UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

¨ | Definitive Proxy Statement |

| x | Definitive

Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

TRINITY

PLACE HOLDINGS INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing

Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check all boxes that

apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 7, 2024 (February 9, 2024)

Trinity Place Holdings Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-08546 |

|

22-2465228 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

340 Madison Avenue, New York, New York 10173

(Address of principal executive offices) (Zip Code)

(212) 235-2190

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange on which

registered |

| Common Stock $0.01 Par Value Per Share |

|

TPHS |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.07 Submission

of Matters to a Vote of Security Holders.

As

previously disclosed, Trinity Place Holdings Inc. (the “Company”)

entered into a Stock Purchase Agreement, dated as of January 5, 2024 (as amended, the “Stock Purchase Agreement”),

with TPHS Lender LLC, the lender under the Company’s corporate credit facility (the “Company Investor”)

and TPHS Investor LLC, an affiliate of Company Investor. On January 30, 2024, the Company filed with the Securities and Exchange Commission

(the “SEC”) a definitive consent solicitation statement on Schedule 14A (the “Consent Solicitation Statement”)

seeking consent from stockholders to the stockholder proposals relating to the transactions contemplated by the Stock Purchase Agreement

(the “Transactions”), as described in more detail in the Consent Solicitation Statement (the “Stockholder

Proposals”). The affirmative vote of the Company’s stockholders of record as of the record date of January 2,

2024 holding a majority of the outstanding shares of common stock, par value $0.01 per share (the “Common Stock”) was

required to authorize and adopt the Stockholder Proposals (the “Required Stockholder Consent”). On February 7, 2024,

the Company received the Required Stockholder Consent, upon which such stockholder consents became irrevocable in accordance with the

terms of the consent solicitation.

The

Consent Solicitation Statement provides that the deadline for stockholders to return their consents to the Transactions is February 16,

2024, unless extended (the “Consent Deadline”). Because the Company has obtained the Required Stockholder

Consent, the parties to the Stock Purchase Agreement may proceed with effectuating the transactions contemplated by the stockholder proposals

prior to the Consent Deadline. Until the earlier of the Consent Deadline or closing of the Transactions, the Company will continue

to accept and tabulate consents. Although the Company has received the Required Stockholder Consent, the closing of the Transactions will

not occur until the other conditions to closing set forth in the Stock Purchase Agreement are satisfied or waived in accordance with the

Stock Purchase Agreement.

The

voting results of the consent solicitation as of February 7, 2024 are set forth below:

| 1. | Authorization of the Stock Purchase Agreement and the transactions contemplated thereby, as described

in the Consent Solicitation Statement, by adoption of the following resolutions: |

WHEREAS,

the Board has adopted, approved and authorized the Stock Purchase Agreement, JV Operating Agreement and the Transactions contemplated

thereby (the “Transactions”) and has recommended that the Company’s stockholders adopt resolutions authorizing the Stock

Purchase Agreement, JV Operating Agreement and the Transactions.

NOW

THEREFORE, BE IT RESOLVED, that the Stock Purchase Agreement, JV Operating Agreement and the Transactions are hereby authorized

in all respects; and be it further

RESOLVED,

that, pursuant to Section 271(b) of the Delaware General Corporation Law, notwithstanding the approval of the Stock Purchase Agreement,

JV Operating Agreement and the Transactions, the Board may abandon the Stock Purchase Agreement, JV Operating Agreement and the Transactions

without further action by the Company’s stockholders, subject to the rights, if any, of third parties under any contract relating

thereto.

|

For |

|

Against |

|

Abstentions |

|

|

Broker Non-Votes |

|

| 21,598,345 |

|

339,376 |

|

|

299 |

|

|

|

0 |

|

|

| 2. | Approval, pursuant to Section 713(a) of the NYSE American LLC Company Guide, of the issuance of 25,112,245

shares of Common Stock of the Company to the Company Investor in accordance with the terms and conditions of the Stock Purchase Agreement

and as described in the Consent Solicitation Statement. |

|

For |

|

Against |

|

Abstentions |

|

|

Broker Non-Votes |

|

| 21,595,845 |

|

341,876 |

|

|

299 |

|

|

|

0 |

|

|

| 3. | Approval, pursuant to Section 713(b) of the NYSE American LLC Company Guide, of the issuance of 25,112,245

shares of Common Stock of the Company to the Company Investor in accordance with the terms and conditions of the Stock Purchase Agreement

and as described in the Consent Solicitation Statement. |

|

For |

|

Against |

|

Abstentions |

|

|

Broker Non-Votes |

|

| 21,595,829 |

|

341,876 |

|

|

315 |

|

|

|

0 |

|

|

Additional Information and Where to Find It

In connection with the proposed transactions

contemplated by the Stock Purchase Agreement, the Company has filed with the SEC a definitive consent solicitation statement relating

to the contemplated transactions and other relevant documents. The definitive consent solicitation statement will be mailed to the Company’s

stockholders as of the record date established for voting on the contemplated transactions and related matters. BEFORE MAKING ANY VOTING

DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE CONSENT SOLICITATION STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS

THERETO, ANY OTHER SOLICITING MATERIALS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE CONTEMPLATED TRANSACTIONS

OR INCORPORATED BY REFERENCE IN THE CONSENT SOLICITATION STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE COMPANY AND THE CONTEMPLATED TRANSACTIONS. Investors and security holders may obtain free copies of these documents (when they

are available) on the SEC’s website at www.sec.gov or on the Company’s website at www.tphs.com.

Participants in Solicitation

This communication is not a solicitation of a

consent from any investor or securityholder. However, the Company and its directors and executive officers may, under SEC rules, be deemed

participants in the solicitation of consents from the stockholders of the Company in connection with the contemplated transactions and

related matters. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of

consents in connection with the proposed transactions and a description of their direct and indirect interests, by security holdings or

otherwise, are set forth in the definitive consent solicitation statement for the contemplated transactions. Additional information regarding

the Company’s directors and executive officers is included in the Company’s Definitive Proxy Statement on Schedule 14A for

the Company’s 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 28, 2023. To the extent holdings of the

Company’s securities by the directors or executive officers have changed since the amounts set forth in the Definitive Proxy Statement

on Schedule 14A for the Company’s 2023 Annual Meeting of Stockholders, such changes have been or will be reflected on Initial Statement

of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes

in Beneficial Ownership on Form 5 filed with the SEC. These documents (when available) are available free of charge from the sources indicated

above.

Forward Looking Statements

This

Current Report on Form 8-K includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act

of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations

and projections about future events and are not guarantees of future performance or results and involve risks and uncertainties that cannot

be predicted or quantified, and, consequently, the actual performance of the Company may differ materially from those expressed or implied

by such forward-looking statements. Forward-looking statements include, among other things, statements about the potential benefits of

the proposed Transactions; the prospective performance and outlook of the Company’s business, performance and opportunities; the

ability of the parties to complete the proposed Transactions and the expected timing of completion of the proposed Transactions; as well

as any assumptions underlying any of the foregoing. Such statements are subject to numerous assumptions, risks, uncertainties and other

factors that could cause actual results to differ materially from those described in such statements, many of which are outside of the

Company’s control. Important factors that could cause actual results to differ materially from those described in forward-looking

statements include, but are not limited to, (i) the risk that the proposed Transactions may not be completed in a timely manner or at

all; (ii) the possibility that any or all of the other conditions to the consummation of the proposed Transactions may not be satisfied

or waived; (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Stock Purchase

Agreement; (iv) the effect of the announcement or pendency of the proposed Transactions on the Company’s ability to attract, motivate

or retain key executives and employees, its ability to maintain relationships with its business counterparties, or its operating results

and business generally; (v) risks related to the proposed Transactions diverting management’s attention from the Company’s

ongoing business operations; (vi) the amount of costs, fees and expenses related to the proposed Transactions; (vii) the risk that the

Company’s stock price may decline significantly and/or that the Company will need to file for bankruptcy if the Transactions are

not consummated; (viii) the risk of stockholder litigation in connection with the proposed Transactions, including resulting expense or

delay; and (ix) other factors as set forth from time to time in the Company’s filings with the SEC, including its Annual Report

on Form 10-K, as amended, for the fiscal year ended December 31, 2022, as may be updated or supplemented by any subsequent Quarterly Reports

on Form 10-Q or other filings with the SEC. Readers are cautioned not to place undue reliance on such statements which speak only as of

the date they are made. The Company does not undertake any obligation to update or release any revisions to any forward-looking statement

or to report any events or circumstances after the date of this communication or to reflect the occurrence of unanticipated events except

as required by law. The forward-looking statements contained herein speak only as of the date hereof, and the Company assumes no obligation

to update any forward-looking statements, whether as a result of new information, subsequent events or otherwise, except as required by

law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TRINITY PLACE HOLDINGS INC. |

| |

|

| Date: February 9, 2024 |

/s/ Steven Kahn |

| |

Steven Kahn |

| |

Chief Financial Officer |

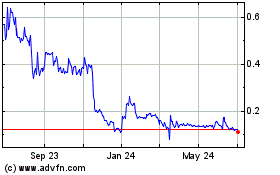

Trinity Place (AMEX:TPHS)

Historical Stock Chart

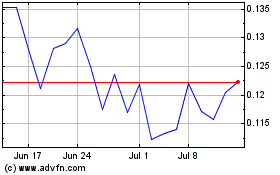

From Feb 2025 to Mar 2025

Trinity Place (AMEX:TPHS)

Historical Stock Chart

From Mar 2024 to Mar 2025