Senseonics Holdings, Inc. (NYSE American: SENS), a medical

technology company focused on the development and manufacturing of

long-term, implantable continuous glucose monitoring (CGM) systems

for people with diabetes, today reported financial results for the

quarter ended March 31, 2022.

Recent Highlights & Accomplishments:

- Received approval from the Food and Drug Administration (FDA)

for the Eversense® E3 CGM System (“E3”), offering industry leading

6-month sensor wear duration, the longest lasting CGM system

available

- Transitioned manufacturing to E3 to enable U.S. commercial

launch through our commercial partner, Ascensia Diabetes Care, at

the beginning of April and initiate retirement of the 90-day

system

- Confirmed immediate coverage policy transition to E3 with

select large payors

“We are excited to have received FDA approval and be underway

with a comprehensive launch campaign for Eversense® E3, the world’s

longest lasting CGM system,” said Tim Goodnow, PhD, President and

Chief Executive Officer of Senseonics. “From awareness and access

to training and operations, Senseonics and Ascensia are

coordinating to engage patients and HCP’s to experience the

differentiated benefits of our longer duration next generation

sensor – inserting the first patient with E3 just six weeks

following FDA approval. We are now focused on bringing the E3

implantable CGM with six months of wear to more people with

diabetes in the U.S.”

First Quarter 2022 Results:

Total revenue for the first quarter of 2022 was $2.5 million

compared to $2.8 million for the first quarter of 2021. U.S.

revenue was $0.8 million in the first quarter of 2022 compared to

$0.3 million in the prior year period, and revenue outside the U.S.

was $1.7 million in the first quarter of 2022 compared to $2.5

million in the prior year period.

First quarter 2022 gross profit of $0.5 million was in line with

gross profit for the first quarter 2021.

First quarter 2022 sales and marketing and general and

administrative expenses increased by $1.3 million year-over-year,

to $7.9 million. The increase was primarily the result of increased

professional fees and payroll and related expenses.

First quarter 2022 research and development expenses increased

by $2.5 million year-over-year, to $7.8 million. The increase was

due to the expansion of the R&D workforce, and an increase in

clinical studies, lab supplies and contractor expenses in order to

support next generation products.

Net income was $86.7 million, or $0.19 per share, in the first

quarter of 2022 compared to a net loss of $249.5 million, or

($0.68) per share, in the first quarter of 2021. Net income

increased by $336.2 million due to the accounting for embedded

derivatives and fair value adjustments.

Cash, cash equivalents, short and long-term investments were

$166.9 million and outstanding indebtedness was $104.7 million as

of March 31, 2022.

2022 Financial Outlook

Senseonics reiterates the expectation for full year 2022 global

net revenue to be in the range of $14.0 million to $18.0

million.

Conference Call and Webcast Information:

Company management will host a conference call at 4:30 pm

(Eastern Time) today, May 10, 2022, to discuss these financial

results and recent business developments. This conference call can

be accessed live by telephone or through Senseonics’ website.

Live

Teleconference Information:

Dial in number: 888-317-6003

Entry Number: 9027379

International dial in: 412-317-6061

Live Webcast

Information:

Visit http://www.senseonics.com and select

the “Investor Relations” section

A replay of the call can be accessed on Senseonics’ website

http://www.senseonics.com under “Investor Relations.”

About Senseonics

Senseonics Holdings, Inc. (“Senseonics”) is a medical technology

company focused on the development and manufacturing of glucose

monitoring products designed to transform lives in the global

diabetes community with differentiated, long-term implantable

glucose management technology. Senseonics' CGM systems, Eversense®,

Eversense® XL and Eversense® E3 include a small sensor inserted

completely under the skin that communicates with a smart

transmitter worn over the sensor. The glucose data are

automatically sent every 5 minutes to a mobile app on the user's

smartphone.

Forward Looking Statements

Any statements in this press release about future expectations,

plans and prospects for Senseonics, including the revenue

projections under “2022 Financial Outlook,” statements about the

commercial launch of Eversense® E3 and other statements containing

the words “believe,” “expect,” “intend,” “may,” “projects,” “will,”

“planned,” and similar expressions, constitute forward-looking

statements within the meaning of The Private Securities Litigation

Reform Act of 1995. Actual results may differ materially from those

indicated by such forward-looking statements as a result of various

important factors, including: uncertainties inherent in the

commercial launch of Eversense® E3 CGM system and commercial

expansion of the Eversense product, uncertainties inherent in the

transition of commercialization responsibilities to Ascensia

Diabetes Care and its commercial initiatives, uncertainties in

insurer, regulatory and administrative processes and decisions,

uncertainties in the duration and severity of the COVID-19

pandemic, and such other factors as are set forth in the risk

factors detailed in Senseonics’ Annual Report on Form 10-K for the

year ended December 31, 2021, the Quarterly Report on Form 10-Q for

the three months ended March 31, 2022 and Senseonics’ other filings

with the SEC under the heading “Risk Factors.” In addition, the

forward-looking statements included in this press release represent

Senseonics’ views as of the date hereof. Senseonics anticipates

that subsequent events and developments will cause Senseonics’

views to change. However, while Senseonics may elect to update

these forward-looking statements at some point in the future,

Senseonics specifically disclaims any obligation to do so except as

required by law. These forward-looking statements should not be

relied upon as representing Senseonics’ views as of any date

subsequent to the date hereof.

Senseonics Holdings, Inc.

Condensed Consolidated Balance Sheets (in thousands, except share

and per share data)

March 31,

December 31,

2022 unaudited

2021

Assets

Current assets:

Cash and cash equivalents

$

39,011

$

33,461

Short term investments, net

102,755

96,445

Accounts receivable, net

232

205

Accounts receivable, net -

related parties

3,797

1,768

Inventory, net

7,153

6,316

Prepaid expenses and other

current assets

7,629

6,218

Total current assets

160,577

144,413

Option

269

239

Deposits and other assets

786

1,086

Long term investments, net

25,145

51,882

Property and equipment, net

1,320

1,308

Total assets

$

188,097

$

198,928

Liabilities and Stockholders’

Deficit

Current liabilities:

Accounts payable

$

2,089

$

1,204

Accrued expenses and other

current liabilities

8,742

10,667

Accrued expenses and other

current liabilities - related parties

3,674

3,597

Note payable, current portion,

net

14,534

—

Derivative liability, current

portion

1,713

—

Term Loans, net

732

2,926

Total current liabilities

31,484

18,394

Long-term debt and notes payables, net

48,035

59,798

Derivative liabilities

150,010

236,291

Option

47,700

69,401

Other liabilities

337

579

Total liabilities

277,566

384,463

Commitments and contingencies

Stockholders’ deficit:

Common stock, $0.001 par value

per share; 900,000,000 shares authorized; 463,229,779 and

447,282,263 shares issued and outstanding as of March 31, 2022 and

December 31, 2021

463

447

Additional paid-in capital

775,172

765,215

Accumulated other comprehensive

loss

(837

)

(212

)

Accumulated deficit

(864,267

)

(950,985

)

Total stockholders' deficit

(89,469

)

(185,535

)

Total liabilities and

stockholders’ deficit

$

188,097

$

198,928

Senseonics Holdings, Inc.

Unaudited Condensed Consolidated Statements of Operations and

Comprehensive Income (Loss) (in thousands, except share and per

share data)

Three Months Ended

March 31,

2022

2021

Revenue, net

292

487

Revenue, net - related parties

2,189

2,359

Total revenue

2,481

2,846

Cost of sales

1,954

2,320

Gross profit

527

526

Expenses:

Sales and marketing

expenses

1,509

1,613

Research and development

expenses

7,804

5,255

General and administrative

expenses

6,374

4,974

Operating loss

(15,160

)

(11,316

)

Other income (expense), net:

Interest income

93

9

Gain (Loss) on fair value

adjustment of option

21,701

(52,675

)

Gain on extinguishment of debt

and option

—

330

Interest expense

(4,494

)

(4,058

)

Gain (Loss) on change in fair

value of derivatives

84,569

(180,899

)

Impairment cost

30

(782

)

Other expense

(21

)

(123

)

Total other income (expense),

net

101,878

(238,198

)

Net Income (Loss)

86,718

(249,514

)

Other comprehensive loss

Unrealized loss on marketable

securities

(625

)

—

Total other comprehensive

loss

(625

)

—

Total comprehensive income (loss)

$

86,093

$

(249,514

)

Basic net income (loss) per common

share

0.19

(0.68

)

Basic weighted-average shares

outstanding

455,942,886

364,274,433

Diluted net loss per common share

(0.03

)

(0.68

)

Diluted weighted-average shares

outstanding

605,198,839

364,274,433

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220510006342/en/

Investor Contact Philip Taylor Investor Relations

415-937-5406 Investors@senseonics.com

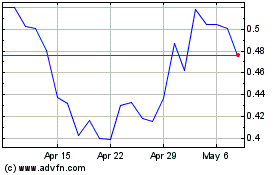

Senseonics (AMEX:SENS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Senseonics (AMEX:SENS)

Historical Stock Chart

From Jul 2023 to Jul 2024