Top 3 Leveraged Energy ETFs - Leveraged ETF's

October 31 2011 - 8:13AM

Zacks

Energy

ETFs offer an attractive opportunity to investors with a long term

horizon since they represent a stable industry with a bright

future. The demand for energy continues to rise steadily and this

is particularly true of nations growing at a rapid pace. Along with

this trend, the pressure on natural resources which are harnessed

to provide energy and related services has also increased

considerably. With the advantage of well diversified portfolios

Energy ETFs are the most viable route to invest in this sector.

| Mutual Fund |

Ticker |

Ultra DJ- UBS Crude OIL

|

UCO

|

| Direxion Daily Energy Bull 3X |

ERX |

| Direxion Daily Natural Gas Bull 2x |

GASL |

Ultra DJ- UBS Crude Oil - seeks to replicate the 2X the

return of the daily performance of the Dow Jones US Crude Oil

Subindex. This ETF has a category average annual expense ratio of

0.95%, and net asset of $1.15 billion. The largest holding of this

ETF is the WTI October 2011 Futures Contract.

Direxion Daily Energy Bull 3X - seeks daily

investment results, before fees and expenses, of 300% of the price

performance of the Russell 1000 Energy Index

.

This ETF has an average expense ratio of 0.95%, and has net assets

of $354 million. This ETFs largest holding is Exxon Mobil.

Direxion Daily Natural Gas Bull 2X - tracks the

daily performance of the 300% of the price performance of

the ISE-REVERE Natural Gas Index. This ETF has a 0.95% annual

expense ratio and has net assets of $11.3 million.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

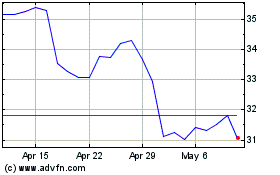

ProShares Ultra Bloomber... (AMEX:UCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

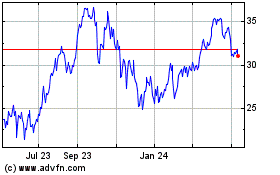

ProShares Ultra Bloomber... (AMEX:UCO)

Historical Stock Chart

From Dec 2023 to Dec 2024