Revised Proxy Soliciting Materials (definitive) (defr14a)

April 12 2019 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

x

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Under Rule 14a-12

|

TRILOGY METALS

INC.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount

on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

¨

|

Fee paid previously with preliminary materials:

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which

the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule

and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

AMENDMENT TO THE NOTICE OF ANNUAL GENERAL MEETING OF

SHAREHOLDERS OF TRILOGY METALS INC. AND THE MANAGEMENT

INFORMATION CIRCULAR

DATED MARCH 25, 2019

APRIL 8, 2019

Explanatory

Note

The notice of the annual general meeting

of shareholders (the “

Notice

”) of Trilogy Metals Inc. (the “

Company

”) and accompanying management

information circular (the “

Circular

”), each dated March 25, 2019, relating to the annual general meeting of

shareholders of the Company to be held on May 22, 2019, are revised per this amendment (the “

Amendment

”). As

such, the Notice and the Circular should be read in conjunction with this Amendment. As discussed below, the revisions contained

in this Amendment are being made in order to add an additional item of business at the Meeting. All capitalized terms not otherwise

defined herein have the meaning ascribed thereto in the Circular.

This Amendment also amends the definitive

proxy statement of the Company that was filed with the U.S. Securities and Exchange Commission on April 1, 2019.

In accordance with the requirements of

Section 14A of the Securities Exchange Act of 1934, as amended (which was added by the Dodd-Frank Wall Street Reform and Consumer

Protection Act), and the related rules of the SEC, the Company is providing the Shareholders with a non-binding advisory vote to

approve the frequency of shareholder advisory votes on the compensation of the Company’s named executive officers. At the

2013 annual general meeting of Shareholders, the Shareholders indicated their preference for the Company to hold advisory votes

on executive compensation on a triennial basis and the Board subsequently determined that the Company would hold a triennial advisory

vote on executive compensation. Accordingly, the current frequency of our advisory votes on executive compensation is once every

three years. The next scheduled advisory vote on executive compensation is scheduled to occur at the Meeting.

Amendments

to the Notice

Paragraph 1, item 7 of the Notice is deleted and replaced with

the following:

|

|

7.

|

To conduct a non-binding vote on the frequency of a non-binding vote on the compensation of the

Company’s Named Executive Officers; and

|

|

|

8.

|

To transact such further and other business as may properly come before the Meeting or any adjournment

thereof.

|

AMENDMENTS

TO THE CIRCULAR

The following text is added as a new row

at the bottom of the table on page 4 of the Circular under the heading “Voting Standards”:

|

Matter

|

Voting Options

|

Required Vote

|

Impact of Abstentions or Broker Non-Votes

|

|

Non-Binding Advisory Vote on Frequency of Non-Binding Vote on Executive Compensation

|

One Year; Two Years; Three Years; Abstain

|

Plurality of votes – the option receiving the highest number of votes will be determined to be the preferred frequency.

|

No effect. Abstentions and broker non-votes will not be counted in favour of any option and will therefore have no effect.

|

The following text is added under the heading

“Matters to be Acted Upon at the Meeting” and immediately before the heading “Information Concerning the Board

of Directors, Director Nominees and Executive Officers” at page 14 of the Circular:

Frequency of Non-Binding

Advisory Vote on Executive Compensation

The Dodd-Frank Act enables our

Shareholders to approve, on an advisory (non-binding) basis, how frequently we should seek an advisory vote on the compensation

of our named executive officers, as disclosed pursuant to the SEC’s compensation disclosure rules. By voting on this proposal,

Shareholders may indicate whether they would prefer an advisory vote on named executive officer compensation once every one year,

two years, or three years. This proposal is commonly known as a “say-on-frequency” proposal.

The Board has determined that

submitting the non-binding vote on compensation of the Company’s NEOs to Shareholders on a TRIENNIAL basis is appropriate

for the Company and its Shareholders at this time.

The proxy form provides Shareholders

with four choices (every one, two, or three years, or abstain). Shareholders are not voting to approve or disapprove our Board’s

recommendation. Shareholder approval of a one, two, or three-year frequency vote is non-binding and will not require the Company

to implement the non-binding vote on compensation of the Company’s NEOs every one, two, or three years. The final decision

on the frequency of a non-binding vote on compensation of the Company’s NEOs remains with our Board and/or its committees.

Our Board values the opinions

of the Company’s Shareholders. Although the vote is non-binding, the Board and its committees will carefully consider the

outcome of the frequency vote when making future decisions regarding the frequency of voting on a non-binding vote on compensation

of the Company’s NEOs.

Unless the proxy specifically

instructs the proxyholder to withhold such vote, Common Shares represented by the proxies hereby solicited shall be voted FOR the

non-binding Shareholder vote on compensation of the Company’s NEOs to occur every THREE YEARS.

The Company will report the

voting results in a current report on Form 8-K that will be filed after the Meeting. In addition, the Company will disclose in

a current report on Form 8-K within the time frame required by SEC rules the decision by the Company as to the frequency of shareholder

advisory votes on executive compensation in light of the results of this shareholder advisory vote.

The following text is added under the heading

“Compensation Discussion and Analysis” and immediately before the heading “Risk Assessment of Compensation Policies

and Practices” at page 27 of the Circular:

Advisory Vote on the Frequency

of Advisory Vote on Executive Compensation

In accordance with Section 951

of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Section 14A of the Exchange Act, the Company is asking you

pursuant to this Circular to consider and, if deemed advisable, pass a non-binding resolution establishing the frequency for holding

a non-binding vote to approve the compensation of the Company’s NEOs. The Company recommends holding a non-binding vote on

NEO compensation TRIENNIALLY to provide the Company with regular input on matters of executive compensation. See the “Matters

to be Acted Upon at the Meeting - Frequency of Non-Binding Advisory Vote on Executive Compensation”.

TRILOGY METALS INC.

Security Class Holder Account Number Form of Proxy - Annual General Meeting to be held on May 22, 2019 This Form of Proxy is solicited

by and on behalf of Management. Notes to proxy1.Every holder has the right to appoint some other person or company of their choice,

who need not be a holder, to attend and act on their behalf at the meeting or any adjournment or postponement thereof. If you

wish to appoint a person or company other than the persons whose names are printed herein, please insert the name of your chosen

proxyholder in the space provided (see reverse). 2.If the securities are registered in the name of more than one owner (for example,

joint ownership, trustees, executors, etc.), then all those registered should sign this proxy. If you are voting on behalf of

a corporation or another individual you must sign this proxy with signing capacity stated, and you may be required to provide

documentation evidencing your power to sign this proxy. 3.This proxy should be signed in the exact manner as the name(s) appear(s)

on the proxy. 4.If this proxy is not dated, it will be deemed to bear the date on which it is mailed by Management to the holder.

5.The securities represented by this proxy will be voted as directed by the holder, however, if such a direction is not made in

respect of any matter, this proxy will be voted as recommended by Management. 6.The securities represented by this proxy will

be voted in favour or withheld from voting or voted against each of the matters described herein, as applicable, in accordance

with the instructions of the holder, on any ballot that may be called for and, if the holder has specified a choice with respect

to any matter to be acted on, the securities will be voted accordingly. 7.This proxy confers discretionary authority in respect

of amendments or variations to matters identified in the Notice of Meeting or other matters that may properly come before the

meeting or any adjournment or postponement thereof. 8.This proxy should be read in conjunction with the accompanying documentation

provided by Management. Proxies submitted must be received by 10:00 AM (Vancouver Time) on May 17, 2019. VOTE USING THE TELEPHONE

OR INTERNET 24 HOURS A DAY 7 DAYS A WEEK! If you vote by telephone or the Internet, DO NOT mail back this proxy. Voting by mail

may be the only method for securities held in the name of a corporation or securities being voted on behalf of another individual.

Voting by mail or by Internet are the only methods by which a holder may appoint a person as proxyholder other than the Management

nominees named on the reverse of this proxy. Instead of mailing this proxy, you may choose one of the two voting methods outlined

above to vote this proxy. To vote by telephone or the Internet, you will need to provide your CONTROL NUMBER listed below. CONTROL

NUMBER

Appointment of Proxy

holderI/We being holder(s) of Trilogy Metals Inc. hereby appoint(s): Elaine Sanders, or failing her, Trisha Robertson, OR Print

the name of the person you are appointing if this person is someone other than the Chairman of the Meeting. as my/our proxyholder

with full power of substitution and to attend, act and to vote for and on behalf of the shareholder in accordance with the following

direction (or if no directions have been given, as the proxyholder sees fit) and all other matters that may properly come before

the Annual General Meeting of shareholders of Trilogy Metals Inc. to be held at Suite 2600, 595Burrard Street, Vancouver, British

Columbia, V7X 1L3, on May 22, 2019 at 10:00 a.m. (Vancouver Time) and at any adjournment or postponement thereof. VOTING RECOMMENDATIONS

ARE INDICATED BY HIGHLIGHTED TEXT OVER THE BOXES. 1. Election of Directors For Withhold 01. Tony Giardini 02. James Gowans 03.

William Hayden 04. William Iggiagruk Hensley 05. Gregory Lang 06. Kalidas Madhavpeddi 07. Janice Stairs 08. Rick Van Nieuwenhuyse

09. Diana Walters 2. Appointment of Auditors Appointment of PricewaterhouseCoopers LLP as Auditors of the Company for the ensuing

year and authorizing the Directors to fix the irremuneration. For Against Abstain 3. Continuation of the Restricted Share Unit

Plan To consider and, if deemed advisable, pass an ordinary resolution approving all unallocated entitlements to be settled in

common shares of the Company from treasury under the Restricted Share Unit Plan. 4. Continuation of the Deferred Share Unit Plan

To consider and, if deemed advisable, pass an ordinary resolution approving all unallocated entitlements to be settled in common

shares of the Company from treasury under the Deferred Share Unit Plan. 5. Non-Binding Advisory Vote on Executive Compensation

To consider and, if deemed advisable, pass a non-binding resolution approving the compensation of the Company's Named Executive

Officers. 6. Non-Binding Frequency of Non-Binding Advisory Vote on Executive Compensation The Board recommends a vote of EVERY

THREE YEARS on this proposal. Authorized Signature(s) - This section must be completed for your instructions to be executed. I/We

authorize you to act in accordance with my/our instructions set out above. I/We hereby revoke any proxy previously given with

respect to the Meeting. If no voting instructions are indicated above, this Proxy will be voted as recommended by Management.

Signature(s) Date Interim Financial Statements - Mark this box if you would like to receive Interim Financial Statements and accompanying

Management’s Discussion and Analysis by mail. Annual Financial Statements - Mark this box if you would like to receive the

Annual Financial Statements and accompanying Management’s Discussion and Analysis by mail. If you are not mailing back your

proxy, you may register online to receive the above financial report(s) by mail at www.computershare.com/mailinglist. N V K Q

2 9 1 7 5 7 A R 1

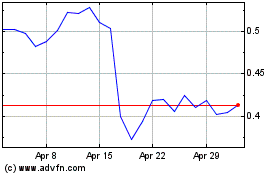

Trilogy Metals (AMEX:TMQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

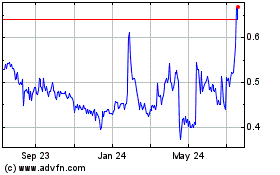

Trilogy Metals (AMEX:TMQ)

Historical Stock Chart

From Jul 2023 to Jul 2024