrantsOneMember2023-02-210001375205urg:WarrantsOneMember2021-02-012021-02-280001375205urg:CommonSharesMember2024-01-012024-09-300001375205urg:WarrantsOneMember2023-02-012023-02-2100013752052024-07-2900013752052023-02-2100013752052023-02-012023-02-2100013752052024-07-012024-07-290001375205urg:WarrantsMember2024-01-012024-09-300001375205urg:WarrantsExercisePriceRangeThreeMember2024-01-012024-09-300001375205urg:WarrantsMember2024-03-310001375205urg:WarrantsExercisePriceRangeThreeMember2024-03-310001375205urg:RedemptionDateFourMemberMember2024-01-012024-09-300001375205urg:RedemptionDateThreeMemberMember2024-01-012024-09-300001375205urg:RedemptionDateFourMemberMember2024-09-300001375205urg:RedemptionDateThreeMemberMember2024-09-300001375205us-gaap:StockOptionMember2024-01-012024-09-300001375205urg:StockOptionExercisePriceRangeTenMember2024-01-012024-09-300001375205urg:WarrantsExercisePriceRangeTwoMember2024-01-012024-09-300001375205urg:StockOptionExercisePriceRangeOneMember2024-01-012024-09-300001375205urg:StockOptionExercisePriceRangeSixMember2024-01-012024-09-300001375205urg:StockOptionExercisePriceRangeFiveMember2024-01-012024-09-300001375205urg:StockOptionExercisePriceRangeFourMember2024-01-012024-09-300001375205urg:StockOptionExercisePriceRangeThreeMember2024-01-012024-09-300001375205urg:StockOptionExercisePriceRangeOneMember2024-09-300001375205us-gaap:StockOptionMember2024-09-300001375205urg:StockOptionExercisePriceRangeTenMember2024-09-300001375205urg:WarrantsExercisePriceRangeTwoMember2024-09-300001375205urg:StockOptionExercisePriceRangeSixMember2024-09-300001375205urg:StockOptionExercisePriceRangeFiveMember2024-09-300001375205urg:StockOptionExercisePriceRangeFourMember2024-09-300001375205urg:StockOptionExercisePriceRangeThreeMember2024-09-300001375205srt:MaximumMember2024-01-012024-09-300001375205srt:MinimumMember2024-01-012024-09-300001375205urg:FebruaryTwoThousandTwentyThreeWarrantMember2024-09-300001375205urg:FebruaryTwoThousandTwentyThreeWarrantMember2024-01-012024-09-300001375205urg:FebruaryTwoThousandTwentyThreeWarrantMember2023-12-310001375205urg:FebruaryTwoThousandTwentyOneWarrantMember2024-09-300001375205urg:FebruaryTwoThousandTwentyOneWarrantMember2024-01-012024-09-300001375205urg:FebruaryTwoThousandTwentyOneWarrantMember2023-12-310001375205urg:DueQuarterlyCommencingFromJanuaryOneTwoThousandFifteenMember2013-10-230001375205urg:DueQuarterlyCommencingFromJanuaryOneTwoThousandFourteenMember2013-10-2300013752052024-03-012024-03-270001375205urg:SweetwaterIdrBondMember2015-10-012015-10-150001375205urg:RightOfUseAssetsMember2023-12-310001375205urg:RightOfUseAssetsMember2024-09-300001375205urg:InformationTechnologyMember2023-12-310001375205urg:InformationTechnologyMember2024-09-300001375205us-gaap:FurnitureAndFixturesMember2023-12-310001375205us-gaap:FurnitureAndFixturesMember2024-09-300001375205us-gaap:MachineryAndEquipmentMember2023-12-310001375205us-gaap:MachineryAndEquipmentMember2024-09-300001375205urg:EnclosuresMember2023-12-310001375205urg:EnclosuresMember2024-09-300001375205urg:RollingStockMember2023-12-310001375205urg:RollingStockMember2024-09-300001375205urg:PathfinderPropertiesMember2013-01-012013-12-310001375205urg:NfuWyomingLlcMember2005-01-012005-12-310001375205urg:PathfinderPropertiesMember2013-12-310001375205urg:NfuWyomingLlcMember2005-12-310001375205urg:OtherUSPropertiesPropertiesMember2024-09-300001375205urg:LostCreekPropertyMember2024-09-300001375205urg:ShirleyBasinPropertyMember2024-09-300001375205urg:OtherUSPropertiesPropertiesMember2024-01-012024-09-300001375205urg:ShirleyBasinPropertyMember2024-01-012024-09-300001375205urg:LostCreekPropertyMember2024-01-012024-09-300001375205urg:OtherUSPropertiesPropertiesMember2023-12-310001375205urg:ShirleyBasinPropertyMember2023-12-310001375205urg:LostCreekPropertyMember2023-12-310001375205us-gaap:SuretyBondMember2023-12-310001375205us-gaap:SuretyBondMember2024-09-300001375205urg:PlantInventoryMember2023-12-310001375205urg:PlantInventoryMember2024-09-300001375205urg:ConversionFacilityInventorysMember2023-12-310001375205urg:ConversionFacilityInventorysMember2024-09-300001375205urg:InProcessInventoryMember2023-12-310001375205urg:InProcessInventoryMember2024-09-300001375205us-gaap:RetainedEarningsMember2024-09-300001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001375205urg:ContributedSurplusMember2024-09-300001375205urg:ShareCapitalMember2024-09-300001375205us-gaap:RetainedEarningsMember2024-07-012024-09-300001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001375205urg:ContributedSurplusMember2024-07-012024-09-300001375205urg:ShareCapitalMember2024-07-012024-09-3000013752052024-06-300001375205us-gaap:RetainedEarningsMember2024-06-300001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001375205urg:ContributedSurplusMember2024-06-300001375205urg:ShareCapitalMember2024-06-3000013752052024-04-012024-06-300001375205us-gaap:RetainedEarningsMember2024-04-012024-06-300001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001375205urg:ContributedSurplusMember2024-04-012024-06-300001375205urg:ShareCapitalMember2024-04-012024-06-3000013752052024-03-310001375205us-gaap:RetainedEarningsMember2024-03-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001375205urg:ContributedSurplusMember2024-03-310001375205urg:ShareCapitalMember2024-03-3100013752052024-01-012024-03-310001375205us-gaap:RetainedEarningsMember2024-01-012024-03-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001375205urg:ContributedSurplusMember2024-01-012024-03-310001375205urg:ShareCapitalMember2024-01-012024-03-310001375205us-gaap:RetainedEarningsMember2023-12-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001375205urg:ContributedSurplusMember2023-12-310001375205urg:ShareCapitalMember2023-12-3100013752052023-09-300001375205us-gaap:RetainedEarningsMember2023-09-300001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001375205urg:ContributedSurplusMember2023-09-300001375205urg:ShareCapitalMember2023-09-300001375205us-gaap:RetainedEarningsMember2023-07-012023-09-300001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001375205urg:ContributedSurplusMember2023-07-012023-09-300001375205urg:ShareCapitalMember2023-07-012023-09-3000013752052023-06-300001375205us-gaap:RetainedEarningsMember2023-06-300001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001375205urg:ContributedSurplusMember2023-06-300001375205urg:ShareCapitalMember2023-06-3000013752052023-04-012023-06-300001375205us-gaap:RetainedEarningsMember2023-04-012023-06-300001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001375205urg:ContributedSurplusMember2023-04-012023-06-300001375205urg:ShareCapitalMember2023-04-012023-06-3000013752052023-03-310001375205us-gaap:RetainedEarningsMember2023-03-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001375205urg:ContributedSurplusMember2023-03-310001375205urg:ShareCapitalMember2023-03-3100013752052023-01-012023-03-310001375205us-gaap:RetainedEarningsMember2023-01-012023-03-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001375205urg:ContributedSurplusMember2023-01-012023-03-310001375205urg:ShareCapitalMember2023-01-012023-03-3100013752052022-12-310001375205us-gaap:RetainedEarningsMember2022-12-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001375205urg:ContributedSurplusMember2022-12-310001375205urg:ShareCapitalMember2022-12-3100013752052024-07-012024-09-3000013752052023-07-012023-09-3000013752052023-01-012023-09-3000013752052023-12-3100013752052024-09-3000013752052024-10-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureurg:integeriso4217:CAD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE QUARTERLY PERIOD ENDED September 30, 2024 |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD OF _________ TO _________. |

Commission File Number: 001-33905

UR-ENERGY INC. |

(Exact name of registrant as specified in its charter) |

Canada | | Not Applicable |

State or other jurisdiction of incorporation or organization | | (I.R.S. Employer Identification No.) |

10758 West Centennial Road, Suite 200

Littleton, Colorado 80127

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 720-981-4588

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: | | Trading Symbol | | Name of each exchange on which registered: |

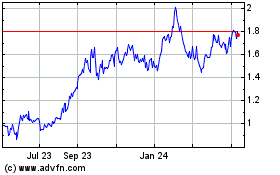

Common stock | | URG (NYSE American); URE (TSX) | | NYSE American; TSX |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ | Smaller reporting company | ☒ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of October 30, 2024, there were 364,101,038 shares of the registrant’s no par value Common Shares (“Common Shares”), the registrant’s only outstanding class of voting securities, outstanding.

UR-ENERGY INC.

TABLE OF CONTENTS

When we use the terms “Ur-Energy,” “we,” “us,” or “our,” or the “Company” we are referring to Ur-Energy Inc. and its subsidiaries, unless the context otherwise requires. Throughout this document we make statements that are classified as “forward-looking.” Please refer to the “Cautionary Statement Regarding Forward-Looking Statements” section below for an explanation of these types of assertions.

Cautionary Statement Regarding Forward-Looking Information

This report on Form 10-Q contains "forward-looking statements" within the meaning of applicable United States (“U.S.”) and Canadian securities laws, and these forward-looking statements can be identified by the use of words such as "expect," "anticipate," "estimate," "believe," "may," "potential," "intends," "plans" and other similar expressions or statements that an action, event or result "may," "could" or "should" be taken, occur or be achieved, or the negative thereof or other similar statements. These statements are only predictions and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance, or achievements expressed or implied by these forward-looking statements. Such statements include, but are not limited to: (i) the ability to maintain safe and compliant operations at Lost Creek; (ii) the continued schedule for ramp-up at Lost Creek to reach budgeted production, including the ability to overcome continuing challenges of ramp-up and to meet our production guidance; (iii) our ability to reach and sustain steady state higher production levels at Lost Creek in a timely and cost-effective manner; (iv) development and construction priorities and timelines for Shirley Basin, and whether our current projections for buildout can to be achieved with respect to budget and timelines; (v) the ability to complete additional favorable uranium sales agreements; (vi) our ability to timely deliver into our contractual obligations with Lost Creek production and other available sources; (vii) the timing and outcome of final regulatory approvals of the amendments for uranium recovery at the LC East Project; (viii) continuing supply-chain and labor market challenges, and whether the Company will continue to anticipate and overcome such challenges; (ix) the effects of the current evolving uranium market, including supply and demand, and whether higher spot and term pricing will be sustained including from demands of big data and new governmental programs in the U.S.; and (x) what impacts the ban on Russian uranium and fuel purchasers objectives for energy security will have on the uranium market and on what timeline. Additional factors include, among others, the following: future estimates for production; capital expenditures; operating costs; mineral resources, grade estimates and recovery rates; market prices; business strategies and measures to implement such strategies; competitive strengths; estimates of goals for expansion and growth of the business and operations; plans and references to our future successes; our history of operating losses and uncertainty of future profitability; status as an exploration stage company; the lack of mineral reserves; risks associated with obtaining permits and other authorizations in the U.S.; risks associated with current variable economic conditions; the possible impact of future debt or equity financings; the hazards associated with mining production operations; compliance with environmental laws and regulations; wastewater management; the possibility for adverse results in potential litigation; uncertainties associated with changes in law, government policy and regulation; uncertainties associated with a Canada Revenue Agency or U.S. Internal Revenue Service audit of any of our cross border transactions; changes in size and structure; the effectiveness of management and our strategic relationships; ability to attract and retain key personnel and management; uncertainties regarding the need for additional capital; sufficiency of insurance coverages, bonding surety arrangements, and indemnifications for our inventory; uncertainty regarding the fluctuations of quarterly results; foreign currency exchange risks; ability to enforce civil liabilities under U.S. securities laws outside the U.S.; ability to maintain our listing on the NYSE American and Toronto Stock Exchange (“TSX”); risks associated with the expected classification as a "passive foreign investment company" under the applicable provisions of the U.S. Internal Revenue Code of 1986, as amended; risks associated with our investments and other risks and uncertainties described under the heading “Risk Factors” in our Annual Report on Form 10-K, dated March 6, 2024.

Cautionary Note to Investors Concerning Disclosure of Mineral Resources

Unless otherwise indicated, all mineral resource estimates included in this report on Form 10-Q have been prepared in accordance with U.S. securities laws pursuant to Regulation S-K, Subpart 1300 (“S-K 1300”). Prior to these estimates, we prepared our estimates of mineral resources in accord with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (“CIM Definition Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for public disclosure an issuer makes of scientific and technical information concerning mineral projects. We are required by applicable Canadian Securities Administrators to file in Canada an NI 43-101 compliant report at the same time we file an S-K 1300 technical report summary. The NI 43-101 and S-K 1300 reports (for each of the Lost Creek Property (March 4, 2024) and Shirley Basin Project, as amended (March 11, 2024)), are substantively identical to one another except for internal references to the regulations under which the report is made, and certain organizational differences.

Investors should note that the term “mineral resource” does not equate to the term “mineral reserve.” Mineralization may not be classified as a “mineral reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under S-K 1300, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies. Additionally, as required under S-K 1300, our report on the Lost Creek Property includes two economic analyses to account for the chance that the inferred resources are not upgraded as production recovery progresses and the Company collects additional drilling data; the second economic analysis was prepared which excluded the inferred resources. The estimated recovery excluding the inferred resources also establishes the potential viability at the property, as detailed in the S-K 1300 report. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable.

PART I

Item 1. FINANCIAL STATEMENTS

Ur-Energy Inc. |

Interim Condensed Consolidated Balance Sheets (Unaudited) |

(expressed in thousands of U.S. dollars) |

| (the accompanying notes are an integral part of these condensed consolidated financial statements) |

| | Note | | | September 30, 2024 | | | December 31, 2023 | |

| | | | | | | | | |

Assets | | | | | | | | | |

Current assets | | | | | | | | | |

Cash and cash equivalents | | | 3 | | | | 118,460 | | | | 59,700 | |

Trade receivables | | | | | | | 27 | | | | - | |

Current portion of lease receivable (net) | | | | | | | 207 | | | | 77 | |

Inventory | | | 4 | | | | 4,246 | | | | 2,571 | |

Prepaid expenses | | | | | | | 2,075 | | | | 1,321 | |

Total current assets | | | | | | | 125,015 | | | | 63,669 | |

| | | | | | | | | | | | |

Non-current assets | | | | | | | | | | | | |

Lease receivable (net) | | | | | | | 598 | | | | 208 | |

Restricted cash and cash equivalents | | | 5 | | | | 10,897 | | | | 8,549 | |

Mineral properties | | | 6 | | | | 39,359 | | | | 34,906 | |

Capital assets | | | 7 | | | | 25,502 | | | | 21,044 | |

Total non-current assets | | | | | | | 76,356 | | | | 64,707 | |

Total assets | | | | | | | 201,371 | | | | 128,376 | |

| | | | | | | | | | | | |

Liabilities and shareholders' equity | | | | | | | | | | | | |

Current liabilities | | | | | | | | | | | | |

Accounts payable and accrued liabilities | | | 8 | | | | 7,107 | | | | 2,366 | |

Current portion of notes payable | | | 9 | | | | - | | | | 5,694 | |

Current portion of warrant liability | | | 10 | | | | - | | | | 1,743 | |

Current portion of lease liability | | | | | | | 281 | | | | 162 | |

Environmental remediation accrual | | | | | | | 63 | | | | 69 | |

Total current liabilities | | | | | | | 7,451 | | | | 10,034 | |

| | | | | | | | | | | | |

Non-current liabilities | | | | | | | | | | | | |

Warrant liability | | | 10 | | | | 3,646 | | | | 11,549 | |

Asset retirement obligations | | | 11 | | | | 36,412 | | | | 31,236 | |

Lease liability | | | | | | | 948 | | | | 687 | |

Total non-current liabilities | | | | | | | 41,006 | | | | 43,472 | |

| | | | | | | | | | | | |

Shareholders' equity | | | | | | | | | | | | |

Share capital | | | 12 | | | | 412,606 | | | | 302,182 | |

Contributed surplus | | | | | | | 20,270 | | | | 19,881 | |

Accumulated other comprehensive income | | | | | | | 4,076 | | | | 3,718 | |

Accumulated deficit | | | | | | | (284,038 | ) | | | (250,911 | ) |

Total shareholders' equity | | | | | | | 152,914 | | | | 74,870 | |

Total liabilities and shareholders' equity | | | | | | | 201,371 | | | | 128,376 | |

Ur-Energy Inc. |

| Interim Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited) |

(expressed in thousands of U.S. dollars, except share data) |

| (the accompanying notes are an integral part of these condensed consolidated financial statements) |

| | | | | Three Months Ended | | | Nine Months Ended | |

| | | | | September 30, | | | September 30, | |

| | Note | | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | | | | | | | | | | |

Sales | | | 13 | | | | 6,400 | | | | 5,752 | | | | 11,053 | | | | 12,238 | |

Cost of sales | | | 14 | | | | (5,613 | ) | | | (4,855 | ) | | | (10,079 | ) | | | (14,310 | ) |

Gross profit (loss) | | | | | | | 787 | | | | 897 | | | | 974 | | | | (2,072 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating costs | | | 15 | | | | (12,650 | ) | | | (11,289 | ) | | | (40,528 | ) | | | (20,373 | ) |

Operating loss | | | | | | | (11,863 | ) | | | (10,392 | ) | | | (39,554 | ) | | | (22,445 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net interest income | | | | | | | 1,220 | | | | 406 | | | | 2,288 | | | | 1,079 | |

Warrant liability revaluation gain (loss) | | | 10 | | | | 2,968 | | | | (7,216 | ) | | | 4,442 | | | | (4,155 | ) |

Foreign exchange gain | | | | | | | 6 | | | | 13 | | | | 22 | | | | 335 | |

Other income (loss), net | | | | | | | (333 | ) | | | 2 | | | | (325 | ) | | | 2 | |

Net loss | | | | | | | (8,002 | ) | | | (17,187 | ) | | | (33,127 | ) | | | (25,184 | ) |

| | | | | | | | | | | | | | | | | | | | |

Foreign currency translation adjustment | | | | | | | (23 | ) | | | 144 | | | | 358 | | | | (290 | ) |

Comprehensive loss | | | | | | | (8,025 | ) | | | (17,043 | ) | | | (32,769 | ) | | | (25,474 | ) |

| | | | | | | | | | | | | | | | | | | | |

Loss per common share: | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | (0.02 | ) | | | (0.07 | ) | | | (0.11 | ) | | | (0.10 | ) |

Diluted | | | | | | | (0.02 | ) | | | (0.07 | ) | | | (0.11 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | |

Weighted average common shares: | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | 341,418,122 | | | | 265,279,380 | | | | 302,077,595 | | | | 257,385,661 | |

Diluted | | | | | | | 341,418,122 | | | | 265,279,380 | | | | 302,077,595 | | | | 257,385,661 | |

Ur-Energy Inc. |

| Interim Condensed Consolidated Statements of Changes in Shareholders' Equity (Unaudited) |

(expressed in thousands of U.S. dollars, except share data) |

| (the accompanying notes are an integral part of these condensed consolidated financial statements) |

Nine Months Ended September 30, 2024 | | Note | | | Shares | | | Share Capital | | | Contributed Surplus | | | Accumulated Other Comprehensive Income | | | Accumulated Deficit | | | Shareholders’ Equity | |

| | | | | | | | | | | | | | | | | | | | | |

December 31, 2023 | | | | | | 270,898,900 | | | | 302,182 | | | | 19,881 | | | | 3,718 | | | | (250,911 | ) | | | 74,870 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exercise of stock options | | | 12 | | | | 74,674 | | | | 61 | | | | (21 | ) | | | - | | | | - | | | | 40 | |

Exercise of warrants | | | 12 | | | | 8,188,250 | | | | 15,849 | | | | - | | | | - | | | | - | | | | 15,849 | |

Shares issued for cash | | | 12 | | | | 2,464,500 | | | | 4,227 | | | | - | | | | - | | | | - | | | | 4,227 | |

Share issue costs | | | 12 | | | | - | | | | (106 | ) | | | - | | | | - | | | | - | | | | (106 | ) |

Stock compensation | | | 12 | | | | - | | | | - | | | | 324 | | | | - | | | | - | | | | 324 | |

Comprehensive income (loss) | | | | | | | - | | | | - | | | | - | | | | 283 | | | | (18,541 | ) | | | (18,258 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

March 31, 2024 | | | | | | | 281,626,324 | | | | 322,213 | | | | 20,184 | | | | 4,001 | | | | (269,452 | ) | | | 76,946 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exercise of stock options | | | 12 | | | | 449,879 | | | | 366 | | | | (112 | ) | | | - | | | | - | | | | 254 | |

Shares issued for cash | | | 12 | | | | 13,108,525 | | | | 22,419 | | | | - | | | | - | | | | - | | | | 22,419 | |

Share issue costs | | | 12 | | | | - | | | | (700 | ) | | | - | | | | - | | | | - | | | | (700 | ) |

Stock compensation | | | 12 | | | | - | | | | - | | | | 325 | | | | - | | | | - | | | | 325 | |

Comprehensive income (loss) | | | | | | | - | | | | - | | | | - | | | | 98 | | | | (6,584 | ) | | | (6,486 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

June 30, 2024 | | | | | | | 295,184,728 | | | | 344,298 | | | | 20,397 | | | | 4,099 | | | | (276,036 | ) | | | 92,758 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exercise of stock options | | | 12 | | | | 1,522,207 | | | | 1,263 | | | | (387 | ) | | | - | | | | - | | | | 876 | |

Shares issued for cash | | | 12 | | | | 67,089,300 | | | | 70,922 | | | | - | | | | - | | | | - | | | | 70,922 | |

Share issue costs | | | 12 | | | | - | | | | (3,877 | ) | | | - | | | | - | | | | - | | | | (3,877 | ) |

Redemption of RSUs | | | 12 | | | | - | | | | - | | | | (56 | ) | | | - | | | | - | | | | (56 | ) |

Stock compensation | | | 12 | | | | - | | | | - | | | | 316 | | | | - | | | | - | | | | 316 | |

Comprehensive loss | | | | | | | - | | | | - | | | | - | | | | (23 | ) | | | (8,002 | ) | | | (8,025 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

September 30, 2024 | | | | | | | 363,796,235 | | | | 412,606 | | | | 20,270 | | | | 4,076 | | | | (284,038 | ) | | | 152,914 | |

Ur-Energy Inc. |

| Interim Condensed Consolidated Statements of Changes in Shareholders' Equity (Unaudited), continued |

(expressed in thousands of U.S. dollars, except share data) |

| (the accompanying notes are an integral part of these condensed consolidated financial statements) |

Nine Months Ended September 30, 2023 | | Note | | | Shares | | | Share Capital | | | Contributed Surplus | | | Accumulated Other Comprehensive Income | | | Accumulated Deficit | | | Shareholders’ Equity | |

| | | | | | | | | | | | | | | | | | | | | |

December 31, 2022 | | | | | | 224,699,621 | | | | 258,646 | | | | 19,843 | | | | 4,265 | | | | (220,255 | ) | | | 62,499 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exercise of stock options | | | 12 | | | | 536,183 | | | | 429 | | | | (131 | ) | | | - | | | | - | | | | 298 | |

Shares issued for cash | | | 12 | | | | 39,491,000 | | | | 37,528 | | | | - | | | | - | | | | - | | | | 37,528 | |

Share issue costs | | | 12 | | | | - | | | | (2,992 | ) | | | - | | | | - | | | | - | | | | (2,992 | ) |

Stock compensation | | | 12 | | | | - | | | | - | | | | 253 | | | | - | | | | - | | | | 253 | |

Comprehensive loss | | | | | | | - | | | | - | | | | - | | | | (317 | ) | | | (713 | ) | | | (1,030 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

March 31, 2023 | | | | | | | 264,726,804 | | | | 293,611 | | | | 19,965 | | | | 3,948 | | | | (220,968 | ) | | | 96,556 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Share issue costs | | | 12 | | | | - | | | | (10 | ) | | | - | | | | - | | | | - | | | | (10 | ) |

Stock compensation | | | 12 | | | | - | | | | - | | | | 266 | | | | - | | | | - | | | | 266 | |

Comprehensive loss | | | | | | | - | | | | - | | | | - | | | | (117 | ) | | | (7,284 | ) | | | (7,401 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

June 30, 2023 | | | | | | | 264,726,804 | | | | 293,601 | | | | 20,231 | | | | 3,831 | | | | (228,252 | ) | | | 89,411 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exercise of stock options | | | 12 | | | | 1,005,541 | | | | 960 | | | | (288 | ) | | | - | | | | - | | | | 672 | |

Redemption of RSUs | | | 12 | | | | 241,857 | | | | 308 | | | | (389 | ) | | | - | | | | - | | | | (81 | ) |

Stock compensation | | | 12 | | | | - | | | | - | | | | 260 | | | | - | | | | - | | | | 260 | |

Comprehensive income (loss) | | | | | | | - | | | | - | | | | - | | | | 144 | | | | (17,187 | ) | | | (17,043 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

September 30, 2023 | | | | | | | 265,974,202 | | | | 294,869 | | | | 19,814 | | | | 3,975 | | | | (245,439 | ) | | | 73,219 | |

Ur-Energy Inc. |

| Interim Condensed Consolidated Statements of Cash Flow (Unaudited) |

(expressed in thousands of U.S. dollars) |

| (the accompanying notes are an integral part of these condensed consolidated financial statements) |

| | | | | Nine Months Ended September 30, | |

Cash provided by (used for): | | Note | | | 2024 | | | 2023 | |

| | | | | | | | | |

Operating activities | | | | | | | | | |

Net loss for the period | | | | | | (33,127 | ) | | | (25,184 | ) |

| | | | | | | | | | | |

Items not affecting cash: | | | | | | | | | | | |

Stock based compensation | | | | | | 965 | | | | 779 | |

Inventory net realizable value adjustments | | | | | | 2,061 | | | | 8,158 | |

Amortization of mineral properties | | | | | | 205 | | | | 828 | |

Depreciation of capital assets | | | | | | 1,979 | | | | 1,546 | |

Accretion expense | | | | | | 518 | | | | 371 | |

Amortization of deferred loan costs | | | | | | 33 | | | | 33 | |

Provision for reclamation | | | | | | (6 | ) | | | - | |

Warrant liability revaluation loss (gain) | | | | | | (4,442 | ) | | | 4,155 | |

Gain on sale of capital assets | | | | | | (2 | ) | | | - | |

Foreign exchange gain | | | | | | (22 | ) | | | (329 | ) |

Changes in non-cash working capital: | | | | | | | | | | | |

Trade receivables | | | | | | (27 | ) | | | (5,600 | ) |

Lease receivable | | | | | | (520 | ) | | | - | |

Inventory | | | | | | (3,736 | ) | | | (2,956 | ) |

Prepaid expenses | | 16 | | | | 623 | | | | (565 | ) |

Accounts payable and accrued liabilities | | 16 | | | | 3,011 | | | | 2,105 | |

| | | | | | (32,487 | ) | | | (16,659 | ) |

| | | | | | | | | | | |

Investing activities | | | | | | | | | | | |

Purchase of capital assets | | 16 | | | | (5,701 | ) | | | (1,923 | ) |

| | | | | | (5,701 | ) | | | (1,923 | ) |

| | | | | | | | | | | |

Financing activities | | | | | | | | | | | |

Issuance of common shares for cash | | | 12 | | | | 97,568 | | | | 46,637 | |

Share issue costs | | | 12 | | | | (4,683 | ) | | | (3,002 | ) |

Proceeds from exercise of warrants and stock options | | | 12 | | | | 12,228 | | | | 969 | |

RSUs redeemed for cash | | | | | | | (56 | ) | | | (81 | ) |

Repayment of debt | | | | | | | (5,727 | ) | | | (4,027 | ) |

| | | | | | | 99,330 | | | | 40,496 | |

| | | | | | | | | | | | |

Effects of foreign exchange rate changes on cash | | | | | | | (34 | ) | | | 7 | |

| | | | | | | | | | | | |

Increase in cash, cash equivalents, and restricted cash and cash equivalents | | | | | | | 61,108 | | | | 21,921 | |

Beginning cash, cash equivalents, and restricted cash and cash equivalents | | | | | | | 68,249 | | | | 41,140 | |

Ending cash, cash equivalents, and restricted cash and cash equivalents | | | 16 | | | | 129,357 | | | | 63,061 | |

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

1. Nature of Operations

Ur-Energy Inc. (the “Company”) was incorporated on March 22, 2004, under the laws of the Province of Ontario. The Company continued under the Canada Business Corporations Act on August 8, 2006. The Company is an exploration stage issuer, as defined by United States Securities and Exchange Commission (“SEC”). The Company is engaged in uranium mining and recovery operations, with activities including the acquisition, exploration, development, and production of uranium mineral resources located primarily in Wyoming. The Company commenced uranium production at its Lost Creek Project in Wyoming in 2013.

Due to the nature of the uranium recovery methods used by the Company on the Lost Creek Property, and the definition of “mineral reserves” under Subpart 1300 to Regulation S-K (“S-K 1300”), the Company has not determined whether the property contains mineral reserves. The recoverability of amounts recorded for mineral properties is dependent upon the discovery of economic resources, the ability of the Company to obtain the necessary financing to develop the properties and upon attaining future profitable production from the properties or sufficient proceeds from the disposition of the properties.

2. Summary of Significant Accounting Policies

Basis of presentation

These unaudited interim condensed consolidated financial statements do not conform in all respects to the requirements of U.S. generally accepted accounting principles (“US GAAP”) for annual financial statements. These unaudited interim condensed consolidated financial statements reflect all the normal adjustments which in the opinion of management are necessary for a fair presentation of the results for the periods presented. These unaudited interim condensed consolidated financial statements should be read in conjunction with the audited annual consolidated financial statements for the year ended December 31, 2023. We applied the same accounting policies as in the prior year. Certain information and footnote disclosures required by US GAAP have been condensed or omitted in these interim consolidated financial statements.

Functional and reporting currency

Items included in the financial statements of each of the Company’s entities are measured using the currency of the primary economic environment in which the entity operates (“the functional currency”). The functional currency of the Company is the Canadian dollar and the functional currency for Ur-Energy USA Inc. and its subsidiaries, all of which are wholly owned subsidiaries, is the U.S. dollar. The reporting currency for these consolidated financial statements is U.S. dollars.

Accounting pronouncements not yet adopted

In November 2023, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. This ASU requires annual and interim disclosures about significant segment expenses that are regularly provided to the chief operating decision maker and included within each reported measure of segment profit or loss as well as the amount and composition of other segment items. All disclosure requirements under this ASU are also required for public entities with a single reportable segment. This ASU is effective for the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, and subsequent interim periods, with early adoption permitted. The Company is currently evaluating the impact of adopting this ASU on its consolidated financial statements and disclosures.

3. Cash and Cash Equivalents

The Company’s cash and cash equivalents consist of the following:

Cash and Cash Equivalents | | September 30, 2024 | | | December 31, 2023 | |

| | | | | | |

Cash on deposit | | | 3,611 | | | | 11,515 | |

Money market accounts | | | 114,849 | | | | 48,185 | |

| | | 118,460 | | | | 59,700 | |

4. Inventory

The Company’s inventory consists of the following:

Inventory by Type | | September 30, 2024 | | | December 31, 2023 | |

| | | | | | |

In-process inventory | | | 427 | | | | - | |

Plant inventory | | | 1,499 | | | | 1,343 | |

Conversion facility inventory | | | 2,320 | | | | 1,228 | |

| | | 4,246 | | | | 2,571 | |

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

Using lower of cost or net realizable value (“NRV”) calculations, the Company reduced the inventory valuation by $2,061 and $8,158 for the nine months ended September 30, 2024 and 2023, respectively.

5. Restricted Cash and Cash Equivalents

The Company’s restricted cash consists of the following:

Restricted Cash | | September 30, 2024 | | | December 31, 2023 | |

| | | | | | |

Cash pledged for reclamation | | | 10,885 | | | | 8,518 | |

Other restricted cash | | | 12 | | | | 31 | |

| | | 10,897 | | | | 8,549 | |

The Company’s restricted cash consists of money market and short-term government bond investment accounts.

The bonding requirements for reclamation obligations on various properties have been reviewed and approved by the Wyoming Department of Environmental Quality (“WDEQ”), including the Wyoming Uranium Recovery Program (“URP”), and the Bureau of Land Management (“BLM”) as applicable. The restricted accounts are pledged as collateral against performance surety bonds, which secure the estimated costs of reclamation related to the properties. Surety bonds totaled $41.6 million and $28.4 million as of September 30, 2024, and December 31, 2023, respectively.

6. Mineral Properties

The Company’s mineral properties consist of the following:

Mineral Properties | | Lost Creek Property | | | Shirley Basin Property | | | Other U.S. Properties | | | Total | |

| | | | | | | | | | | | |

December 31, 2023 | | | 2,466 | | | | 17,726 | | | | 14,714 | | | | 34,906 | |

| | | | | | | | | | | | | | | | |

Change in estimated reclamation costs | | | 4,565 | | | | 93 | | | | - | | | | 4,658 | |

Depletion and amortization | | | (205 | ) | | | - | | | | - | | | | (205 | ) |

| | | | | | | | | | | | | | | | |

September 30, 2024 | | | 6,826 | | | | 17,819 | | | | 14,714 | | | | 39,359 | |

Lost Creek Property

The Company acquired certain Wyoming properties in 2005 when Ur-Energy USA Inc. purchased 100% of NFU Wyoming, LLC. Assets acquired in this transaction include the Lost Creek Project, other Wyoming properties, and development databases. NFU Wyoming, LLC was acquired for aggregate consideration of $20 million plus interest. Since 2005, the Company has increased its holdings adjacent to the initial Lost Creek acquisition through staking additional claims and making additional property purchases and leases.

There is a royalty on each of the State of Wyoming sections under lease at the Lost Creek, LC West and EN Projects, as required by law. We are not recovering uranium oxide (“U3O8”) within the State section under lease at Lost Creek and therefore are not subject to royalty payments currently. Other royalties exist on certain mining claims at the LC South, LC East and EN Projects. There are no royalties on the mining claims in the Lost Creek, LC North, or LC West Projects.

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

Shirley Basin Property

The Company acquired additional Wyoming properties in 2013 when Ur-Energy USA Inc. purchased 100% of Pathfinder Mines Corporation (“Pathfinder”). Assets acquired in this transaction include the Shirley Basin property, other Wyoming properties, and development databases. Pathfinder was acquired for aggregate consideration of $6.7 million, the assumption of $5.7 million in estimated asset reclamation obligations, and other consideration.

Other U.S. Properties

Other U.S. properties include the acquisition costs of several prospective mineralized properties, which the Company continues to maintain through claim payments, lease payments, insurance, and other holding costs in anticipation of future exploration efforts.

7. Capital Assets

The Company’s capital assets consist of the following:

| | September 30, 2024 | | | December 31, 2023 | |

Capital Assets | | Cost | | | Accumulated Depreciation | | | Net Book Value | | | Cost | | | Accumulated Depreciation | | | Net Book Value | |

| | | | | | | | | | | | | | | | | | |

Rolling stock | | | 8,410 | | | | (4,219 | ) | | | 4,191 | | | | 5,226 | | | | (3,701 | ) | | | 1,525 | |

Enclosures | | | 35,606 | | | | (18,134 | ) | | | 17,472 | | | | 35,190 | | | | (16,850 | ) | | | 18,340 | |

Machinery and equipment | | | 3,958 | | | | (1,175 | ) | | | 2,783 | | | | 2,016 | | | | (1,081 | ) | | | 935 | |

Furniture and fixtures | | | 1,067 | | | | (176 | ) | | | 891 | | | | 265 | | | | (163 | ) | | | 102 | |

Information technology | | | 1,274 | | | | (1,117 | ) | | | 157 | | | | 1,198 | | | | (1,067 | ) | | | 131 | |

Right of use assets | | | 14 | | | | (6 | ) | | | 8 | | | | 14 | | | | (3 | ) | | | 11 | |

| | | 50,329 | | | | (24,827 | ) | | | 25,502 | | | | 43,909 | | | | (22,865 | ) | | | 21,044 | |

8. Accounts Payable and Accrued Liabilities

Accounts payable and accrued liabilities consist of the following:

Accounts Payable and Accrued Liabilities | | September 30, 2024 | | | December 31, 2023 | |

| | | | | | |

Accounts payable | | | 5,729 | | | | 1,680 | |

Accrued payroll liabilities | | | 1,068 | | | | 578 | |

Accrued severance, ad valorem, and other taxes payable | | | 310 | | | | 108 | |

| | | 7,107 | | | | 2,366 | |

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

9. Notes Payable

On October 15, 2013, the Sweetwater County Commissioners approved the issuance of a $34.0 million Sweetwater County, State of Wyoming, Taxable Industrial Development Revenue Bond (Lost Creek Project), Series 2013 (the “Sweetwater IDR Bond”) to the State of Wyoming, acting by and through the Wyoming State Treasurer, as purchaser. On October 23, 2013, the Sweetwater IDR Bond was issued, and the proceeds were in turn loaned by Sweetwater County to Lost Creek ISR, LLC pursuant to a financing agreement dated October 23, 2013 (the “State Bond Loan”). The State Bond Loan called for payments of interest at a fixed rate of 5.75% per annum on a quarterly basis commencing January 1, 2014. The principal was scheduled to be paid in 28 quarterly installments commencing January 1, 2015.

During the term of the State Bond Loan, the Sweetwater County Commissioners and the State of Wyoming approved two separate deferrals of principal payments during the downturn in the uranium market and our period of reduced production operations. Following those deferrals, quarterly principal payments resumed on October 1, 2022, and were scheduled to continue until October 1, 2024.

On March 27, 2024, the remaining $4.4 million balance due on the State Bond Loan was prepaid in full. The State Bond Loan was secured by all the assets of the Lost Creek Project. All releases of collateral have been obtained following the final repayment of the facility.

The following table summarizes the Company’s current debt.

Current Debt | | September 30, 2024 | | | December 31, 2023 | |

| | | | | | |

State Bond Loan | | | - | | | | 5,727 | |

Deferred financing costs | | | - | | | | (33 | ) |

| | | - | | | | 5,694 | |

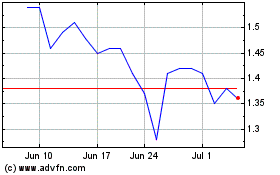

10. Warrant Liability

In February 2021, the Company issued 16,930,530 warrants to purchase 8,465,265 common shares at $1.35 per whole common share for a term of three years.

In February 2023, the Company issued 39,100,000 warrants to purchase 19,550,000 common shares at $1.50 per whole common share for a term of three years.

Because the warrants are priced in U.S. dollars and the functional currency of Ur-Energy Inc., the parent entity, is Canadian dollars, a derivative financial liability was created. Using Level 2 inputs of the fair value hierarchy under US GAAP, the liability created is measured and recorded at fair value, and adjusted monthly, using the Black-Scholes model described below as there is no active market for the warrants. Any gain or loss from the adjustment of the liability is reflected in net income (loss) for the period.

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

The Company’s warrant liabilities consist of the following. The Company has no current warrant liability.

Warrant Liability Activity | | Feb-2021 Warrants | | | Feb-2023 Warrants | | | Total | |

| | | | | | | | | |

December 31, 2023 | | | 1,743 | | | | 11,549 | | | | 13,292 | |

| | | | | | | | | | | | |

Warrants exercised | | | (4,770 | ) | | | (21 | ) | | | (4,791 | ) |

Warrant liability revaluation loss (gain) | | | 3,072 | | | | (7,514 | ) | | | (4,442 | ) |

Effects of foreign exchange rate changes | | | (45 | ) | | | (368 | ) | | | (413 | ) |

| | | | | | | | | | | | |

September 30, 2024 | | | - | | | | 3,646 | | | | 3,646 | |

The fair value of the warrant liabilities on September 30, 2024, was determined using the Black-Scholes model with the following assumptions:

| | Feb-2023 | |

Black-Scholes Assumptions as of September 30, 2024 | | Warrants | |

| | | |

Expected forfeiture rate | | | 0.0 | % |

Expected life (years) | | | 1.4 | |

Expected volatility rate | | | 48.5 | % |

Risk free rate | | | 2.9 | % |

Expected dividend rate | | | 0.0 | % |

Exercise price | | $ | 1.50 | |

Market price | | $ | 1.19 | |

11. Asset Retirement Obligations

Asset retirement obligations relate to the Lost Creek mine and Shirley Basin project and are equal to the current estimated reclamation cost escalated at inflation rates ranging from 0.74% to 5.20% and then discounted at credit adjusted risk-free rates ranging from 0.33% to 9.61%. Current estimated reclamation costs include costs of closure, reclamation, demolition, and stabilization of the wellfields, processing plants, infrastructure, aquifer restoration, waste dumps, and ongoing post-closure environmental monitoring and maintenance costs. The schedule of payments required to settle the future reclamation extends through 2033.

The present value of the estimated future closure estimate is presented in the following table.

Asset Retirement Obligations | | Total | |

| | | |

December 31, 2023 | | | 31,236 | |

| | | | |

Change in estimated reclamation costs | | | 4,658 | |

Accretion expense | | | 518 | |

| | | | |

September 30, 2024 | | | 36,412 | |

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

The restricted cash and cash equivalents discussed in note 5 relates to the surety bonds provided to the governmental agencies for these and other reclamation obligations.

12. Shareholders’ Equity and Capital Stock

Common shares

The Company’s share capital consists of an unlimited amount of Class A preferred shares authorized, without par value, of which no shares are issued and outstanding; and an unlimited amount of common shares authorized, without par value, of which 363,796,235 shares and 270,898,900 shares were issued and outstanding as of September 30, 2024, and December 31, 2023, respectively.

On February 21, 2023, the Company closed an underwritten public offering of 34,000,000 common shares and accompanying warrants to purchase up to 17,000,000 common shares, at a combined public offering price of $1.18 per common share and accompanying warrant. The warrants have an exercise price of $1.50 per whole common share and will expire three years from the date of issuance. Ur-Energy also granted the underwriters a 30-day option to purchase up to an additional 5,100,000 common shares and warrants to purchase up to 2,550,000 common shares on the same terms. The option was exercised in full. Including the exercised option, Ur-Energy issued a total of 39,100,000 common shares and accompanying warrants to purchase up to 19,550,000 common shares. The gross proceeds to Ur-Energy from this offering were approximately $46.1 million. After fees and expenses of $3.0 million, net proceeds to the Company were approximately $43.1 million.

On July 29, 2024, the Company closed an underwritten public offering of 57,150,000 common shares at a price of $1.05 per common share. The Company also granted the underwriters a 30-day option to purchase up to 8,572,500 additional common shares on the same terms. The option was exercised in full. Including the exercised option, the Company issued a total of 65,722,500 common shares. The gross proceeds to the Company from this offering were approximately $69.0 million. After fees and expenses of $3.8 million, net proceeds to the Company were approximately $65.2 million.

During the nine months ended September 30, 2024, the Company sold 16,939,825 common shares through its At Market facility for $28.6 million. After issue costs of $0.9 million, net proceeds to the Company were $27.7 million.

Stock options

In 2005, the Company’s Board of Directors approved the adoption of the Company's stock option plan (the “Option Plan”). The Option Plan was most recently approved by the shareholders on June 2, 2023. Eligible participants under the Option Plan include directors, officers, employees, and consultants of the Company. Under the terms of the Option Plan, grants of options will vest over a three-year period: one-third on the first anniversary, one-third on the second anniversary, and one-third on the third anniversary of the grant. The term of the options is five years.

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

Activity with respect to stock options is summarized as follows:

Stock Option Activity | | Outstanding Options | | | Weighted-average Exercise Price | |

December 31, 2023 | | | 8,900,335 | | | | 0.87 | |

| | | | | | | | |

Granted | | | 500,000 | | | | 1.79 | |

Exercised | | | (2,046,760 | ) | | | 0.58 | |

Forfeited | | | (353,649 | ) | | | 1.30 | |

| | | | | | | | |

September 30, 2024 | | | 6,999,926 | | | | 0.98 | |

The exercise price of a new grant is set at the closing price for the shares on the Toronto Stock Exchange (TSX) on the trading day immediately preceding the grant date and there is no intrinsic value as of the date of grant.

We received $1.2 million from options exercised in the nine months ended September 30, 2024.

Stock-based compensation expense from stock options was $0.2 million and $0.6 million for the three and nine months ended September 30, 2024, respectively and $0.2 million and $0.5 million for the three and nine months ended September 30, 2023, respectively.

As of September 30, 2024, there was approximately $1.3 million of unamortized stock-based compensation expense related to the Option Plan. The expenses are expected to be recognized over the remaining weighted-average vesting period of 2.1 years under the Option Plan.

As of September 30, 2024, outstanding stock options are as follows (expressed in U.S. dollars):

| Options Outstanding | Options Exercisable | |

Exercise Price | Number of Options | Weighted-average Remaining Contractual Life | Aggregate Intrinsic Value | Number of Options | Weighted-average Remaining Contractual Life | Aggregate Intrinsic Value | Expiry |

$ | $ | years | $ | # | years | $ | |

0.58 | 304,803 | 0.1 | 184,672 | 304,803 | 0.1 | 184,672 | 2024-11-05 |

0.47 | 2,512,347 | 1.1 | 1,819,386 | 2,512,347 | 1.1 | 1,819,386 | 2025-11-13 |

1.06 | 1,244,100 | 1.9 | 155,841 | 1,244,100 | 1.9 | 155,841 | 2026-08-27 |

1.65 | 175,000 | 2.5 | - | 116,666 | 2.5 | - | 2027-03-14 |

1.15 | 1,200,788 | 3.3 | 52,751 | 434,906 | 3.3 | 19,105 | 2028-01-04 |

1.52 | 1,062,888 | 4.2 | - | - | - | - | 2028-12-07 |

1.82 | 500,000 | 4.6 | - | - | - | - | 2029-05-08 |

| | | | | | | |

0.98 | 6,999,926 | 2.3 | 2,212,650 | 4,612,822 | 1.5 | 2,179,004 | |

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

The aggregate intrinsic value of the options in the preceding table represents the total pre-tax intrinsic value for stock options, with an exercise price less than the Company’s TSX closing stock price as of the last trading day in the nine months ended September 30, 2024 (approximately US$1.19), that would have been received by the option holders had they exercised their options on that date. There were 5,262,038 in-the-money stock options outstanding and 4,496,156 in-the-money stock options exercisable as of September 30, 2024.

The fair value of the options granted in the nine months ended September 30, 2024 was determined using the Black-Scholes model with the following assumptions:

Stock Options Fair Value Assumptions | | 2024 | |

| | | |

Expected forfeiture rate | | | 5.0 | % |

Expected life (years) | | | 4.0 | |

Expected volatility | | | 67.1 | % |

Risk free rate | | | 3.8 | % |

Expected dividend rate | | | 0.0 | % |

Weighted average exercise price (CAD$) | | $ | 2.46 | |

Black-Scholes value (CAD$) | | $ | 1.33 | |

Restricted share units

On June 24, 2010, the Company’s shareholders approved the adoption of the Company’s restricted share unit plan (the “RSU Plan”), as subsequently amended and now known as the Restricted Share Unit and Equity Incentive Plan (the “RSU&EI Plan”). The RSU&EI Plan was approved by our shareholders most recently on June 2, 2022.

Eligible participants under the RSU&EI Plan include directors and employees of the Company. Granted RSUs are redeemed on the second anniversary of the grant. Upon an RSU redemption, the holder of the RSU will receive one common share, for no additional consideration, for each RSU held.

Activity with respect to RSUs is summarized as follows:

Restricted Share Unit Activity | | Outstanding RSUs | | | Weighted-average Grant Date Fair Value | |

December 31, 2023 | | | 641,910 | | | | 1.33 | |

| | | | | | | | |

Redeemed | | | (39,233 | ) | | | 1.30 | |

Forfeited | | | (6,905 | ) | | | 1.51 | |

| | | | | | | | |

September 30, 2024 | | | 595,772 | | | | 1.32 | |

Stock-based compensation expense from RSUs was $0.1 million and $0.4 million for the three and nine months ended September 30, 2024, respectively, and $0.1 million and $0.2 million for the three and nine months ended September 30, 2023, respectively.

As of September 30, 2024, there was approximately $0.3 million of unamortized stock-based compensation expense related to the RSU&EI Plan. The expenses are expected to be recognized over the remaining weighted-average vesting periods of 1.0 years under the RSU&EI Plan.

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

As of September 30, 2024, outstanding RSUs were as follows (expressed in U.S. dollars):

Number of RSUs | | | Weighted-average Remaining Contractual Life | | | Aggregate Intrinsic Value | | | Redemption Date | |

# | | | years | | | $ | | | | |

| 310,024 | | | | 0.3 | | | | 368,929 | | | 2025-01-04 | |

| 285,748 | | | | 1.2 | | | | 340,040 | | | 2025-12-07 | |

| 595,772 | | | | 0.7 | | | | 708,969 | | | | |

No restricted share units were granted in the nine months ended September 30, 2024.

Warrants

In February 2021, the Company issued 16,930,530 warrants to purchase 8,465,265 of our common shares at $1.35 per full share.

In February 2023, the Company issued 39,100,000 warrants to purchase 19,550,000 of our common shares at $1.50 per full share.

Activity with respect to warrants is summarized as follows:

Warrant Activity | | Outstanding Warrants | | | Number of Shares to be Issued Upon Exercise | | | Per Share Exercise Price | |

December 31, 2023 | | | 55,417,500 | | | | 27,708,750 | | | | 1.46 | |

| | | | | | | | | | | | |

Exercised | | | (16,376,500 | ) | | | (8,188,250 | ) | | | 1.35 | |

| | | | | | | | | | | | |

September 30, 2024 | | | 39,041,000 | | | | 19,520,500 | | | | 1.50 | |

We received $11.1 million from warrants exercised in the nine months ended September 30, 2024.

As of September 30, 2024, outstanding warrants were as follows (expressed in U.S. dollars):

Exercise Price | | | Number of Warrants | | | Weighted-average Remaining Contractual Life | | | Aggregate Intrinsic Value | | | Expiry | |

$ | | | # | | | years | | | $ | | | $ | |

| 1.50 | | | | 39,041,000 | | | | 1.4 | | | | - | | | 2026-02-21 | |

| 1.50 | | | | 39,041,000 | | | | 1.4 | | | | - | | | | |

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

Fair value calculation assumptions for stock options and restricted share units

The fair value of stock options are determined using the Black-Scholes model on their respective grant dates. The fair value of restricted share units are determined using the Intrinsic Value Method on their respective grant dates.

The Company estimates expected future volatility based on daily historical trading data of the Company’s common shares. The risk-free interest rates are determined by reference to Canadian Benchmark Bond Yield rates with maturities that approximate the expected life. The Company has never paid dividends and currently has no plans to do so. Forfeitures and expected lives were estimated based on actual historical experience.

Share-based compensation expense related to stock options and restricted share units is recognized net of estimated pre-vesting forfeitures, which results in expensing the awards that are ultimately expected to vest over the expected life.

13. Sales

Revenue is primarily derived from the sale of U3O8 under multi-year agreements or spot sales agreements. The Company also receives disposal fee revenues, which are not related to the sale of U3O8.

Revenues for the three and nine months ended September 30, 2024 and 2023 were as follows:

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Sales | | $ | | | % | | | $ | | | % | | | $ | | | % | | | $ | | | % | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Customer A | | | 6,165 | | | | 96.3 | % | | | 5,440 | | | | 94.6 | % | | | 10,789 | | | | 97.6 | % | | | 5,440 | | | | 44.5 | % |

Customer B | | | - | | | | 0.0 | % | | | - | | | | 0.0 | % | | | - | | | | 0.0 | % | | | 6,447 | | | | 52.7 | % |

U3O8 sales | | | 6,165 | | | | 96.3 | % | | | 5,440 | | | | 94.6 | % | | | 10,789 | | | | 97.6 | % | | | 11,887 | | | | 97.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Disposal fees | | | 235 | | | | 3.7 | % | | | 312 | | | | 5.4 | % | | | 264 | | | | 2.4 | % | | | 351 | | | | 2.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 6,400 | | | | 100.0 | % | | | 5,752 | | | | 100.0 | % | | | 11,053 | | | | 100.0 | % | | | 12,238 | | | | 100.0 | % |

14. Cost of Sales

Cost of sales includes ad valorem and severance taxes related to the extraction of uranium, all costs of wellfield and plant operations including the related depreciation and amortization of capitalized assets, reclamation, and mineral property costs, plus product distribution costs. These costs are also used to value inventory. The resulting inventoried cost per pound is compared to the NRV of the product, which is based on the estimated sales price of the product, net of any necessary costs to finish the product. Any inventory value in excess of the NRV is charged to cost of sales.

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

Cost of sales consists of the following:

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

Cost of Sales | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | | | | | | | |

U3O8 product cost | | | 4,891 | | | | 2,523 | | | | 8,018 | | | | 6,152 | |

Lower of cost or NRV adjustments | | | 722 | | | | 2,332 | | | | 2,061 | | | | 8,158 | |

| | | 5,613 | | | | 4,855 | | | | 10,079 | | | | 14,310 | |

15. Operating Costs

Operating expenses include exploration and evaluation expense, development expense, general and administration (“G&A”) expense, and mineral property write-offs. Exploration and evaluation expenses consist of labor and the associated costs of the exploration and evaluation departments as well as land holding and exploration costs including drilling and analysis on properties which have not reached the permitting or operations stage. Development expense relates to properties that have reached the permitting or operations stage and include costs associated with exploring, delineating, and permitting a property. Once permitted, development expenses also include the costs associated with the construction and development of the permitted property that are otherwise not eligible to be capitalized. G&A expense relates to the administration, finance, investor relations, land, and legal functions, and consists principally of personnel, facility, and support costs.

Operating costs consist of the following:

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

Operating Costs | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | | | | | | | |

Exploration and evaluation | | | 934 | | | | 512 | | | | 2,862 | | | | 1,687 | |

Development | | | 10,088 | | | | 9,339 | | | | 31,730 | | | | 13,577 | |

General and administration | | | 1,397 | | | | 1,314 | | | | 5,418 | | | | 4,738 | |

Accretion | | | 231 | | | | 124 | | | | 518 | | | | 371 | |

| | | 12,650 | | | | 11,289 | | | | 40,528 | | | | 20,373 | |

16. Supplemental Information for Statement of Cash Flows

Cash, cash equivalents, and restricted cash and cash equivalents per the Statement of Cash Flows consists of the following:

| | Nine Months Ended September 30, | |

Cash and Cash Equivalents, and Restricted Cash | | 2024 | | | 2023 | |

| | | | | | |

Cash and cash equivalents | | | 118,460 | | | | 54,627 | |

Restricted cash and cash equivalents | | | 10,897 | | | | 8,434 | |

| | | 129,357 | | | | 63,061 | |

Ur-Energy Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) September 30, 2024 |

| (expressed in thousands of U.S. dollars, except share data) |

Interest expense paid was nil and $0.1 million for the three and nine months ended September 30, 2024, respectively, and $0.1 million and $0.4 million for the three and nine months ended September 30, 2023, respectively.

Accounts payable included $1.4 million of insurance and surety bond expenses and $0.6 million in equipment purchases at September 30, 2024. Accounts payable included $0.2 million in equipment purchases at December 31, 2023. As these did not affect cash balances at the respective dates, they have been adjusted on the Statement of Cash Flow.

17. Financial Instruments

The Company’s financial instruments consist of cash and cash equivalents, trade receivables, lease receivable, restricted cash and cash equivalents, accounts payable and accrued liabilities, notes payable, and warrant liabilities. The Company is exposed to risks related to changes in interest rates and management of cash and cash equivalents.

Credit risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist of cash and cash equivalents, and restricted cash and cash equivalents. These assets include Canadian dollar and U.S. dollar denominated certificates of deposit, money market accounts, and demand deposits. These instruments are maintained at financial institutions in Canada and the U.S. Of the amount held on deposit, approximately $0.6 million is covered by the Canada Deposit Insurance Corporation, the Securities Investor Protection Corporation, or the U.S. Federal Deposit Insurance Corporation, leaving approximately $128.7 million at risk on September 30, 2024, should the financial institutions with which these amounts are invested be rendered insolvent. The Company considers any expected credit losses on its financial instruments to be nominal as of September 30, 2024.

Currency risk

As of September 30, 2024, we maintained a balance of approximately $2.5 million Canadian dollars. The funds will be used to pay Canadian dollar expenses and are considered to be a low currency risk to the Company.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they come due. As of September 30, 2024, the Company’s financial liabilities consisted of accounts payable and accrued liabilities of $7.1 million, and the current portion of lease liability of $0.3 million. As of September 30, 2024, the Company had $118.5 million of cash and cash equivalents.

Interest rate risk

The Company has completed a sensitivity analysis to estimate the impact that a change in interest rates would have on the net loss and considers the change to be a low interest rate risk to the Company.

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

Business Overview

The following discussion and analysis by management is designed to provide information that we believe is necessary for an understanding of our financial condition, changes in financial condition, and results of our operations and should be read in conjunction with the audited financial statements and MD&A contained in our Annual Report on Form 10-K for the year ended December 31, 2023.

Incorporated on March 22, 2004, Ur-Energy is an exploration stage issuer, as that term is defined by the SEC. We are engaged in uranium recovery and processing activities, including the acquisition, exploration, development, and operation of uranium mineral properties in the U.S. We are operating our first in situ recovery uranium facility at our Lost Creek Project in Wyoming. Ur-Energy is a corporation continued under the Canada Business Corporations Act on August 8, 2006. Our common shares are listed on the TSX under the symbol “URE” and on the NYSE American under the symbol “URG.”

Ur-Energy has one wholly owned subsidiary, Ur-Energy USA Inc., incorporated under the laws of the State of Colorado. Ur-Energy USA Inc. has three wholly-owned subsidiaries: NFU Wyoming, LLC, a limited liability company formed under the laws of the State of Wyoming which acts as our land holding and exploration entity; Lost Creek ISR, LLC, a limited liability company formed under the laws of the State of Wyoming to operate our Lost Creek Project and hold our Lost Creek properties and assets; and Pathfinder Mines Corporation, incorporated under the laws of the State of Delaware, which holds, among other assets, the Shirley Basin Project in Wyoming. Our material U.S. subsidiaries remain unchanged since the filing of our Annual Report on Form 10-K, dated March 6, 2024.

We utilize in situ recovery (“ISR”) of the uranium at our flagship project, Lost Creek, and will do so at other projects where possible. The ISR technique is employed in uranium extraction because it allows for an effective recovery of roll front uranium mineralization at a lower cost. At Lost Creek, we extract and process uranium oxide (“U3O8”) for shipping to a third-party conversion facility to be weighed, assayed and stored until sold. After sale, when further processed, the uranium we have produced fuels carbon-free, emissions-free nuclear power which is a cost-effective, safe, and reliable form of electrical power. Nuclear power provides an estimated 50% of the carbon-free electricity in the U.S.

Our Lost Creek Project is permitted and licensed for annual recovery of up to 1.2 million pounds U3O8. The processing facility at Lost Creek, which includes all circuits for the production, drying and packaging of U3O8 for delivery into sales transactions, is designed and approved under current licensing to process up to 2.2 million pounds of U3O8 annually, which provides additional capacity of up to one million pounds U3O8 to process material from other sources. The Lost Creek processing facility will be utilized to process captured U3O8 from our Shirley Basin Project for which a satellite plant will be built in 2025. However, the Shirley Basin permit and license allow for the construction of a full processing facility, providing greater construction and operating flexibility as may be dictated by future market conditions.

Our sales deliveries in 2024 are projected to be 570,000 pounds U3O8 into two of our sales agreements secured in 2022. We now have six multi-year sales agreements which together anticipate sales of approximately 5.7 million pounds U3O8 between 2024 and 2030.

Industry and Market Update

In the past several years, the nuclear markets have been favorably affected in many ways through greater acceptance of nuclear energy. Recently, technology and other industries operating data centers (in what is now simply being referred to as “big data”) have realized the opportunities which exist to maintain carbon free baseload electricity while supporting the immense electric demand generated by these centers. The Electric Power Research Institute’s May 28, 2024, White Paper titled Powering Intelligence, suggests that data centers are expected to consume as much as 9.1% of U.S. electricity generation by 2030 versus an estimated 4% today.

The International Energy Agency stated in its Electricity 2024, Analysis and Forecast to 2026 report that

Data centres are significant drivers of growth in electricity demand in many regions. After globally consuming an estimated 460 terawatt-hours (TWh) in 2022, data centres’ total electricity consumption could reach more than 1 000 TWh in 2026. This demand is roughly equivalent to the electricity consumption of Japan.

The use of nuclear power by big data isn’t just a projection; it is already happening in a material way. Talen has already been selling significant power to big data. During the quarter, Constellation Energy announced a power purchase agreement with Microsoft for 835 megawatts of electricity. This is the largest ever power purchase agreement for Constellation and will result in the restart of the Three Mile Island Unit 1 nuclear reactor in Pennsylvania. While contributing 835 megawatts of carbon-free electricity to the grid, this historic project will create 3,400 jobs and offset approximately 61 million metric tons of CO2 emissions over 20 years. Still others in big data, including Google and Amazon, have announced plans to utilize nuclear energy to satisfy these rapidly growing electrical needs.

Throughout 2024, utilities and other buyers continue to identify energy security as a nearly universal priority. Ongoing war and geopolitics have only strengthened the resolve of fuel purchasers to reduce dependence on Russian nuclear products. U.S. and global utilities have increasingly been seeking non-Russian supplies when negotiating uranium term sales agreements.

In the U.S., the ban on Russian imports of nuclear fuels, signed into law earlier in the year, became effective in August 2024. While allowing certain waivers until January 1, 2028, the prohibitions on imports continue through 2040. The ban will help to secure the U.S. nuclear fuel supply chain and advance domestic uranium recovery operations.

The U.S. Department of Energy (DOE) has been progressing its requests for proposals under both its high-assay, low-enriched uranium (HALEU) and low-enriched uranium (LEU) programs for which domestic uranium supply is preferred. In October 2024, the DOE announced it awarded contracts to Centrus Energy Corp., Orano SA, General Matter Inc. and Louisiana Energy Services (a URENCO company) to provide enrichment services to develop HALEU to fuel small modular nuclear reactors. The contracts for enrichment are worth up to $2.7 billion over the next ten years. These programs also reflect efforts by the U.S. to advance energy security; Russia has been the only potential source of HALEU.

Mineral Rights and Properties

We have 12 U.S. uranium properties. Ten of our uranium properties are in the Great Divide Basin, Wyoming, including Lost Creek. Currently, we control nearly 1,800 unpatented mining claims and three State of Wyoming mineral leases for a total of more than 35,000 acres in the area of the Lost Creek Property, including the Lost Creek permit area (the “Lost Creek Project”), and certain adjoining properties referred to as LC East, LC West, LC North, LC South and EN Project areas (collectively, with the Lost Creek Project, the “Lost Creek Property”). Our Shirley Basin Project permit area, also in Wyoming, comprises nearly 1,800 acres of Company-controlled mineral acres.

Lost Creek Property

During 2024 Q3 we captured 75,075 pounds, dried and packaged 71,804 pounds and shipped 67,488 pounds U3O8. Although not at previously anticipated rates, these figures represent increases in production numbers compared with the captured and dried figures of earlier quarters.

At quarter end, our in-process inventory was approximately 90,140 pounds, our drummed inventory at Lost Creek was 26,580 pounds, and our finished inventory at the conversion facility was 40,713 pounds U3O8. In addition to the two shipments made to the conversion facility during 2024 Q3, we made two shipments following the end of the quarter, which totaled 46,592 pounds U3O8.

As we continue to work through the challenges of ramp-up at Lost Creek, we now anticipate 2024 production will be in a range between 240,000 and 280,000 pounds U3O8 captured on IX resin.

We expect to satisfy our remaining 2024 contractual commitments to our customers with Lost Creek production and other available sources.

During the quarter, we brought Header Houses (HHs) 2-9 and 2-10 online, bringing the number of new header houses in the first three quarters of 2024 to five. HH 2-11 came online in early October. HH 2-12 is on the ground at Lost Creek, and HHs 2-13 through 2-15 are being constructed in our Casper facilities.

Throughout 2024 Q3 we increased our drill rig count at Lost Creek to 15. Two of the rigs which had been deployed to Shirley Basin returned to Lost Creek in October, such that our current rig count at Lost Creek is 17. We anticipate at least three additional drill rigs will mobilize to Lost Creek prior to the end of the year.

Our most recently completed deep disposal well, LCDW5, has been placed into operation, and with Lost Creek’s other two deep wells, is satisfying wastewater needs.

Because our incoming employees have little or no experience with uranium ISR operations, training remains a priority. As we are gaining a larger core group of staff, we continue to focus on retention as well as recruitment in efforts to stabilize our workforce.

Shirley Basin

Following our announcement in early 2024 of the “go” decision to begin buildout of our Shirley Basin in situ recovery facility in Carbon County, Wyoming we initiated several work programs for the year. These programs have complemented our initial purchasing plan for long lead-time equipment which began in 2023.