FALSE000009016800000901682024-02-142024-02-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) – August 12, 2024

SIFCO Industries, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

Ohio | | 1-5978 | | 34-0553950 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

970 East 64th Street, Cleveland Ohio | | 44103 |

(Address of principal executive offices) | | (ZIP Code) |

Registrant’s telephone number, including area code: (216) 881-8600

N.A.

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Shares | | SIF | | NYSE American |

| | | | | |

Item 2.02 | Results of Operations and Financial Condition. |

On August 12, 2024, SIFCO Industries, Inc. (the "Company" or "SIFCO") issued a press release announcing its financial results for its third quarter ended June 30, 2024. A copy of this press release is furnished with this Report as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this item and in the accompanying exhibit shall not be deemed filed by SIFCO for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such information will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that SIFCO specifically incorporates it by reference.

| | | | | |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

Resignation of Mr. Thomas R. Kubera.

On August 8, 2024, Thomas R. Kubera notified the Board of Directors (the “Board”) of SIFCO Industries, Inc., an Ohio corporation (the “Company”), of his desire to retire and resign from his position as Chief Financial Officer of the Company, effective as of November 13, 2024. Mr. Kubera’s decision to resign is not the result of any dispute or disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

The Board intends to identify and name a successor prior to Mr. Kubera’s retirement on November 13, 2024.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | SIFCO Industries, Inc. |

| | (Registrant) |

| |

Date: August 12, 2024 | | |

| | /s/ Thomas R. Kubera |

| | Thomas R. Kubera |

| | Chief Financial Officer |

| | (Principal Financial Officer) |

SIFCO Industries, Inc. (“SIFCO”) Announces

Third Quarter Fiscal 2024 Financial Results

Cleveland - SIFCO Industries, Inc. (NYSE American: SIF) today announced financial results for its third quarter of fiscal 2024, which ended June 30, 2024.

Third Quarter Results

•Net sales in the third quarter of fiscal 2024 increased 33.9% to $29.3 million, compared with $21.9 million for the same period in fiscal 2023.

•Net income for the third quarter of fiscal 2024 was $0.1 million, or $0.01 per diluted share, compared with net loss of $(0.6) million, or $(0.11) per diluted share, in the third quarter of fiscal 2023.

•EBITDA was $2.7 million in the third quarter of fiscal 2024, compared with $1.3 million in the third quarter of fiscal 2023.

•Adjusted EBITDA in the third quarter of fiscal 2024 was $3.4 million, compared with Adjusted EBITDA of $1.9 million in the third quarter of fiscal 2023.

Year to Date Results

•Net sales in the first nine months of fiscal 2024 increased 23.2% to $76.9 million, compared with $62.4 million for the same period in fiscal 2023.

•Net loss for the first nine months of fiscal 2024 was $(4.9) million, or $(0.82) per diluted share, compared with net loss of $(5.6) million, or $(0.94) per diluted share, in the first nine month of fiscal 2023.

•EBITDA was $2.3 million in the first nine month of fiscal 2024, compared with $0.3 million in the first nine months of fiscal 2023.

•Adjusted EBITDA in the first nine month of fiscal 2024 was $3.9 million, compared with Adjusted EBITDA of $1.8 million in the first nine months of fiscal 2023.

Other Highlights

CEO George Scherff stated, “We are pleased with our continued progress this past quarter as revenues rose 34% over last year. Third quarter EBITDA more than doubled compared with last year to $2.7 million, leading to a profitable quarter. We continue to increase our backlog, which has grown to $139.2 million to support our customers."

Use of Non-GAAP Financial Measures

The Company uses certain non-GAAP measures in this release. EBITDA and Adjusted EBITDA are non-GAAP financial measures and are intended to serve as supplements to results provided in accordance with accounting principles generally accepted in the United States. SIFCO Industries, Inc. believes that such information provides an additional measurement and consistent historical comparison of the Company’s performance. A reconciliation of the non-GAAP financial measures to the most directly comparable GAAP measures is available in this news release.

Forward-Looking Language

Certain statements contained in this press release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements relating to financial results and plans for future business development activities, and are thus prospective. Such forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Potential risks and uncertainties include, but are not limited to, economic conditions, concerns with or threats of, or the consequences of, pandemics, contagious diseases or health epidemics, including COVID-19, competition and other uncertainties the Company, its customers, and the industry in which they operate have experienced and continue to experience, detailed from time to time in the Company’s Securities and Exchange Commission filings.

The Company's Annual Report on Form 10-K for the year ended September 30, 2023 and other reports filed with the Securities and Exchange Commission can be accessed through the Company's website: www.sifco.com, or on the Securities and Exchange Commission's website: www.sec.gov.

SIFCO Industries, Inc. is engaged in the production of forgings and machined components primarily for the aerospace and energy markets. The processes and services include forging, heat-treating, coating, and machining.

Third Quarter ended June 30,

(Amounts in thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Nine Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net sales | $ | 29,259 | | | $ | 21,853 | | | $ | 76,854 | | | $ | 62,394 | |

Cost of goods sold | 24,725 | | 18,375 | | 68,857 | | 55,935 |

Gross profit | 4,534 | | 3,478 | | 7,997 | | 6,459 |

Selling, general and administrative expenses | 3,150 | | 3,388 | | 9,939 | | 10,517 |

Amortization of intangible assets | 40 | | 63 | | 121 | | 187 |

(Gain) loss on disposal of operating assets | — | | (3) | | 3 | | — |

Operating profit (loss) | 1,344 | | 30 | | (2,066) | | (4,245) |

Interest expense, net | 1,078 | | 305 | | 2,471 | | 919 |

Foreign currency exchange (gain) loss, net | (1) | | 1 | | 6 | | 11 |

Other expense, net | 139 | | 323 | | 244 | | 287 |

Income (loss) before income tax expense | 128 | | (599) | | (4,787) | | (5,462) |

Income tax expense | 56 | | 35 | | 153 | | 128 |

Net income (loss) | $ | 72 | | | $ | (634) | | | $ | (4,940) | | | $ | (5,590) | |

| | | | | | | |

| | | | | | | |

Net income (loss) per share | | | | | | | |

Basic | $ | 0.01 | | | $ | (0.11) | | | $ | (0.82) | | | $ | (0.94) | |

Diluted | $ | 0.01 | | | $ | (0.11) | | | $ | (0.82) | | | $ | (0.94) | |

| | | | | | | |

Weighted-average number of common shares (basic) | 6,009 | | 5,940 | | 5,991 | | 5,925 |

Weighted-average number of common shares (diluted) | 6,105 | | 5,940 | | 5,991 | | 5,925 |

Consolidated Condensed Balance Sheets

(Amounts in thousands, except per share data)

(Unaudited)

| | | | | | | | | | | |

| June 30,

2024 | | September 30, 2023 |

| (unaudited) | | |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 1,696 | | | $ | 368 | |

Short-term investments | 1,713 | | — |

Receivables, net of allowance for credit losses of $124 and $242, respectively | 26,831 | | 20,196 |

Contract assets | 10,055 | | 10,091 |

Inventories, net | 13,423 | | 8,853 |

Refundable income taxes | 84 | | 84 |

Prepaid expenses and other current assets | 1,200 | | 1,882 |

Total current assets | 55,002 | | 41,474 |

Property, plant and equipment, net | 33,914 | | 36,287 |

Operating lease right-of-use assets, net | 13,673 | | 14,380 |

Intangible assets, net | 161 | | 278 |

Goodwill | 3,493 | | 3,493 |

Other assets | 88 | | 81 |

Total assets | $ | 106,331 | | | $ | 95,993 | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Current maturities of long-term debt | $ | 6,116 | | | $ | 3,820 | |

Promissory note - related party | 3,366 | | — |

Revolver | 19,693 | | 16,289 |

Short-term operating lease liabilities | 906 | | 869 |

Accounts payable | 14,965 | | 13,497 |

Contract liabilities | 3,880 | | 1,150 |

Accrued liabilities (Related party is $880 at June 30, 2024 and $0 at September 30, 2023) | 6,506 | | 5,327 |

Total current liabilities | 55,432 | | 40,952 |

Long-term debt, net of current maturities, net of unamortized debt issuance costs | 3,620 | | 2,457 |

Long-term operating lease liabilities, net of short-term | 13,333 | | 14,020 |

Deferred income taxes, net | — | | 142 |

Pension liability | 3,469 | | 3,417 |

Other long-term liabilities | 651 | | 670 |

Shareholders’ equity: | | | |

| Serial preferred shares, no par value, 1,000 shares authorized; 0 shares issued and outstanding at June 30, 2024 and September 30, 2023 | — | | — |

| Common shares, par value $1 per share, 10,000 shares authorized; issued and outstanding shares 6,180 at June 30, 2024 and 6,105 at September 30, 2023 | 6,180 | | 6,105 |

Additional paid-in capital | 11,745 | | 11,626 |

Retained earnings | 18,324 | | 23,264 |

Accumulated other comprehensive loss | (6,423) | | (6,660) |

Total shareholders’ equity | 29,826 | | 34,335 |

Total liabilities and shareholders’ equity | $ | 106,331 | | | $ | 95,993 | |

Non-GAAP Financial Measures

Presented below is certain financial information based on the Company's EBITDA and Adjusted EBITDA. References to “EBITDA” mean earnings (losses) from continuing operations before interest, taxes, depreciation and amortization, and references to “Adjusted EBITDA” mean EBITDA plus, as applicable for each relevant period, certain adjustments as set forth in the reconciliations of net income to EBITDA and Adjusted EBITDA.

Neither EBITDA nor Adjusted EBITDA is a measurement of financial performance under generally accepted accounting principles in the United States of America (“GAAP”). The Company presents EBITDA and Adjusted EBITDA because management believes that they are useful indicators for evaluating operating performance and liquidity, including the Company’s ability to incur and service debt and it uses EBITDA to evaluate prospective acquisitions. Although the Company uses EBITDA and Adjusted EBITDA for the reasons noted above, the use of these non-GAAP financial measures as analytical tools has limitations. Therefore, reviewers of the Company’s financial information should not consider them in isolation, or as a substitute for analysis of the Company's results of operations as reported in accordance with GAAP. Some of these limitations include:

•Neither EBITDA nor Adjusted EBITDA reflects the interest expense, or the cash requirements necessary to service interest payments on indebtedness;

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and neither EBITDA nor Adjusted EBITDA reflects any cash requirements for such replacements;

•The omission of the amortization expense associated with the Company’s intangible assets further limits the usefulness of EBITDA and Adjusted EBITDA; and

•Neither EBITDA nor Adjusted EBITDA includes the payment of taxes, which is a necessary element of operations.

Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as measures of discretionary cash available to the Company to invest in the growth of its businesses. Management compensates for these limitations by not viewing EBITDA or Adjusted EBITDA in isolation and specifically by using other GAAP measures, such as net income (loss), net sales, and operating income (loss), to measure operating performance. Neither EBITDA nor Adjusted EBITDA is a measurement of financial performance under GAAP, and neither should be considered as an alternative to net loss or cash flow from operations determined in accordance with GAAP. The Company’s calculation of EBITDA and Adjusted EBITDA may not be comparable to the calculation of similarly titled measures reported by other companies.

The following table sets forth a reconciliation of net loss to EBITDA and Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | |

Dollars in thousands | Three Months Ended | | Nine Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss) | $ | 72 | | | $ | (634) | | | $ | (4,940) | | | $ | (5,590) | |

Adjustments: | | | | | | | |

Depreciation and amortization expense | 1,499 | | | 1,623 | | | 4,567 | | | 4,820 | |

Interest expense, net | 1,078 | | | 305 | | | 2,471 | | | 919 | |

Income tax expense | 56 | | | 35 | | | 153 | | | 128 | |

EBITDA | 2,705 | | | 1,329 | | | 2,251 | | | 277 | |

Adjustments: | | | | | | | |

Foreign currency exchange loss, net (1) | (1) | | | 1 | | | 6 | | | 11 | |

Other expense (income), net (2) | 78 | | | 295 | | | 184 | | | 149 | |

Gain (loss) on disposal of assets (3) | — | | | (3) | | | 3 | | | — | |

Equity compensation (4) | 72 | | | 85 | | | 243 | | | 292 | |

Pension settlement expense (5) | 60 | | | 78 | | | 60 | | | 78 | |

Severance expense (6) | 435 | | | — | | | 435 | | | — | |

LIFO impact (7) | 475 | | | (73) | | | 826 | | | (272) | |

IT incident (benefit) cost, net (8) | (627) | | | 182 | | | (605) | | | 1,269 | |

Strategic alternative expense (9) | 169 | | | 29 | | | 490 | | | 29 | |

Adjusted EBITDA | $ | 3,366 | | | $ | 1,923 | | | $ | 3,893 | | | $ | 1,833 | |

(1)Represents the gain or loss from changes in the exchange rates between the functional currency and the foreign currency in which the transaction is denominated.

(2)Represents miscellaneous non-operating income or expense, such as pension costs or grant income (prior year included $0.1 million in loss on insurance recovery, separately reclassed to IT incident costs, net line).

(3)Represents the difference between the proceeds from the sale of operating equipment and the carrying value shown on the Company's books.

(4)Represents the equity-based compensation expense recognized by the Company under the 2016 Plan due to granting of awards, awards not vesting and/or forfeitures.

(5)Represents expense incurred by its defined benefit pension plans related to settlement of pension obligations.

(6)Represents expense incurred for executive severance.

(7)Represents the change in the reserve for inventories for which cost is determined using the last-in, first-out ("LIFO") method.

(8)Represents incremental information technology costs as it relates to the cybersecurity incident and loss on insurance recovery.

(9)Represents expense related to evaluation of strategic alternatives.

Reference to the above activities can be found in the consolidated financial statements included in Item 8 of the Company's Annual Report on Form 10-K.

Contacts

SIFCO Industries, Inc.

Thomas R. Kubera, 216-881-8600

www.sifco.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

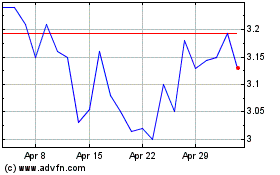

Sifco Industries (AMEX:SIF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sifco Industries (AMEX:SIF)

Historical Stock Chart

From Dec 2023 to Dec 2024