THIRD-QUARTER

& 9-MONTH 2012 RESULTS (unaudited)

Financial statements at Sept. 30,

2012 were authorized for issue by the Management Board on October

24, 2012.

REPORTED

SALES UP 7.2% IN Q3 AND 6.8% IN THE 9 MONTHS

RESILIENT

PERFORMANCE IN A CHALLENGING ENVIRONMENT

FULL-YEAR

PROFITABILITY AND CASH-FLOW TARGETS CONFIRMED

NEW STRATEGIC

ACQUISITION IN THE US

SOLID GROWTH IN REPORTED

SALES

- Reported sales up 7.2% in

Q3 and up 6.8% in the 9 months

- Strong contribution from

acquisitions and positive currency effect more than offset the

decrease in organic sales

RESILIENT PERFORMANCE IN

INCREASINGLY CHALLENGING CONDITIONS

- Q3: Reported EBITA up 3.9%

and Adjusted EBITA1 margin of

5.6%

- 9 months: Reported EBITA up

8.2% and Adjusted EBITA1 margin of

5.6%

FULL-YEAR PROFITABILITY AND

CASH-FLOW TARGETS CONFIRMED

NEW STRATEGIC ACQUISITION IN

THE US: MUNRO DISTRIBUTING COMPANY

|

At September 30 |

Q3

2012 |

YoY

Change |

9m 2012 |

YoY

Change |

|

On a reported basis |

|

|

|

|

|

Sales (€m) |

3,441.3 |

+7.2% |

10,009.4 |

+6.8% |

| % change

constant & same-day |

|

-3.6% |

|

-0.8% |

|

EBITA (€m) |

190.8 |

+3.9% |

561.2 |

+8.2% |

|

EBITA margin (as a % sales) |

5.5% |

-20bps |

5.6% |

+10bps |

|

Operating income (€m) |

172.0 |

+3.9% |

482.2 |

+1.4% |

|

Net income (€m) |

85.3 |

+1.3% |

236.4 |

-7.8% |

|

Recurring net income (€m) |

96.4 |

+0.3% |

286.7 |

+10.0% |

|

Free cash flow before interest and tax paid

(€m) |

103.8 |

-34.8% |

228.6 |

-3.4% |

|

Net debt end of period (€m) |

|

|

2,773.2 |

+22.2% |

|

On a constant and adjusted basis1 |

|

|

|

|

|

Gross profit (€m) |

834.0 |

-3.3% |

2,456.0 |

+0.3% |

|

Gross margin (as a % sales) |

24.2% |

+20bps |

24.5% |

+20bps |

|

EBITA (€m) |

191.7 |

-8.2% |

558.1 |

+1.7% |

|

EBITA margin (as a % sales ) |

5.6% |

-20bps |

5.6% |

+10bps |

1

Constant and adjusted = at comparable scope of

consolidation and exchange rates, excluding the non-recurring

effect related to changes in copper-based cable prices and before

amortization of purchase price allocation; an extract of financial

statements is presented in Appendix.

Rudy PROVOOST, Chairman of

the Management Board and CEO, said:

"In the past

quarter, we demonstrated the resilience of our business model

despite a challenging environment. Supported by acquisitions and

driven by our Energy in Motion initiatives, Rexel posted solid

growth in reported sales and reported EBITA. The strategic

acquisition of Munro announced today is a further demonstration of

our commitment to increase our footprint in the US market and

expand our offer in Energy Efficiency solutions.

In an increasingly uncertain macroeconomic

context, we target mid- to high- single-digit growth in reported

sales and reported EBITA for the year and confirm our targets of

profitability and cash generation with an adjusted EBITA margin of

5.7% and free cash-flow before interest and tax of around

€600m."

Financial

review for the period ended September 30, 2012

Unless otherwise

stated, all comments are on a constant and adjusted basis and, for

sales, at same number of working days

Reported

sales: +7.2% in Q3 and +6.8% in the 9 months, supported by solid

contribution from acquisitions and a positive currency

effect

Constant and

same-day sales evolution: -3.6% in Q3, reflecting the economic

slowdown and challenging comparables vs. Q3 2011; -0.8% in the 9

months

In the third quarter, Rexel

recorded sales of €3,441.3 million, up 7.2% on a reported basis and

down 3.6% on a constant and same-day basis. Excluding the negative

1.0 percentage point impact due to the change in copper-based cable

prices, sales were down 2.6% on a constant and same-day basis.

The 7.2% rise in sales on a

reported basis included:

· A positive currency effect

of €191.4 million (mainly due to the appreciation of the USD, the

CAD, the GBP and the AUD against the euro),

· A net positive effect of

€191.5 million from changes in the scope of consolidation

(acquisitions: €193.4 million minus divestments: €1.9 million),

which accelerated in Q3 due to the consolidation of Platt as from

July 1,

· A negative calendar effect

of 0.6 percentage point.

On a constant and same-day basis,

sales reflected increasingly challenging conditions in Rexel's

end-markets:

-

Slowing momentum from industry,

-

Persistently low level of residential

construction,

-

Weak activity in the commercial end-market,

impacted by postponement of projects,

as well as challenging

comparables: Q3 2011 was the strongest quarter last year (+7.5% on

a constant and same-day basis).

In the nine months, Rexel recorded

sales of €10,009.4 million, up 6.8% on a reported basis and down

0.8% on a constant and same-day basis. Excluding the negative 0.9

percentage point impact due to the change in copper-based cable

prices, sales were slightly up (+0.1%) on a constant and same-day

basis.

The 6.8% rise in sales on a

reported basis included:

· A positive currency effect

of €410.5 million (mainly due to the appreciation of the USD, the

CAD, the GBP and the AUD against the euro),

· A net positive effect of

€281.3 million from changes in the scope of consolidation

(acquisitions: €346.2 million minus divestments: €64.9

million),

· A positive calendar effect

of 0.2 percentage points.

Europe (55%

of Group sales): -5.2% in Q3 and -2.5% in 9m on a constant and

same-day basis

In the third quarter, sales in

Europe decreased by 0.7% on a reported basis, including a positive

impact of €67.8 million from the consolidation of Eurodis and

Toutelectric in France, Wilts in the UK, La Grange in Belgium and

Erka in Spain.

On a constant and same-day basis,

sales slowed sequentially: -5.2% in Q3 vs. -2.7% in Q2. Excluding

photovoltaic, sales were down 4.6% in Q3.

In France, sales were down 4.9%

in Q3 (vs. -2.8% in the previous quarter), reflecting lower demand

from the industrial end-market as well as a slowdown in residential

and commercial construction.

In the UK, sales were down 3.3% in

Q3, in line with the previous quarter and against very challenging

comparables (Q3 2011 was the strongest quarter last year at

+11.0%). Excluding photovoltaic and the impact of the branch

optimization program that was implemented in recent quarters (438

branches at September 30, 2012 vs. 452 branches at September 30,

2011), sales were down only -1.6% in Q3 (vs. -2.5% in the previous

quarter).

In Germany, sales were down 5.1%,

in Q3 (vs. -5.4% in the previous quarter). Excluding photovoltaic,

sales were down 3.4% in Q3 (vs. +0.1% in the previous quarter),

reflecting slowing momentum from the industrial end-market and

lower export activity

In Belgium, sales were down 13.9%,

in Q3. Excluding photovoltaic, sales were down 6.8% (vs. -0.4% in

the previous quarter), impacted by delayed commercial projects and

lower residential activity.

In the Netherlands, sales posted a

9.6% decline in Q3, continuing to reflect difficult market

conditions and the business transformation underway.

In both Switzerland and Austria,

sales grew in Q3, respectively by 2.3% and 4.2%.

In Scandinavia, sales decreased by

3.3% in Q3. They were up 1.4% in Norway, while Sweden and Finland

were down respectively 5.2% and 6.4%, reflecting challenging

macroeconomic conditions in both countries.

Southern European countries posted

a decline of 11.8% in Q3, largely due to the continued poor

performance of Spain (-16.8%) and Italy (- 8.4%), while Portugal

posted an increase of 4.6%, helped by export activity.

North

America (32% of Group sales): +0.1% in Q3 and +3.2% in 9m on a

constant and same-day basis

In the third quarter, sales in

North America were up 22.5% on a reported basis, including a

positive effect of €116.1 million from exchange rates (USD and CAD

against the euro) and a further positive effect of €100.8 million

resulting from the consolidation of Liteco (Canada) as from January

2012 and, more significantly, from the acquisition of Platt (US) as

from July 2012. Platt represented €86.0 million out of the €100.8

million scope effect in the quarter.

On a constant and same-day basis,

sales were broadly flat (+0.1%), reflecting contrasting situations:

-1.8% in the US and +5.0% in Canada.

In the US, sales were down 1.8% in

Q3, reflecting challenging comparables (Q3 2011 was the strongest

quarter last year: +9.2% on a constant and same-day basis). On a

24-month basis, sales were up 8.9% in Q3 2012 (vs. Q3 2010) in line

with the 8.7% growth posted in Q2 2012 (vs. Q2 2010).

In Canada, sales were up 5.0%,

despite a challenging base effect (constant and same-day growth was

+11.2% in Q3 2011). Growth continued to be driven by the industrial

end-market, particularly in the mining and oil & gas

segments.

Asia-Pacific

(10% of Group sales): -9.0% in Q3 and -4.4% in 9m on a constant and

same-day basis

In the third quarter, sales in

Asia-Pacific were up 0.9% on a reported basis, including a positive

effect of €40.9 million from favorable exchange rates (primarily

the appreciation of the AUD against the euro).

On a constant and same-day basis,

sales were down 9.0% in Q3.

In China (c. 25% of the region's

sales), sales were down 7.4%, reflecting a strong decline in wind

sales and extremely challenging comparables as Q3 2011 was the

strongest quarter last year, notably due to the positive impact of

a large project operated by Gexpro China (+33.3% on a constant and

same-day basis). Excluding wind, sales were up 1.1% in Q3.

In Australia (c. 60% of the

region's sales), sales were down 8.5%, still impacted by difficult

macroeconomic conditions but also by the implementation of a new

carbon tax as from July 1, that severely hit mining and

projects.

In New Zealand (c. 10% of the

region's sales), sales were down 14.8%, still reflecting the poor

macroeconomic environment, branch closures (50 branches at

September 30, 2012 vs. 61 branches at September 30, 2011) and delay

in post-earthquake reconstruction.

Latin

America (3% of Group sales): +4.3% in Q3 and +5.4% in 9m on a

constant and same-day basis

In the third quarter, sales in

Latin America were up 47.7% on a reported basis, including a

positive effect of €24.6 million resulting from the consolidation

of Delamano and Etil in Brazil and V&F Tecnologia in Peru.

On a constant and same-day basis,

sales were up 4.3% due to strong performance in Chile (+15.9%) and

Peru (+15.8%), while sales in Brazil were slightly down (-2.0%),

impacted by slower momentum in industry and the integration process

of the recently acquired Delamano.

Resilient profitability in

Europe and improvement in North America (87% of sales) despite

increasingly challenging macroeconomic conditions; Asia-Pacific and

Latin America under pressure

In the third quarter,

EBITA[1] margin

decreased by 20 basis points and stood at 5.6%.

This 20 basis point drop

reflected:

-

A 20 basis point improvement in gross margin, to

24.2%,

-

An increase in distribution and administrative

expenses[2] as a

percentage of sales (from 18.20% in Q3 2011 to 18.66% in Q3 2012):

these expenses were reduced by 1.8% while sales decreased by 4.2%

on a constant and actual-day basis.

By geography:

-

Europe demonstrated very strong resilience with

stable EBITA1 margin of

6.5% (sales were down 5.9% in the quarter on a constant and

actual-day basis),

-

North America continued to improve its

EBITA1 margin by

20bps to 5.4% (sales were flat in the quarter on a constant and

actual-day basis),

-

Asia-Pacific posted a 230bp drop in

EBITA1 margin to

5.1%, impacted by the strong decline in sales (down 9.7% in the

quarter on a constant and actual-day basis) and adverse geographic

mix,

-

Latin America posted a 220bp drop in

EBITA1 margin to

1.5% (although sales were up 1.2% in the quarter on a constant and

actual-day basis), impacted by strong inflation in personnel costs

and expense due to building a strong national platform in

Brazil.

Europe and North America, which

demonstrated either very resilient or improved EBITA1

margin, represent over 85% of Group sales.

In the nine months,

EBITA1 margin

improved by 10 basis points and stood at 5.6%

This 10bp improvement

reflected:

-

A 20bp improvement in gross margin, to

24.5%,

-

An increase in distribution and administrative

expenses2 as a percentage of sales (from 18.87% in 9m 2011 to

18.96% in 9m 2012): these expenses were reduced by 0.1% while sales

decreased by 0.6% on a constant and actual-day basis.

Reported

EBITA up 3.9% in Q3 and up 8.2% in the nine months

Reported EBITA reached €190.8

million in the quarter, up 3.9% year-on-year, and €561.2 million in

the nine months, up 8.2% year-on-year, boosted by acquisitions and

a positive currency effect.

Operating

income up 3.9% in Q3 and 1.4% in the nine months

Recurring

net income up 10.0% in the nine months; reported net income

impacted by rise in tax rate

In the nine months, operating

income was up 1.4% at €482.2 million.

-

Amortization of purchase price allocation

amounted to €9.3 million (vs. €13.1 million in 9m 2011).

-

Other income and expenses amounted to a net

charge of €69.7 million (vs. a net charge of €29.9 million in 9m

2011, which benefited from the net proceeds from the disposals of

HBA and Kompro for €26.1 million). They included €27.6 million of

goodwill impairment (already accounted for as of June 30 and mainly

due to weaker than expected performance in the Netherlands and in

New Zealand). They also included €28.2 million of restructuring

costs (vs. €15.2 million in 9m 2011).

In the nine months, net income

stood at €236.4 million vs. €256.3 million in 9m 2011. The 7.8%

decrease was mainly attributable to the rise in the effective tax

rate: as expected, this rate increased to 29.5% in 9m 2012 vs.

21.2% in 9m 2011, which benefited from the recognition of

prior-year losses carried forward.

It included:

-

Net financial expenses for €149.0 million

(vs. €152.1 million in 9m 2011). The average effective interest

rate for the nine months stood at 7.2% (flat vs. 9m 2011).

-

Income tax represented a charge of €98.3

million (vs. €68.5 million in 9m 2011), as explained above.

-

Share of profit/loss in associates was a

profit of €1.5 million (vs. a profit of €1.2 million in 9m

2011).

In the nine months, recurring net

income amounted to €286.6 million, up 10.0% year-on-year (see

appendix 2).

Positive

free cash-flow before interest and tax3 of €228.6

million in the nine months

Temporary

rise in indebtedness ratio to slightly above 3 times EBITDA at

September 30, 2012 (vs. 2.80x at September 30, 2011) due to the

impact of the payment of Platt in early July

In the nine months, free cash flow

before interest and tax[3] was an

inflow of €228.6 million (vs. an inflow of €236.6 million in 9m

2011). This inflow included:

-

Net capital expenditure of €54.2 million,

-

A €268.0 million outflow from change in working

capital, resulting from stronger sales, higher inventories and

lower level of trade payables.

At September 30, 2012, net debt

stood at €2,773.2 million, vs. 2,270.2 million at September 30,

2011 and vs. 2,078.2 million at December 31, 2011. It took into

account:

· €491.6 million

of net financial investment, of which €338.1 million in Q3 largely

attributable to the payment of Platt in early July,

· €126.1 million

of net interest paid,

· €94.9 million

of income tax paid,

· €143.0 million

of dividend paid in cash,

· €19.9 million

of unfavorable currency effect.

At the end of September, the

indebtedness ratio (Net financial debt / EBITDA), as calculated

under the Senior Credit Agreement terms, stood at 3.07 (vs. 2.80x

at September 30, 2011 and vs. 2.40x at December 31, 2011). This

level was temporarily impacted by the payment of Platt in early

July. It will return to around 2.8 times at the end of the year

(including the impact of the two acquisitions announced below),

thanks to the strong seasonality of cash flow generation during

Q4.

Two new acquisitions in line

with Rexel's external growth strategy and Energy in Motion

plan

Rexel reached an agreement

yesterday to acquire Munro Distributing Company, an innovative

electrical products & services distributor specializing in

energy efficiency and conservation solutions in the Eastern US and

California. This acquisition significantly reinforces Rexel's

position in the US as a premier provider of energy efficiency

solutions. The combination of Rexel's robust energy platform -

within its Gexpro and Rexel Inc. banners - and Munro Distributing

Company will create an energy efficiency solutions offering of

unrivaled scope in the U.S. market, in line with Rexel's Energy in

Motion strategic plan.

Munro Distributing Company's history of innovative energy

efficiency solutions and strong partnerships with energy services

companies (ESCOs) and utilities will create significant value for

the Group.

Founded in 1951 and based in Massachusetts, the company operates 12

branches located in 5 states (Massachusetts, Rhode Island, New

York, New Jersey and California) and employs about 185 people. It

should post annual sales of c. €115 million this year (vs. €88

million in 2011).

This acquisition represents c. €115 million (enterprise value) for

Rexel and it will be accretive by the end of 2013. The transaction,

subject to customary conditions, should close in early December and

Munro Distributing Company's operations should be consolidated from

December 1.

In early August, Rexel acquired

one of the leading players in Peru, Dirome. This acquisition

expands Rexel's footprint in the fast-growing Peruvian market and

strengthens its presence in the mining industry, one of the

priorities of Rexel's Energy in Motion company plan.

With its experience in distributing a broad offer of electrical

products to large industrial and service companies, small and

medium-sized contractors and retail operators, Dirome offers strong

geographical and business complementarity with V&F Tecnologia,

which Rexel acquired in October 2011.

Founded in 1996, Dirome operates 4 branches (2 in Trujillo, 1 in

Piura and 1 in Lima), employs 55 people and serves the Peruvian

coast from North to South. It should post annual sales of c. €10

million in 2012.

This acquisition will be accretive by the end of 2013 and Dirome's

operations are consolidated as from October 1.

In a

macroeconomic environment that has slowed continuously since the

beginning of the year, Rexel, driven by its acquisition strategy,

targets:

-

Mid- to high-single digit

growth in reported sales (vs. previous

target of "organic growth above weighted GDP average

growth"),

-

Mid- to high-single digit

growth in reported EBITA (new

target).

Despite the increasingly uncertain

macroeconomic context, Rexel confirms its profitability and

cash-flow targets:

-

Adjusted EBITA1

margin of 5.7% (in line with the

previously-announced target of "at least 5.7%"),

-

Free cash-flow before

interest and tax of around €600 million (unchanged).

February 12,

2013

Fourth-quarter and full-year 2012 results

May 2,

2013

First-quarter 2013 results

July 26,

2013

Second-quarter and half-year 2013 results

October 31,

2013

Third-quarter and 9-month 2013 results

The financial report for the

period ended September 30, 2012 is available on the Group's website

(www.rexel.com), in the "Regulated information" section, and has

been filed with the French Autorité des Marchés

Financiers.

A slideshow of the third-quarter

& 9-month 2012 results is also available on the Group's

website.

Rexel, a global leader in the

distribution of sustainable and innovative products and services

for automation, technical supply and energy management, addresses

three main markets - industrial, commercial and residential. The

Group supports customers around the globe, wherever they are, to

create value and run their business better. With a network of some

2,200 branches in 37 countries, and over 28,000 employees, Rexel's

sales were €12.7 billion in 2011. Its majority shareholders are an

investor group led by Clayton, Dubilier & Rice, Eurazeo and

BAML Capital Partners.

Rexel is listed on the Eurolist market of Euronext Paris

(compartment A, ticker RXL, ISIN code FR0010451203). It is included

in the following indices: SBF 120, CAC Mid 100, CAC AllTrade, CAC

AllShares, FTSE EuroMid, FTSE4Good, STOXX600, STOXX Europe

Sustainability and ASPI Eurozone.

|

Financial Analysts / Investors |

Press |

| Marc MAILLET |

Karolina ADAMKIEWICZ |

| +33 1 42 85 76 12 |

+33 1 42 85 76 39 |

| mmaillet@rexel.com |

kadamkiewicz@rexel.com |

| Florence MEILHAC |

Brunswick: Thomas KAMM |

| +33 1 42 85 57 61 |

+33 1 53 96 83 92 |

| fmeilhac@rexel.com |

tkamm@brunswickgroup.com |

Rexel has elected for early

adoption of revised IAS 19 "Employee Benefits" following its

endorsement by EU on June 6, 2012. The early adoption of this

amendment improves information of the Group's financial situation,

in particular the presentation in the financial statements of the

surplus or deficit of pension funds. Accounting policy changes have

been applied retrospectively of of January 1, 2011 and comparative

information are available in the consolidated financial

statements.

Appendix

1

Segment

reporting - Constant and adjusted basis (*)

(*) Constant and

adjusted = at comparable scope of consolidation and exchange rates,

excluding the non-recurring effect related to changes in

copper-based cables price and before amortization of purchase price

allocation; the non-recurring effect related to changes in

copper-based cables price was, at the EBITA level:

- a loss of €8.8 million in Q3

2011 and a loss of €0.9 million in Q3 2012;

- a loss of €0.4 million in 9m

2011 and a profit of €3.1 million in 9m 2012.

| GROUP |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Constant and adjusted basis

(€m) |

Q3 2011 |

Q3 2012 |

Change |

9m 2011 |

9m 2012 |

Change |

| Sales |

|

3,593.7 |

3,441.3 |

-4.2% |

10,065.1 |

10,009.4 |

-0.6% |

|

on a constant basis and same

days |

|

|

-3.6% |

|

|

-0.8% |

| Gross profit |

862.7 |

834.0 |

-3.3% |

2,447.5 |

2,456.0 |

+0.3% |

| |

as a % of sales |

24.0% |

24.2% |

+20bps |

24.3% |

24.5% |

+20bps |

| Distribution & adm. expenses (incl. depreciation) |

(653.9) |

(642.3) |

-1.8% |

(1,899.0) |

(1,897.9) |

-0.1% |

| EBITA |

|

208.8 |

191.7 |

-8.2% |

548.6 |

558.1 |

+1.7% |

| |

as a % of sales |

5.8% |

5.6% |

-20bps |

5.5% |

5.6% |

+10bps |

|

Headcount (end of period) |

30,927 |

30,400 |

-1.7% |

30,927 |

30,400 |

-1.7% |

| EUROPE |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Constant and adjusted basis

(€m) |

Q3 2011 |

Q3 2012 |

Change |

9m 2011 |

9m 2012 |

Change |

| Sales |

|

1,944.9 |

1,829.3 |

-5.9% |

5,690.1 |

5,525.6 |

-2.9% |

|

on a constant

basis and same days |

|

|

-5.2% |

|

|

-2.5% |

| o/w |

France |

606.6 |

576.9 |

-4.9% |

1,882.8 |

1,825.5 |

-3.0% |

|

on a constant basis and same

days |

|

|

-4.9% |

|

|

-2.5% |

|

United Kingdom |

294.9 |

281.3 |

-4.6% |

806.4 |

794.5 |

-1.5% |

|

on a constant basis and same

days |

|

|

-3.3% |

|

|

-1.5% |

|

Germany |

241.1 |

225.5 |

-6.5% |

669.3 |

650.5 |

-2.8% |

|

on a constant basis and same

days |

|

|

-5.1% |

|

|

-2.3% |

|

Scandinavia |

239.9 |

228.6 |

-4.7% |

682.1 |

688.4 |

+0.9% |

|

on a constant basis and same

days |

|

|

-3.3% |

|

|

+1.3% |

| Gross |

profit |

500.8 |

482.6 |

-3.6% |

1,498.6 |

1,489.4 |

-0.6% |

|

as a % of

sales |

25.7% |

26.4% |

+70bps |

26.3% |

27.0% |

+70bps |

| Distribution & adm. expenses (incl. depreciation) |

(373.8) |

(364.1) |

-2.6% |

(1,124.4) |

(1,108.2) |

-1.4% |

| EBITA |

|

127.0 |

118.4 |

-6.7% |

374.2 |

381.2 |

+1.9% |

|

as a % of

sales |

6.5% |

6.5% |

stable |

6.6% |

6.9% |

+30bps |

|

Headcount (end of period) |

17,818 |

17,230 |

-3.3% |

17,818 |

17,230 |

-3.3% |

| NORTH AMERICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Constant and adjusted basis

(€m) |

Q3 2011 |

Q3 2012 |

Change |

9m 2011 |

9m 2012 |

Change |

| Sales |

|

1,181.4 |

1,181.3 |

0.0% |

3,078.5 |

3,224.4 |

+4.7% |

|

on a constant basis and same

days |

|

|

+0.1% |

|

|

+3.2% |

| o/w |

United States |

838.2 |

826.0 |

-1.4% |

2,125.6 |

2,209.8 |

+4.0% |

|

on a constant basis and same

days |

|

|

-1.8% |

|

|

+1.8% |

|

Canada |

343.3 |

355.3 |

+3.5% |

952.9 |

1,014.6 |

+6.5% |

|

on a constant basis and same

days |

|

|

+5.0% |

|

|

+6.5% |

| Gross |

profit |

255.7 |

258.2 |

+1.0% |

659.7 |

693.1 |

+5.1% |

| as a % of sales |

21.6% |

21.8% |

+20bps |

21.4% |

21.5% |

+10bps |

| Distribution & adm. expenses (incl. depreciation) |

(194.0) |

(194.5) |

+0.2% |

(528.6) |

(530.7) |

+0.4% |

| EBITA |

|

61.7 |

63.7 |

+3.3% |

131.1 |

162.4 |

+23.9% |

|

as a % of sales |

5.2% |

5.4% |

+20bps |

4.3% |

5.0% |

+70bps |

|

Headcount (end of period) |

8,378 |

8,485 |

1.3% |

8,378 |

8,485 |

1.3% |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| ASIA-PACIFIC |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Constant and adjusted basis

(€m) |

Q3 2011 |

Q3 2012 |

Change |

9m 2011 |

9m 2012 |

Change |

| Sales |

|

390.8 |

352.9 |

-9.7% |

1,071.9 |

1,026.0 |

-4.3% |

|

on a constant

basis and same days |

|

|

-9.0% |

|

|

-4.4% |

| o/w |

China |

103.3 |

97.2 |

-5.8% |

264.3 |

274.9 |

+4.0% |

|

on a constant basis and same

days |

|

|

-7.4% |

|

|

+3.2% |

|

Australia |

226.7 |

203.8 |

-10.1% |

634.2 |

599.9 |

-5.4% |

|

on a constant basis and same

days |

|

|

-8.5% |

|

|

-5.5% |

|

New Zealand |

41.0 |

34.4 |

-16.1% |

115.6 |

100.1 |

-13.4% |

|

on a constant basis and same

days |

|

|

-14.8% |

|

|

-12.5% |

| Gross |

profit |

88.5 |

74.6 |

-15.7% |

238.2 |

218.2 |

-8.4% |

|

as a % of

sales |

22.6% |

21.1% |

-150bps |

22.2% |

21.3% |

-90bps |

| Distribution & adm. expenses (incl. depreciation) |

(59.4) |

(56.4) |

-5.0% |

(172.2) |

(168.1) |

-2.4% |

| EBITA |

|

29.1 |

18.1 |

-37.6% |

66.0 |

50.1 |

-24.2% |

|

as a % of

sales |

7.4% |

5.1% |

-230bps |

6.2% |

4.9% |

-130bps |

| Headcount (end of

period) |

2,920 |

2,794 |

-4.3% |

2,920 |

2,794 |

-4.3% |

| |

|

|

|

|

|

|

|

| LATIN AMERICA |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Constant and adjusted basis

(€m) |

Q3 2011 |

Q3 2012 |

Change |

9m 2011 |

9m 2012 |

Change |

|

Sales |

|

76.7 |

77.6 |

+1.2% |

224.4 |

233.2 |

+3.9% |

|

on a constant basis and same

days |

|

|

+4.3% |

|

|

+5.4% |

| o/w |

Brazil |

49.1 |

47.3 |

-3.5% |

137.1 |

135.8 |

-0.9% |

|

on a constant basis and same

days |

|

|

-2.0% |

|

|

+0.3% |

|

Chile |

24.3 |

26.2 |

+8.0% |

77.9 |

86.1 |

+10.6% |

|

on a constant basis and same

days |

|

|

+15.9% |

|

|

+12.9% |

|

Peru |

3.4 |

4.1 |

+19.3% |

9.4 |

11.3 |

+20.4% |

|

on a constant basis and same

days |

|

|

+15.8% |

|

|

+18.5% |

|

Gross |

profit |

17.3 |

18.1 |

+4.7% |

48.8 |

53.8 |

+10.1% |

|

as a % of sales |

22.5% |

23.3% |

+80bps |

21.8% |

23.1% |

+130bps |

|

Distribution & adm. expenses (incl. depreciation) |

(14.4) |

(16.9) |

+17.4% |

(40.7) |

(48.3) |

+18.6% |

|

EBITA |

|

2.9 |

1.2 |

-58.5% |

8.1 |

5.5 |

-32.1% |

|

as a % of sales |

3.7% |

1.5% |

-220bps |

3.6% |

2.4% |

-120bps |

| Headcount (end of period) |

1,614 |

1,685 |

4.4% |

1,614 |

1,685 |

4.4% |

Appendix

2

Extract of

Financial Statements

Consolidated

Income Statement

|

Reported basis (€m) |

Q3 2011 |

Q3 2012 |

Change |

9m 2011 |

9m 2012 |

Change |

| Sales |

3,210.8 |

3,441.3 |

+7.2% |

9,373.3 |

10,009.4 |

+6.8% |

| Gross profit |

761.9 |

833.1 |

+9.3% |

2,294.5 |

2,459.3 |

+7.2% |

| |

as a % of sales |

23.7% |

24.2% |

|

24.5% |

24.6% |

|

|

Distribution & adm. expenses (excl. depreciation) |

(560.4) |

(623.3) |

+11.2% |

(1,721.0) |

(1,843.7) |

+7.1% |

| EBITDA |

201.5 |

209.7 |

+4.1% |

573.5 |

615.6 |

+7.3% |

| |

as a % of sales |

6.3% |

6.1% |

|

6.1% |

6.2% |

|

| Depreciation |

(17.9) |

(18.9) |

|

(54.8) |

(54.4) |

|

| EBITA |

183.6 |

190.8 |

+3.9% |

518.7 |

561.2 |

+8.2% |

| |

as a % of sales |

5.7% |

5.5% |

|

5.5% |

5.6% |

|

| Amortization of purchase price allocation |

(3.9) |

(4.2) |

|

(13.1) |

(9.3) |

|

| Operating income bef. other inc. and

exp. |

179.7 |

186.6 |

+3.8% |

505.6 |

551.9 |

+9.2% |

| |

as a % of sales |

5.6% |

5.4% |

|

5.4% |

5.5% |

|

| Other income and expenses |

(14.1) |

(14.6) |

|

(29.9) |

(69.7) |

|

| Operating income |

165.6 |

172.0 |

+3.9% |

475.7 |

482.2 |

+1.4% |

| Financial expenses (net) |

(54.4) |

(52.0) |

|

(152.1) |

(149.0) |

|

| Share of profit (loss) in associates |

1.1 |

1.3 |

|

1.2 |

1.5 |

|

| Net income (loss) before income

tax |

112.3 |

121.3 |

+8.1% |

324.8 |

334.7 |

+3.0% |

| Income tax |

(28.1) |

(36.0) |

|

(68.5) |

(98.3) |

|

| Net income (loss) |

84.2 |

85.3 |

+1.3% |

256.3 |

236.4 |

-7.8% |

| Net income (loss) attr. to non-controlling interests |

0.6 |

0.6 |

|

1.0 |

0.7 |

|

| Net income (loss) attr. to equity holders of the

parent |

83.6 |

84.7 |

+1.3% |

255.3 |

235.7 |

-7.7% |

Recurring Net

Income

| In millions of euros |

Q3 2011 |

Q3 2012 |

Change |

9m 2011 |

9m 2012 |

Change |

| Reported net income |

84.2 |

85.3 |

+1.3% |

256.3 |

236.4 |

-7.8% |

| Non-recurring copper effect |

8.6 |

0.9 |

|

0.6 |

-3.1 |

|

| Other expense & income |

14.2 |

14.6 |

|

29.9 |

69.7 |

|

| Financial expense |

3.1 |

0.0 |

|

13.1 |

-7.4 |

|

| Tax expense |

-13.9 |

-4.4 |

|

-39.4 |

-9.0 |

|

| Recurring net income |

96.1 |

96.4 |

+0.3% |

260.5 |

286.7 |

+10.0% |

Sales and

profitability by segment

|

Reported basis (€m) |

Q3 2011 |

Q3 2012 |

Change |

9m 2011 |

9m 2012 |

Change |

| Sales |

3,210.8 |

3,441.3 |

+7.2% |

9,373.3 |

10,009.4 |

+6.8% |

|

Europe |

1,842.2 |

1,829.3 |

-0.7% |

5,480.3 |

5,525.6 |

+0.8% |

|

North America |

964.5 |

1,181.3 |

+22.5% |

2,712.9 |

3,224.4 |

+18.9% |

|

Asia-Pacific |

349.7 |

352.9 |

+0.9% |

953.0 |

1,026.0 |

+7.7% |

|

Latin America |

52.6 |

77.6 |

+47.7% |

162.1 |

233.2 |

+43.9% |

| Gross profit |

761.9 |

833.1 |

+9.3% |

2,294.5 |

2,459.3 |

+7.2% |

|

Europe |

467.9 |

482.7 |

+3.2% |

1,442.5 |

1,494.2 |

+3.6% |

|

North America |

203.7 |

257.9 |

+26.6% |

577.6 |

692.2 |

+19.8% |

|

Asia-Pacific |

76.6 |

73.8 |

-3.6% |

210.3 |

217.6 |

+3.5% |

|

Latin America |

12.3 |

18.0 |

+46.1% |

36.4 |

53.7 |

+47.5% |

| EBITA |

183.6 |

190.8 |

+3.9% |

518.7 |

561.2 |

+8.2% |

|

Europe |

119.3 |

118.6 |

-0.5% |

368.7 |

385.8 |

+4.6% |

|

North America |

48.4 |

63.4 |

+31.0% |

114.4 |

161.5 |

+41.2% |

|

Asia-Pacific |

25.4 |

17.4 |

-31.4% |

59.8 |

49.5 |

-17.2% |

|

Latin America |

2.1 |

1.1 |

-48.7% |

6.5 |

5.4 |

-16.4% |

Impact on

sales from changes in the scope of consolidation

| Acquisitions |

Country |

Conso. |

Q3 2012 |

9m 2012 |

|

|

as from |

|

|

| Europe |

France, UK, Spain, Belgium |

misc. |

67.8 |

136.0 |

| North America |

Canada, USA |

misc. |

100.8 |

123.7 |

| Asia-Pacific |

China, India |

01/07/11 |

0.2 |

23.1 |

| Latin America |

Brazil, Peru |

misc. |

24.6 |

63.4 |

| Total acquisitions |

|

|

193.4 |

346.1 |

| Divestments |

Country |

Deconso. |

Q3 2012 |

9m 2012 |

|

|

as from |

|

|

| ACE |

ACE |

01/07/11 |

-1.9 |

-64.9 |

| Total divestments |

|

|

-1.9 |

-64.9 |

| Net impact on sales |

|

|

191.5 |

281.2 |

Consolidated

Balance Sheet

| Assets (€m) |

December

31, 2011 |

September 30, 2012 |

| Goodwill |

4,002.2 |

4,348.2 |

| Intangible assets |

935.7 |

1,045.5 |

| Property, plant & equipment |

261.7 |

276.1 |

| Long-term investments(1) |

97.1 |

89.9 |

| Investments in associates |

11.8 |

11.2 |

| Deferred tax assets |

153.2 |

164.9 |

| Total non-current

assets |

5,461.7 |

5,935.8 |

| Inventories |

1,240.8 |

1,468.6 |

| Trade receivables |

2,122.9 |

2,316.8 |

| Other receivables |

476.2 |

473.4 |

| Assets classified as held for sale |

3.7 |

3.3 |

| Cash and cash equivalents |

413.7 |

251.6 |

| Total current assets |

4,257.3 |

4,513.7 |

| Total assets |

9,719.0 |

10,449.5 |

| |

|

|

| Liabilities (€m) |

December

31, 2011 |

September 30, 2012 |

| Total equity |

4,042.5 |

4,132.8 |

| Long-term debt |

2,182.3 |

2,557.6 |

| Deferred tax liabilities |

111.3 |

163.0 |

| Other non-current liabilities |

437.2 |

471.2 |

| Total non-current

liabilities |

2,730.8 |

3,191.8 |

| Interest bearing debt & accrued interests |

333.5 |

503.2 |

| Trade payables |

1,903.3 |

1,926.1 |

| Other payables |

708.9 |

695.6 |

| Liabilities classified as held for sale |

0.0 |

0.0 |

| Total current

liabilities |

2,945.7 |

3,124.9 |

| Total liabilities |

5,676.5 |

6,316.7 |

| Total equity &

liabilities |

9,719.0 |

10,449.5 |

1 Includes Fair

value hedge derivatives for €23.8 million at December 31, 2011 and

for €36.0 million at September 30, 2012

Change in Net

Debt

| €m |

Q3 2011 |

Q3 2012 |

9m 2011 |

9m 2012 |

| EBITDA |

201.5 |

209.7 |

573.5 |

615.6 |

| Other operating revenues & costs(1) |

(10.8) |

(19.5) |

(40.9) |

(64.8) |

| Operating cash

flow |

190.7 |

190.2 |

532.6 |

550.8 |

| Change in working capital |

(16.5) |

(69.0) |

(253.9) |

(268.0) |

| Net capital expenditure, of which: |

(15.1) |

(17.4) |

(42.1) |

(54.2) |

| Gross capital expenditure |

(16.0) |

(20.2) |

(60.4) |

(53.8) |

| Disposal of fixed assets &

other |

0.9 |

2.8 |

18.3 |

(0.4) |

| Free cash flow before

interest and tax |

159.1 |

103.8 |

236.6 |

228.6 |

| Net interest paid / received |

(43.8) |

(44.7) |

(115.2) |

(126.1) |

| Income tax paid |

(24.1) |

(27.1) |

(71.6) |

(94.9) |

| Free cash flow after interest

and tax |

91.2 |

32.0 |

49.8 |

7.6 |

| Net financial investment(2) |

41.2 |

(353.1) |

(14.0) |

(491.6) |

| Dividends paid |

(0.1) |

0.0 |

(105.3) |

(143.0) |

| Net change in equity |

0.0 |

(0.2) |

88.4 |

0.0 |

| Other |

(15.1) |

(13.4) |

(36.6) |

(48.1) |

| Currency exchange variation |

(23.6) |

19.9 |

20.8 |

(19.9) |

| Decrease (increase) in net

debt |

93.6 |

(314.8) |

3.1 |

(695.0) |

| Net debt at the beginning of the

period |

2,363.8 |

2,458.4 |

2,273.3 |

2,078.2 |

| Net debt at the end of the

period |

2,270.2 |

2,773.2 |

2,270.2 |

2,773.2 |

(1) Includes restructuring outflows of :

(2) Q3 2012 includes €338.1 million of

acquisitions (net of cash) and 9m 2012 includes €473.1 million of

acquisitions (net of cash)

Appendix

3

Working

Capital Analysis

| Constant basis |

September 30, 2011 |

September 30, 2012 |

| Net inventories |

|

|

| as a % of sales 12

rolling months |

10.0% |

10.3% |

| as a number of days |

|

|

| Net trade receivables |

|

|

| as a % of sales 12

rolling months |

18.2% |

17.2% |

| as a number of days |

|

|

| Net trade payables |

|

|

| as a % of sales 12

rolling months |

14.9% |

13.8% |

| as a number of days |

|

|

| Trade working capital |

|

|

| as a % of sales 12

rolling months |

13.3% |

13.6% |

| Total working capital |

|

|

| as a % of sales 12

rolling months |

11.8% |

12.4% |

Appendix

4

Headcount and

branches by geography

|

FTEs at end of period |

30/09/2011 |

31/12/2011 |

30/09/2012 |

Change |

|

comparable |

| Europe |

17,818 |

17,710 |

17,230 |

-3.3% |

| USA |

6,017 |

6,078 |

6,070 |

0.9% |

| Canada |

2,361 |

2,397 |

2,414 |

2.2% |

| North America |

8,378 |

8,475 |

8,485 |

1.3% |

| Asia-Pacific |

2,920 |

2,926 |

2,794 |

-4.3% |

| Latin America |

1,614 |

1,661 |

1,685 |

4.4% |

| Other |

197 |

204 |

206 |

4.6% |

| Group |

30,927 |

30,976 |

30,400 |

-1.7% |

| |

|

|

|

|

|

Branches |

30/09/2011 |

31/12/2011 |

30/09/2012 |

Change |

|

comparable |

| Europe |

1,396 |

1,389 |

1,377 |

-1.4% |

| USA |

413 |

406 |

395 |

-4.4% |

| Canada |

223 |

221 |

218 |

-2.2% |

| North America |

636 |

627 |

613 |

-3.6% |

| Asia-Pacific |

299 |

293 |

278 |

-7.0% |

| Latin America |

83 |

85 |

89 |

7.2% |

| Group |

2,414 |

2,394 |

2,357 |

-2.4% |

Appendix

5

Senior Credit

Agreement

The €1.3bn SCA comprises two revolving credit

facilities:

-

a 3-year multi-currency revolving credit

facility in an amount of €200m (the initial amount was €600m and

was reduced to €400m after one year and to €200m after two years),

named "Facility A"

-

a 5-year multi-currency revolving credit

facility in an amount of €1.1bn, named "Facility B"

The applicable margin levels vary according to the

IR thresholds (IR = Indebtedness Ratio, i.e. adjusted consolidated

net debt to adjusted consolidated EBITDA of the last 12 months), as

indicated below:

|

Indebtedness Ratio (IR) |

IR sup. or equal to 5.0x |

IR sup. or equal to 4.5x and inf. to

5.0x |

IR sup. or equal to 4.0x and inf. to

4.5x |

IR sup. or equal to 3.5x and inf. to

4.0x |

IR sup. or equal to 3.0x and inf. to

3.5x |

IR sup. or equal to 2.5x and inf. to

3.0x |

IR inf. to 2.5x |

|

Facility A |

4.25% |

3.50% |

3.00% |

2.50% |

2.00% |

1.75% |

1.50% |

|

Facility B |

4.50% |

3.75% |

3.25% |

2.75% |

2.25% |

2.00% |

1.75% |

In addition, the margin applicable to both

facilities shall be increased by an utilisation fee equal to:

-

25bps if the total amount drawn under both

facilities is comprised between 33% and 66% of the total

commitment;

-

50bps if the total amount drawn under both

facilities equals or exceeds 66% of the total commitment.

The applicable financial covenants are the

following:

- Commitment to keep indebtedness ratio below

thresholds:

|

Date |

30 june 2010 |

31 dec. 2010 |

30 june 2011 |

31 dec. 2011 |

30 june 2012 |

Thereafter |

|

Covenant |

5.15x |

4.90x |

4.50x |

4.00x |

3.75x |

3.5x |

- Commitment to suspend dividend payments as long

as IR equals or exceeds 4.00x

- Commitment to limit capital expenditure to 0.75%

of sales as long as IR equals or exceeds 4.00x

The SCA contains customary clauses

for this type of agreement. These include clauses restricting the

ability of Rexel Group companies to pledge their assets, carry out

mergers or restructuring programs, borrow or lend money or provide

guarantees. In particular, the Rexel Group has no restriction on

acquisitions if the Indebtedness Ratio does not exceed 3.50x and

has an acquisition basket of up to €200 million for each 12-months

period if the Indebtedness Ratio equals or exceed 3.50x.

DISCLAIMER

The Group is

exposed to fluctuations in copper prices in connection with its

distribution of cable products. Cables accounted for approximately

17% of the Group's sales, and copper accounts for approximately 60%

of the composition of cables. This exposure is indirect since cable

prices also reflect copper suppliers' commercial policies and the

competitive environment in the Group's markets. Changes in copper

prices have an estimated so-called "recurring" effect and an

estimated so called "non-recurring" effect on the Group's

performance, assessed as part of the monthly internal reporting

process of the Rexel Group:

- the recurring

effect related to the change in copper-based cable prices

corresponds to the change in value of the copper part included in

the sales price of cables from one period to another. This effect

mainly relates to the Group's sales;

- the

non-recurring effect related to the change in copper-based cables

prices corresponds to the effect of copper price variations on the

sales price of cables between the time they are purchased and the

time they are sold, until all such inventory has been sold (direct

effect on gross profit). Practically, the non-recurring effect on

gross profit is determined by comparing the historical purchase

price for copper-based cable and the supplier price effective at

the date of the sale of the cables by the Rexel Group.

Additionally, the non-recurring effect on EBITA corresponds to the

non-recurring effect on gross profit, which may be offset, when

appropriate, by the non-recurring portion of changes in the

distribution and administrative expenses (principally, the variable

portion of compensation of sales personnel, which accounts for

approximately 10% of the variation in gross profit).

The impact of

these two effects is assessed for as much of the Group's total

cable sales as possible, over each period. Group procedures require

that entities that do not have the information systems capable of

such exhaustive calculations to estimate these effects based on a

sample representing at least 70% of the sales in the period. The

results are then extrapolated to all cables sold during the period

for that entity. Considering the sales covered, the Rexel Group

considers such estimates of the impact of the two effects to be

reasonable.

This press

release may contain statements of future expectations and other

forward-looking statements. By their nature, they are subject to

numerous risks and uncertainties, including those described in the

Document de Référence registered with the French Autorité des

Marchés Financiers (AMF) on March 15, 2012 under number D.12-0164.

These forward-looking statements are not guarantees of Rexel's

future performance. Rexel's actual results of operations, financial

condition and liquidity as well as development of the industry in

which Rexel operates may differ materially from those made in or

suggested by the forward-looking statements contained in this

release. The forward-looking statements contained in this

communication speak only as of the date of this communication and

Rexel does not undertake, unless required by law or regulation, to

update any of the forward-looking statements after this date to

conform such statements to actual results, to reflect the

occurrence of anticipated results or otherwise.

The market and

industry data and forecasts included in this press release were

obtained from internal surveys, estimates, experts and studies,

where appropriate, as well as external market research, publicly

available information and industry publications. Rexel, its

affiliates, directors, officers, advisors and employees have not

independently verified the accuracy of any such market and industry

data and forecasts and make no representations or warranties in

relation thereto. Such data and forecasts are included herein for

information purposes only.

This press

release includes only summary information and must be read in

conjunction with Rexel's Document de Référence registered with the

AMF March 15, 2012 under number D.12-0164, as well as the

consolidated financial statements and activity report for the 2011

fiscal year, which may be obtained from Rexel's website

(www.rexel.com).

[1] Constant and adjusted = at

comparable scope of consolidation and exchange rates, excluding the

non-recurring effect related to changes in copper-based cable

prices and before amortization of purchase price allocation

[2]Including depreciations

[3]Cash from operating activities minus net

capital expenditure and before net interest and income tax paid

Thrid-quarter & 9-month 2012

results (non audited)

This

announcement is distributed by Thomson Reuters on behalf of Thomson

Reuters clients.

The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the

information contained therein.

Source: REXEL via Thomson Reuters ONE

HUG#1653769

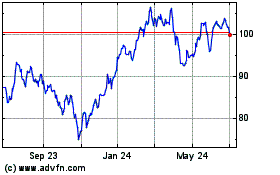

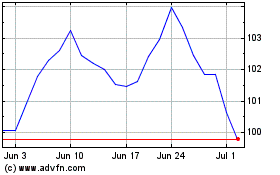

ProShares Ultra Health C... (AMEX:RXL)

Historical Stock Chart

From Jan 2025 to Feb 2025

ProShares Ultra Health C... (AMEX:RXL)

Historical Stock Chart

From Feb 2024 to Feb 2025