true

0001222333

FY

0001222333

2023-10-01

2024-09-30

0001222333

2024-03-31

0001222333

2024-11-22

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-37996

SPDR® GOLD TRUST

SPONSORED BY WORLD GOLD TRUST SERVICES, LLC

(Exact name of registrant as specified in its charter)

|

Delaware

|

36-7650517

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

c/o World Gold Trust Services, LLC

685 Third Avenue, Suite 2702

New York, New York 10017

(212) 317-3800

(Address of principal executive offices, telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s) Name

|

|

Name of each exchange

on which registered

|

|

SPDR® Gold Shares

|

|

GLD®

|

|

NYSE Arca, Inc.

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☒

|

Accelerated filer ☐

|

|

Non-Accelerated filer ☐

|

Smaller reporting company ☐

|

| |

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Aggregate market value of registrant’s common stock held by non-affiliates of the registrant, based upon the closing price of a share of the registrant’s common stock on March 31, 2024 as reported by the NYSE Arca, Inc. on that date: $59,081,825,589.

Number of shares of the registrant’s common stock outstanding as of November 22, 2024: 305,600,000.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

EXPLANATORY NOTE

The Registrant is filing this Amendment No. 1 on Form 10-K/A (the “Amendment”) to its Form 10-K for the year ended September 30, 2024, as originally filed with the U.S. Securities and Exchange Commission on November 25, 2024 (the “Original Filing”), for the sole purpose of including Exhibit 97.1.

In accordance with Rule 12b-15 and Rule 13a-14 promulgated under the Securities Exchange Act of 1934, as amended, this Amendment also includes new certifications by the Principal Executive Officer and Principal Financial Officer of the Registrant’s Sponsor on behalf of the Registrant dated as of the date of this filing. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the certifications have been omitted. Similarly, because no financial statements have been included in this Amendment, certifications pursuant to Section 906 of the Sarbanes Oxley Act of 2002 have been omitted.

Except as described above, no other amendments are being made to the Original Filing. This Amendment does not supersede, modify or update any other items or disclosures found in the Original Filing. In addition, this Amendment does not reflect any information, events or transactions occurring after the reporting period of the Original Filing and does not supersede, modify or update those disclosures affected by subsequent events. As a result, information included in the report continues to speak as of the date of the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing together with the Registrant’s other filings with the SEC.

Item 15. Exhibits, as amended, is included in this Amendment.

This Amendment consists solely of the preceding cover page, this explanatory note, Item 15. Exhibits, the signature page and Exhibits 31.1, 31.2 and 97.1.

PART IV

Item 15. Exhibits and Financial Statements Schedules

3. Exhibits

|

Exhibit

Number

|

|

Exhibit Description

|

|

Incorporated by Reference

|

| |

|

|

|

Form

|

|

Exhibit

|

|

Filing Date/Period

End Date

|

| |

|

|

|

|

|

|

|

|

|

4.1

|

|

|

|

10-K

|

|

4.1

|

|

9/30/07

|

| |

|

|

|

|

|

|

|

|

|

4.1.1

|

|

|

|

8-K

|

|

4.1

|

|

12/13/07

|

| |

|

|

|

|

|

|

|

|

|

4.1.2

|

|

|

|

10-K

|

|

4.1.2

|

|

9/30/08

|

| |

|

|

|

|

|

|

|

|

|

4.1.3

|

|

|

|

8-K

|

|

4.1

|

|

6/1/11

|

| |

|

|

|

|

|

|

|

|

|

4.1.4

|

|

|

|

8-K

|

|

4.1

|

|

6/19/14

|

| |

|

|

|

|

|

|

|

|

|

4.1.5

|

|

|

|

8-K

|

|

4.1.5

|

|

3/20/15

|

| |

|

|

|

|

|

|

|

|

|

4.1.6

|

|

|

|

8-K

|

|

4.1.6

|

|

7/14/15

|

| |

|

|

|

|

|

|

|

|

|

4.1.7

|

|

|

|

8-K

|

|

4.1.7

|

|

9/11/17

|

| |

|

|

|

|

|

|

|

|

|

4.1.8

|

|

|

|

10-Q

|

|

4.1.8

|

|

2/7/20

|

| |

|

|

|

|

|

|

|

|

|

4.1.9

|

|

|

|

8-K

|

|

4.1.9

|

|

11/30/22

|

| |

|

|

|

|

|

|

|

|

|

4.1.10

|

|

|

|

8-K

|

|

4.1.0

|

|

5/29/24

|

| |

|

|

|

|

|

|

|

|

|

4.2

|

|

|

|

10-K |

|

4.2 |

|

11/25/24 |

| |

|

|

|

|

|

|

|

|

|

4.3

|

|

|

|

10-K

|

|

4.3

|

|

9/30/07

|

| |

|

|

|

|

|

|

|

|

|

4.4

|

|

|

|

10-K

|

|

4.4

|

|

11/22/23

|

| |

|

|

|

|

|

|

|

|

|

10.1

|

|

|

|

8-K

|

|

10.1

|

|

5/29/24

|

| |

|

|

|

|

|

|

|

|

|

10.2

|

|

|

|

8-K

|

|

10.2

|

|

5/29/24

|

| |

|

|

|

|

|

|

|

|

|

10.4

|

|

|

|

10-K

|

|

10.4

|

|

9/30/07

|

| |

|

|

|

|

|

|

|

|

|

10.5

|

|

|

|

S-1

|

|

10.5

|

|

9/26/03

|

| |

|

|

|

|

|

|

|

|

|

10.6

|

|

|

|

8-K

|

|

10.6

|

|

7/17/15

|

|

10.6.1

|

|

|

|

10-Q

|

|

10.6.1

|

|

8/7/18

|

| |

|

|

|

|

|

|

|

|

|

10.6.2

|

|

|

|

8-K

|

|

10.6.2

|

|

11/30/22

|

| |

|

|

|

|

|

|

|

|

|

10.8

|

|

|

|

10-K

|

|

10.8

|

|

9/30/07

|

| |

|

|

|

|

|

|

|

|

|

10.8.1

|

|

|

|

10-K

|

|

10.8.1

|

|

9/30/08

|

| |

|

|

|

|

|

|

|

|

|

10.10

|

|

|

|

10-K

|

|

10.10

|

|

9/30/07

|

| |

|

|

|

|

|

|

|

|

|

10.12

|

|

|

|

10-K

|

|

10.12

|

|

9/30/08

|

| |

|

|

|

|

|

|

|

|

|

10.13

|

|

|

|

8-K

|

|

10.13

|

|

11/21/14

|

| |

|

|

|

|

|

|

|

|

|

10.14

|

|

|

|

8-K

|

|

11.1

|

|

11/30/22

|

| |

|

|

|

|

|

|

|

|

|

10.15

|

|

|

|

8-K

|

|

11.2

|

|

11/30/22

|

| |

|

|

|

|

|

|

|

|

|

23.1

|

|

|

|

10-K

|

|

23.1

|

|

11/25/24

|

| |

|

|

|

|

|

|

|

|

|

23.2

|

|

|

|

10-K

|

|

23.2

|

|

11/25/24

|

| |

|

|

|

|

|

|

|

|

|

31.1*

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

31.2*

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

32.1

|

|

|

|

10-K

|

|

32.1

|

|

11/25/24

|

| |

|

|

|

|

|

|

|

|

|

32.2

|

|

|

|

10-K

|

|

32.2

|

|

11/25/24

|

| |

|

|

|

|

|

|

|

|

|

97.1*

|

|

|

|

|

|

|

|

|

|

101.INS

|

|

Inline XBRL Instance Document

|

|

10-K

|

|

101.INS

|

|

11/25/24

|

| |

|

|

|

|

|

|

|

|

|

101.SCH

|

|

Inline XBRL Taxonomy Extension Schema Document

|

|

10-K

|

|

101.SCH

|

|

11/25/24

|

| |

|

|

|

|

|

|

|

|

|

101.CAL

|

|

Inline XBRL Taxonomy Extension Calculation Linkbase Document

|

|

10-K

|

|

101.CAL

|

|

11/25/24

|

| |

|

|

|

|

|

|

|

|

|

101.DEF

|

|

Inline XBRL Taxonomy Extension Definition Linkbase Document

|

|

10-K

|

|

101.DEF

|

|

11/25/24

|

| |

|

|

|

|

|

|

|

|

|

101.LAB

|

|

Inline XBRL Taxonomy Extension Label Linkbase Document

|

|

10-K

|

|

101.LAB

|

|

11/25/24

|

| |

|

|

|

|

|

|

|

|

|

101.PRE

|

|

Inline XBRL Taxonomy Extension Presentation Linkbase Document

|

|

10-K

|

|

101.PRE

|

|

11/25/24

|

| |

|

|

|

|

|

|

|

|

|

104.1

|

|

Cover Page Interactive Data File – The cover page interactive data file does not appear in the interactive data file because its XBRL tags are embedded within the inline XBRL document.

|

|

|

|

|

|

|

* Filed herewith.

Our independent registered public accounting firm is KPMG LLP, New York, NY, Auditor Firm ID: 185.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned in the capacities* indicated thereunto duly authorized.

| |

WORLD GOLD TRUST SERVICES, LLC

Sponsor of the SPDR® Gold Trust

(Registrant)

|

| |

|

| |

/s/ Joseph R. Cavatoni

|

| |

Joseph R. Cavatoni

Principal Executive Officer*

|

| |

|

| |

/s/ Amanda Krichman

|

| |

Amanda Krichman

Principal Financial and Accounting Officer*

|

| |

|

| |

/s/ William J. Shea

|

| |

William J. Shea

Director*

|

| |

|

| |

/s/ Molly Duffy

|

| |

Molly Duffy

Director*

|

| |

|

| |

/s/ Carlos Rodriguez

|

| |

Carlos Rodriguez

Director*

|

| |

|

| |

/s/ David Tait

|

| |

David Tait

Director*

|

Date: December 19, 2024

* The Registrant is a trust and the persons are signing in their capacities as officers or directors of World Gold Trust Services, LLC, the Sponsor of the registrant.

Exhibit 31.1

CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER PURSUANT TO RULE 13a-14(a)

AND 15d-14(a) UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

I, Joseph R. Cavatoni, certify that:

1. I have reviewed this annual report on Form 10-K/A of the SPDR® Gold Trust (the “Registrant”);

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

Date: December 19, 2024

|

/s/ Joseph R. Cavatoni

|

|

|

Joseph R. Cavatoni**

Principal Executive Officer

|

|

|

*

|

The originally executed copy of this Certification will be maintained at the Sponsor’s offices and will be made available for inspection upon request.

|

|

**

|

The Registrant is a trust and Mr. Cavatoni is signing in his capacity as Principal Executive Officer of World Gold Trust Services, LLC, the Sponsor of the Registrant.

|

Exhibit 31.2

CERTIFICATION OF PRINCIPAL FINANCIAL AND ACCOUNTING OFFICER PURSUANT TO RULE 13a-14(a)

AND 15d-14(a) UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

I, Amanda Krichman, certify that:

1. I have reviewed this annual report on Form 10-K/A of the SPDR® Gold Trust (the “Registrant”);

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

Date: December 19, 2024

|

/s/ Amanda Krichman

|

|

|

Amanda Krichman**

Principal Financial and Accounting Officer

|

|

|

*

|

The originally executed copy of this Certification will be maintained at the Sponsor’s offices and will be made available for inspection upon request.

|

|

**

|

The Registrant is a trust and Ms. Krichman is signing in her capacity as Principal Financial and Accounting Officer of World Gold Trust Services, LLC, the Sponsor of the Registrant.

|

Exhibit 97.1

WORLD GOLD TRUST SERVICES, LLC

CLAWBACK POLICY

Introduction

World Gold Trust Services, LLC (the “Company”) is the sponsor of SPDR® Gold Trust (the “Trust”) and, with the assistance of the trustee of the Trust, is responsible for preparing and filing periodic reports on behalf of the Trust with the Securities and Exchange Commission (the “SEC”), including the Trust’s quarterly and annual reports which include the Trust’s financial statements. The Trust does not have officers, directors or employees, however, the officers and directors of the Company perform certain functions with respect to the Trust that, if the Trust had directors or officer, would typically be performed by them.

The Board of Directors (the "Board") of the Company believes that it is in the best interests of the Company, the Trust and the Trust’s shareholders to create and maintain a culture that emphasizes integrity and accountability and that reinforces the Company's compensation philosophy. The Board has therefore adopted this policy which provides for the recoupment of certain executive compensation in the event of an accounting restatement of the Trust resulting from material noncompliance with financial reporting requirements under the federal securities laws (the "Policy"). This Policy is designed to comply with Section 10D of the Securities Exchange Act of 1934 (the "Exchange Act") and Section 303A.14 of the New York Stock Exchange Listed Company Manual (the "Clawback Listing Standards").

Administration

This Policy shall be administered by the Board. Any determinations made by the Board shall be final and binding on all affected individuals.

Covered Executives

This Policy applies to the Company's current and former executive officers, as determined by the Board in accordance with the definition in Section 10D of the Exchange Act and the Clawback Listing Standards ("Covered Executives").

Recoupment; Accounting Restatement

In the event the Company is required to prepare an accounting restatement of the Trust’s financial statements due to the Company's material noncompliance with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period, the Board will require reimbursement or forfeiture of any excess Incentive Compensation received by any Covered Executive during the three completed fiscal years immediately preceding the date on which the Company is required to prepare an accounting restatement on behalf of the Trust.

Incentive Compensation

For purposes of this Policy, Incentive Compensation means any of the following; provided that, such compensation is granted, earned, or vested based wholly or in part on the attainment of a financial reporting measure:

| |

●

|

Annual bonuses and other short- and long-term cash incentives.

|

| |

●

|

Stock appreciation rights.

|

| |

●

|

Restricted stock units.

|

Financial reporting measures include with respect to the Trust:

| |

●

|

Total shareholder return.

|

Excess Incentive Compensation: Amount Subject to Recovery

The amount to be recovered will be the excess of the Incentive Compensation paid to the Covered Executive based on the erroneous data over the Incentive Compensation that would have been paid to the Covered Executive had it been based on the restated results, as determined by the Board, without regard to any taxes paid by the Covered Executive in respect of the Incentive Compensation paid based on the erroneous data.

If the Board cannot determine the amount of excess Incentive Compensation received by the Covered Executive directly from the information in the accounting restatement, then it will make its determination based on a reasonable estimate of the effect of the accounting restatement.

Method of Recoupment

The Board will determine, in its sole discretion, the method for recouping Incentive Compensation hereunder which may include, without limitation:

(a) requiring reimbursement of cash Incentive Compensation previously paid;

(b) seeking recovery of any gain realized on the vesting, exercise, settlement, sale, transfer, or other disposition of any equity-based awards;

(c) offsetting the recouped amount from any compensation otherwise owed by the Company to the Covered Executive;

(d)) cancelling outstanding vested or unvested equity awards; and/or

(e) taking any other remedial and recovery action permitted by law, as determined by the Board.

No Indemnification

The Company shall not indemnify any Covered Executives against the loss of any incorrectly awarded Incentive Compensation.

Interpretation

The Board is authorized to interpret and construe this Policy and to make all determinations necessary, appropriate, or advisable for the administration of this Policy. It is intended that this Policy be interpreted in a manner that is consistent with the requirements of Section 10D of the Exchange Act, any applicable rules or standards adopted by the Securities and Exchange Commission, and the Clawback Listing Standards.

Effective Date

This Policy shall be effective as of the date it is adopted by the Board (the "Effective Date") and shall apply to Incentive Compensation that is received by Covered Executives on or after October 2, 2023, even if such Incentive Compensation was approved, awarded, or granted to Covered Executives prior to October 2, 2023.

Amendment; Termination

The Board may amend this Policy from time to time in its discretion and shall amend this Policy as it deems necessary to reflect final regulations adopted by the Securities and Exchange Commission under Section 10D of the Exchange Act and to comply with the Clawback Listing Standards and any other rules or standards adopted by a national securities exchange on which the Company's securities are listed. The Board may terminate this Policy at any time.

Other Recoupment Rights

Any right of recoupment under this Policy is in addition to, and not in lieu of, any other remedies or rights of recoupment that may be available to the Company pursuant to the terms of any similar policy in any employment agreement, equity award agreement, or similar agreement and any other legal remedies available to the Company.

Relationship to Other Plans and Agreements

The Board intends that this Policy will be applied to the fullest extent of the law. The Board may require that any employment agreement, equity award agreement, or similar agreement entered into on or after the Effective Date shall, as a condition to the grant of any benefit thereunder, require a Covered Executive to agree to abide by the terms of this Policy. In the event of any inconsistency between the terms of the Policy and the terms of any employment agreement, equity award agreement, or similar agreement under which Incentive Compensation has been granted, awarded, earned or paid to a Covered Executive, whether or not deferred, the terms of the Policy shall govern.

Impracticability

The Board shall recover any excess Incentive Compensation in accordance with this Policy unless such recovery would be impracticable, as determined by the Board in accordance with Rule 10D-1 of the Exchange Act and the listing standards of the national securities exchange on which the Company's securities are listed.

Successors

This Policy shall be binding and enforceable against all Covered Executives and their beneficiaries, heirs, executors, administrators or other legal representatives.

v3.24.4

Document And Entity Information - USD ($)

|

12 Months Ended |

|

|

Sep. 30, 2024 |

Nov. 22, 2024 |

Mar. 31, 2024 |

| Document Information [Line Items] |

|

|

|

| Entity, Registrant Name |

SPDR® GOLD TRUST

|

|

|

| Current Fiscal Year End Date |

--09-30

|

|

|

| Document, Fiscal Period Focus |

FY

|

|

|

| Document, Fiscal Year Focus |

2024

|

|

|

| Document, Type |

10-K/A

|

|

|

| Document, Annual Report |

true

|

|

|

| Document, Period End Date |

Sep. 30, 2024

|

|

|

| Document, Transition Report |

false

|

|

|

| Entity, File Number |

001-37996

|

|

|

| Entity, Incorporation, State or Country Code |

DE

|

|

|

| Entity, Tax Identification Number |

36-7650517

|

|

|

| Entity, Address, Address Line One |

c/o World Gold Trust Services, LLC

|

|

|

| Entity, Address, Address Line Two |

685 Third Avenue, Suite 2702

|

|

|

| Entity, Address, City or Town |

New York

|

|

|

| Entity, Address, State or Province |

NY

|

|

|

| Entity, Address, Postal Zip Code |

10017

|

|

|

| City Area Code |

212

|

|

|

| Local Phone Number |

317-3800

|

|

|

| Title of 12(b) Security |

SPDR® Gold Shares

|

|

|

| Trading Symbol |

GLD

|

|

|

| Security Exchange Name |

NYSE

|

|

|

| Entity, Well-known Seasoned Issuer |

Yes

|

|

|

| Entity, Voluntary Filers |

No

|

|

|

| Entity, Current Reporting Status |

Yes

|

|

|

| Entity, Interactive Data, Current |

Yes

|

|

|

| Entity, Filer Category |

Large Accelerated Filer

|

|

|

| Entity, Small Business |

false

|

|

|

| Entity, Emerging Growth Company |

false

|

|

|

| Document, Financial Statement Error Correction Flag |

false

|

|

|

| ICFR Auditor Attestation Flag |

true

|

|

|

| Entity, Shell Company |

false

|

|

|

| Entity, Public Float |

|

|

$ 59,081,825,589

|

| Entity, Common Stock Shares, Outstanding |

|

305,600,000

|

|

| Amendment Description |

The Registrant is filing this Amendment No. 1 on Form 10-K/A (the “Amendment”) to its Form 10-K for the year ended September 30, 2024, as originally filed with the U.S. Securities and Exchange Commission on November 25, 2024 (the “Original Filing”), for the sole purpose of including Exhibit 97.1.

In accordance with Rule 12b-15 and Rule 13a-14 promulgated under the Securities Exchange Act of 1934, as amended, this Amendment also includes new certifications by the Principal Executive Officer and Principal Financial Officer of the Registrant’s Sponsor on behalf of the Registrant dated as of the date of this filing. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the certifications have been omitted. Similarly, because no financial statements have been included in this Amendment, certifications pursuant to Section 906 of the Sarbanes Oxley Act of 2002 have been omitted.

Except as described above, no other amendments are being made to the Original Filing. This Amendment does not supersede, modify or update any other items or disclosures found in the Original Filing. In addition, this Amendment does not reflect any information, events or transactions occurring after the reporting period of the Original Filing and does not supersede, modify or update those disclosures affected by subsequent events. As a result, information included in the report continues to speak as of the date of the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing together with the Registrant’s other filings with the SEC.

Item 15. Exhibits, as amended, is included in this Amendment.

This Amendment consists solely of the preceding cover page, this explanatory note, Item 15. Exhibits, the signature page and Exhibits 31.1, 31.2 and 97.1.

|

|

|

| Auditor Name |

KPMG LLP

|

|

|

| Auditor Location |

New York, NY

|

|

|

| Auditor Firm ID |

185

|

|

|

| Amendment Flag |

true

|

|

|

| Entity, Central Index Key |

0001222333

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

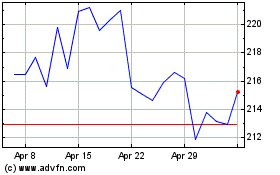

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Jan 2025 to Feb 2025

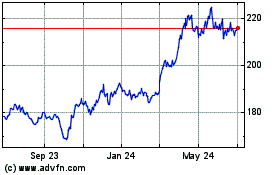

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Feb 2024 to Feb 2025