Millennium Investment & Acquisition Co. Inc. (Ticker: MILC)

(“MILC” or the “Company”) today announced that it is expanding its

sustainable cannabis cultivation activities by establishing

operations in the second largest cannabis market in the country:

Michigan. A subsidiary of MILC’s wholly owned subsidiary,

Millennium Cannabis LLC, (“Millennium Cannabis”), has executed a

long-term lease (the “Lease”) for a 556,146 square foot

state-of-the-art greenhouse cultivation facility located in Marengo

Township, Michigan (the “Property”). The Lease was entered into

simultaneously with the acquisition of the Property by Power REIT

(Ticker: PW and PW.PRA). David H. Lesser, MILC’s Chairman and CEO

is also Chairman and CEO of Power REIT.

Property Details

The state-of-the-art “Dutch Venlo Style”

greenhouse is 26-foot high which helps control the growing

environment. The diffused glass roof is beneficial to plant growth

and allows greater plant density. The greenhouse features advanced

cultivation controls and a best-in-class irrigation/fertigation

system. There are also two large, multi-functional boilers that

heat and help dehumidify the greenhouse as well as provide the crop

with enhanced CO2 levels to improve plant yields. There is a

1-million-gallon hot water storage tank that allows the boilers to

run during the day to provide enhanced CO2 to the plants for

photosynthesis but then uses the stored heat at night and as

otherwise needed. The greenhouse also includes an exceptional

irrigation system with 500,000 gallons of feed tanks that can water

the entire greenhouse in under 20 minutes. The irrigation system is

configured with 12 different feed zones. This allows for precision

crop feeding targeting each zone based on the plant growth stage

and cultivar. This facility is labor-efficient with an under-bench

radiant heating system that acts as a dual-purpose rail system for

carts and other equipment to enhance labor efficiency.

Capital Improvements

As part of the transaction, Power REIT has

agreed to fund capital improvements for the Property to position it

for cannabis cultivation. Power REIT’s current capital commitment

for the initial phase of improvements is approximately $3 million

which includes costs related to permitting and licensing, fire

suppression, security and site work. Power REIT is working with its

tenant to finalize the budget for additional property improvements

that Power REIT will fund and amend the lease accordingly. These

improvements are expected to include a light deprivation system

which is important to maximize plant yields, dry and cure space, a

state-of-the-art propagation room, as well as an early-stage plant

nursery at the facility as well as upgrades to facilities to

support the needs of employees such as bathrooms and lockers.

The Michigan Cannabis

Market

In 2008, Michigan passed the Michigan Marijuana

Act and became the 10th state to legalize medical cannabis. During

2020, its first full year of recreational sales, the Michigan

market generated $1 billion in total legal medical and adult-use

revenue. Revenue for 2021 is projected to reach $1.8 billion, an

increase of 80% YoY. This would make Michigan the second largest

cannabis market in the country, second only to California. Michigan

cannabis sales are expected to grow to $4 Billion over the next 3 –

5 years.

David Lesser, MILC’s Chairman and CEO,

commented, “In May of this year, MILC announced

sustainable greenhouse cultivation of cannabis as a new area of

focus and commenced operations in Colorado. This was followed by

the entry into the Oklahoma market in June. We are pleased with the

progress we have made at both of these facilities including

implementing property improvements, commencing significant initial

crops and building a strong team. Michigan represents a significant

next step in the growth of Millennium Cannabis. This facility will

be the largest cannabis cultivation facility in Michigan and one of

the largest cannabis greenhouse cultivation facilities in the

United States. Property improvements will begin immediately, and

Millennium Cannabis is working with the state and local

jurisdictions on the final steps for licensing which will allow us

to start growing plants. We hope to begin generating revenue by

mid-2022 and have the greenhouse full of plants by the end of next

year.”

Millennium Cannabis is led by Jared Schrader,

who has built a team of more than 50 seasoned cannabis cultivators

and operators. With the Michigan transaction, Millennium Cannabis

now boasts one of the largest multi-state cannabis cultivation

footprints in the United States. Millennium Cannabis engages

agriculture experts from outside of the cannabis industry to

incorporate proven growing methods from traditional crops into

successful cannabis cultivation operations in low-energy greenhouse

environments. Millennium Cannabis shares Power REIT’s thesis that

greenhouses represent the sustainable solution for cultivating

cannabis at a low cost and with a significantly reduced carbon

footprint when compared to the expensive indoor warehouse

cultivation facilities that are more typical across the cannabis

industry.

Millennium Cannabis strategically deploys this

wide range of expertise to empower strong local operating partners

to apply Millennium Cannabis’s proven growing protocols and

best-in-class production methods to meet the evolving needs of

consumers within their local markets. Its partners in Michigan

include the long-time Facility Director who operated the greenhouse

during its prior use who will immediately transition his years of

experience growing acres of red peppers at the facility to now

supporting cannabis cultivation and production at the property. He

is joined by an industry-leading women and minority-owned

operations advisory group with more than a decade of experience

creating and leading cannabis operations across the US and abroad.

Rounding out the local team is a locally based women-owned

licensing partner who most recently oversaw regulatory and

compliance affairs for two of the largest cannabis greenhouse

operators in the country.

Jared Schrader, Millennium Cannabis’ President, commented,

“Millennium Cannabis is excited to commence operations at this

truly state-of-the-art greenhouse cultivation facility to create a

large-scale, low-energy, and low-cost production operation that is

well positioned to compete favorably in the Michigan cannabis

market for years to come. The nascent Michigan market is

experiencing dramatic growth and has current pricing that far

exceeds the national averages based on a supply/demand imbalance.

We currently see prices of $3,500 - $4,000 per pound in Michigan.

In the near-term this represents an opportunity to generate

significant cash flow. Given our focus on using greenhouse

technology to lower the cost of cultivation, we are confident we

can compete favorably even as the prices inevitably compress in

this market. With over 500,000 square feet of greenhouse

cultivation space, we are initially targeting approximately 90,000

plants. Conservatively assuming 3 harvests per year this could

produce more than 40,500 pounds of cannabis flower annually. Once

we ramp up operations, we believe the existing square footage can

also accommodate a much greater plant density which provides the

potential for built in revenue growth.”

Updated Investor Deck

MILC has posted an updated investor deck which is available on

our website: http://www.millinvestment.com/

Deregistration as a 1940 Act

CompanyOn October 14, 2020, shareholders approved a

proposal to change the nature of the Company’s business from a

registered investment company under the Investment Company Act of

1940 (the “1940 Act”) and to a holding company that focuses

primarily on owning and operating businesses that produce activated

carbon and acquiring other private businesses (collectively, the

“Deregistration Proposal”). The Company is in the process of

implementing the Deregistration Proposal so that it is no longer an

“investment company” under the 1940 Act and has applied to the

Securities and Exchange Commission (the “SEC”) for an order under

the 1940 Act declaring that the Company has ceased to be an

investment company (the “Deregistration Order”).

While the Company is committed to fully

implementing the Deregistration Proposal, it is still contingent

upon regulatory approval and the ability to reconfigure the

Company’s portfolio to deregister as an investment company. The

time required to reconfigure the Company’s portfolio could be

impacted by, among other things, the COVID-19 pandemic and related

market volatility, determinations to preserve capital, the

Company’s ability to identify and execute on desirable acquisition

opportunities, and applicable regulatory, lender and governance

requirements. The conversion process could take up to 24 months;

and there can be no assurance that the Deregistration Proposal,

even if fully implemented, will improve the Company’s performance.

Further, the SEC may determine not to grant the Company’s request

for the Deregistration Order, which would materially change the

Company’s plans for its business.

As previously announced, MILC has now completed

the liquidation of its sole investment in securities - its

investment in SMC and plans to invest the proceeds in operating

businesses.

ABOUT MILLENNIUM INVESTMENT & ACQUISITION COMPANY

INC.

Millennium Investment and Acquisition Co. Inc.

(ticker: MILC) is an internally managed, non-diversified,

closed-end investment company. During 2020, MILC announced

that it was seeking to de-register as an Investment Company that is

regulated under Investment Company Act of 1940. MILC is currently

seeking an Order from the SEC declaring that it has ceased to be an

Investment Company as it no longer meets the definition of holding

itself out as investing in securities but rather has pivoted to

focus on direct investments in operating businesses.

MILC is currently focusing on opportunities in

sustainable cannabis cultivation and sustainable production of

activated carbon.

Additional information about MILC can be found

on its website: www.millinvestment.com

ABOUT POWER REIT

Power REIT (ticker: PW and PW.PRA), with a focus

on the “Triple Bottom Line” and a commitment to Profit, Planet and

People is a specialized real estate investment trust (REIT) that

owns sustainable real estate related to infrastructure assets

including properties for Controlled Environment Agriculture,

Renewable Energy and Transportation. Power REIT is actively seeking

to expand its real estate portfolio related to Controlled

Environment Agriculture for the cultivation of food and

cannabis.

Additional information about Power REIT can be

found on its website: www.pwreit.com

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING

STATEMENTS

This document includes forward-looking

statements within the meaning of the U.S. securities laws.

Forward-looking statements are those that predict or describe

future events or trends and that do not relate solely to historical

matters. You can generally identify forward-looking statements as

statements containing the words "believe," "expect," "will,"

"anticipate," "intend," "estimate," "project," "plan," "assume",

"seek" or other similar expressions, or negatives of those

expressions, although not all forward-looking statements contain

these identifying words. All statements contained in this document

regarding our future strategy, future operations, future prospects,

the future of our industries and results that might be obtained by

pursuing management's current or future plans and objectives are

forward-looking statements. You should not place undue reliance on

any forward-looking statements because the matters they describe

are subject to known and unknown risks, uncertainties and other

unpredictable factors, many of which are beyond our control. Our

forward-looking statements are based on the information currently

available to us and speak only as of the date of the filing of this

document. Over time, our actual results, performance, financial

condition or achievements may differ from the anticipated results,

performance, financial condition or achievements that are expressed

or implied by our forward-looking statements, and such differences

may be significant and materially adverse to our security

holders.

CONACT:

|

David H. Lesser, Chairman & CEO |

|

dlesser@millinvestment.com |

|

212-750-0371 |

|

|

| 301 Winding RoadOld Bethpage, NY

11804 |

| www.millinvestment.com |

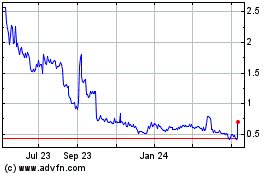

Power REIT (AMEX:PW)

Historical Stock Chart

From Jan 2025 to Feb 2025

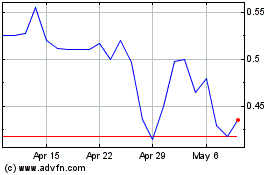

Power REIT (AMEX:PW)

Historical Stock Chart

From Feb 2024 to Feb 2025