Time to Bargain Hunt with This Technology ETF? - ETF News And Commentary

April 17 2014 - 7:45AM

Zacks

The technology sector delivered a stellar performance last year,

but has been unable to provide meaningful support to earnings

growth of the S&P 500 index of late, despite being the second

largest earnings contributor (about 17.5%) to the index. The total

earnings for the sector is expected to slip 1% in Q1 on 2.2% higher

revenues and a 52 basis-point decline in net margins (read: 3 ETFs

in Focus on Apple Earnings Results).

The mood can further be validated by the biggest daily drop in the

tech-laden Nasdaq Composite Index in mid March since early

February. Most of the large tech ETFs strived hard to deliver even

one percentage point return over the past one month. Some

seasonality issues, tough comparisons and overvaluation can be

blamed for this burst in the tech bubble.

However, investors should not be bogged down by this slowdown.

Rather they can play the correction by looking to buy in to

technology stocks, in individual or in basket form. The sector

is expected to speed up earnings growth from this year and the

next. As per the Zacks Earnings Trend, earnings from this industry

are expected to go up 10.1% in 2014 and 11.5% in 2015.

Revenues are expected to grow 3.9% in 2014 but decline 5.4% in

2015.

In fact, Q1 is supposed to be the last quarter of earnings decline

as from 2Q the sector is slated to gather some momentum. As of now,

Zacks Earnings Trend has modeled 6.8% earnings growth for 2Q, 8.8%

for 3Q and 7.6% for the concluding quarter of the year. Revenues

will likely jump 3.3% in 2Q and 5.0% in 3Q.

Given this potential, a look at some of the top ranked ETFs in the

technology space could be a good way to target the best of the

segment with lower levels of risk. In order to do this, investors

can look at the Zacks ETF Rank and find the top ETFs in the above

mentioned sector (read: Top Ranked Technology ETF in Focus:

QTEC).

About the Zacks ETF Rank

The Zacks ETF Rank provides a recommendation for the ETF in the

context of our outlook for the underlying industry, sector, style

box or asset class (Read: Zacks ETF Rank Guide). Our proprietary

methodology also takes into account the risk preferences of

investors. ETFs are ranked on a scale of 1 (Strong Buy) to 5

(Strong Sell) while they also receive one of three risk ratings,

namely Low, Medium or High.

The aim of our models is to select the best ETFs within each risk

category. We assign each ETF one of the five ranks within each risk

bucket. Thus, the Zacks ETF Rank reflects the expected return of an

ETF relative to other products with a similar level of risk.

For investors seeking to apply this methodology to their portfolio

in the technology space, we have taken a closer look at the top

ranked FXL. This ETF has a Zacks ETF Rank of 2 or ‘Buy’ rating (see

the full list of top ranked ETFs) and is detailed below:

First Trust Technology AlphaDEX Fund (FXL)

This fund looks to have an enhanced exposure to the StrataQuant

Technology Index. The index uses the AlphaDEX methodology to select

stocks from the Russell 1000 Index. Stocks are screened on the

criteria of higher price appreciation, sales to price and one-year

sales growth, book value to price ratio, cash flow to price ratio

and return on assets.

The best part of the index is that it uses a smart beta technique

instead of focusing on plain vanilla market cap oriented approach.

It ranks the stocks in the space by various growth and value

factors, eliminating the bottom ranked 25% of the stocks. As such,

FXL should generate positive alpha relative to traditional passive

indices since it uses AlphaDEX methodology and allots higher weight

to more favorably ranked firms.

This ETF invests about $838 million of assets in 90 securities. The

portfolio is well balanced across individual holdings,

capitalization and style. No stock occupies more than 2.36% of

total assets. Its top three holdings include Ingram Micro, Brocade

Communications and Tech Data Corp.

FXL is also less exposed to the rather struggling Internet and

hardware industry of the technology sector. As far as

capitalization is concerned, mid-caps rule the category with almost

half share of the basket followed by large caps (37%) and small

caps (12%) (Read: Best ETF Strategies for 2014).

For this unique exposure, the fund charges 70 basis points in

annual fees which is slightly costly in the technology ETF space.

The fund has gained about 26.2% in the past year time frame in

contrast to the 19.3% gain seen in the biggest fund in the space –

SPDR Technology Select Sector Fund (XLK) – as well

as another top tech ETF from Vanguard, VGT, which added about 23.8%

in the time frame.

We currently give FYT a Zacks ETF Rank of 2 or ‘Buy’ rating along

with a medium risk outlook, so we are looking for this stretch

of relative outperformance to continue, though the fund

is clearly capable of some big moves in short time frames.

Bottom Line

In a nutshell, the technology sector has been broadly mixed so far

this year due to the broader market slump and uncertainty

surrounding some of the top tech players. The sector may have a

rocky earnings season coming up, so volatility may continue.

In such a scenario, investors need to deal with extra caution while

landing on some investment options in the space. And to accomplish

the goal, a smart beta approach like FXL should do the trick.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

FT-TECH ALPHA (FXL): ETF Research Reports

VIPERS-INFO TEC (VGT): ETF Research Reports

SPDR-TECH SELS (XLK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

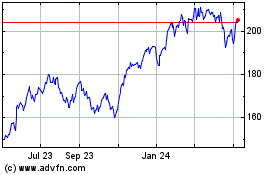

Technology Select Sector (AMEX:XLK)

Historical Stock Chart

From Apr 2024 to May 2024

Technology Select Sector (AMEX:XLK)

Historical Stock Chart

From May 2023 to May 2024