- Net product sales increased 13% over the prior year driven by

higher sales of Avenova®-branded products through OTC channels and

branded wound care products

- Sales and marketing expenses declined 15% reflecting continued

digital marketing optimization

- Ordered product sales for Avenova-branded products on

Amazon.com reached new all-time records in March and April

Conference call begins at 4:30 p.m. Eastern

time today

NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY) reports

financial results for the three months ended March 31, 2024 and

provides a business update.

“Net product sales growth of 13% versus the prior year was

driven by higher sales of Avenova-branded products through online

channels and by sales of branded wound care products,” said Justin

Hall, CEO of NovaBay. “During the quarter, ordered sales for

Avenova products on Amazon.com, our most important sales channel,

hit new all-time records in March and again in April. We achieved

these records by further optimizing our highly efficient digital

marketing programs while reducing our sales and marketing spend,

which declined by 15% versus the prior year.

“NovaBay is operating under a streamlined business model

primarily focused on the large and growing eyecare market, with

creative marketing programs that are resonating well with online

customers,” he added. “We are working to build upon this growth by

introducing new and enhanced digital media programs to

cost-efficiently support our loyal customer base and reach new

prospective customers.”

First Quarter Financial Results

Financial results for the first quarters of 2024 and 2023 do not

include results from DERMAdoctor, which was divested on March 25,

2024 and is accounted for in discontinued operations. Financial

information about discontinued operations is available under

“Divestiture and Discontinued Operations” in the Company’s Form

10-Q, which is to be filed with the SEC later today.

Product sales, net for the first quarter of 2024 were $2.6

million, an increase of 13% from $2.3 million for the prior-year

period, with the increase due primarily to higher Avenova-branded

products sold through online channels and an increase in

PhaseOne®-branded wound care products.

Gross margin on net product revenue for the first quarters of

2024 and 2023 remained consistent at 68%.

Sales and marketing expenses for the first quarter of 2024 were

$1.1 million, a 15% decrease from $1.2 million for the prior-year

period, reflecting continued lower digital advertising and related

consulting costs. General and administrative (G&A) expenses for

the first quarter of 2024 were $2.3 million, compared with $1.7

million for the prior-year period, with the increase due mainly to

higher legal costs primarily related to non-recurring strategic

initiatives. Research & development (R&D) expenses for the

first quarter of 2024 were $19 thousand, versus $10 thousand for

the prior-year period. The Company recorded a non-cash loss of $865

thousand for the first quarter of 2024 related to the DERMAdoctor

divestiture, with no comparable item in the prior-year period.

For the first quarter of 2024, non-cash items included a gain on

changes in fair value of warrant liabilities of $0.2 million, a

gain on change in fair value of embedded derivative liability of

$65 thousand and accretion of interest and amortization of

discounts on convertible notes of $0.4 million. There were no

comparable items for the first quarter of 2023.

Other expense, net for the first quarter of 2024 was $0.5

million, primarily due to the issuance of the March 2024 warrant

and the unsecured convertible notes issued in March 2024, with no

comparable item in the first quarter of 2023.

Net loss attributable to common stockholders for the first

quarter of 2024 was $3.6 million, or $0.15 per share, compared with

a net loss attributable to common stockholders for the first

quarter of 2023 of $1.7 million, or $0.85 per share.

NovaBay had cash and cash equivalents of $1.8 million as of

March 31, 2024, compared with $2.9 million as of December 31,

2023.

Conference Call

NovaBay management will host an investment community conference

call today beginning at 4:30 p.m. Eastern time (1:30 p.m. Pacific

time) to discuss the Company’s financial and operational results

and answer questions. Participants can pre-register for the

conference call here. Callers who pre-register will be emailed

conference details and a unique Registration ID to gain immediate

access to the call and bypass the live operator. Participants may

pre-register at any time, including up to and after the call start

time.

Stockholders and other interested parties may also participate

in the conference call by dialing 888-500-3691 from within the U.S.

or 646-307-1951 from outside the U.S., and requesting conference

ID# 85516.

A live webcast of the call will be available here and will be

archived for 90 days. A replay of the call will be available

beginning three hours after the call ends through June 9, 2024 by

dialing 877-660-6853 from within the U.S. or 201-612-7415 from

outside the U.S., and entering the conference ID #13746453.

About NovaBay Pharmaceuticals, Inc.:

NovaBay’s leading product Avenova® Antimicrobial Lid & Lash

Solution is often prescribed by eyecare professionals for

blepharitis and dry-eye disease and is available directly to

consumers through online distribution channels such as Amazon.com.

It is clinically proven to kill a broad spectrum of bacteria to

help relieve the symptoms of bacterial dry eye, yet is

non-irritating and completely safe for regular use. NovaBay offers

a full portfolio of scientifically developed products for each step

of the standard dry eye treatment regimen, including the Avenova

Eye Health Support antioxidant-rich oral supplement, Avenova

Lubricating Eye Drops for instant relief, Avenova Warm Eye Compress

to soothe the eyes and the i-Chek by Avenova to monitor physical

eyelid health. The Avenova Allograft, an amniotic tissue

prescription-only product, is available through eyecare

professionals in the United States.

Forward-Looking Statements

This release contains information about management's view of the

Company's future expectations, plans and prospects that constitute

forward-looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by the fact that they

do not relate strictly to historic or current facts. Such

forward-looking statements are based upon management’s current

expectations, assumptions, estimates, projections and beliefs.

These statements include, but are not limited to, statements

regarding our business strategies, commercial progress, current and

potential future product offerings, expanded access to our products

through new and existing sales channels, and any future revenue,

and the timing of such revenue, that may result from selling these

products, as well as generally the Company’s expected future

financial results. These statements involve risks, uncertainties

and other factors that may cause actual results or achievements to

be materially different and adverse from those expressed in or

implied by these forward-looking statements. Factors that might

cause or contribute to such differences include, but are not

limited to, risks and uncertainties relating to the size of the

potential market for our products, the Company’s products not being

able to penetrate one or more targeted markets and the Company’s

ability to continue as a going concern and revenues (or the

execution on capital raise opportunities) not being sufficient to

meet the Company’s cash needs. Other risks relating to NovaBay’s

business, including risks that could cause results to differ

materially from those projected in the forward-looking statements

in this press release, are detailed in NovaBay’s latest Form 10-K/Q

filings with the Securities and Exchange Commission, especially

under the heading “Risk Factors.” The forward-looking statements in

this release speak only as of this date, and NovaBay disclaims any

intent or obligation to revise or update publicly any

forward-looking statement except as required by law.

Socialize and Stay Informed on

NovaBay’s Progress Like us on Facebook Follow us on X

Connect with NovaBay on LinkedIn Visit NovaBay’s Website

Avenova Purchasing

Information For NovaBay Avenova purchasing information:

Please call 800-890-0329 or email sales@avenova.com Avenova.com

Financial tables follow

NOVABAY PHARMACEUTICALS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

value amounts)

March 31,

December 31,

2024

2023

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

1,823

$

2,924

Accounts receivable, net of allowance for

credit losses ($3 at March 31, 2024 and December 31, 2023)

734

680

Inventory, net of allowance for excess and

obsolete inventory and lower of cost or estimated net realizable

value adjustments ($229 and $264 at March 31, 2024 and December 31,

2023, respectively)

663

564

Prepaid expenses and other current

assets

371

256

Current assets, discontinued

operations

—

2,730

Total current assets

3,591

7,154

Operating lease right-of-use assets

1,212

1,296

Property and equipment, net

77

87

Other assets

477

478

Other assets, discontinued operations

—

19

TOTAL ASSETS

$

5,357

$

9,034

LIABILITIES AND STOCKHOLDERS’

EQUITY

Liabilities:

Current liabilities:

Accounts payable

$

1,117

$

906

Accrued liabilities

1,266

1,169

Secured Convertible Notes, net of

discounts

973

1,137

Unsecured Convertible Notes, net of

discounts

34

—

Embedded derivative liability

159

—

Operating lease liabilities

375

368

Current liabilities, discontinued

operations

—

698

Total current liabilities

3,924

4,278

Warrant liabilities

232

334

Operating lease

liabilities-non-current

1,041

1,108

Total liabilities

5,197

5,720

Commitments & contingencies

Stockholders’ equity:

Preferred stock, $0.01 par value; 5,000

shares authorized;

Series B Preferred Stock; 1 and 6 shares

issued and outstanding at March 31, 2024 and December 31, 2023,

respectively

44

275

Series C Preferred Stock; 1 shares issued

and outstanding at March 31, 2024 and December 31, 2023

1,441

1,675

Common stock, $0.01 par value; 150,000

shares authorized, 32,025 and 11,230 shares issued and outstanding

at March 31, 2024 and December 31, 2023, respectively

320

112

Additional paid-in capital

176,798

176,101

Accumulated deficit

(178,443

)

(174,849

)

Total stockholders’ equity

160

3,314

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

5,357

$

9,034

NOVABAY PHARMACEUTICALS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except per

share data)

Three Months Ended

March 31,

2024

2023

Sales:

Product revenue, net

$

2,624

$

2,332

Other revenue, net

7

7

Total sales, net

2,631

2,339

Cost of goods sold

837

739

Gross profit

1,794

1,600

Operating expenses

Research and development

19

10

Sales and marketing

1,055

1,236

General and administrative

2,291

1,699

Loss on divestiture of subsidiary

865

—

Total operating expenses

4,230

2,945

Operating loss

(2,436

)

(1,345

)

Non-cash gain on changes in fair value of

warrant liabilities

194

—

Non-cash gain on change in fair value of

embedded derivative liability

65

—

Accretion of interest and amortization of

discounts on convertible notes

(433

)

—

Other expense, net

(480

)

—

Net loss from continuing operations

(3,090

)

(1,345

)

Loss from discontinued operations

(124

)

(394

)

Net loss

(3,214

)

(1,739

)

Less: Increase to accumulated deficit due

to adjustment to Preferred Stock conversion price

380

—

Net loss attributable to common

stockholders

$

(3,594

)

$

(1,739

)

Basic and diluted net loss per share

Loss from continuing operations

$

(0.14

)

$

(0.66

)

Loss from discontinued operations

(0.01

)

(0.19

)

Net loss per share attributable to common

stockholders (basic and diluted)

$

(0.15

)

$

(0.85

)

Weighted-average shares of common stock

outstanding used in computing net loss per share of common stock

(basic and diluted)

24,672

2,035

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509593442/en/

NovaBay Contact Justin Hall

Chief Executive Officer and General Counsel 510-899-8800

jhall@novabay.com

Investor Contact LHA

Investor Relations Jody Cain 310-691-7100 jcain@lhai.com

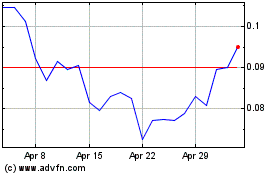

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Oct 2024 to Nov 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Nov 2023 to Nov 2024