ETF Trading Report: Short Dow, Euro ETF In Focus - ETF News And Commentary

May 23 2012 - 1:07PM

Zacks

In what was another rocky session for Wall Street, equities

started the day in a big slump before they recouped nearly all of

their losses and finished the session at breakeven. The main

catalyst for the volatility was more worry over Europe and a

potential Greek exit from the common currency. However, France

boosted confidence, and the markets, by talking up growth,

liquidity, and even Eurobonds in late Wednesday trading.

Thanks to this, the Dow finished lower by just seven points

while the S&P 500 and the Nasdaq clawed back into the green,

adding, respectively, 0.2% and 0.4% for the day. Big sector

winners came in the services and materials segments, while

financials were also a big winner. Tech was more mixed while

consumer goods and healthcare led the way on the downside (read

Three European ETFs That Have Held Their Ground).

Currency trading was also volatile, although generally a

positive day for the U.S. dollar. The Dollar index finished at the

$82 mark thanks to more losses against the euro although the dollar

added against the pound as well. This risk-off trade also helped

Treasury securities as the 10 year saw yields slide by about seven

basis points before they finished down three points, to the 1.74%

level.

Unsurprisingly with this backdrop, commodities were a loser

nearly across the board in Wednesday trading. Natural gas was the

only energy commodity to finish in the green while corn was one of

the few winners in the soft market. Instead, oil finished lower by

about 1.5%, while cotton (-4.0%), coffee (-4.4%), and wheat (-2.5%)

took the brunt of the losses in the soft commodity market.

In ETF trading, it was a pretty robust session across the board

with many of the major products seeing heavy volume. Activity was

back to normal—if not higher—in the commodity space while short

leveraged products ate up a huge portion of the ETF volume as

well.

Particularly, investors saw a great deal of interest in the

ProShares UltraShort Dow 30 ETF (DXD). The product

usually sees volume of about 580,000 shares but saw a spike to 3.1

million shares in Wednesday trading (See Try Value Investing With

These Large Cap ETFs).

Volume was spread out across the product during the session,

although there was more activity during the opening hour and in the

last 30 minutes of the day. Nevertheless, the product gained about

0.2% over the course of trading and the product is now up 5.6% over

the past month.

Additionally, investors should note that the fund has been

seeing much higher levels of volume over the past week or so,

suggesting that this -2x daily resetting product is seeing more

interest with the weakened economic outlook.

Another ETF that saw an outsized day of volume was the

CurrencyShares Euro Trust (FXE). This product

usually sees about 1.2 million shares in volume on a normal day but

saw a spike to 3.4 million during Wednesday trading (Read Emerging

Market Currency ETFs: A Great Start to 2012).

Undoubtedly one of the biggest reasons for this jump was the

uncertainty in the European situation and the ongoing Greek issue.

In the morning, this was a big problem and it led to much of the

volume while the product was tumbling.

However, investors also saw a nice boost in volume during the

final hour of the session, as it appeared as though the euro story

was turning around. During that time, several blocks over 50,000

shares moved hands, suggesting that some investors were using this

product to position themselves ahead of Thursday’s trading.

(see more in the Zacks ETF Center)

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

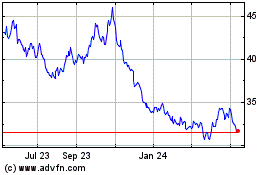

ProShares UltraShort Dow30 (AMEX:DXD)

Historical Stock Chart

From Apr 2024 to May 2024

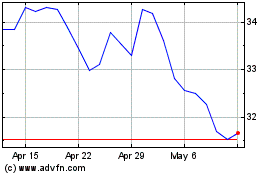

ProShares UltraShort Dow30 (AMEX:DXD)

Historical Stock Chart

From May 2023 to May 2024