Senseonics Holdings, Inc. (NYSE-MKT: SENS), a medical technology

company focused on the development and commercialization of

Eversense®, a long-term, implantable continuous glucose monitoring

(CGM) system for people with diabetes, today reported financial

results for the third quarter and nine months ended September 30,

2016.

RECENT HIGHLIGHTS & ACCOMPLISHMENTS:

- Completed Eversense® U.S. pivotal trial

and released top-line results

- Eversense® PMA submitted to FDA in

October

- German launch initiated late

September

"We continued to make progress on both the clinical and

regulatory front as well as in our commercial roll-out in Europe,”

said Tim Goodnow, President and Chief Executive Officer of

Senseonics. “The submission of our PMA to the FDA represented a

major milestone for the company as we move closer to bringing the

Eversense system to people with diabetes in the United States.”

Dr. Mark Christiansen, lead clinician in the PRECISE II trial,

will present “PRECISE II Pivotal Trail: 90-Day Subcutaneously

Implanted Glucose Sensor” at 8:25 a.m. EST on November 10, 2016.

Senseonics intends to contemporaneously file a Current Report on

Form 8-K with the U.S. Securities and Exchange Commission on

November 10, 2016 containing a copy of Dr. Christensen’s

presentation. An archived copy of this presentation will be made

available on Senseonics’ website.

THIRD QUARTER 2016 RESULTS:

Net loss was $10.9 million, or $0.12 per share, in the third

quarter of 2016, compared to $8.6 million, or $4.39 per share, in

the third quarter of 2015. Third quarter 2016 net loss per share

was based on 93.4 million weighted-average shares outstanding,

compared to 1.9 million weighted-average shares outstanding in the

third quarter of 2015.

Third quarter 2016 sales and marketing expenses increased $0.3

million year-over year to $0.7 million, compared to $0.4 million

for the third quarter of 2015. The increase in sales and marketing

expenses was primarily related to investments in additional

headcount in support of the commercial launch of Eversense in

Europe. On a sequential quarter comparison, third quarter 2016

sales and marketing expense increased $0.1 million compared to the

second quarter of 2016.

Third quarter 2016 research and development expenses increased

$2.2 million year-over-year, to $6.9 million, compared to $4.7

million for the third quarter of 2015. The increase in research and

development expense was primarily driven by product development

expenses for future versions of Eversense and clinical trial costs

related to the conduct of Senseonics’ U.S. pivotal trial. On a

sequential quarter comparison, third quarter 2016 research and

development expenses decreased $0.7 million, or 9%, compared to the

second quarter of 2016. The primary driver behind this decrease is

the completion of the U.S. pivotal trial.

Third quarter 2016 general and administrative expenses decreased

$0.5 million, year-over-year, to $2.8 million, compared to $3.3

million for the third quarter of 2015. The decrease in general and

administration expenses was driven primarily by a reduction in

legal expenses. On a sequential quarter comparison, third quarter

2016 general and administrative expenses decreased $0.5 million, or

16%, compared to the second quarter of 2016. The primary drivers of

this decrease were a $0.3 million decrease in non-cash stock-based

compensation expense and a $0.2 decrease in legal expense.

As of September 30, 2016, cash, cash equivalents, and marketable

securities were $25.7 million and outstanding indebtedness was

$14.6 million, compared to cash and cash equivalents of $3.9

million and outstanding indebtedness of $9.9 million, as of

December 31, 2015.

CONFERENCE CALL AND WEBCAST INFORMATION

Company management will host a conference call at 4:30 pm

(Eastern Time) today, November 3, 2016, to discuss these financial

results. This conference call can be accessed live by telephone or

through Senseonics’ website.

Live

Teleconference Information:

Live Webcast

Information:

Dial in number: (877)883-0383, PW

1720785

Visit http://www.senseonics.com and

select

International dial in: (412)902-6506

the “Investor Relations” section

A replay of the call can be accessed on Senseonics’ website

http://www.senseonics.com under “Investor Relations.”

About Senseonics

Senseonics Holdings, Inc. is a medical technology company

focused on the design, development and commercialization of glucose

monitoring products designed to help people with diabetes

confidently live their lives with ease. Senseonics’ first

generation continuous glucose monitoring (CGM) system, Eversense®,

includes a small sensor, smart transmitter and mobile application.

Based on fluorescence sensing technology, the sensor is designed to

be inserted subcutaneously and communicate with the smart

transmitter to wirelessly transmit glucose levels to a mobile

device. After insertion, the sensor is designed to continually and

accurately measure glucose levels. For more information on

Senseonics, please visit www.senseonics.com.

SAFE HARBOR STATEMENT

Certain statements contained in this press release, other than

statements of fact that are independently verifiable at the date

hereof, may constitute “forward-looking statements.” These

forward-looking statements reflect Senseonics’ current views about

its plans, intentions, expectations, strategies and prospects,

including statements concerning the commercial launch of Eversense,

future regulatory filings and future product enhancements. These

statements are based on the information currently available to

Senseonics and on assumptions Senseonics has made. Although

Senseonics believes that its plans, intentions, expectations,

strategies and prospects as reflected in or suggested by those

forward-looking statements are reasonable, Senseonics can give no

assurance that the plans, intentions, expectations or strategies

will be attained or achieved. Furthermore, actual results may

differ materially from those described in the forward-looking

statements and will be affected by a variety of risks and factors

that are beyond Senseonics’ control. Other risks and uncertainties

are more fully described in the section entitled “Risk Factors” in

Senseonics’ Annual Report on Form 10-K filed with the Securities

and Exchange Commission (SEC) on February 19, 2016, the Quarterly

Report on Form 10-Q filed with the SEC on August 9, 2016 and its

other SEC filings. Existing and prospective investors are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof. The statements made in this

press release speak only as of the date stated herein, and

subsequent events and developments may cause Senseonics’

expectations and beliefs to change. Unless otherwise required by

applicable securities laws, Senseonics does not intend, nor does it

undertake any obligation, to update or revise any forward-looking

statements contained in this news release to reflect subsequent

information, events, results or circumstances or otherwise.

Senseonics Holdings, Inc. Condensed

Consolidated Balance Sheets (in thousands, except share and

per share data) September 30, December 31,

2016 2015 (unaudited)

Assets Current assets:

Cash and cash equivalents $ 16,496 $ 3,939 Marketable securities

9,176 — Prepaid expenses and other current assets 593 1,025

Inventory 329 — Total current assets

26,594 4,964 Deposits and other assets 644 217 Property and

equipment, net 776 311 Total assets $

28,014 $ 5,492

Liabilities and

Stockholders’ Equity (Deficit) Current liabilities: Accounts

payable $ 5,348 $ 1,252 Accrued expenses and other current

liabilities 3,578 3,694 Note payable, current portion 1,667

2,389 Total current liabilities 10,593 7,335

Note payable, net of discount 12,983 7,499 Accrued interest

127 327 Other liabilities 86 28 Total

liabilities 23,789 15,189

Commitments and contingencies

Stockholders’ equity (deficit): Preferred stock, $0.001 par

value per share; 5,000,000 and 0 shares authorized, no shares

issued and outstanding as of September 30, 2016 and December 31,

2015 — — Common stock, $0.001 par value per share; 250,000,000

shares authorized, 93,390,172 and 75,760,061 shares issued and

outstanding as of September 30, 2016 and December 31, 2015 93 76

Additional paid-in capital 198,889 151,019 Accumulated deficit

(194,757 ) (160,792 ) Total stockholders’ equity

(deficit) 4,225 (9,697 ) Total liabilities and

stockholders’ equity (deficit) $ 28,014 $ 5,492

Senseonics Holdings, Inc.

Unaudited Condensed Consolidated

Statement of Operations and Comprehensive Income (Loss)

(in thousands, except share and per share data)

Three Months Ended Nine Months Ended September

30, September 30, 2016 2015 2016

2015 Revenue $ 37 $ — $ 56 $ 38 Cost of sales 114

— 148 — Gross

profit (77 ) — (92 ) 38 Expenses: Sales and marketing

expenses 733 351 2,001 941 Research and development expenses 6,883

4,682 20,838 13,542 General and administrative expenses 2,819 3,282

10,060 6,178

Operating loss (10,512 ) (8,315 ) (32,991 ) (20,623 ) Other

income (expense), net: Interest income 35 2 69 5 Interest expense

(502 ) (266 ) (1,045 ) (834 ) Other income (expense) 92 (6 ) 3 (11

) Net loss

(10,887 ) (8,585 ) (33,964 ) (21,463 ) Other comprehensive income

(loss) — — — —

Total comprehensive loss $ (10,887 ) $ (8,585 ) $ (33,964 )

$ (21,463 ) Basic and diluted net loss per common share $

(0.12 ) $ (4.39 ) $ (0.39 ) $ (11.07 ) Basic and diluted

weighted-average shares outstanding 93,386,139

1,955,222 87,838,031 1,939,588

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161103006722/en/

Senseonics Holdings, Inc.INVESTOR CONTACTR. Don

ElseyChief Financial

Officer301-556-1602don.elsey@senseonics.com

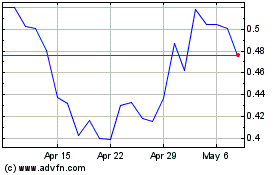

Senseonics (AMEX:SENS)

Historical Stock Chart

From Sep 2024 to Oct 2024

Senseonics (AMEX:SENS)

Historical Stock Chart

From Oct 2023 to Oct 2024