- Eyecare product revenue increased 8% driven by higher sales of

Avenova®-branded products through online channels

- Sales and marketing expenses declined 13% reflecting efficient

growth through digital marketing optimization

- Balance sheet strengthened with $3.9 million financing in

July

Conference call begins at 4:30 p.m. Eastern

time today

NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY) reports

financial results for the three and six months ended June 30, 2024

and provides a business update.

“Revenue growth was driven by higher Avenova sales through

online channels including an expanded subscription customer base,”

said Justin Hall, CEO of NovaBay. “The number of Subscribe &

Save customers on Amazon.com increased 16% during the first half of

the year. In fact, subscriber sales on Amazon.com and Avenova.com

accounted for approximately 24% of all online Avenova sales year to

date. These recurring sales create predictable revenue, provide a

strong foundation for future growth and allow us to efficiently

manage our sales and marketing spend, which decreased 13% for the

quarter. These repeat sales also give us confidence in achieving

our goal of 2024 net revenue from our eyecare business of

approximately $10.0 million.

“Following the close of the quarter we completed a capital raise

that strengthened our balance sheet, allowing us to pursue

strategic and fundamental transactions from a position of

strength,” he added.

Second Quarter Financial Results

Financial results for the three and six months ended June 30,

2024 and 2023 do not include results from DERMAdoctor, which was

divested on March 25, 2024 and is accounted for in discontinued

operations. Financial information about discontinued operations is

available under “Divestiture and Discontinued Operations” in the

Company’s Quarterly Report on Form 10-Q for the quarter ended June

30, 2024, which will be filed with the Securities and Exchange

Commission (the “SEC”) later

today.

Total sales, net for the second quarter of 2024 were $2.4

million. Essentially all net sales for the quarter were derived

from sales of eyecare products, which increased 8% over the prior

year due to more Avenova®-branded products sold through online

channels. Total sales, net for the second quarter of 2023 were $3.5

million, which included $2.2 million from eyecare products and $1.3

million from wound care products, including a large order of

NeutroPhase®-branded wound care products with no comparable order

in the 2024 period.

Gross margin on net sales for the second quarter of 2024 was

66%, compared with 49% for the second quarter of 2023, with the

improvement primarily due to product mix.

Sales and marketing expenses for the second quarter of 2024 were

$1.0 million, a 13% decrease from $1.2 million for the prior-year

period, reflecting continued efficiencies in digital advertising

and lower professional services. General and administrative

(G&A) expenses for the second quarters of 2024 and 2023

remained consistent at $1.6 million. Research & development

(R&D) expenses for the second quarter of 2024 were $9 thousand,

versus $22 thousand for the prior-year period.

Non-cash items for the second quarter of 2024 included a loss on

the change in fair value of warrant liabilities of $80 thousand and

a loss on adjustments to the fair value of embedded derivative

liability of $83 thousand. Non-cash items for the second quarter of

2023 included a gain on changes in fair value of warrant

liabilities of $216 thousand and a gain on change in fair value of

embedded derivative liability of $40 thousand. Accretion of

interest and amortization of discounts on convertible notes for the

second quarter of 2024 was $0.3 million, compared with $0.5 million

for the second quarter of 2023.

Other expense, net for the second quarter of 2024 was $69

thousand, compared with $0.4 million for the second quarter of

2023, with the decrease due primarily to higher financing costs in

the prior-year period.

Net loss attributable to common stockholders for the second

quarter of 2024 was $1.6 million, or $1.37 per share. This compares

with a net loss attributable to common stockholders for the second

quarter of 2023 of $4.0 million, or $44.43 per share, which

included a $2.0 million non-cash increase to accumulated deficit

due to an adjustment to the preferred stock conversion price.

Six Month Financial Results

Total sales, net for the six months ended June 30, 2024 was $5.0

million, compared with $5.9 million for the six months ended June

30, 2023.

Gross margin on net sales for the first half of 2024 increased

to 67% from 57% for the first half of 2023.

For the six months ended June 30, 2024, sales and marketing

expenses decreased 14% and G&A expenses increased 19%, both

compared with the six months ended June 30, 2023. R&D expenses

were $28 thousand for the first half of 2024, versus $32 thousand

for the prior-year period.

Net loss attributable to common stockholders for the first half

of 2024 was $5.2 million, or $5.57 per share, compared with a net

loss for the first half of 2023 of $5.8 million, or $77.42 per

share.

NovaBay had cash and cash equivalents of $0.8 million as of June

30, 2024, compared with $2.9 million as of December 31, 2023. In

July 2024, the Company completed an underwritten public offering

raising gross proceeds of $3.9 million.

Conference Call

NovaBay management will host an investment community conference

call today beginning at 4:30 p.m. Eastern time (1:30 p.m. Pacific

time) to discuss the Company’s financial and operational results

and answer questions. Participants can pre-register for the

conference call here. Callers who pre-register will be given a

conference passcode and unique PIN to gain immediate access to the

call and bypass the live operator. Participants may pre-register at

any time, including up to and after the call start time.

Stockholders and other interested parties may also participate

in the conference call by dialing 833-816-1121 from within the U.S.

or 412-317-1862 from outside the U.S. and requesting the NovaBay

Pharmaceuticals call.

A live webcast of the call will be available here and will be

archived for 90 days. A replay of the call will be available

beginning two hours after the call ends through September 3, 2024

by dialing 877-344-7529 from within the U.S., 855-669-9658 from

Canada or 412-317-0088 from outside the U.S. and Canada, and

entering the conference identification number 3413491.

About NovaBay Pharmaceuticals, Inc.

NovaBay's leading product Avenova® Antimicrobial Lid & Lash

Solution is often recommended by eyecare professionals for

blepharitis and dry eye disease. Manufactured in the U.S., Avenova

spray is formulated with NovaBay's patented, proprietary, stable

and pure form of hypochlorous acid. All Avenova products are

available directly to consumers through online distribution

channels such as Amazon.com and Avenova.com.

Forward-Looking Statements

This release contains information about management's view of the

Company's future expectations, plans and prospects that constitute

forward-looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by the fact that they

do not relate strictly to historic or current facts. Such

forward-looking statements are based upon management’s current

expectations, assumptions, estimates, projections and beliefs.

These statements include, but are not limited to, statements

regarding our business strategies, commercial progress, current and

potential future product offerings, expanded access to our products

through new and existing sales channels, and any future revenue,

and the timing of such revenue, that may result from selling these

products, as well as generally the Company’s expected future

financial results. These statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or achievements to be materially different and adverse from

those expressed in or implied by these forward-looking statements.

Factors that might cause or contribute to such differences include,

but are not limited to, risks and uncertainties relating to the

size of the potential market for our products, the Company’s

products not being able to penetrate one or more targeted markets

and the Company’s ability to continue as a going concern and

revenues (or the execution on capital raise opportunities) not

being sufficient to meet the Company’s cash needs. Other risks

relating to NovaBay’s business, including risks that could cause

results to differ materially from those projected in the

forward-looking statements in this press release, are detailed in

the Company’s latest Form 10-K/Q filings and registration

statements, as may be amended from time to time, with the SEC,

especially under the heading “Risk Factors.” The forward-looking

statements in this release speak only as of this date, and the

Company disclaims any intent or obligation to revise or update

publicly any forward-looking statement except as required by

law.

Socialize and Stay Informed on

NovaBay’s Progress Like us on Facebook Follow us on X

Connect with NovaBay on LinkedIn Visit NovaBay’s Website

Avenova Purchasing

Information For NovaBay Avenova purchasing information:

Please call 800-890-0329 or email sales@avenova.com Avenova.com

Financial tables follow

NOVABAY PHARMACEUTICALS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

value amounts)

June 30,

2024

December 31,

2023

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

751

$

2,924

Accounts receivable, net of allowance for

credit losses ($3 at June 30, 2024 and December 31, 2023)

547

680

Inventory, net of allowance for excess and

obsolete inventory and lower of cost or estimated net realizable

value adjustments ($204 and $264 at June 30, 2024 and December 31,

2023, respectively)

700

564

Prepaid expenses and other current

assets

255

256

Current assets, discontinued

operations

—

2,730

Total current assets

2,253

7,154

Operating lease right-of-use assets

1,128

1,296

Property and equipment, net

68

87

Other assets

476

478

Other assets, discontinued operations

—

19

TOTAL ASSETS

$

3,925

$

9,034

LIABILITIES AND STOCKHOLDERS’

(DEFICIT) EQUITY

Liabilities:

Current liabilities:

Accounts payable

$

1,235

$

906

Accrued liabilities

1,297

1,169

Secured Convertible Notes, net of

discounts

655

1,137

Unsecured Convertible Notes, net of

discounts

41

—

Operating lease liabilities

382

368

Current liabilities, discontinued

operations

—

698

Total current liabilities

3,610

4,278

Warrant liabilities

—

334

Operating lease

liabilities-non-current

932

1,108

Total liabilities

4,542

5,720

Commitments and contingencies

Stockholders’ (deficit) equity:

Preferred stock, $0.01 par value; 5,000

shares authorized;

Series B Preferred Stock; 1 and 6 shares

issued and outstanding at June 30, 2024 and December 31, 2023,

respectively

6

275

Series C Preferred Stock; 0 and 1 shares

issued and outstanding at June 30, 2024 and December 31, 2023,

respectively

—

1,675

Common stock, $0.01 par value; 150,000

shares authorized, 1,348 and 321 shares issued and outstanding at

June 30, 2024 and December 31, 2023, respectively*

13

3

Additional paid-in capital*

179,392

176,210

Accumulated deficit

(180,028

)

(174,849

)

Total stockholders’ (deficit) equity

(617

)

3,314

TOTAL LIABILITIES AND STOCKHOLDERS’

(DEFICIT) EQUITY

$

3,925

$

9,034

NOVABAY PHARMACEUTICALS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except per

share data)

Three Months Ended June

30,

Six Months Ended

June 30,

2024

2023

2024

2023

Sales:

Product revenue, net

$

2,387

$

3,523

$

5,011

$

5,855

Other revenue, net

13

11

20

18

Total sales, net

2,400

3,534

5,031

5,873

Cost of goods sold

808

1,795

1,645

2,534

Gross profit

1,592

1,739

3,386

3,339

Operating expenses:

Research and development

9

22

28

32

Sales and marketing

1,019

1,175

2,074

2,411

General and administrative

1,617

1,593

3,908

3,292

Loss on divestiture of subsidiary

—

—

865

—

Total operating expenses

2,645

2,790

6,875

5,735

Operating loss

(1,053

)

(1,051

)

(3,489

)

(2,396

)

Non-cash (loss) gain on changes in fair

value of warrant liabilities

(80

)

216

114

216

Non-cash (loss) gain on change in fair

value of embedded derivative liability

(83

)

40

(18

)

40

Accretion of interest and amortization of

discounts on convertible notes

(300

)

(501

)

(733

)

(501

)

Other expense, net

(69

)

(432

)

(549

)

(432

)

Net loss from continuing operations

(1,585

)

(1,728

)

(4,675

)

(3,073

)

Net loss from discontinued operations

—

(308

)

(124

)

(702

)

Net loss

(1,585

)

(2,036

)

(4,799

)

(3,775

)

Less: Increase to accumulated deficit due

to adjustment to Preferred Stock conversion price

—

(1,996

)

(380

)

(1,996

)

Net loss attributable to common

stockholders

$

(1,585

)

$

(4,032

)

$

(5,179

)

$

(5,771

)

Basic and diluted net loss per share

Net loss per share from continuing

operations*

$

(1.37

)

$

(41.04

)

$

(5.44

)

$

(68.00

)

Net loss per share from discontinued

operations*

—

(3.39

)

(0.13

)

(9.42

)

Net loss per share attributable to common

stockholders (basic and diluted)*

$

(1.37

)

$

(44.43

)

$

(5.57

)

$

(77.42

)

Weighted-average shares of common stock

outstanding used in computing net loss per share of common stock

(basic and diluted)*

1,155

91

930

75

* After giving retroactive effect to a

1-for-35 reverse stock split that became effective May 30,

2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813722587/en/

NovaBay Contact Justin Hall

Chief Executive Officer and General Counsel 510-899-8800

jhall@novabay.com

Investor Contact LHA

Investor Relations Jody Cain 310-691-7100 jcain@lhai.com

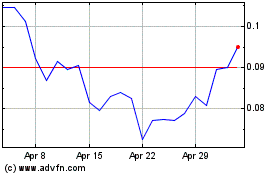

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Oct 2024 to Nov 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Nov 2023 to Nov 2024